As a general matter, a loan by a bank is the borrowing of money by a person or entity who promises to return it on or before a specific date, with interest, or who pledges collateral as security for the loan and promises to redeem it at a specific later date. Loans are usually made on the basis of applications, together with financial statements submitted by the applicants.

The Federal Truth in Lending Act and the regulations promulgated under the Act apply to certain credit transactions, primarily those involving loans made to a natural person and intended for personal, family, or household purposes and for which a finance charge is made, or loans that are payable in more than four installments. However, said Act and regulations do not apply to a business loan of this type.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

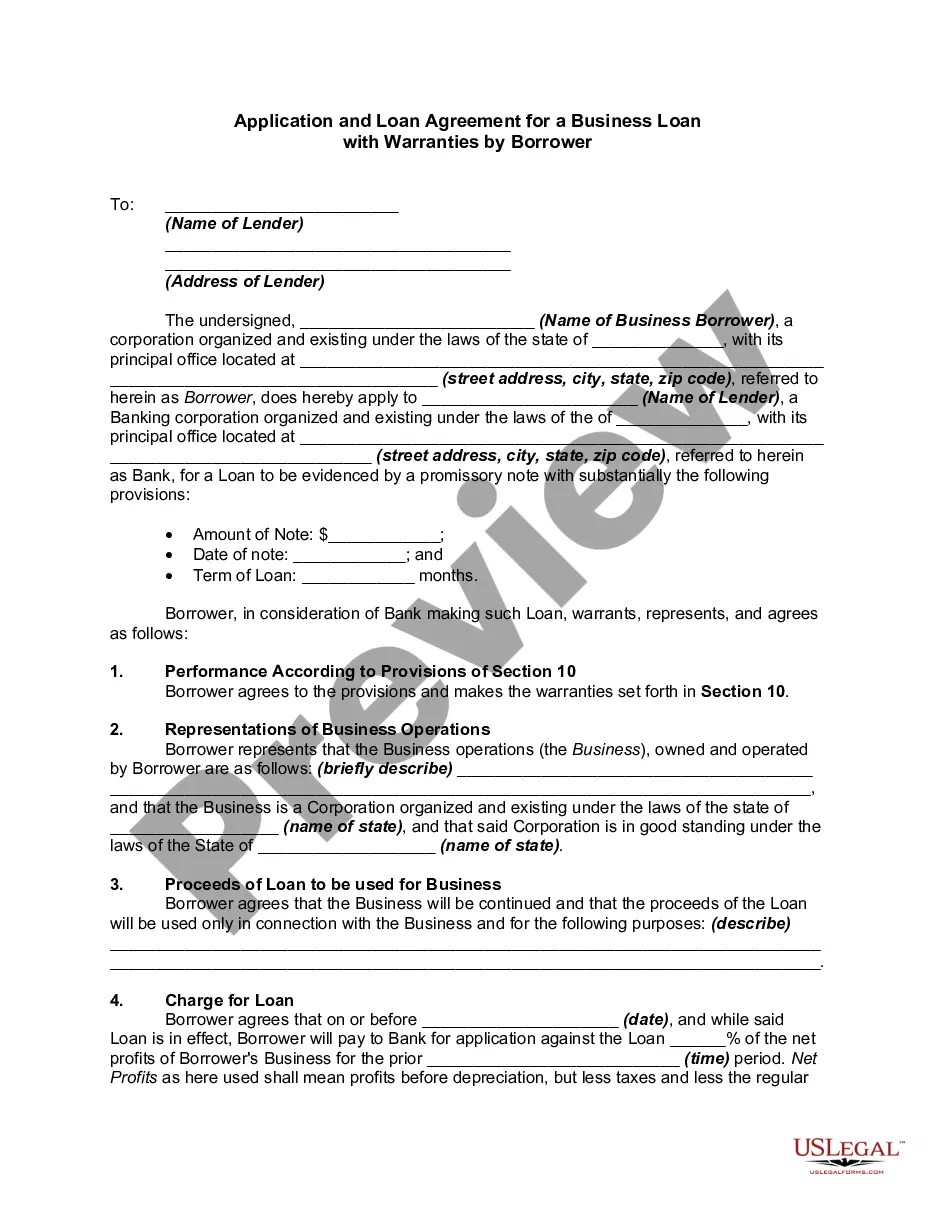

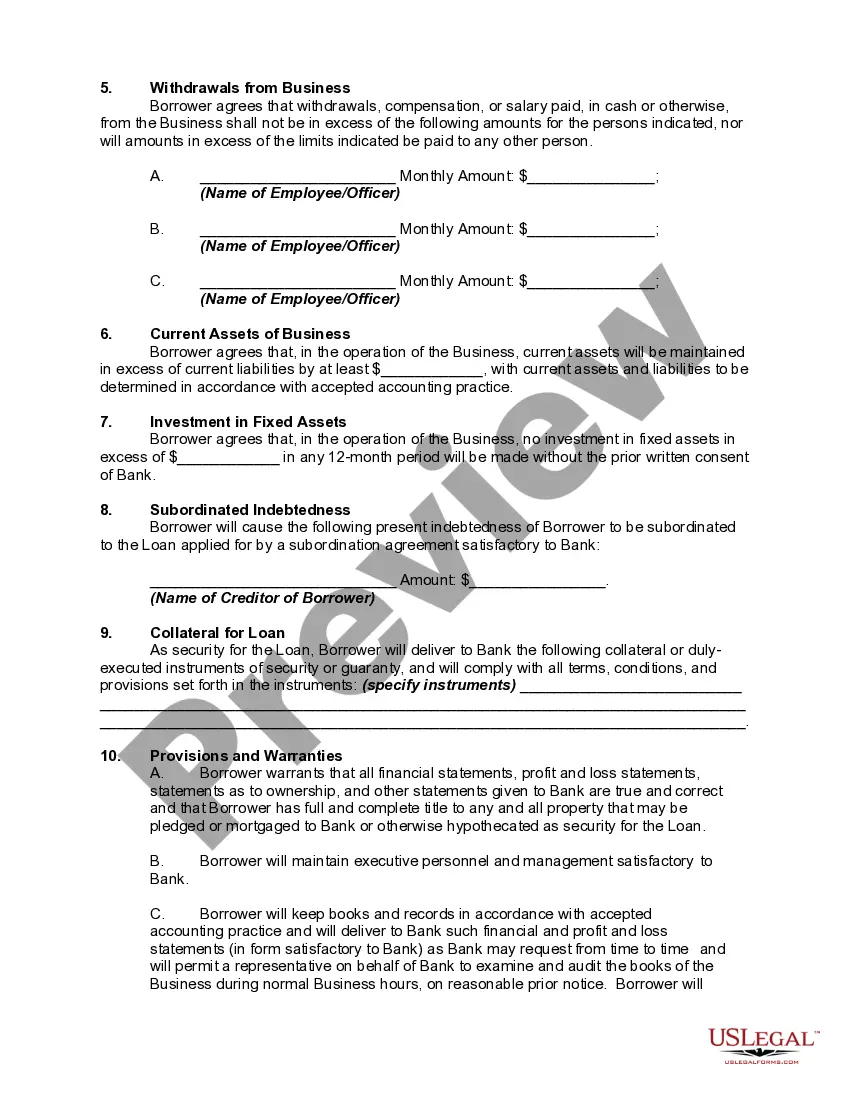

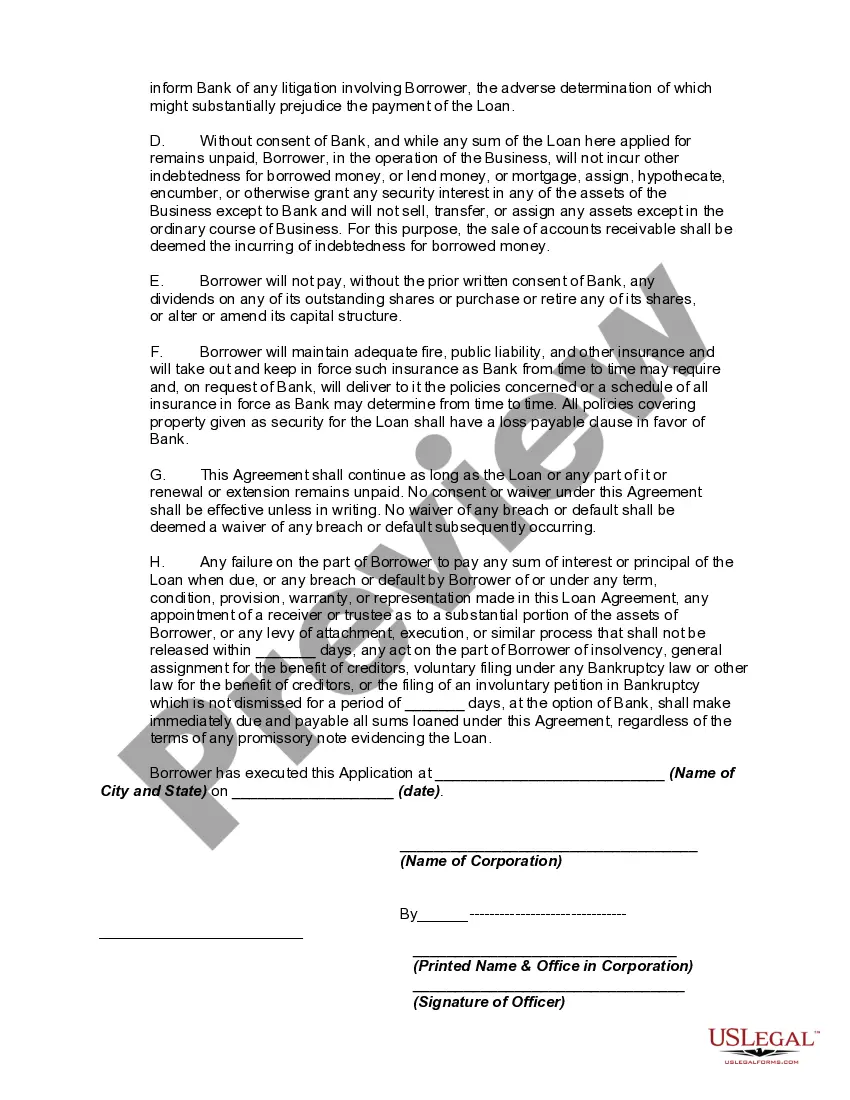

Riverside, California Application and Loan Agreement for a Business Loan with Warranties by Borrower: Explained When venturing into the business world in Riverside, California, it may become necessary to seek financial assistance through a business loan. In such cases, a comprehensive Application and Loan Agreement, enriched with warranties made by the borrower, becomes crucial. This document serves as a legal contract between the borrower and the lender, outlining the terms, conditions, and obligations pertaining to the loan. The Riverside California Application and Loan Agreement for a Business Loan with Warranties imposes certain requirements on the borrower. These typically include providing detailed information about the business, its financial health, and the intended use of the loan proceeds. Additionally, borrowers are often required to furnish documentation such as financial statements, tax returns, legal registrations, and licenses to support their loan application. The agreement encompasses various aspects that are essential for a smooth lending process. It outlines the loan amount, interest rate, repayment terms, and any associated fees or penalties. Moreover, it explicitly mentions the purpose for which the loan will be used, ensuring transparency between the borrower and the lender. Importantly, the Application and Loan Agreement involves warranties made by the borrower. These warranties assert that the information provided by the borrower is accurate, complete, and not misleading. By making these warranties, the borrower guarantees the lender that all statements, financial records, and representations are reliable and factual. Different types or variations of Riverside California Application and Loan Agreement for a Business Loan with Warranties by Borrower may exist depending on the specific needs and circumstances of the borrower and the lender. Such variations might include: 1. Small Business Loan Agreement: Tailored for startups or small business owners seeking financial assistance for operational expenses, expansion plans, or investment in assets. 2. Commercial Real Estate Loan Agreement: Designed to facilitate the purchase or refinancing of commercial properties, such as office buildings, retail spaces, or industrial complexes. 3. Equipment Financing Loan Agreement: Specifically crafted for businesses in need of funds to acquire or upgrade machinery, vehicles, or other types of equipment. 4. Working Capital Loan Agreement: Aimed at providing short-term capital to cover day-to-day operational costs, manage cash flow fluctuations, or fulfill immediate business needs. These mentioned variations account for just a few examples; the actual range and specificity of loan agreements may be wider, catering to the diverse requirements of different businesses in Riverside, California. In conclusion, the Riverside California Application and Loan Agreement for a Business Loan with Warranties by Borrower serves as a vital legal document that establishes the terms, conditions, and responsibilities for both the borrower and the lender. This agreement caters to various loan types and ensures transparency, accuracy, and compliance throughout the lending process, fostering trust and promoting successful business growth in the vibrant city of Riverside, California.Riverside, California Application and Loan Agreement for a Business Loan with Warranties by Borrower: Explained When venturing into the business world in Riverside, California, it may become necessary to seek financial assistance through a business loan. In such cases, a comprehensive Application and Loan Agreement, enriched with warranties made by the borrower, becomes crucial. This document serves as a legal contract between the borrower and the lender, outlining the terms, conditions, and obligations pertaining to the loan. The Riverside California Application and Loan Agreement for a Business Loan with Warranties imposes certain requirements on the borrower. These typically include providing detailed information about the business, its financial health, and the intended use of the loan proceeds. Additionally, borrowers are often required to furnish documentation such as financial statements, tax returns, legal registrations, and licenses to support their loan application. The agreement encompasses various aspects that are essential for a smooth lending process. It outlines the loan amount, interest rate, repayment terms, and any associated fees or penalties. Moreover, it explicitly mentions the purpose for which the loan will be used, ensuring transparency between the borrower and the lender. Importantly, the Application and Loan Agreement involves warranties made by the borrower. These warranties assert that the information provided by the borrower is accurate, complete, and not misleading. By making these warranties, the borrower guarantees the lender that all statements, financial records, and representations are reliable and factual. Different types or variations of Riverside California Application and Loan Agreement for a Business Loan with Warranties by Borrower may exist depending on the specific needs and circumstances of the borrower and the lender. Such variations might include: 1. Small Business Loan Agreement: Tailored for startups or small business owners seeking financial assistance for operational expenses, expansion plans, or investment in assets. 2. Commercial Real Estate Loan Agreement: Designed to facilitate the purchase or refinancing of commercial properties, such as office buildings, retail spaces, or industrial complexes. 3. Equipment Financing Loan Agreement: Specifically crafted for businesses in need of funds to acquire or upgrade machinery, vehicles, or other types of equipment. 4. Working Capital Loan Agreement: Aimed at providing short-term capital to cover day-to-day operational costs, manage cash flow fluctuations, or fulfill immediate business needs. These mentioned variations account for just a few examples; the actual range and specificity of loan agreements may be wider, catering to the diverse requirements of different businesses in Riverside, California. In conclusion, the Riverside California Application and Loan Agreement for a Business Loan with Warranties by Borrower serves as a vital legal document that establishes the terms, conditions, and responsibilities for both the borrower and the lender. This agreement caters to various loan types and ensures transparency, accuracy, and compliance throughout the lending process, fostering trust and promoting successful business growth in the vibrant city of Riverside, California.