San Diego California Letter to Confirm Accounts Receivable is a formal document used by businesses or individuals in San Diego, California, to verify the outstanding debts or receivables owed to them. This letter serves as a request for acknowledgment and confirmation of the existing account balances. By sending this letter, businesses aim to ensure accurate financial records, strengthen customer relations, and maintain a transparent and professional approach towards their accounts receivable management. In such a letter, it is essential to include specific keywords to make it relevant and comprehensive. Here are some relevant keywords and phrases to consider: 1. San Diego, California: Mentioning the location demonstrates the specificity and relevance of the document to businesses operating in that area. 2. Letter to Confirm Accounts Receivable: This indicates the primary purpose of the letter, which is to obtain confirmation of outstanding debts owed to the sender. 3. Business Name and Contact Information: Include the full name and contact details of the business or individual sending the letter for easy identification and communication. 4. Account Information: Provide a comprehensive list of accounts or invoices that require confirmation, including the account numbers, invoice dates, and amounts owed. 5. Confirmation Process: Explain how the recipient should confirm the accounts receivable. This could include methods such as replying via email, signing and returning the letter, or contacting a specified representative directly. 6. Deadline: Set a clear deadline by which the recipient must respond, emphasizing the importance of timely confirmation for accurate record-keeping and seamless financial management. 7. Privacy and Confidentiality: Assure the recipient that the account details provided will be treated with strict confidentiality and solely used for the intended purpose. Types of San Diego California Letters to Confirm Accounts Receivable: 1. Standard Letter to Confirm Accounts Receivable: This is the most common type of letter used to verify the outstanding debts owed by customers or clients. It includes the essential elements mentioned above. 2. Reminders and Follow-up Letters: In case of non-response or delays, businesses may send follow-up letters or reminders to prompt the recipient to confirm the accounts receivable promptly. 3. Account Update or Revision Letter: If any changes or updates occur in the account balances, businesses may send a revised letter to confirm the updated information. 4. Collection Letter: In case of persistent non-payment or delinquency, businesses may send a collection letter to inform the recipient of potential consequences and the need for immediate resolution. San Diego California Letter to Confirm Accounts Receivable serves as a crucial tool for businesses or individuals to verify and validate their accounts receivable. Its well-structured content and relevant keywords are instrumental in ensuring accuracy, maintaining professional relationships, and promoting efficient financial management practices.

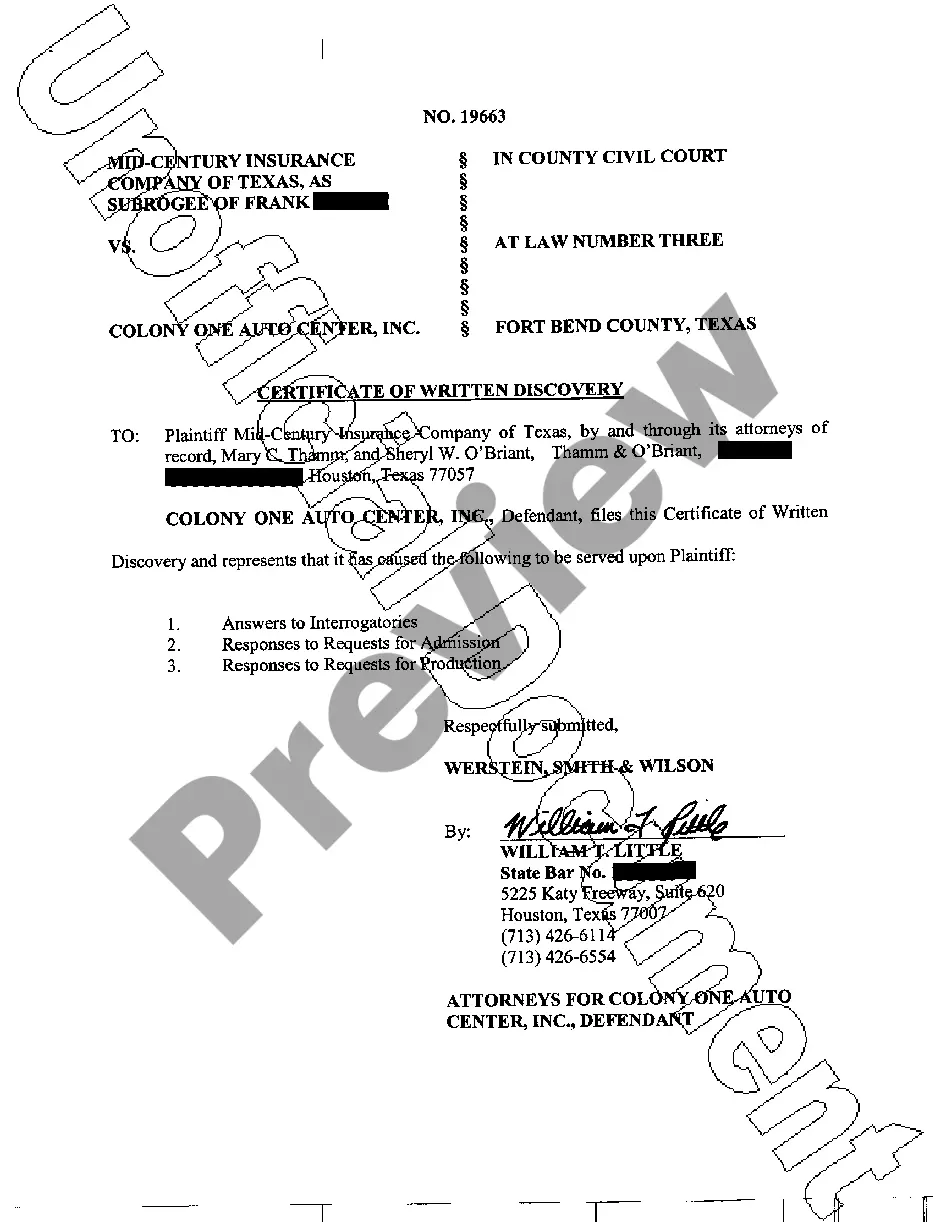

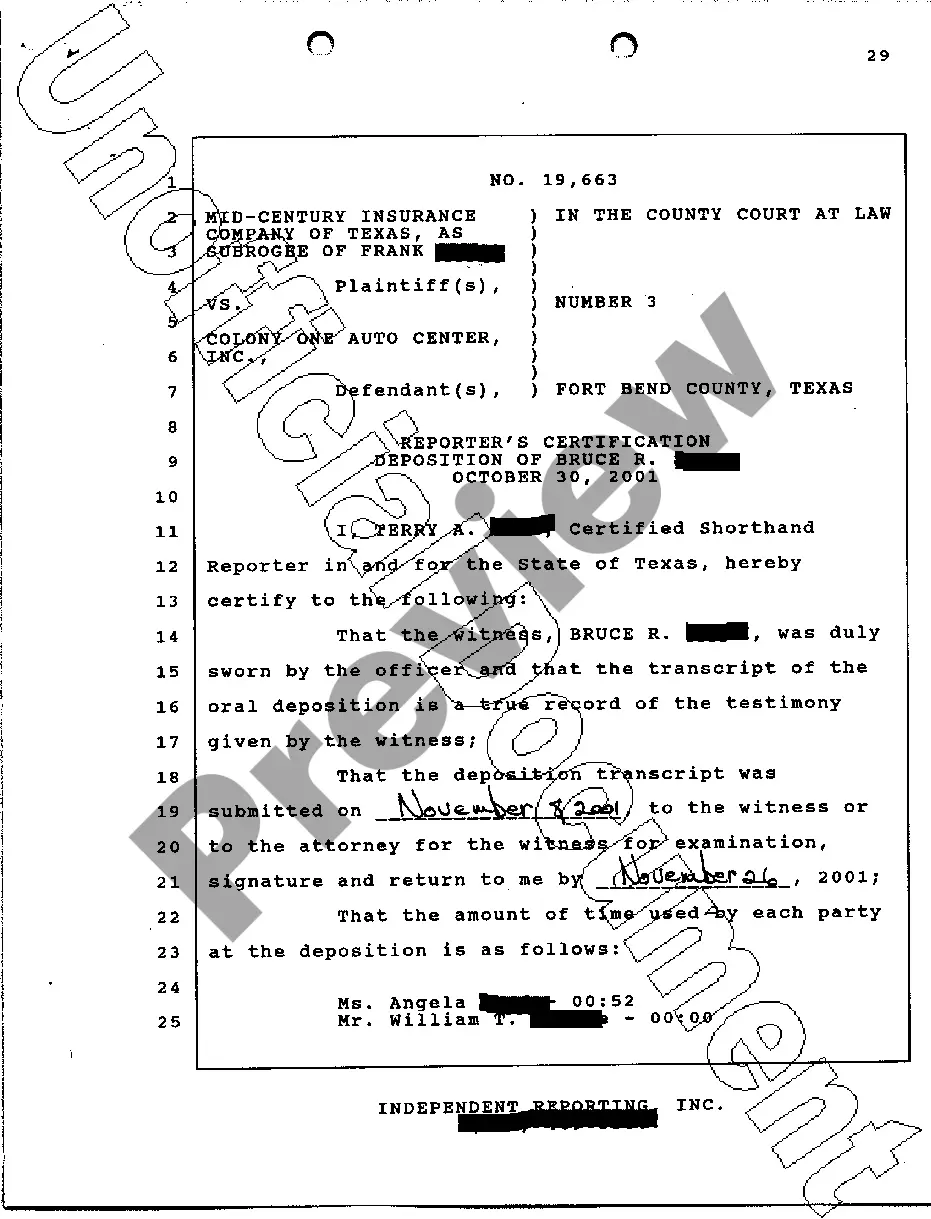

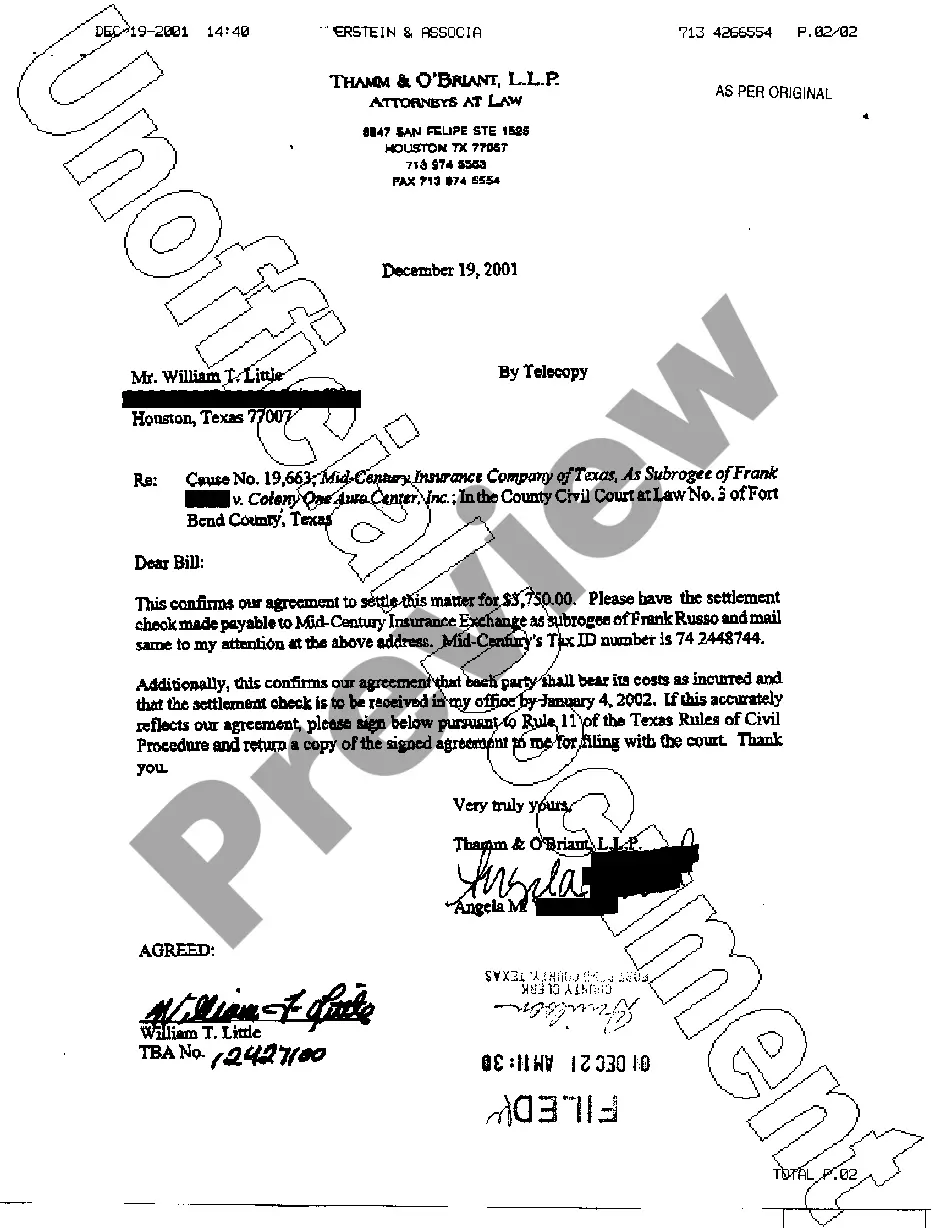

San Diego California Letter to Confirm Accounts Receivable

Description

How to fill out San Diego California Letter To Confirm Accounts Receivable?

Preparing papers for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft San Diego Letter to Confirm Accounts Receivable without expert help.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid San Diego Letter to Confirm Accounts Receivable by yourself, using the US Legal Forms online library. It is the largest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the San Diego Letter to Confirm Accounts Receivable:

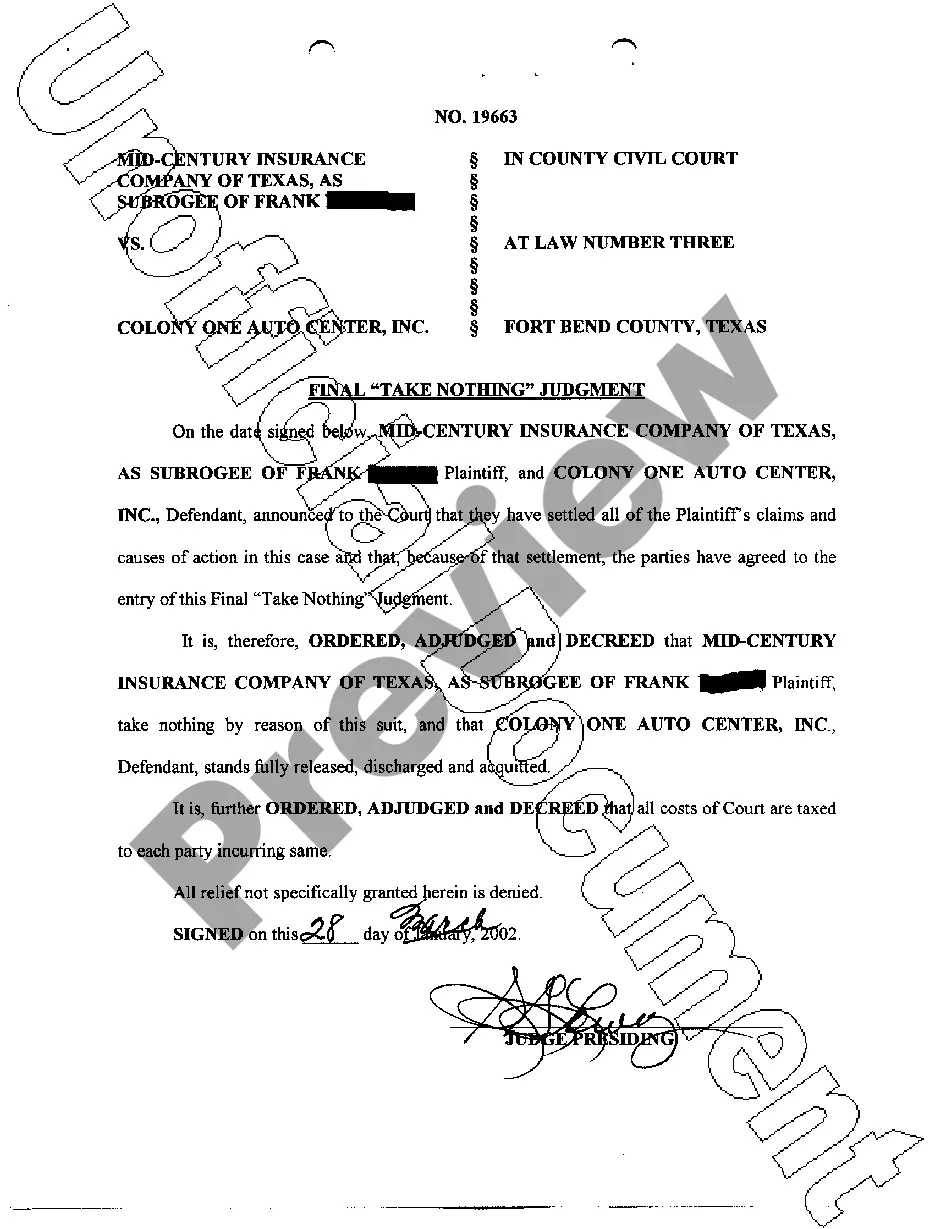

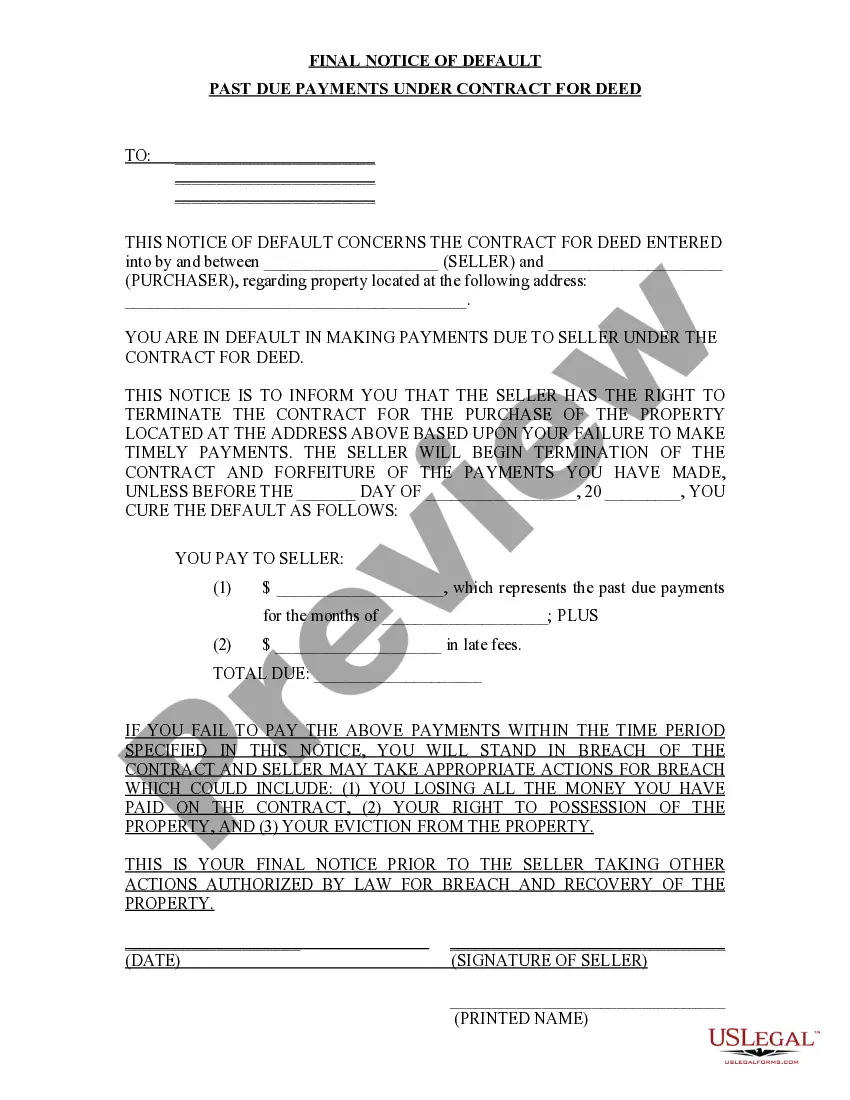

- Examine the page you've opened and check if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that fits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any scenario with just a few clicks!