Keywords: Suffolk New York, demand promissory note, types Description: A Suffolk New York Demand Promissory Note is a legally binding document that establishes a borrower's obligation to repay a loan to a lender within the specified terms. It is commonly used in Suffolk County, New York, and serves as evidence of the borrower's promise to repay the borrowed amount and any accrued interest. This type of promissory note is called a "demand" note because the lender can "demand" repayment at any time, unlike other notes with a fixed maturity date. The lender has the flexibility to ask for the loan amount to be repaid in full whenever they choose, making it a versatile instrument for short-term loans or when there is uncertainty regarding repayment timing. There are various types of Suffolk New York Demand Promissory Notes that can be used according to the specific borrowing arrangements between parties. Some notable types include: 1. Simple Demand Promissory Note: This is the most common type of demand note, typically used for straightforward lending arrangements where repayment can be demanded without any additional conditions. It outlines the principal amount, interest rate, repayment terms, and the lender's right to demand repayment. 2. Secured Demand Promissory Note: If the lender requires additional security, this type of note can be used. It includes provisions that allow the lender to hold collateral or assets as security until repayment is made. This provides the lender with an added layer of protection in case the borrower defaults. 3. Installment Demand Promissory Note: In certain cases, a demand note may be structured to allow for repayment in installments instead of full repayment at once. This type of note includes a schedule of fixed payments, including principal and interest, and allows the lender to demand repayment if the borrower fails to make the scheduled installments. 4. Unsecured Demand Promissory Note: This type of note does not require any collateral or security from the borrower. It solely relies on the borrower's creditworthiness and promise to repay. Since it carries a higher risk for the lender, the interest rate might be higher for an unsecured demand promissory note compared to a secured one. It is important to consult a legal professional when drafting or entering into a Suffolk New York Demand Promissory Note to ensure compliance with applicable laws and to include all necessary clauses to protect the rights and interests of both the lender and the borrower.

Suffolk New York Demand Promissory Note

Description

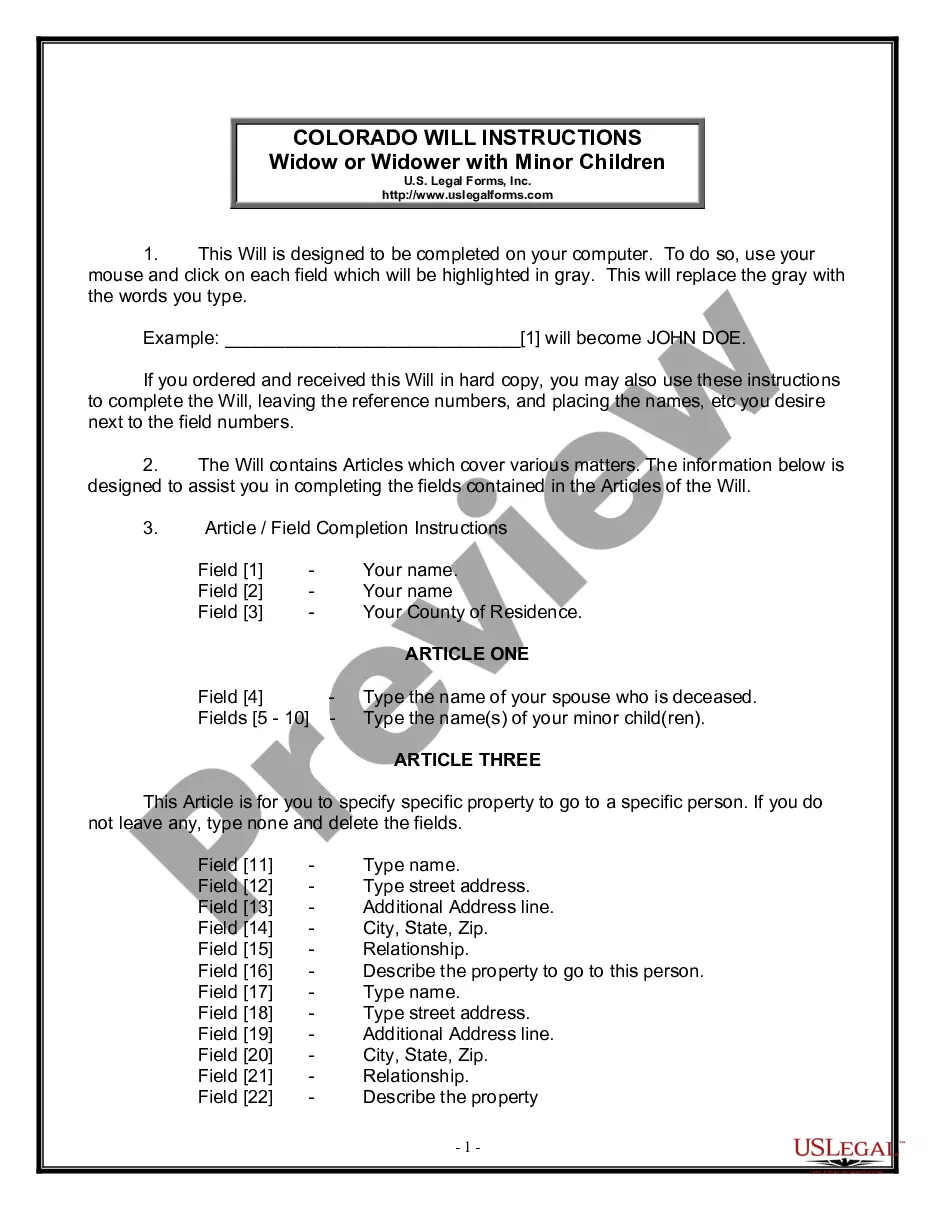

How to fill out Suffolk New York Demand Promissory Note?

Whether you intend to open your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Suffolk Demand Promissory Note is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few additional steps to get the Suffolk Demand Promissory Note. Adhere to the guide below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the file once you find the correct one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Demand Promissory Note in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

Demand and Time Instruments A promissory note is how a borrower shows their intent to repay the note. All rules associated with promissory notes are from the Uniform Commercial Code Article 3 (Article 3). This stipulates the notes can act as instruments of demand or time.

When payment is requested, a time period will be given for repayment. A promissory note, in contrast, can have the option for payment to be 'on demand' or at a specified date. A demand note is not required to show cause notice to be given to a borrower who is delinquent, unlike a mortgage loan.

A promissory note payable on demand is a way to get repaid when you loan money to someone. It is a document that states the terms of the loan and includes the payable on demand notation on it. This means that you can demand full payment of the loan at any time you deem necessary.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

All Promissory Notes are valid only for a period of 3 years starting from the date of execution, after which they will be invalid. There is no maximum limit in terms of the amount which can be lent or borrowed. The issuer / lender of the funds is normally the one who will hold the Promissory Note.

Acknowledgment in writing of the promissory note and promised to pay later. Then the date on which he signed on the written format....Steps in Filing a case: Verification of Limitation period of Promissory note. Sending Notice. File a suit in Civil Court. Paying Court Fee. After Filing of the suit.

To collect on a demand promissory note, you will need to send a demand for payment letter to the lender. This lets the lender know that you want the loan paid back now and that the repayment period is ending. This demand letter should include the following: The date of the letter.

To enforce a promissory note, the holder must provide notice as is required per the note. If timely payment is not made by the borrower, the note holder can file an action to recover payment.

There are two types of promissory notes often used to evidence a loan or debt. One type is referred to as demand promissory note because the note is payable at any time on demand by the lender.

Demand promissory notes are notes that do not carry a specific maturity date, but are due on demand of the lender. Usually the lender will only give the borrower a few days' notice before the payment is due. Promissory notes may be used in combination with security agreements.

Interesting Questions

More info

It is not a real promise of payment and is not binding on you. There are no bills of exchange, notes or other securities that have binding value on the exchange of such promissory note as of the time you signed the promissory note, therefore, it does not serve as evidence of a legally-binding contract or promise. The promissory note has no legal force until it has been accepted as a substitute for cash and other property by one of the parties to the contract and accepted by the other party. The promissory note serves as proof of a contract of one party only.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.