Maricopa Arizona Equipment Financing Agreement refers to a legally binding contract between a borrower and a lender for the purpose of financing the purchase or lease of various types of equipment within the city of Maricopa, Arizona. This agreement provides individuals and businesses in Maricopa with the financial means to acquire necessary equipment for their operations, without having to rely solely on upfront capital. Keywords: Maricopa, Arizona, equipment financing, agreement, borrower, lender, purchase, lease, equipment, financial means, operations, upfront capital. Different Types of Maricopa Arizona Equipment Financing Agreements: 1. Lease Financing Agreement: This type of agreement allows businesses in Maricopa to lease equipment for a predetermined period, paying regular rental payments to the lender. The equipment remains the property of the lender during the lease term. 2. Conditional Sale Agreement: This agreement enables borrowers in Maricopa to acquire equipment immediately, with the lender retaining ownership until the borrower completes all payment obligations. Once all payments are made, the ownership of the equipment is transferred to the borrower. 3. Hire Purchase Agreement: This financing option allows Maricopa businesses to acquire equipment by making regular payments over a specified period. However, ownership of the equipment is only transferred to the borrower upon final payment. 4. Equipment Loan Agreement: Through this agreement, Maricopa borrowers can obtain a loan specifically for purchasing equipment. The loan terms, including interest rates and repayment schedules, are agreed upon between the lender and the borrower. 5. Equipment Leaseback Agreement: This type of agreement allows Maricopa individuals or businesses to generate immediate capital by selling their owned equipment to a lender and simultaneously leasing it back for continued use. The borrower retains the equipment's operational control while benefiting from the released funds. 6. Operating Lease Agreement: This option permits Maricopa businesses to lease equipment for a short period rather than purchasing it outright. This agreement is suitable for equipment that needs regular upgrading or replacement, as it allows for easy modifications and returns without long-term commitments. These different types of Maricopa Arizona Equipment Financing Agreements cater to the specific needs and financial preferences of borrowers in Maricopa, providing flexibility and access to crucial equipment for various industries such as manufacturing, construction, healthcare, agriculture, and more. The terms and provisions of each agreement may vary based on factors such as equipment cost, duration of financing, interest rates, and specific lender guidelines.

Maricopa Arizona Equipment Financing Agreement

Description

How to fill out Maricopa Arizona Equipment Financing Agreement?

Are you looking to quickly draft a legally-binding Maricopa Equipment Financing Agreement or probably any other form to handle your personal or corporate affairs? You can go with two options: hire a professional to draft a legal paper for you or create it completely on your own. The good news is, there's a third option - US Legal Forms. It will help you get neatly written legal papers without having to pay unreasonable prices for legal services.

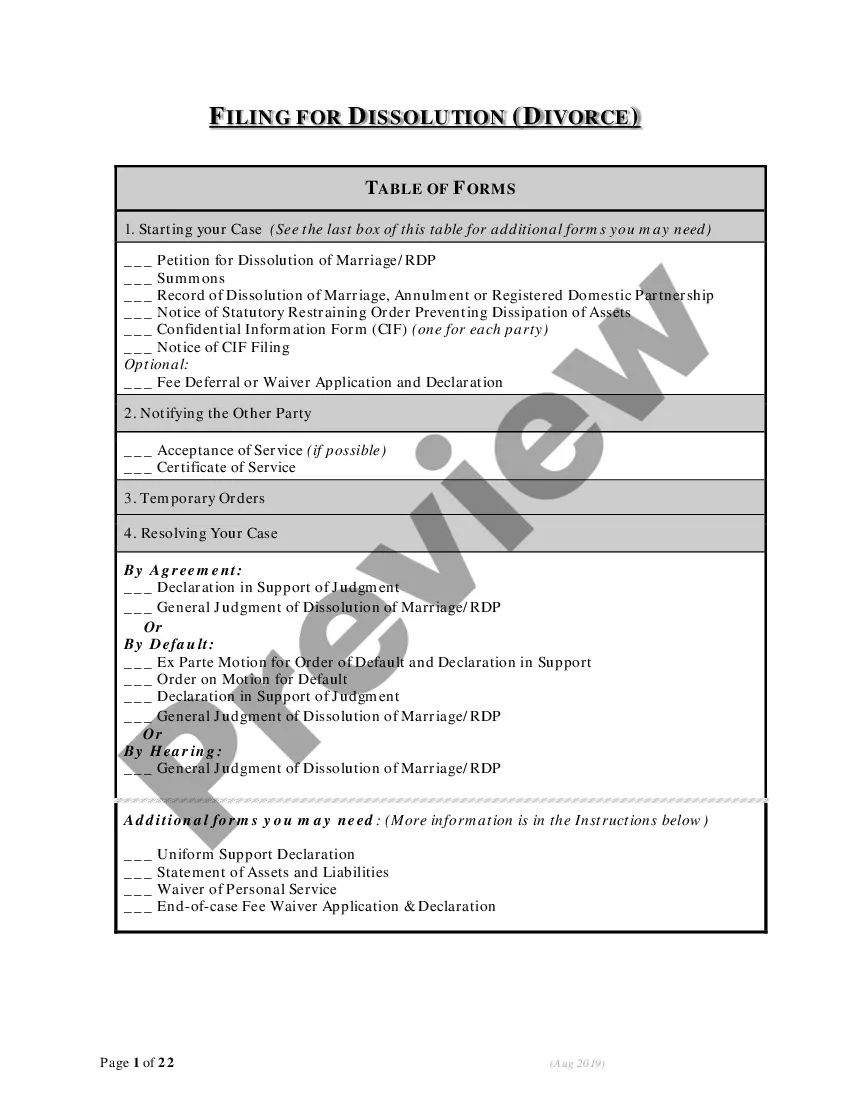

US Legal Forms offers a rich collection of more than 85,000 state-compliant form templates, including Maricopa Equipment Financing Agreement and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary document without extra hassles.

- To start with, carefully verify if the Maricopa Equipment Financing Agreement is tailored to your state's or county's laws.

- If the form includes a desciption, make sure to verify what it's intended for.

- Start the searching process over if the document isn’t what you were looking for by utilizing the search box in the header.

- Select the plan that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Maricopa Equipment Financing Agreement template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. In addition, the documents we offer are reviewed by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!