The Suffolk New York Accounts Receivable Write-Off Approval Form is a document that plays a crucial role in managing and controlling financial operations in Suffolk County, New York. This form is specifically designed to authorize the write-off of unpaid accounts receivable, which involves removing outstanding debts from a company's balance sheet when it is deemed as uncollectible. The purpose of the Suffolk New York Accounts Receivable Write-Off Approval Form is to establish a standardized procedure for reviewing and approving write-offs, ensuring transparency and accountability within the organization. By using this form, businesses can streamline their write-off processes, minimizing errors and preventing unauthorized actions. Keywords: Suffolk New York, Accounts Receivable, Write-Off Approval Form, financial operations, managing, controlling, unpaid, debts, balance sheet, uncollectible, standardized procedure, reviewing, approving, transparency, accountability, organization, streamline, errors, unauthorized. There may be different types of Suffolk New York Accounts Receivable Write-Off Approval Forms, tailored to specific industries or organizations. Some possible variations can include: 1. Suffolk New York Accounts Receivable Write-Off Approval Form for Small Businesses: This form can be customized to suit the needs of small businesses, taking into account their unique financial circumstances and requirements. 2. Suffolk New York Accounts Receivable Write-Off Approval Form for Healthcare Providers: This specialized form is designed specifically for healthcare professionals or organizations, considering the specific challenges and regulations in the industry. 3. Suffolk New York Accounts Receivable Write-Off Approval Form for Nonprofit Organizations: Nonprofits often have different financial procedures and requirements compared to for-profit entities. This form caters to the specific needs of nonprofit organizations, ensuring compliance with legal and accounting standards. 4. Suffolk New York Accounts Receivable Write-Off Approval Form for Government Agencies: Government entities often follow rigorous financial regulations. This form can be specifically designed for government agencies in Suffolk County, ensuring compliance with applicable laws and regulations. Keywords: Small businesses, healthcare providers, nonprofit organizations, government agencies, specialized, customized, financial circumstances, healthcare professionals, challenges, regulations, compliance, legal, accounting standards, industry-specific, rigorous.

Suffolk New York Accounts Receivable Write-Off Approval Form

Description

How to fill out Suffolk New York Accounts Receivable Write-Off Approval Form?

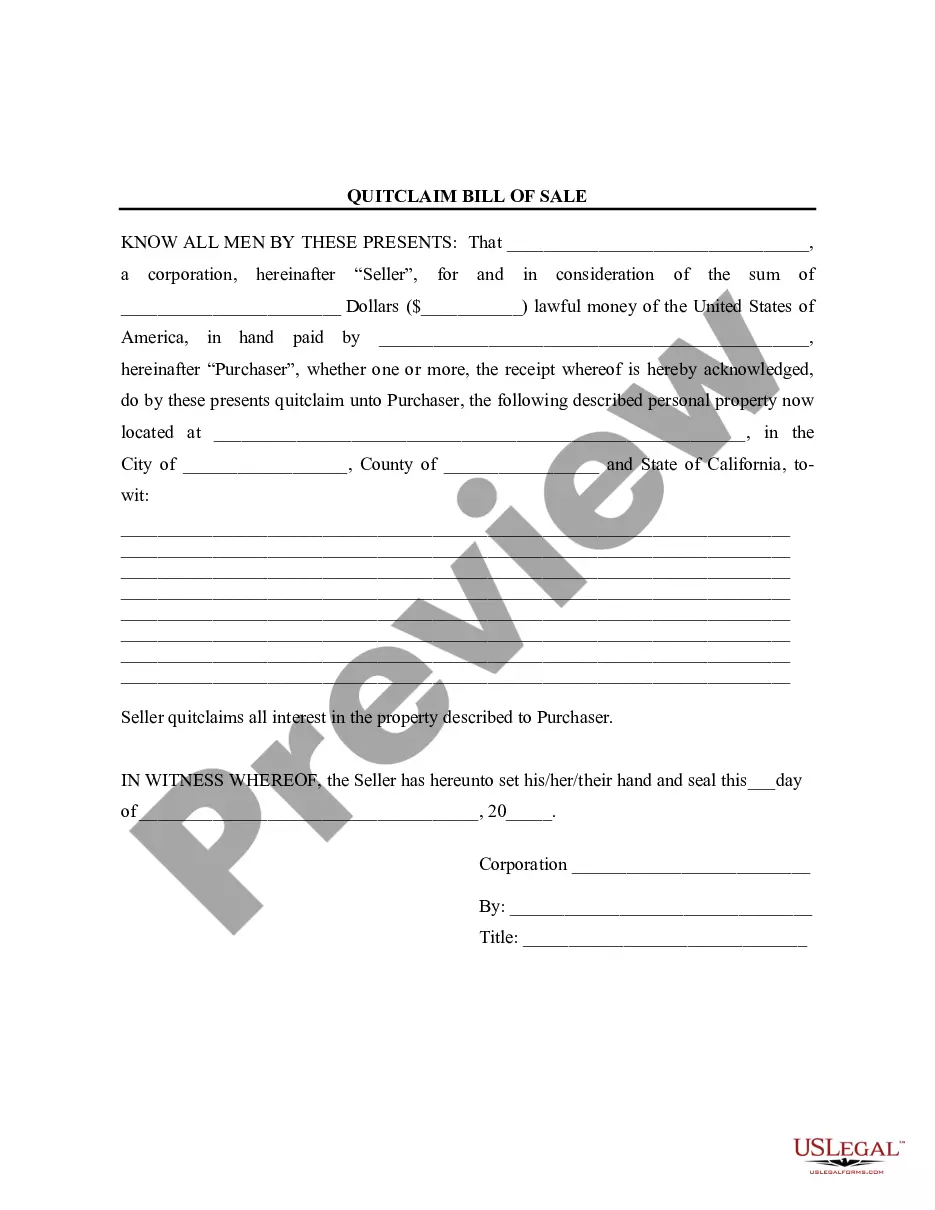

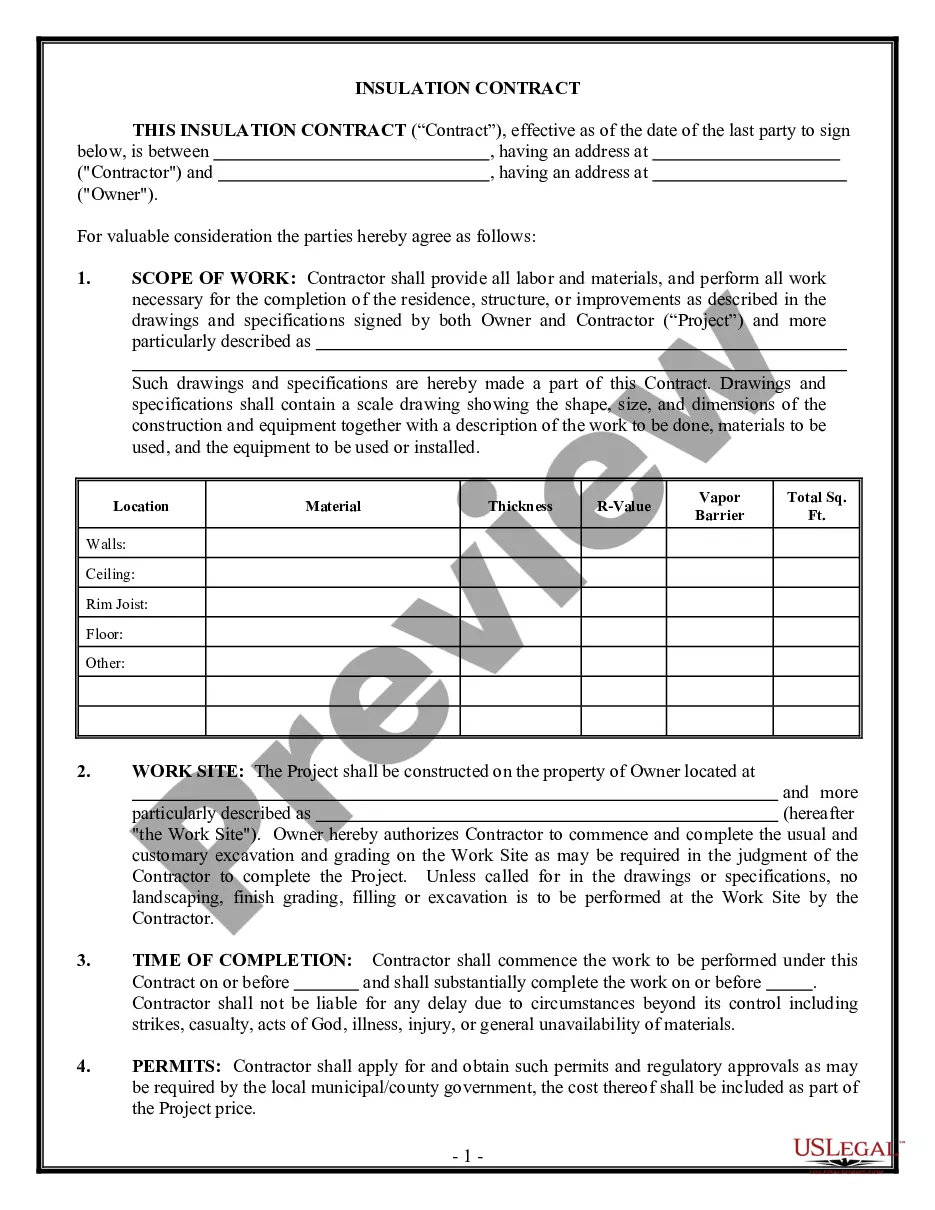

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from the ground up, including Suffolk Accounts Receivable Write-Off Approval Form, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in different categories varying from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find detailed materials and guides on the website to make any tasks associated with document completion simple.

Here's how you can purchase and download Suffolk Accounts Receivable Write-Off Approval Form.

- Go over the document's preview and outline (if provided) to get a general information on what you’ll get after downloading the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can impact the legality of some records.

- Examine the similar document templates or start the search over to locate the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment method, and purchase Suffolk Accounts Receivable Write-Off Approval Form.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Suffolk Accounts Receivable Write-Off Approval Form, log in to your account, and download it. Of course, our website can’t take the place of a legal professional entirely. If you have to cope with an exceptionally challenging case, we advise getting an attorney to check your document before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Become one of them today and get your state-compliant paperwork with ease!