San Jose California Invoice Template for Taxi Driver: A Comprehensive Guide Whether you are an independent taxi driver or a taxi company owner in San Jose, California, having a well-designed and easy-to-use invoice template is crucial for managing your billing and ensuring timely payments. In this article, we will delve into what a San Jose California Invoice Template for Taxi Driver entails, its importance, and various types available. A San Jose California Invoice Template for Taxi Driver is a pre-made document that enables taxi drivers to generate professional invoices for their passengers or clients. It includes all the necessary information to facilitate smooth financial transactions and maintain a record of services rendered. By utilizing an invoice template, taxi drivers can streamline their billing process, accurately track payments, and enhance financial transparency. Key Information Included in a San Jose California Invoice Template for Taxi Driver: 1. Contact Information: The template includes the taxi driver's or company's name, address, phone number, email, and website (if applicable). This ensures easy communication and facilitates any queries or clarifications regarding the invoice. 2. Invoice Number and Date: Each invoice is assigned a unique invoice number along with the date of issuance. This helps in distinguishing between multiple invoices and maintaining a chronological order for proper record-keeping. 3. Passenger Information: The template provides fields to input passenger details such as their name, address, contact number, and any additional information required for identification or verification purposes. 4. Trip Details: This section captures vital information about the taxi ride, including the date, time, pick-up and drop-off locations, distance traveled, and any toll charges incurred. It helps both the driver and passenger to accurately review and validate the services provided. 5. Fare Calculation: The invoice incorporates a fare calculation section where the driver can input the trip details, including the base fare, distance traveled, waiting time, and any additional charges (such as late-night fees or airport surcharges). The template then automatically calculates the total fare, which the passenger needs to pay. 6. Payment Information: Here, drivers can specify the accepted payment methods, including cash, credit card, or other digital payment options. It also allows for the inclusion of any late payment penalties or discounts applicable, promoting prompt payment from customers. Types of San Jose California Invoice Templates for Taxi Drivers: 1. Basic Invoice Template: This template includes all the aforementioned key information sections essential for generating a simple and straightforward invoice. 2. Detailed Invoice Template: Ideal for taxi operators or drivers who require more comprehensive documentation, this template offers additional sections, such as passenger signatures, vehicle details (license plate number, identification number), and fare breakdowns (base fare, rate per mile, extras). 3. Weekly/Monthly Invoice Template: Specifically designed for drivers who prefer submitting invoices on a weekly or monthly basis rather than per trip, this template summarizes all the rides within a designated time frame. 4. Tax Compliant Invoice Template: This specialized template is created in adherence to San Jose, California's tax regulations, ensuring the inclusion of relevant tax and business identification numbers, enabling hassle-free tax filing. In summary, a San Jose California Invoice Template for Taxi Driver is a valuable tool for managing financial transactions, providing professional invoices to passengers, and maintaining an organized record-keeping system. Whether you opt for a basic, detailed, weekly, monthly, or tax-compliant template, choosing the right one can significantly enhance your financial management efficiency, accurate billing, and overall business productivity.

San Jose California Invoice Template for Taxi Driver

Description

How to fill out San Jose California Invoice Template For Taxi Driver?

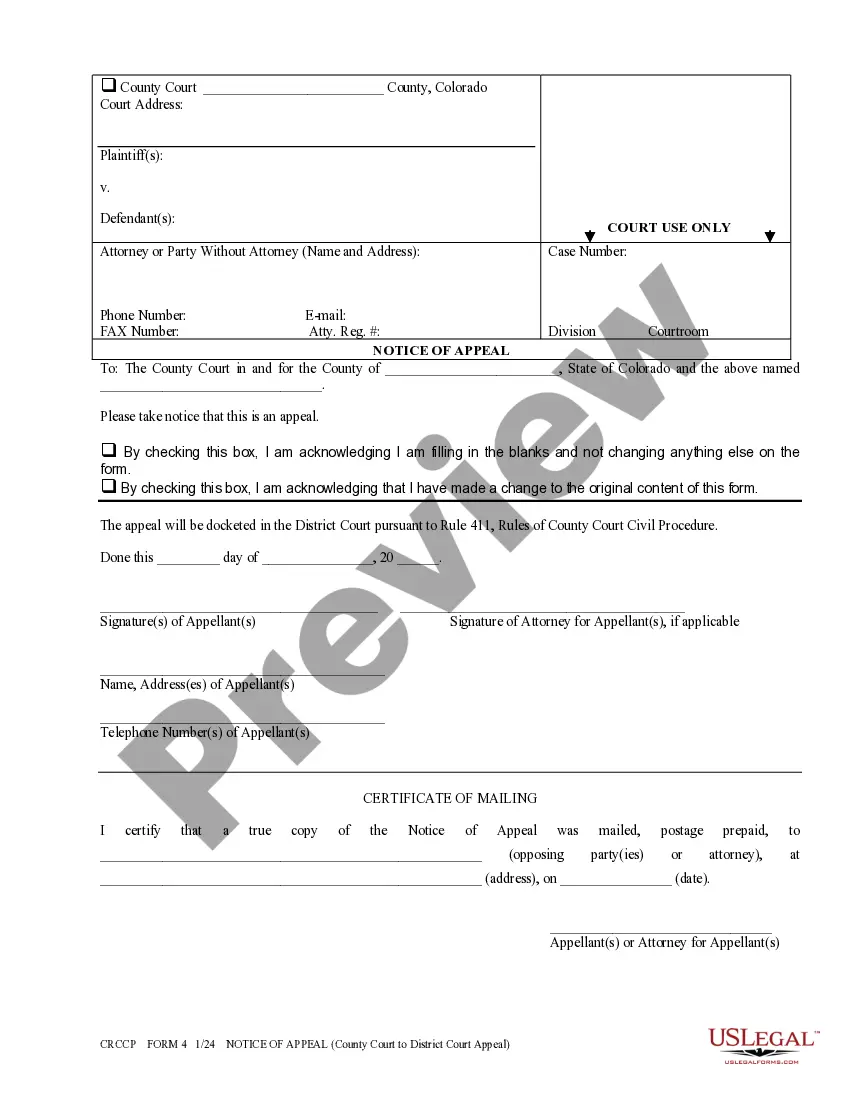

Creating paperwork, like San Jose Invoice Template for Taxi Driver, to take care of your legal affairs is a difficult and time-consumming process. Many situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal issues into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms created for a variety of cases and life situations. We make sure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the San Jose Invoice Template for Taxi Driver template. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as easy! Here’s what you need to do before downloading San Jose Invoice Template for Taxi Driver:

- Ensure that your form is specific to your state/county since the rules for creating legal papers may vary from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the San Jose Invoice Template for Taxi Driver isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to start utilizing our service and download the document.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s easy to locate and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

How to Invoice for Services Develop a Service-Based Invoice Template.List Your Business Name and Contact Information.Include Your Client's Name and Contact Details.Assign a Service Invoice Number.Write the Issuing Date for Your Service Invoice.List All Services Rendered.Include Applicable Taxes for Your Services.

What to include? The taxi company's name. You should see this information together with the logo of the company. The business address of the taxi company.The phone number of the taxi company.Date.Time.Your pickup address.Your destination address.The driver's name.

How to create an invoice: step-by-step Make your invoice look professional. The first step is to put your invoice together.Clearly mark your invoice.Add company name and information.Write a description of the goods or services you're charging for.Don't forget the dates.Add up the money owed.Mention payment terms.

To list your services on the invoice you should: List the service with a brief description of the work completed. List the hours worked or the quantity provided beside each service. List the rate of pay for each service provided. Finally, list the subtotal for each of the services listed.

Microsoft Word provides templates for invoice sheets that you customize to suit your business needs. Office features more than 100 online invoice templates that copy to a Word document. The Word command ribbon plus the Table Tools ribbon help update the style, color, alignment and other layout elements.

Customize free invoice templates from Canva and impress clients with a beautiful, on-brand invoice. Our invoice templates are not only free but also editable to suit just about any business you have.

How to Create an Invoice in Word Open a New Blank Document.Create an Invoice Header.Add the Invoice Date.Include a Unique Invoice Number.Include Your Client's Contact Details.Create an Itemized List of Services.Display the Total Amount Due.Add the Deadline for Payment.

How to Make a Commercial Invoice: Step-By-Step Guide Download a Commercial Invoice Template.Fill in Seller Details.Fill in Customer Details.Assign an Invoice Number.Include a Customer Reference Number.Include the Terms of Sale.Detail the Terms of Payment.Identify the Currency.

To create an invoice for free, build your own invoice using Microsoft Word, Microsoft Excel or Google Docs. You can use a premade invoice template offered by the program you choose, or you can create your own invoice from scratch.