The Fulton Georgia Accounts Receivable Write-Off Approval Form is a document used in the accounting department of Fulton, Georgia to authorize the write-off of outstanding accounts receivable. This form serves as a crucial internal control measure to ensure proper handling of financial transactions and to maintain accurate records. The purpose of the Fulton Georgia Accounts Receivable Write-Off Approval Form is to obtain approval from the designated authorities for the removal of irrecoverable debts from the accounts receivable ledger. This process is usually undertaken when it becomes evident that the chances of receiving payment from a particular customer or client are slim to none. By utilizing the Fulton Georgia Accounts Receivable Write-Off Approval Form, organizations in Fulton, Georgia can ensure that the write-off process is conducted in a systematic and controlled manner. The form typically requires the submission of detailed information, including the customer's name, outstanding amount, reasons for the write-off, and any applicable supporting documentation. It is important to note that there might be different types of Fulton Georgia Accounts Receivable Write-Off Approval Forms, depending on the specific needs of the organization or industry. Some variations may include: 1. Standard Fulton Georgia Accounts Receivable Write-Off Approval Form: This is the most common type of form used for write-off approval. It includes sections to capture essential details such as customer information, outstanding debt amount, and reasons for write-off. 2. Complex Write-Off Approval Form: In cases where the organization deals with large and complex accounts receivable, a more elaborate form may be required. This form could involve additional sections to gather comprehensive information, such as supporting documents, evidence of collection efforts, and explanations of write-off justifications. 3. Department-Specific Write-Off Approval Form: Depending on the organizational structure, there might be department-specific forms designed to cater to the unique requirements of each department. For instance, if multiple departments handle individual accounts, they may have separate forms to streamline the approval process within their respective teams. 4. Electronic Write-Off Approval Form: With the advancement of technology, many organizations have transitioned to electronic forms for increased efficiency and ease of use. These forms can be filled out online, allowing for faster submission and processing. In conclusion, the Fulton Georgia Accounts Receivable Write-Off Approval Form is an essential document used to authorize the removal of uncollectible debts from the accounts receivable ledger. It ensures proper oversight and control over the write-off process, guaranteeing accurate financial records and efficient management of outstanding debts.

Fulton Georgia Accounts Receivable Write-Off Approval Form

Description

How to fill out Fulton Georgia Accounts Receivable Write-Off Approval Form?

If you need to find a reliable legal document provider to get the Fulton Accounts Receivable Write-Off Approval Form, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can search from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of supporting materials, and dedicated support team make it simple to find and complete various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply select to look for or browse Fulton Accounts Receivable Write-Off Approval Form, either by a keyword or by the state/county the form is intended for. After locating required form, you can log in and download it or retain it in the My Forms tab.

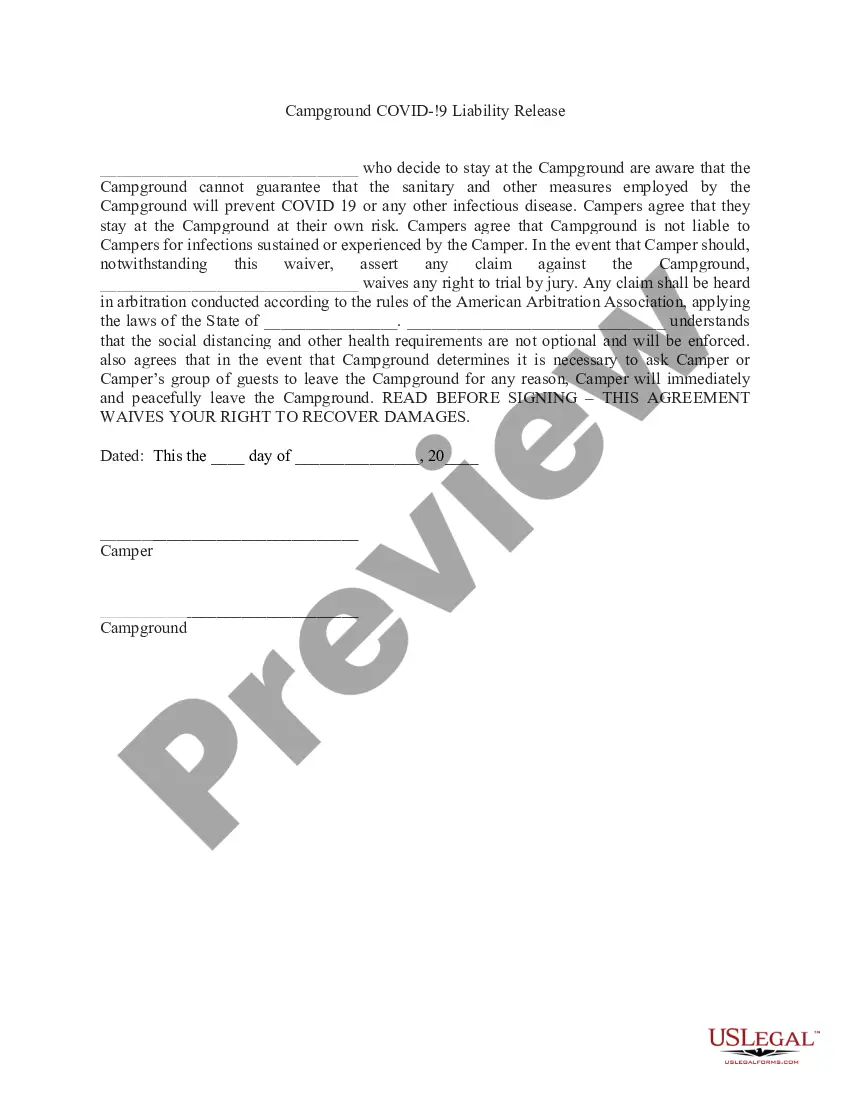

Don't have an account? It's simple to start! Simply find the Fulton Accounts Receivable Write-Off Approval Form template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Register an account and select a subscription plan. The template will be instantly ready for download once the payment is completed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less expensive and more reasonably priced. Create your first company, arrange your advance care planning, create a real estate contract, or execute the Fulton Accounts Receivable Write-Off Approval Form - all from the comfort of your sofa.

Sign up for US Legal Forms now!