The Phoenix Arizona Demand Promissory Note is a legal document used to establish a financial obligation between a lender and a borrower. This note functions as a written promise to repay a specific amount of money, known as the principal, by the borrower to the lender. The amount borrowed is typically stated in US dollars. The key characteristic of a demand promissory note is that the lender has the right to demand payment from the borrower at any time, without prior notice. This means that the borrower must be prepared to repay the loan when called upon. This type of note may be accompanied by an agreed-upon interest rate, which is the cost of borrowing the money over a specific period. In Phoenix, Arizona, a demand promissory note serves as a legally binding agreement that should adhere to the state-specific laws and regulations. These notes are frequently used in various financial transactions, such as personal loans, business loans, or real estate transactions. There are several types of demand promissory notes that may be used in Phoenix, Arizona, based on the specific circumstances of the loan: 1. Individual's Demand Promissory Note: This type of note is used when an individual borrower is obtaining a loan from a private lender or financial institution. It outlines the terms and conditions of the loan, including the repayment schedule, interest rate, and consequences for default. 2. Commercial Demand Promissory Note: This note is utilized in business scenarios where a company or corporation borrows money for operational purposes, expansion, or bridging financial gaps. The commercial demand note includes specific terms related to the business loan, such as collateral requirements and guarantees. 3. Real Estate Demand Promissory Note: In real estate transactions, a demand promissory note is often employed when a buyer requires financing from the seller or a private lender. This note contains details regarding the loan amount, interest rate, repayment terms, and any specific conditions related to the property. It is crucial to consult with legal professionals or financial advisors before drafting or signing a demand promissory note in Phoenix, Arizona. Understanding the legal implications, rights, and obligations involved is essential to ensure compliance with state laws and protect the interests of both the lender and borrower.

Phoenix Arizona Demand Promissory Note

Description

How to fill out Phoenix Arizona Demand Promissory Note?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Phoenix Demand Promissory Note, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Phoenix Demand Promissory Note from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Phoenix Demand Promissory Note:

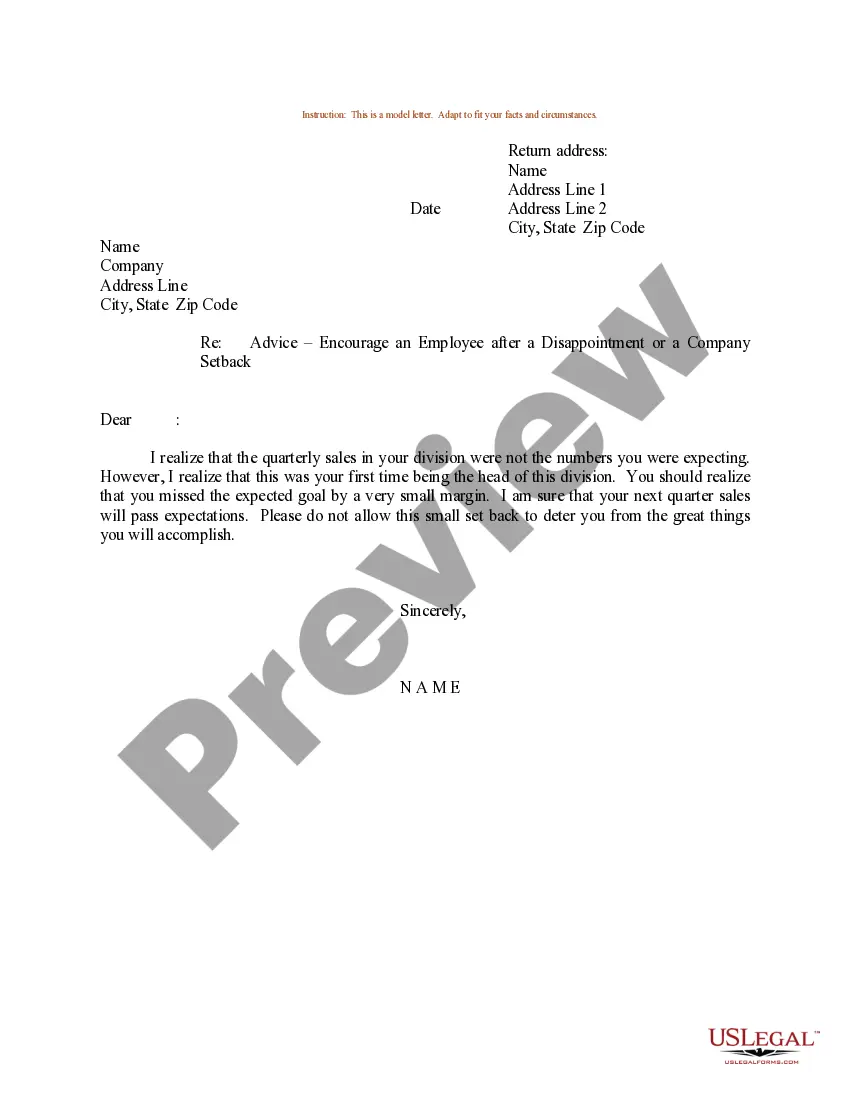

- Examine the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!