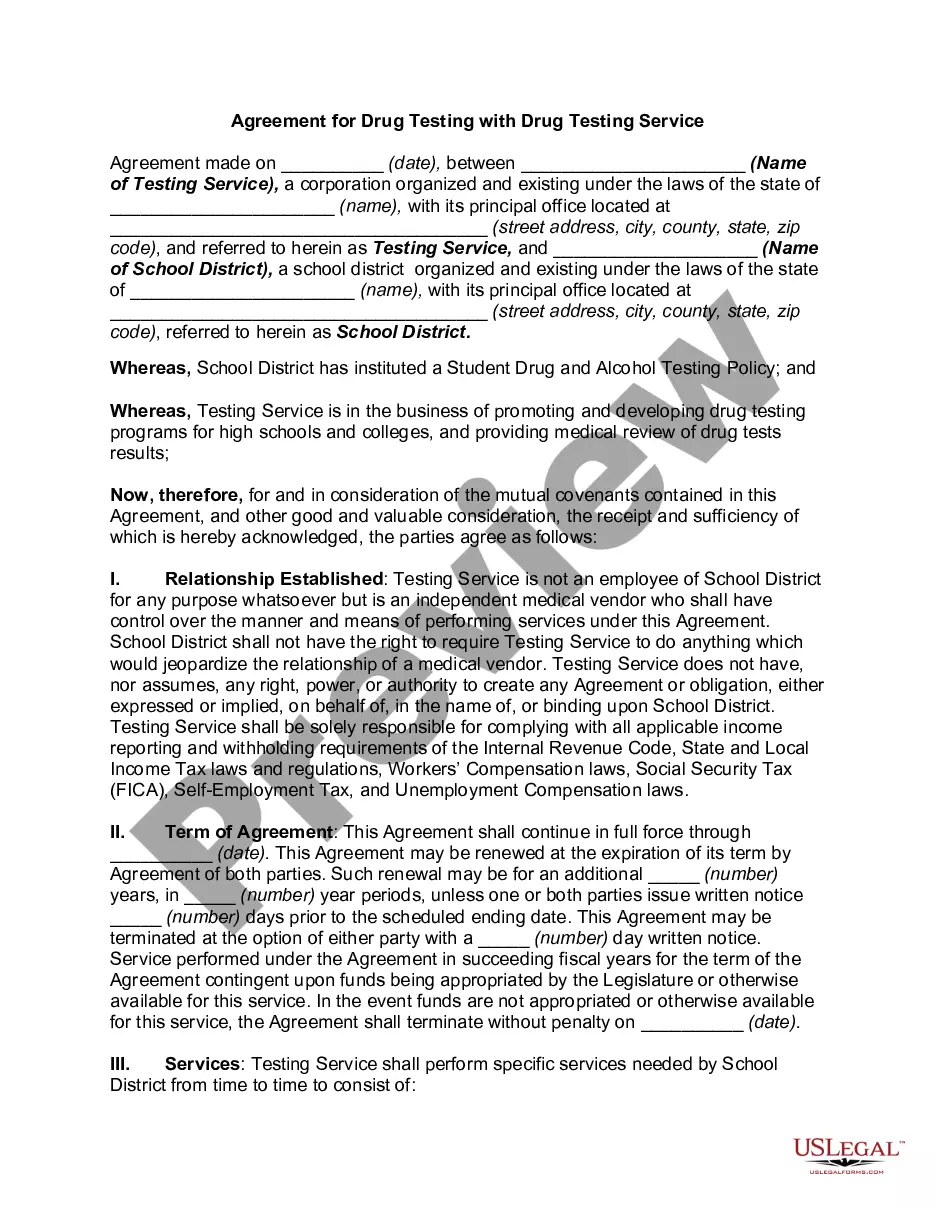

Dallas Texas is a vibrant city known for its booming business sector and entrepreneurial spirit. As a hub for numerous industries such as energy, technology, healthcare, and finance, many businesses and corporate borrowers in Dallas often seek financial assistance from banks to fuel their growth and expansion. In such cases, a Dallas Texas Term Loan Agreement between a business or corporate borrower and a bank becomes crucial. A Dallas Texas Term Loan Agreement is a legal contract that outlines the terms and conditions of a loan provided by a bank to a business or corporate borrower based in Dallas, Texas. This agreement ensures that both parties are aware of their rights, obligations, and responsibilities for the duration of the loan. In this agreement, several key elements are typically included. Firstly, it outlines the loan amount provided by the bank to the borrower. This is a crucial aspect as it determines the financial resources available to the borrower for their business operations or specific projects. The term of the loan is also defined in the agreement, specifying the duration within which the borrower is required to repay the loan amount, along with any accrued interest. This term can vary depending on the borrower's needs and the bank's lending policies. The interest rate charged by the bank for the loan is also clearly mentioned to ensure transparency and clarity. Repayment terms and conditions are an integral part of any Dallas Texas Term Loan Agreement. It outlines the repayment schedule, including the frequency and amount of installment payments to be made by the borrower. Additionally, the agreement may also detail any penalties or fees applicable for late or missed payments. Security or collateral requirements may also be addressed in the agreement. Banks often request collateral as a form of security to mitigate their risk. This could include assets such as property, equipment, or accounts receivable, which the bank can claim in the event of default. Furthermore, the agreement may entail provisions related to loan covenants. These are conditions or restrictions imposed on the borrower, intended to protect the bank's interests. Covenants may include financial ratios, limitations on additional debt, or requirements for periodic financial reporting ensuring the borrower's financial health and ability to repay the loan. There can be variations of the Dallas Texas Term Loan Agreement depending on the specific needs and specifications of the business or corporate borrower. Some examples may include Equipment Term Loan Agreement, Real Estate Term Loan Agreement, Working Capital Term Loan Agreement, or Acquisition Term Loan Agreement. In conclusion, a Dallas Texas Term Loan Agreement is a vital document that governs the lending relationship between a bank and a business or corporate borrower in Dallas, Texas. It serves to protect the interests of both parties, ensuring clarity, transparency, and legal compliance throughout the loan term.

Dallas Texas Term Loan Agreement between Business or Corporate Borrower and Bank

Description

How to fill out Dallas Texas Term Loan Agreement Between Business Or Corporate Borrower And Bank?

If you need to get a trustworthy legal paperwork provider to find the Dallas Term Loan Agreement between Business or Corporate Borrower and Bank, consider US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can search from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of learning materials, and dedicated support make it easy to locate and execute different documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply select to look for or browse Dallas Term Loan Agreement between Business or Corporate Borrower and Bank, either by a keyword or by the state/county the form is created for. After finding the necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Dallas Term Loan Agreement between Business or Corporate Borrower and Bank template and check the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Register an account and select a subscription option. The template will be immediately ready for download once the payment is processed. Now you can execute the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes these tasks less expensive and more reasonably priced. Create your first company, arrange your advance care planning, create a real estate agreement, or execute the Dallas Term Loan Agreement between Business or Corporate Borrower and Bank - all from the convenience of your home.

Sign up for US Legal Forms now!