A Nassau New York Invoice Template for Construction is a pre-designed document that helps construction businesses in Nassau County, New York to effectively manage their invoicing processes. This template simplifies the task of creating professional and accurate invoices while ensuring compliance with local regulations and standards. The Nassau New York Invoice Template for Construction usually includes the following key elements: 1. Company Information: This section includes details of the construction business such as the company name, address, contact information, and logo. It is essential for maintaining a professional image and establishing brand identity. 2. Client Information: The template allows you to input the client's details, including name, address, contact information, and any relevant identification numbers. This information helps in clearly identifying the recipient of the invoice. 3. Invoice Number and Date: Each invoice generated using this template will have a unique identification number and a date of issuance. This aids in organizing and tracking payments and transactions. 4. Description of Services or Products: This section allows you to itemize the services or products provided to the client. It includes a detailed description, quantity, unit price, and total amount for each line item. For construction businesses, these items may include labor costs, material expenses, equipment rental charges, and any additional fees. 5. Tax Calculation: As per the tax laws in Nassau County, New York, appropriate taxes, such as sales tax or value-added tax (VAT), may need to be calculated and included in the invoice. The template ensures accurate tax calculations and provides a breakdown of these charges. 6. Terms of Payment: This section outlines the agreed-upon payment terms and conditions, including due dates, acceptable payment methods, and any late payment fees or discounts. Clear payment terms help avoid disputes and ensure a smoother payment process. There might be variations in Nassau New York Invoice Templates for Construction, such as: 1. Basic Invoice Template: A simple invoice template suitable for smaller construction projects or businesses with fewer invoicing requirements. 2. Detailed Invoice Template: A comprehensive invoice template that allows for more detailed descriptions of services and products, ideal for larger construction projects or businesses with complex billing needs. 3. Progress Payment Invoice Template: Specifically designed for construction projects that involve multiple payments based on project milestones. It includes sections to track the progress made and the corresponding payments due at different stages. In conclusion, a Nassau New York Invoice Template for Construction streamlines the invoicing process for construction businesses operating in Nassau County. By utilizing this template, businesses can efficiently generate professional and accurate invoices, ensuring timely payments while adhering to local invoicing regulations and standards.

Nassau New York Invoice Template for Construction

Description

How to fill out Nassau New York Invoice Template For Construction?

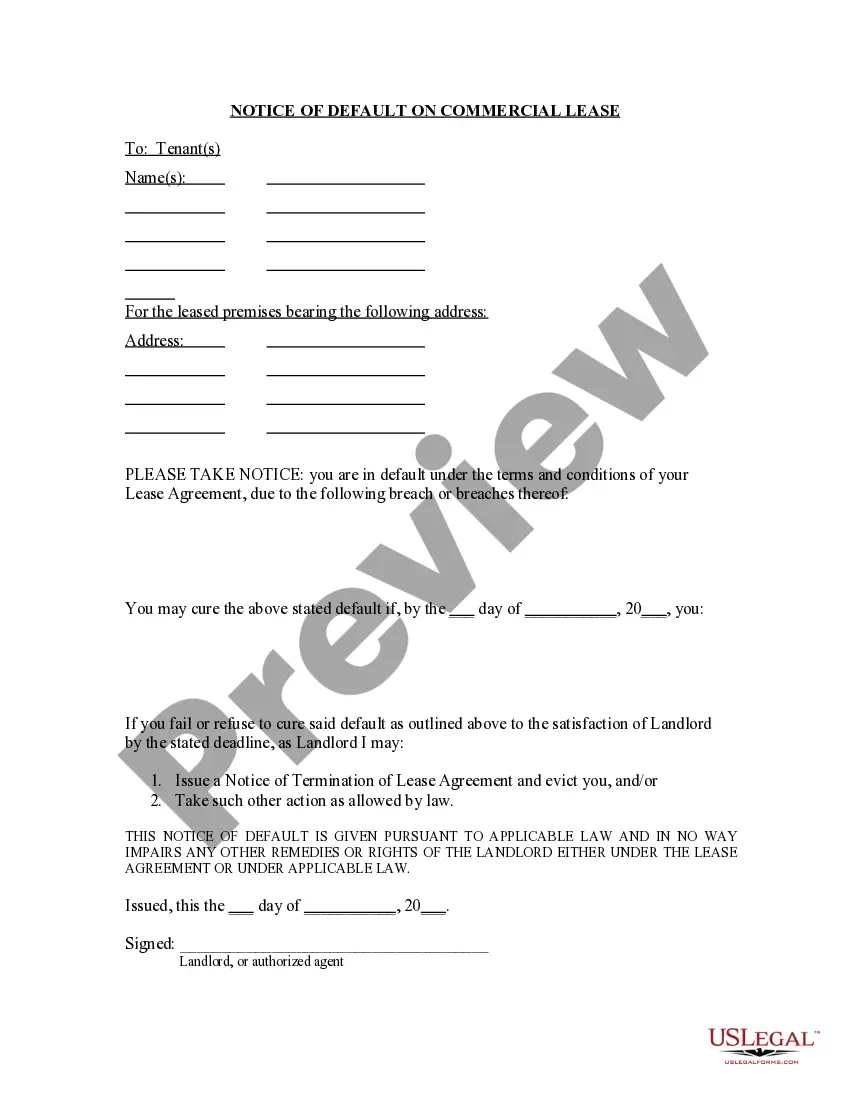

If you need to get a reliable legal document supplier to obtain the Nassau Invoice Template for Construction, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can search from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of supporting resources, and dedicated support make it easy to get and execute different documents.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply type to search or browse Nassau Invoice Template for Construction, either by a keyword or by the state/county the document is created for. After locating necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Nassau Invoice Template for Construction template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be instantly ready for download as soon as the payment is processed. Now you can execute the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less pricey and more affordable. Create your first business, organize your advance care planning, create a real estate contract, or execute the Nassau Invoice Template for Construction - all from the convenience of your home.

Join US Legal Forms now!