As a general matter, a loan by a bank is the borrowing of money by a person or entity who promises to return it on or before a specific date, with interest, or who pledges collateral as security for the loan and promises to redeem it at a specific later date. Loans are usually made on the basis of applications, together with financial statements submitted by the applicants.

The Federal Truth in Lending Act and the regulations promulgated under the Act apply to certain credit transactions, primarily those involving loans made to a natural person and intended for personal, family, or household purposes and for which a finance charge is made, or loans that are payable in more than four installments. However, said Act and regulations do not apply to a business loan of this type.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

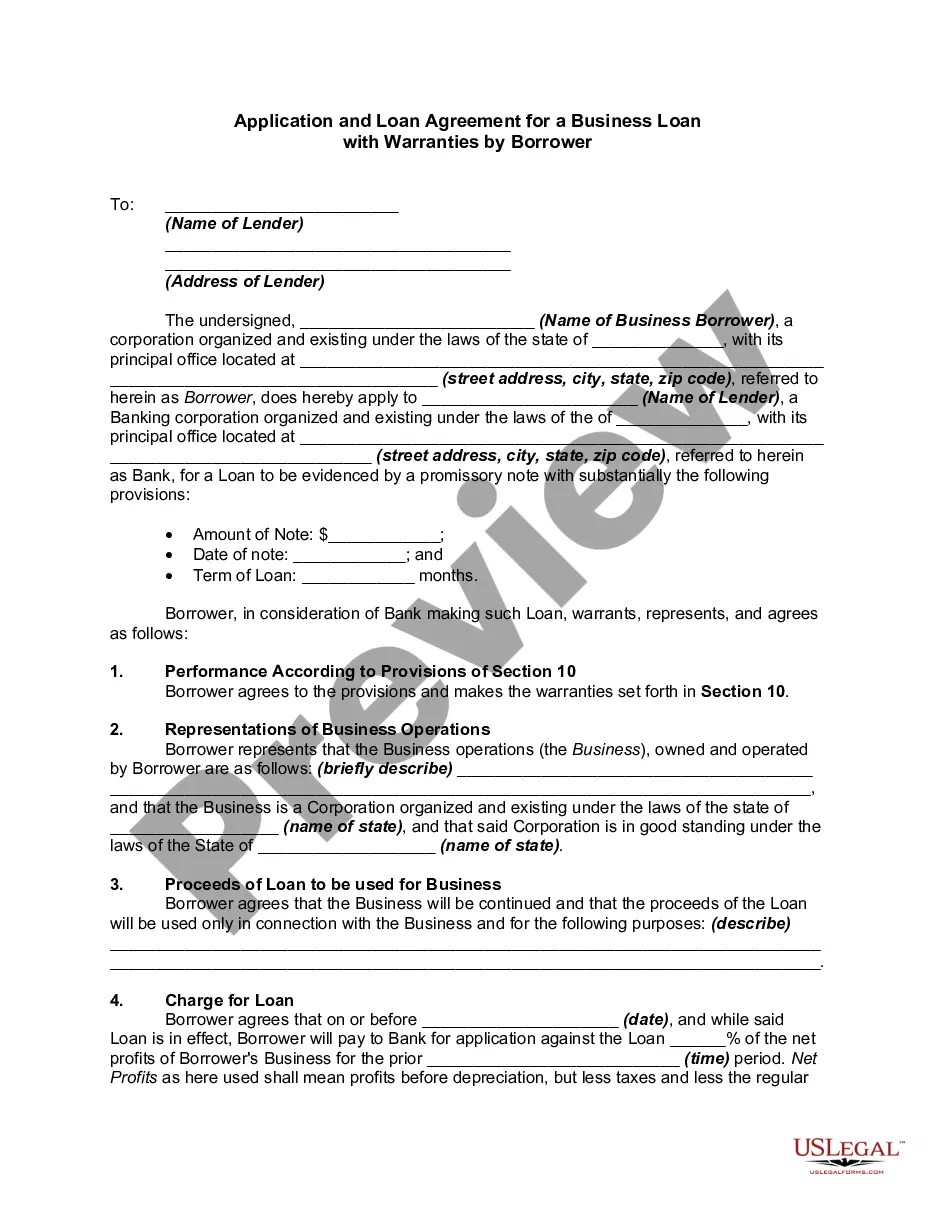

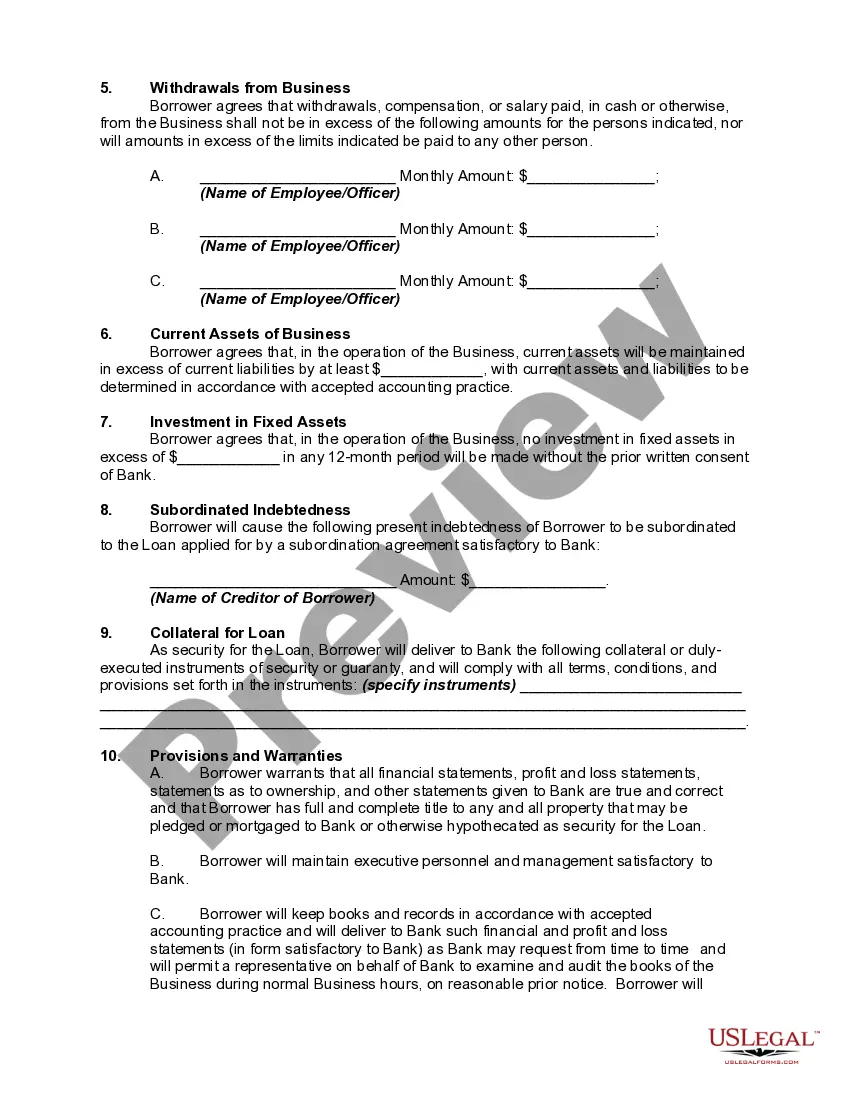

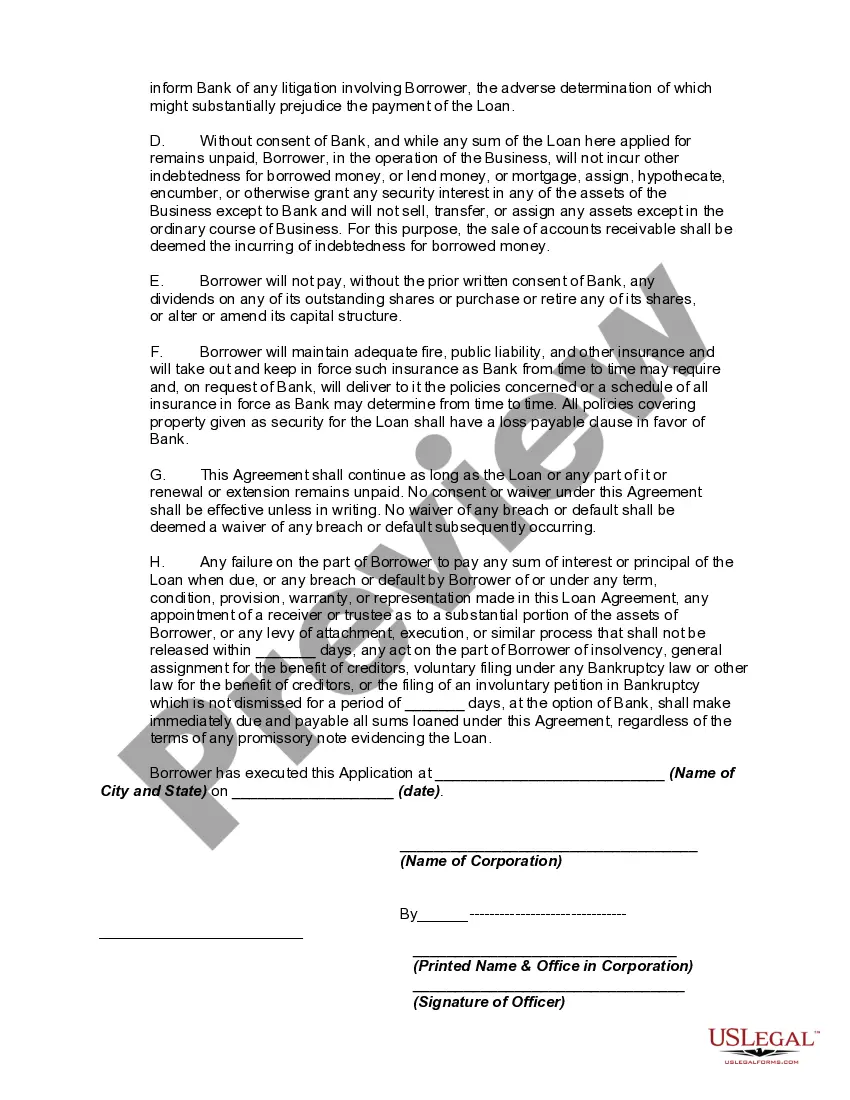

Orange California Application and Loan Agreement for a Business Loan with Warranties by Borrower The Orange California Application and Loan Agreement for a Business Loan with Warranties by Borrower is a legal document that outlines the terms and conditions between a borrower and a lender in relation to a business loan in Orange, California. This agreement is essential for businesses seeking financial assistance to expand their operations, invest in new projects, or overcome financial challenges. This agreement serves as a binding contract that establishes the expectations, rights, and obligations of both the borrower and the lender. It ensures that all parties involved are on the same page and provides legal protection for both the lender's investment and the borrower's business. Keywords: Orange California, Application, Loan Agreement, Business Loan, Warranties, Borrower Different types of Orange California Application and Loan Agreement for a Business Loan with Warranties by Borrower may include: 1. Term Loan Agreement: This agreement specifies the terms and conditions of a fixed-term loan, where the borrower agrees to repay the loan amount along with interest over a predetermined period. 2. Revolving Line of Credit Agreement: This agreement establishes a revolving line of credit, allowing the borrower to access funds up to a certain limit and repay them as per the agreed terms. This type of loan provides flexibility as the borrower can borrow and repay funds as needed. 3. Equipment Financing Agreement: This agreement focuses on securing a loan specifically for the purchase of equipment necessary for the borrower's business operations. The equipment itself often serves as collateral for the loan. 4. Small Business Administration (SBA) Loan Agreement: This agreement is specific to loans obtained through the Small Business Administration. The SBA provides guarantees to lenders, encouraging them to lend to small businesses that might not meet the usual lending criteria. 5. Commercial Real Estate Loan Agreement: This agreement is tailored for borrowers seeking funds to purchase or refinance commercial real estate properties. The loan is secured by the property itself. It is important for businesses in Orange, California, to carefully review and understand the terms and conditions of the Orange California Application and Loan Agreement for a Business Loan with Warranties by Borrower. Seeking legal counsel is advisable during this process to ensure compliance with all applicable laws and regulations.Orange California Application and Loan Agreement for a Business Loan with Warranties by Borrower The Orange California Application and Loan Agreement for a Business Loan with Warranties by Borrower is a legal document that outlines the terms and conditions between a borrower and a lender in relation to a business loan in Orange, California. This agreement is essential for businesses seeking financial assistance to expand their operations, invest in new projects, or overcome financial challenges. This agreement serves as a binding contract that establishes the expectations, rights, and obligations of both the borrower and the lender. It ensures that all parties involved are on the same page and provides legal protection for both the lender's investment and the borrower's business. Keywords: Orange California, Application, Loan Agreement, Business Loan, Warranties, Borrower Different types of Orange California Application and Loan Agreement for a Business Loan with Warranties by Borrower may include: 1. Term Loan Agreement: This agreement specifies the terms and conditions of a fixed-term loan, where the borrower agrees to repay the loan amount along with interest over a predetermined period. 2. Revolving Line of Credit Agreement: This agreement establishes a revolving line of credit, allowing the borrower to access funds up to a certain limit and repay them as per the agreed terms. This type of loan provides flexibility as the borrower can borrow and repay funds as needed. 3. Equipment Financing Agreement: This agreement focuses on securing a loan specifically for the purchase of equipment necessary for the borrower's business operations. The equipment itself often serves as collateral for the loan. 4. Small Business Administration (SBA) Loan Agreement: This agreement is specific to loans obtained through the Small Business Administration. The SBA provides guarantees to lenders, encouraging them to lend to small businesses that might not meet the usual lending criteria. 5. Commercial Real Estate Loan Agreement: This agreement is tailored for borrowers seeking funds to purchase or refinance commercial real estate properties. The loan is secured by the property itself. It is important for businesses in Orange, California, to carefully review and understand the terms and conditions of the Orange California Application and Loan Agreement for a Business Loan with Warranties by Borrower. Seeking legal counsel is advisable during this process to ensure compliance with all applicable laws and regulations.