The Cook Illinois Term Loan Agreement is a comprehensive legal document that outlines the terms and conditions of borrowing funds from a bank by a business or corporate borrower located in Cook County, Illinois. This agreement is essential for establishing a legally binding relationship between the borrower and the bank, ensuring clear communication and understanding of the loan arrangement. Here, we will delve into the essential aspects of a Cook Illinois Term Loan Agreement, highlighting its components and variations if applicable. 1. Parties Involved: The agreement begins by identifying the parties involved in the transaction. It includes the names and contact information of the borrower and the bank, ensuring accurate representation of each party. 2. Loan Amount and Purpose: The agreement specifies the total loan amount that the borrower requests from the bank. Additionally, it outlines the purpose for which the funds will be used, such as business expansion, debt consolidation, or working capital. 3. Repayment Terms: This section outlines the repayment terms agreed upon by both parties. It includes the repayment schedule, which can be structured as monthly, quarterly, or annual payments. The agreement also mentions the interest rate applicable to the loan and any penalties or fees associated with late payments or defaults. 4. Security/Collateral: To secure the loan, the agreement may require the borrower to provide collateral. Collateral can be in the form of assets such as property, inventory, accounts receivable, or other valuable items. The agreement clearly defines the collateral provided and the rights and responsibilities of both parties regarding its protection and disposition. 5. Loan Covenants: In a Cook Illinois Term Loan Agreement, the borrower and the bank usually agree to specific loan covenants. Covenants are conditions or restrictions that the borrower must adhere to during the term of the loan. These can include maintaining a certain debt-to-equity ratio, providing financial statements regularly, or limiting additional borrowing. 6. Events of Default: This section outlines the circumstances under which the loan could be considered in default. When a default occurs, the bank may have the right to accelerate the loan, demand full repayment, or take legal action against the borrower. Common events of default include failure to make timely payments, violation of loan covenants, bankruptcy, or insolvency. 7. Miscellaneous Provisions: The agreement may contain various other provisions, including provisions for dispute resolution, governing law, notices, and amendment procedures. It also typically includes a severability clause, stating that if any part of the agreement is deemed invalid or unenforceable, it will not affect the validity of the remaining provisions. Different types of Cook Illinois Term Loan Agreements can exist depending on the specific requirements of the borrower and the bank. These may include secured or unsecured term loans, revolving term loans, bridge loans, or construction loans. Each loan type has its own unique terms, conditions, and clauses tailored to meet the borrower's needs and the bank's risk appetite. In conclusion, the Cook Illinois Term Loan Agreement establishes a mutual understanding between the borrower and the bank regarding the loan amount, repayment terms, collateral, covenants, and default provisions. It plays a crucial role in facilitating business financing in Cook County, Illinois by outlining the rights and obligations of both parties involved in the loan transaction.

Cook Illinois Term Loan Agreement between Business or Corporate Borrower and Bank

Description

How to fill out Cook Illinois Term Loan Agreement Between Business Or Corporate Borrower And Bank?

Whether you intend to start your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Cook Term Loan Agreement between Business or Corporate Borrower and Bank is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Cook Term Loan Agreement between Business or Corporate Borrower and Bank. Follow the guidelines below:

- Make certain the sample fulfills your individual needs and state law regulations.

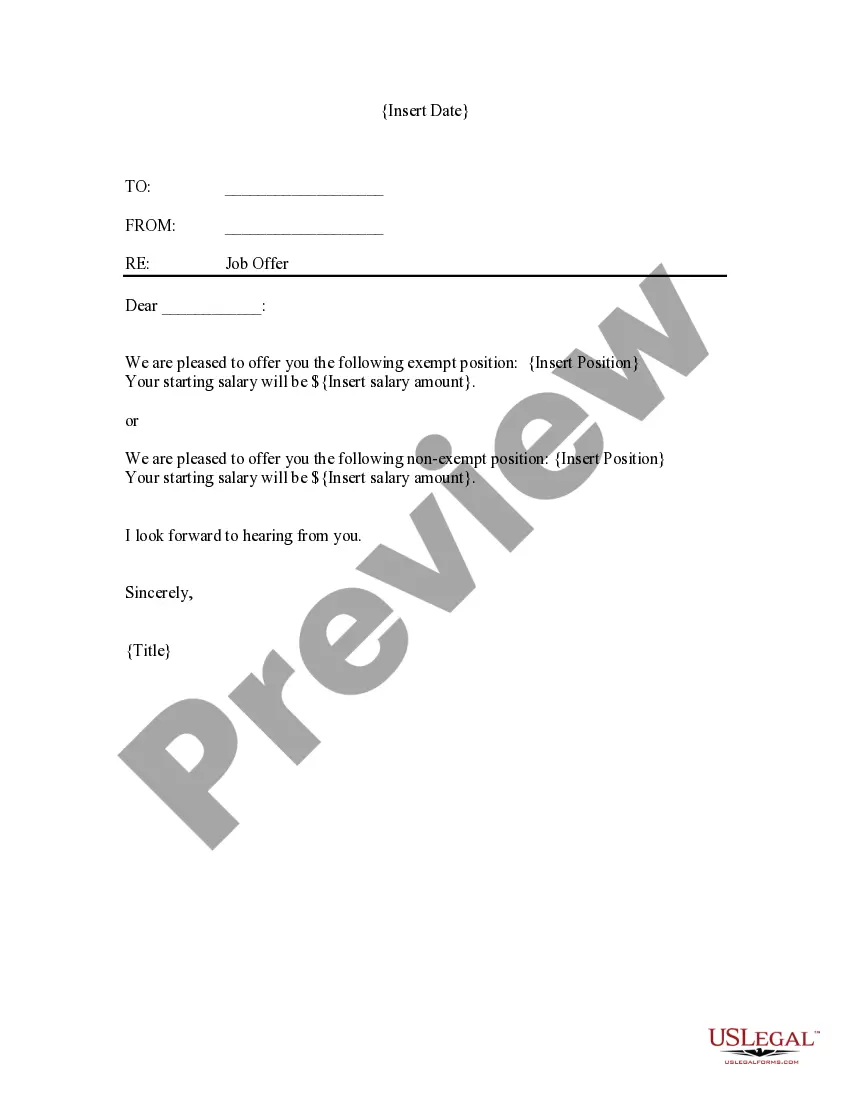

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Cook Term Loan Agreement between Business or Corporate Borrower and Bank in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!