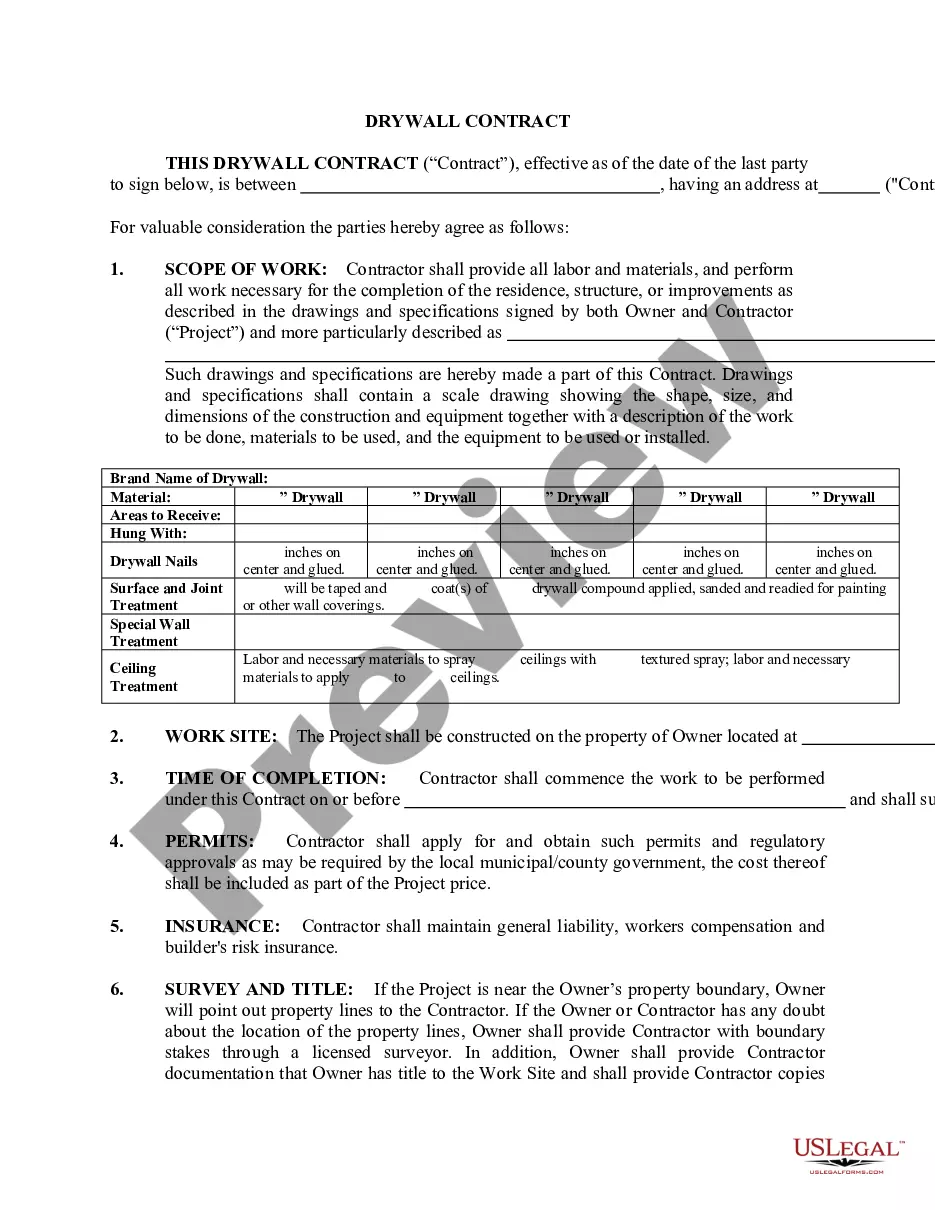

Mecklenburg County, located in the state of North Carolina, offers various invoice templates catered specifically for accountants. These templates are designed to assist accountants in effectively managing their billing processes and effortlessly tracking financial transactions. The following are some key features and types of Mecklenburg North Carolina Invoice Templates for Accountants: 1. Mecklenburg North Carolina Service Invoice Template: This template is ideal for accounting professionals who provide services such as tax preparation, financial consulting, bookkeeping, or auditing. It includes sections to input client details, description of services rendered, hourly rates or fixed fees, and a summary of the total amount due. 2. Mecklenburg North Carolina Sales Invoice Template: Specifically designed for accountants involved in sales-related transactions, this template enables users to itemize products or services sold, specify quantities, unit prices, applicable taxes, and include any discounts if applicable. It provides a comprehensive breakdown of the total charges and facilitates easy calculation of taxes owed. 3. Mecklenburg North Carolina Freelance Invoice Template: Tailored to accountants who work as freelancers or independent contractors, this template allows for the inclusion of project-specific details, such as milestones, hourly rates or project fees, and terms of payment. It enables seamless invoicing for various freelance accounting services, including financial analysis, budgeting, or business valuations. 4. Mecklenburg North Carolina VAT Invoice Template: As accountants dealing with Value Added Tax (VAT), this template incorporates the necessary fields to comply with North Carolina's VAT regulations. It includes the tax registration number, tax percentages, and the breakdown of VAT charges, along with subtotal, total, and payment instructions. 5. Mecklenburg North Carolina Expense Invoice Template: This template is particularly useful for accountants who need to invoice clients for reimbursable expenses incurred on behalf of the client or for specific out-of-pocket expenditures. It allows for easy input of expense details, such as date, description, cost, and any applicable taxes. The template also provides a summary of the reimbursable amount and total invoice value. By utilizing these Mecklenburg North Carolina Invoice Templates for Accountants, accounting professionals can streamline their invoicing processes, maintain accurate financial records, and enhance their professionalism. These templates are designed to cater to the unique requirements of accountants operating in Mecklenburg County, ensuring compliance with local regulations and facilitating efficient client billing practices.

Mecklenburg North Carolina Invoice Template for Accountant

Description

How to fill out Mecklenburg North Carolina Invoice Template For Accountant?

How much time does it usually take you to draw up a legal document? Because every state has its laws and regulations for every life scenario, locating a Mecklenburg Invoice Template for Accountant suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, gathered by states and areas of use. Aside from the Mecklenburg Invoice Template for Accountant, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Experts verify all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Mecklenburg Invoice Template for Accountant:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Mecklenburg Invoice Template for Accountant.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!