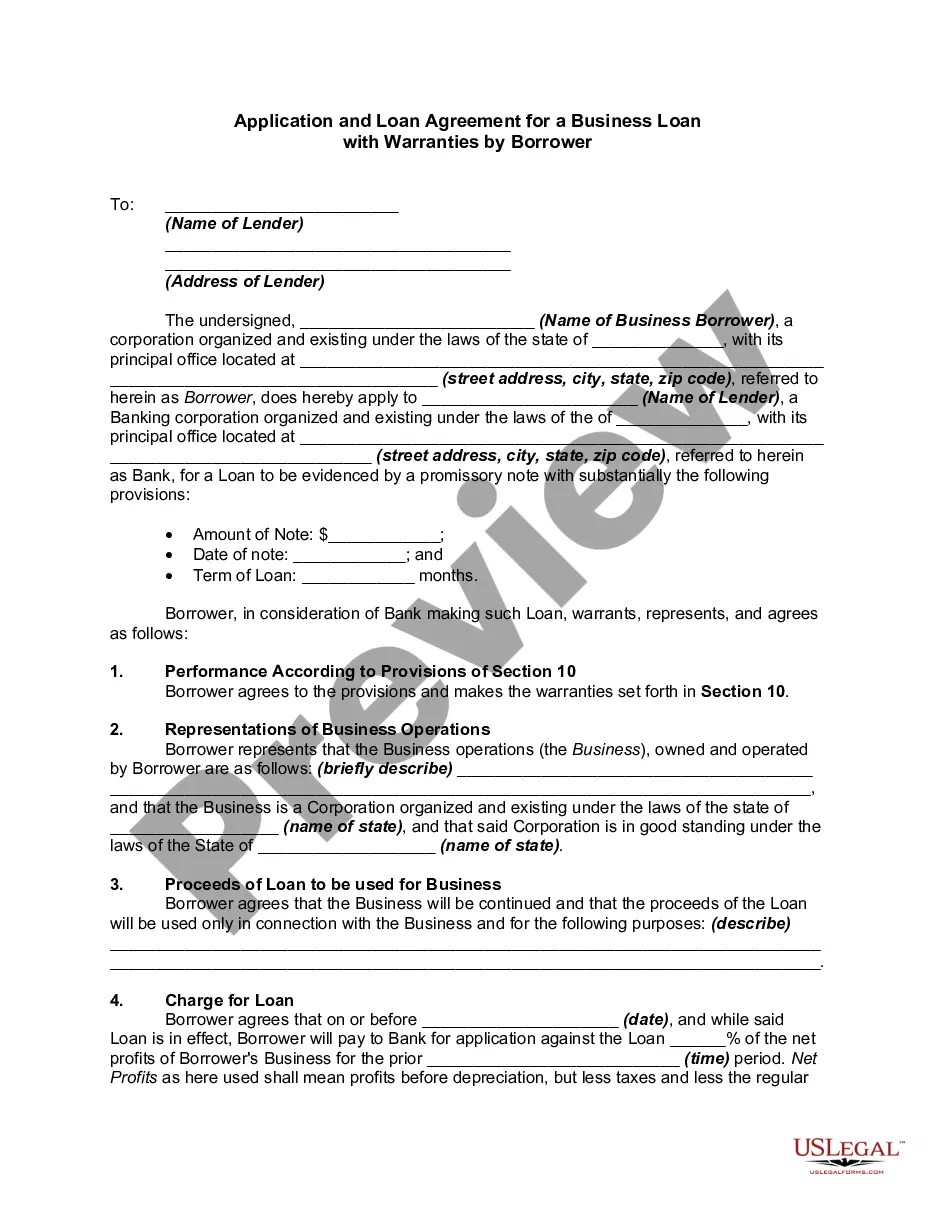

As a general matter, a loan by a bank is the borrowing of money by a person or entity who promises to return it on or before a specific date, with interest, or who pledges collateral as security for the loan and promises to redeem it at a specific later date. Loans are usually made on the basis of applications, together with financial statements submitted by the applicants.

The Federal Truth in Lending Act and the regulations promulgated under the Act apply to certain credit transactions, primarily those involving loans made to a natural person and intended for personal, family, or household purposes and for which a finance charge is made, or loans that are payable in more than four installments. However, said Act and regulations do not apply to a business loan of this type.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

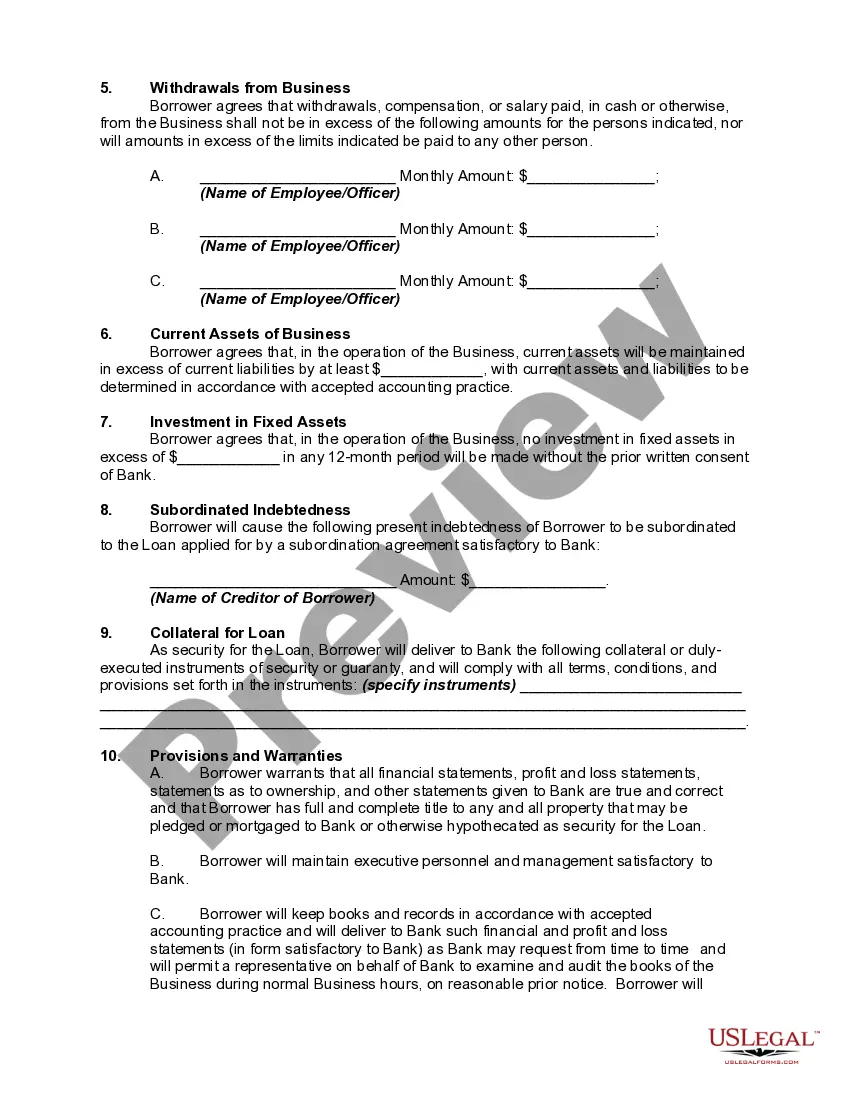

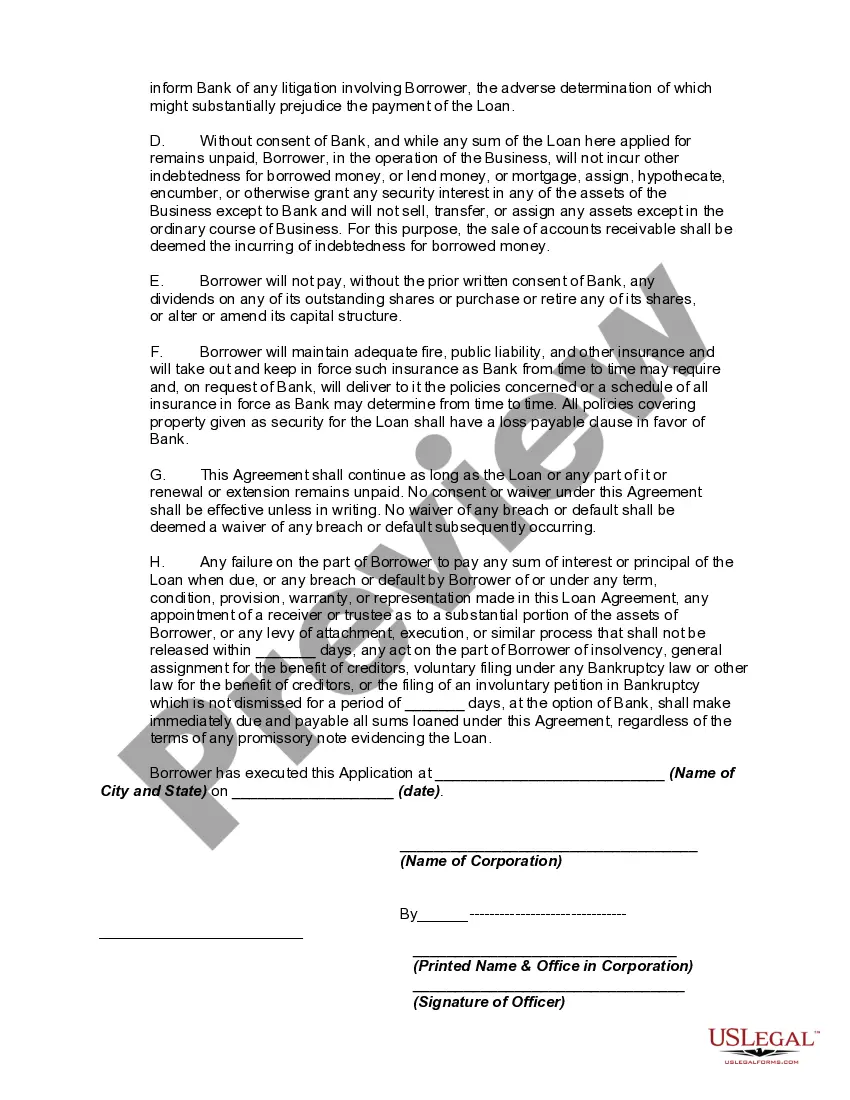

Palm Beach, Florida is a picturesque coastal town located in South Florida. Known for its pristine beaches, upscale shopping destinations, and luxurious residential areas, Palm Beach is a sought-after destination for both tourists and residents. When it comes to financing opportunities for businesses in Palm Beach, entrepreneurs can turn to the Palm Beach Florida Application and Loan Agreement for a Business Loan with Warranties by Borrower. This comprehensive agreement serves as a legally binding contract between a borrower and a lender, outlining the terms and conditions of a business loan. Key elements covered in the Palm Beach Florida Application and Loan Agreement for a Business Loan with Warranties by Borrower include the loan amount, interest rate, repayment terms, collateral requirements, and warranties made by the borrower. These warranties may cover aspects such as the borrower's legal capacity, the accuracy of financial statements provided, the absence of undisclosed liabilities, and the commitment to use the loan funds solely for business purposes. Additionally, there may be different types of Palm Beach Florida Application and Loan Agreements for a Business Loan with Warranties by Borrower, catering to the unique needs of various businesses. Some possible variations could include: 1. Traditional Business Loan Agreement: This type of agreement is typically used for traditional lending scenarios, where the borrower seeks financing for general business purposes. It may require detailed financial documentation and provide for a fixed interest rate and repayment schedule. 2. Small Business Administration (SBA) Loan Agreement: In collaboration with the Small Business Administration, lenders in Palm Beach may offer SBA loans that benefit small businesses with more flexible terms and lower interest rates. The application and loan agreement for such loans may involve additional paperwork and adherence to SBA guidelines. 3. Real Estate Development Loan Agreement: This specialized agreement applies to borrowers seeking financing specifically for real estate development projects in Palm Beach. It may include provisions related to construction stages, drawdown schedules, and specific requirements for collateral. 4. Equipment Financing Loan Agreement: This variation caters specifically to businesses seeking financing for the purchase of equipment or machinery. It may outline details about the equipment being financed, as well as the warranties provided by the borrower regarding the use and maintenance of the equipment. In conclusion, Palm Beach, Florida offers various types of Application and Loan Agreements for Business Loans with Warranties by Borrower to support the diverse financial needs of businesses in the area. These agreements serve as crucial tools for facilitating responsible lending practices and ensuring the mutual understanding and obligations between borrowers and lenders.Palm Beach, Florida is a picturesque coastal town located in South Florida. Known for its pristine beaches, upscale shopping destinations, and luxurious residential areas, Palm Beach is a sought-after destination for both tourists and residents. When it comes to financing opportunities for businesses in Palm Beach, entrepreneurs can turn to the Palm Beach Florida Application and Loan Agreement for a Business Loan with Warranties by Borrower. This comprehensive agreement serves as a legally binding contract between a borrower and a lender, outlining the terms and conditions of a business loan. Key elements covered in the Palm Beach Florida Application and Loan Agreement for a Business Loan with Warranties by Borrower include the loan amount, interest rate, repayment terms, collateral requirements, and warranties made by the borrower. These warranties may cover aspects such as the borrower's legal capacity, the accuracy of financial statements provided, the absence of undisclosed liabilities, and the commitment to use the loan funds solely for business purposes. Additionally, there may be different types of Palm Beach Florida Application and Loan Agreements for a Business Loan with Warranties by Borrower, catering to the unique needs of various businesses. Some possible variations could include: 1. Traditional Business Loan Agreement: This type of agreement is typically used for traditional lending scenarios, where the borrower seeks financing for general business purposes. It may require detailed financial documentation and provide for a fixed interest rate and repayment schedule. 2. Small Business Administration (SBA) Loan Agreement: In collaboration with the Small Business Administration, lenders in Palm Beach may offer SBA loans that benefit small businesses with more flexible terms and lower interest rates. The application and loan agreement for such loans may involve additional paperwork and adherence to SBA guidelines. 3. Real Estate Development Loan Agreement: This specialized agreement applies to borrowers seeking financing specifically for real estate development projects in Palm Beach. It may include provisions related to construction stages, drawdown schedules, and specific requirements for collateral. 4. Equipment Financing Loan Agreement: This variation caters specifically to businesses seeking financing for the purchase of equipment or machinery. It may outline details about the equipment being financed, as well as the warranties provided by the borrower regarding the use and maintenance of the equipment. In conclusion, Palm Beach, Florida offers various types of Application and Loan Agreements for Business Loans with Warranties by Borrower to support the diverse financial needs of businesses in the area. These agreements serve as crucial tools for facilitating responsible lending practices and ensuring the mutual understanding and obligations between borrowers and lenders.