A line of credit or loan agreement between a corporate or business borrower and a bank is a financial contract that outlines the terms and conditions of borrowing funds from a financial institution. In Houston, Texas, there are different types of line of credit or loan agreements available to corporate or business borrowers. These agreements can be categorized based on their purpose and structure. Some common types include: 1. Working Capital Line of Credit: This type of loan agreement provides businesses with access to funds to cover their day-to-day operational expenses, such as inventory purchases, payroll, and accounts receivable. The borrowing limit is typically determined based on the borrower's financial health, creditworthiness, and business performance. 2. Equipment Financing Agreement: This loan agreement allows businesses to acquire new equipment or upgrade their existing machinery. The financed amount is often secured by the equipment itself, reducing the risk for the lender. Interest rates and repayment terms may vary based on the type and expected lifespan of the equipment. 3. Real Estate Line of Credit: This type of loan agreement enables businesses to finance the purchase or renovation of commercial properties. The borrowed funds can be used to acquire office spaces, retail outlets, or warehouses, among others. The repayment terms and interest rates will depend on the borrower's credit history, property appraisal, and other factors. 4. Inventory Financing Agreement: Businesses with substantial inventory levels can utilize this line of credit arrangement to gain access to funds for purchasing additional inventory. The agreement typically involves collateralizing the existing inventory and may entail periodic audits to monitor asset value. 5. Business Expansion Line of Credit: This loan agreement provides funds for the expansion or growth of a business, including opening new locations, launching new products, or entering new markets. Borrowing limits may be higher for established businesses with a proven track record of success. A Houston Texas line of credit or loan agreement between a corporate or business borrower and a bank encompasses several key elements. These include the loan amount, interest rate, repayment terms, collateral requirements, financial covenants, and default provisions. The agreement often outlines the rights and responsibilities of both the borrower and the lender, including conditions for prepayment, refinancing, and amendment of the agreement based on changing circumstances. It is crucial for both parties involved to carefully review and negotiate the terms of the line of credit or loan agreement to ensure they align with their respective goals and risk tolerance. Seeking legal and financial advice before entering into such an agreement can significantly contribute to the success of the borrowing arrangement.

Houston Texas Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank

Description

How to fill out Houston Texas Line Of Credit Or Loan Agreement Between Corporate Or Business Borrower And Bank?

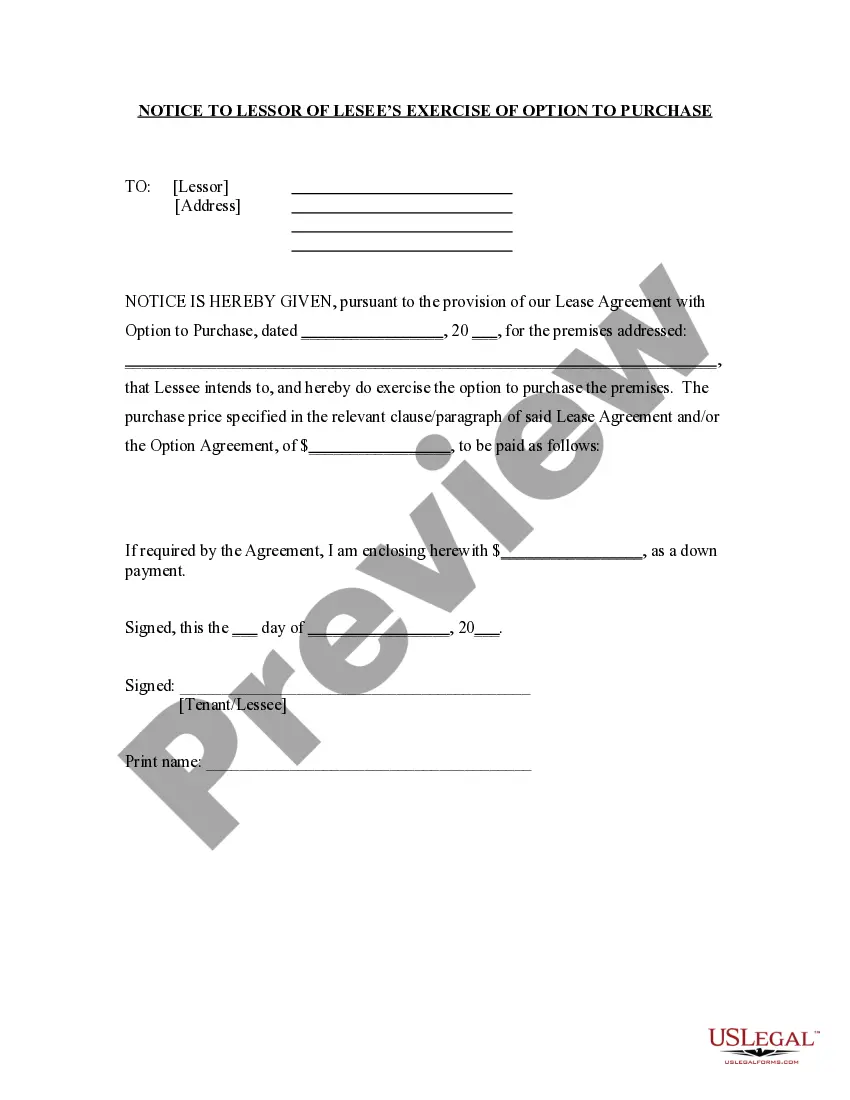

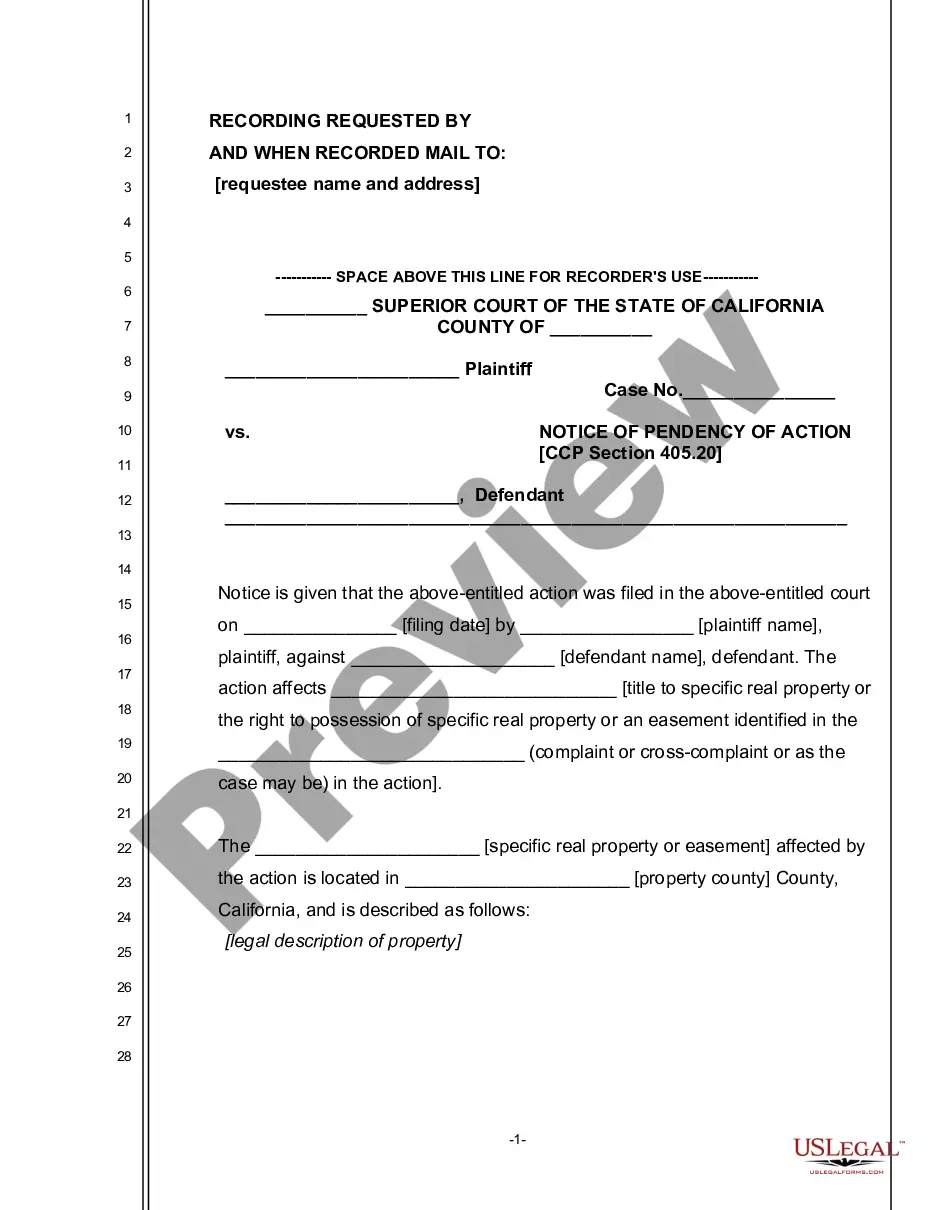

Are you looking to quickly create a legally-binding Houston Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank or maybe any other form to manage your personal or corporate affairs? You can go with two options: hire a professional to write a legal document for you or draft it entirely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get neatly written legal documents without paying unreasonable fees for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-specific form templates, including Houston Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been out there for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the necessary document without extra troubles.

- First and foremost, carefully verify if the Houston Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank is adapted to your state's or county's regulations.

- If the form has a desciption, make sure to check what it's suitable for.

- Start the searching process over if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Select the subscription that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Houston Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to find and download legal forms if you use our services. Additionally, the paperwork we offer are reviewed by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!