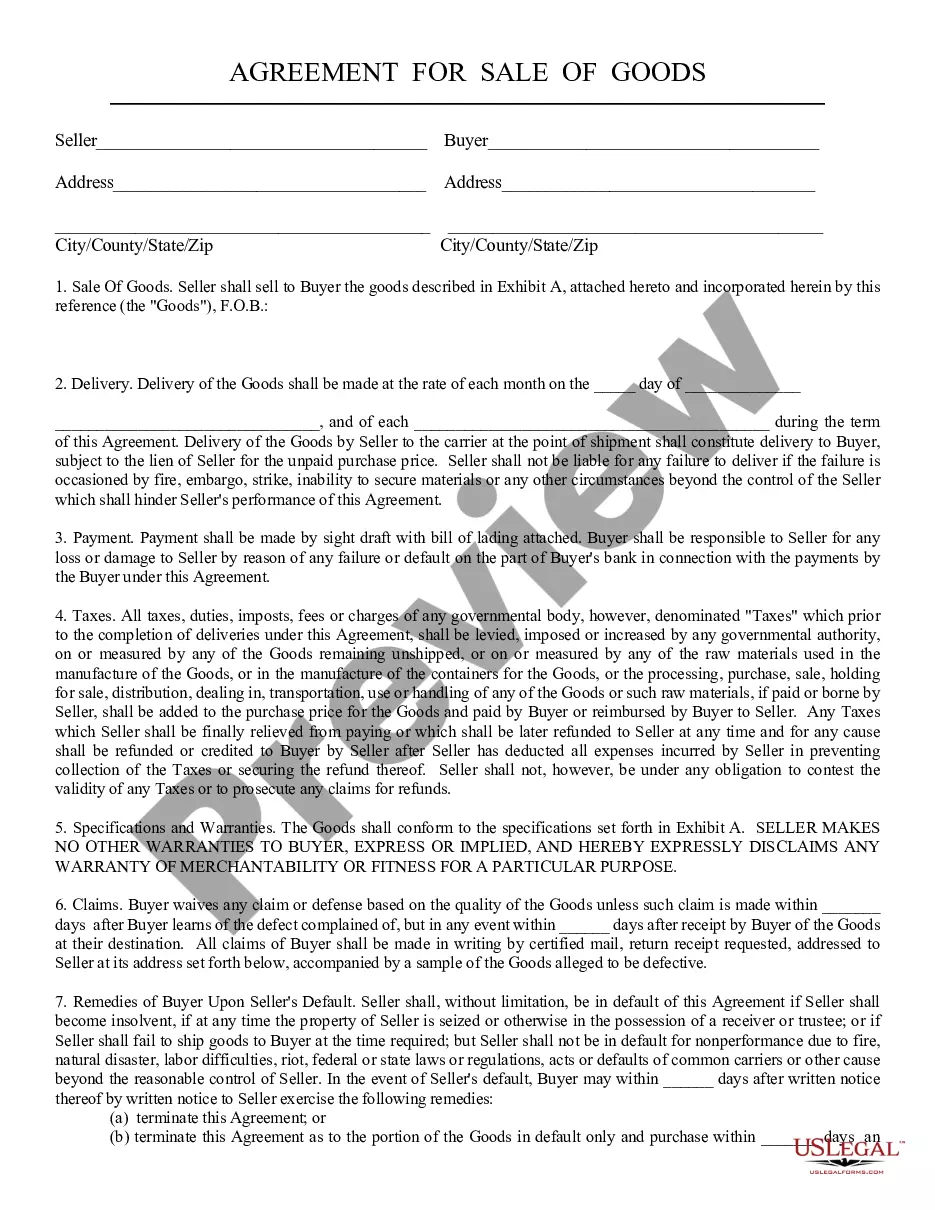

Nassau, New York, is a thriving region known for its robust business community. To support the growth and success of businesses in the area, the Nassau New York Equipment Financing Agreement provides a valuable solution for acquiring essential equipment and machinery. This detailed agreement outlines the terms and conditions under which businesses can secure financing for the acquisition of equipment. For businesses in Nassau, New York, the Equipment Financing Agreement serves as a critical tool to overcome financial barriers and secure the necessary equipment to expand operations, enhance productivity, and stay competitive in the market. With this agreement, companies can obtain funding to acquire a wide range of equipment, including but not limited to construction machinery, medical devices, manufacturing equipment, vehicles, technology infrastructure, and office furniture. The Nassau New York Equipment Financing Agreement ensures a transparent and mutually beneficial arrangement between the lender and the borrower. It carefully outlines the payment terms, interest rates, collateral requirements, and any additional fees involved. By providing clarity on these aspects, businesses can make informed decisions and plan their finances accordingly. There are several types of Equipment Financing Agreements available in Nassau, New York, each catering to different business models and needs. Some common variations include: 1. Capital Lease Agreement: This agreement allows businesses to lease the equipment for an extended period, typically resembling a loan. At the end of the lease term, businesses often have the option to purchase the equipment at a predetermined price. 2. Operating Lease Agreement: With this agreement, businesses can enjoy shorter lease terms, typically for equipment with a shorter lifespan. This agreement provides flexibility as businesses can upgrade the equipment at the end of each lease term. 3. Hire Purchase Agreement: This type of agreement allows businesses to use the equipment while making regular payments, which eventually lead to ownership. The business becomes the owner of the equipment after fulfilling all payment obligations. 4. Sale and Leaseback Agreement: In some cases, businesses may already own equipment but require immediate funding. This agreement allows businesses to sell their existing equipment to a financier and then lease it back for an agreed-upon period, freeing up capital for other business needs. The Nassau New York Equipment Financing Agreement plays a vital role in enabling businesses to acquire the necessary equipment to drive growth and success. By choosing the most suitable type of agreement, businesses in Nassau, New York, can unlock the potential of their operations, enhance productivity, and stay ahead in the dynamic business landscape.

Nassau New York Equipment Financing Agreement

Description

How to fill out Nassau New York Equipment Financing Agreement?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Nassau Equipment Financing Agreement, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario gathered all in one place. Consequently, if you need the recent version of the Nassau Equipment Financing Agreement, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Nassau Equipment Financing Agreement:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Nassau Equipment Financing Agreement and download it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!