Philadelphia, Pennsylvania Invoice Template for Self Employed: A Comprehensive Guide Introduction: In today's fast-paced and competitive business world, managing finances as a self-employed professional in Philadelphia, Pennsylvania can be challenging. As an independent contractor or freelancer, creating accurate and professional invoices is crucial for maintaining a healthy cash flow and ensuring smooth business operations. To simplify this process, Philadelphia offers a variety of invoice templates specifically designed for self-employed individuals. These templates are not only user-friendly but also compliant with the local tax laws and regulations. Philadelphia Pennsylvania Invoice Template for Self Employed: 1. Basic Invoice Template: The Basic Invoice Template is perfect for self-employed professionals who require a simple and streamlined invoicing solution. This template includes all the essential elements of an invoice, such as client information, service details, total amount due, payment terms, and due date. It provides a clean and professional design, making it easy to customize with your brand logo and colors. 2. Hourly Rate Invoice Template: For self-employed individuals in Philadelphia who charge hourly rates for their services, the Hourly Rate Invoice Template is an ideal choice. This template allows you to record the number of hours worked, hourly rate, and calculate the total amount due automatically. It also includes space for descriptions of services provided and any additional expenses incurred during the project. 3. Project-Based Invoice Template: If you work on long-term projects or contracts, the Project-Based Invoice Template can effectively capture the details of your work. This template allows you to itemize each task, its associated cost, and the overall project fee. It also incorporates a clear breakdown of expenses, making it simple to track reimbursements or additional charges. 4. Recurring Invoice Template: For self-employed professionals offering subscription-based services or recurring contracts, the Recurring Invoice Template is an excellent option. This template automates the invoicing process, allowing you to set the frequency of invoicing (weekly, monthly, etc.) and send reminders to your clients for timely payments. It reduces administrative overhead and ensures a steady cash flow for your business. Conclusion: Philadelphia, Pennsylvania Invoice Templates for Self Employed provide an efficient and professional way to manage invoicing tasks for independent contractors, freelancers, and small business owners. Whether you require a basic invoice, hourly rate invoice, project-based invoice, or recurring invoice, Philadelphia offers a range of templates to suit your specific needs. These templates help streamline the invoicing process, maintain accurate records, and ensure timely payments. By utilizing these templates, you can focus on delivering exceptional services to your clients while effectively managing your finances.

Philadelphia Pennsylvania Invoice Template for Self Employed

Description

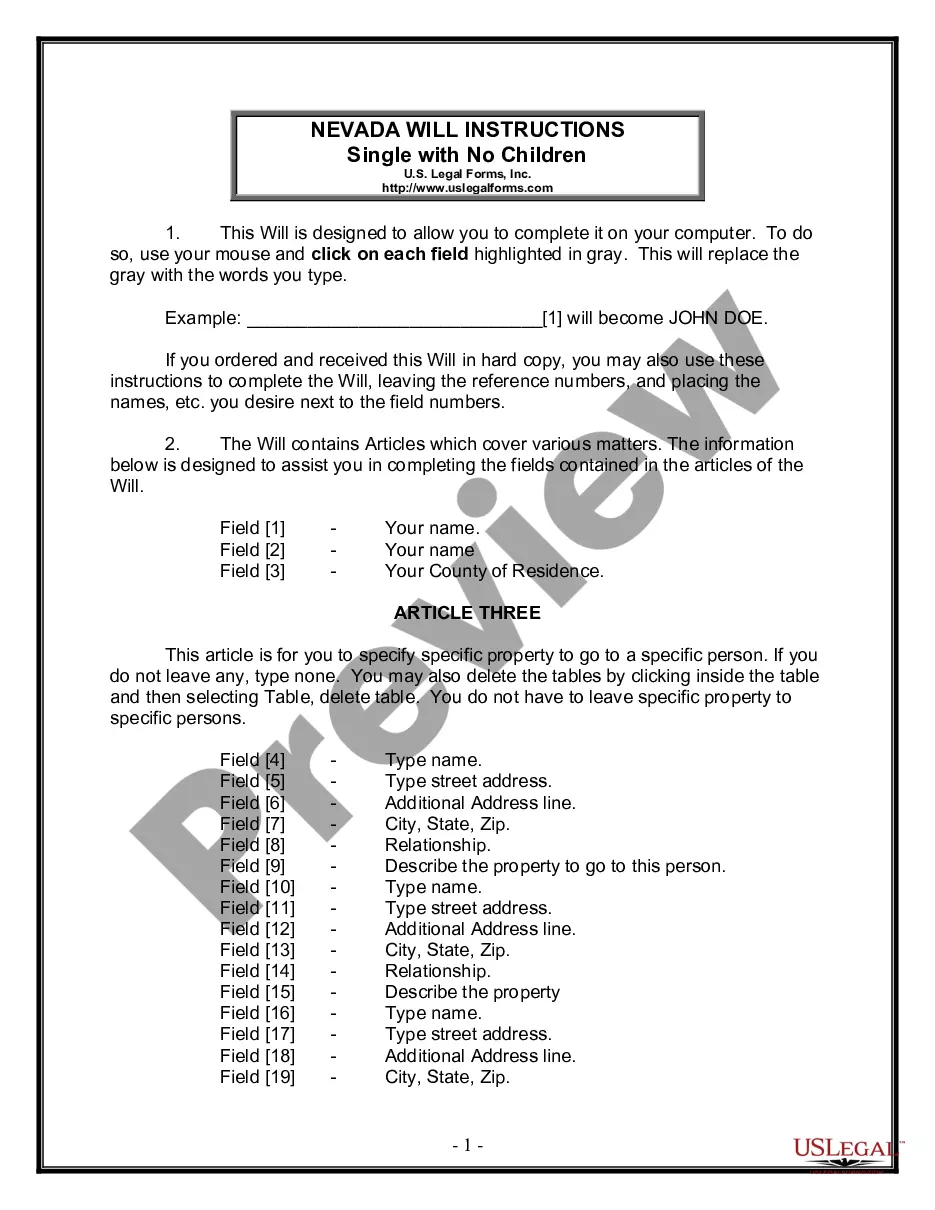

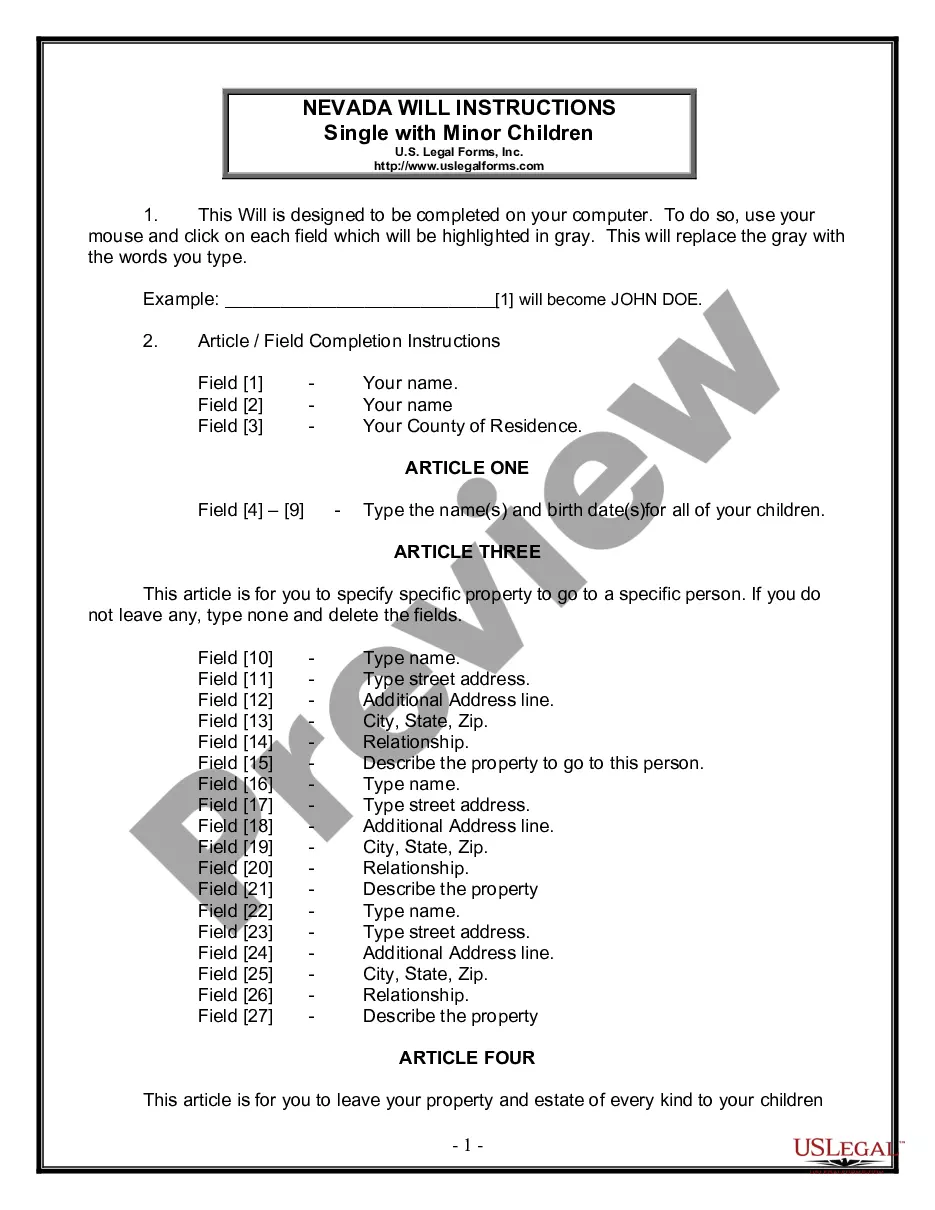

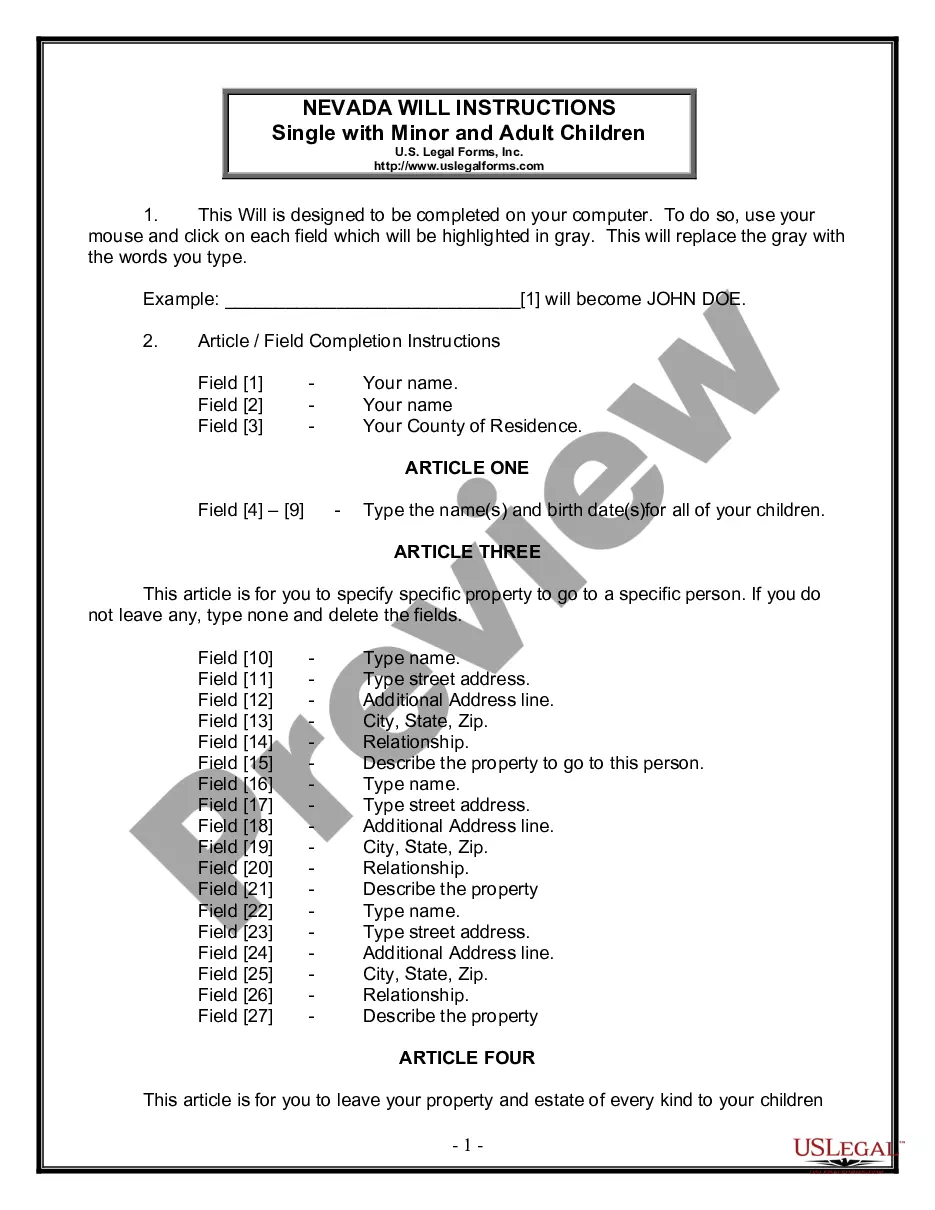

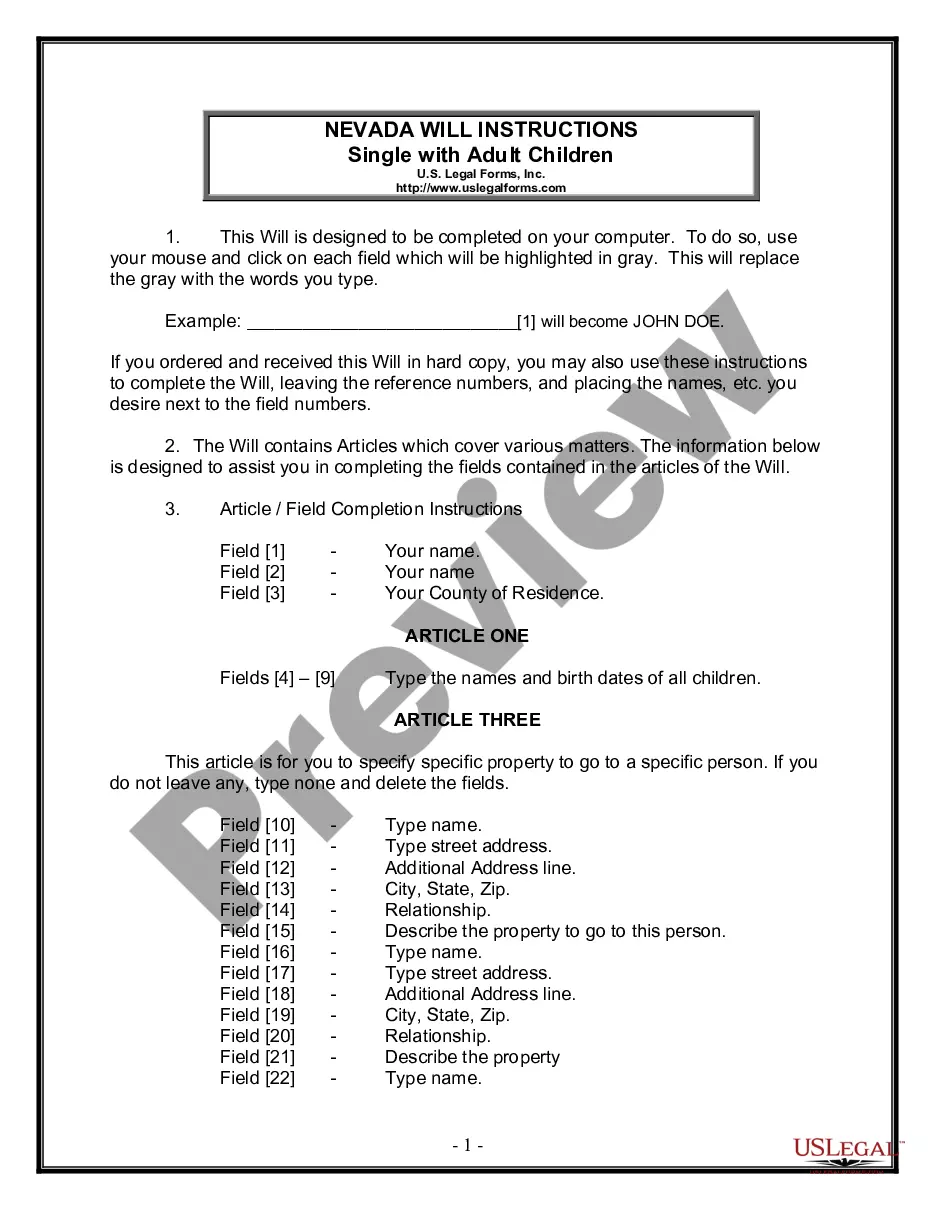

How to fill out Philadelphia Pennsylvania Invoice Template For Self Employed?

How much time does it typically take you to draw up a legal document? Because every state has its laws and regulations for every life situation, locating a Philadelphia Invoice Template for Self Employed meeting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. In addition to the Philadelphia Invoice Template for Self Employed, here you can get any specific document to run your business or personal deeds, complying with your regional requirements. Experts verify all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can retain the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Philadelphia Invoice Template for Self Employed:

- Check the content of the page you’re on.

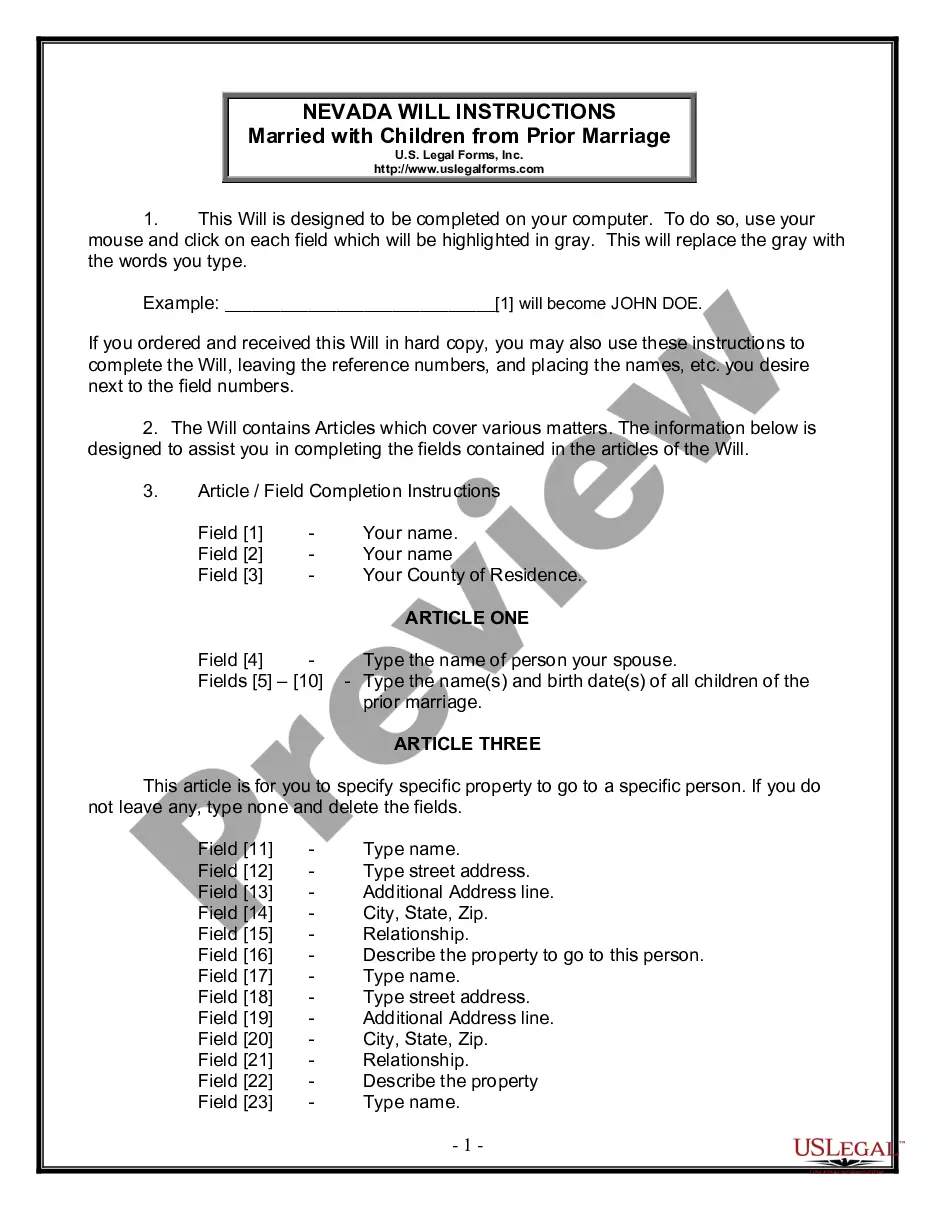

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Philadelphia Invoice Template for Self Employed.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!