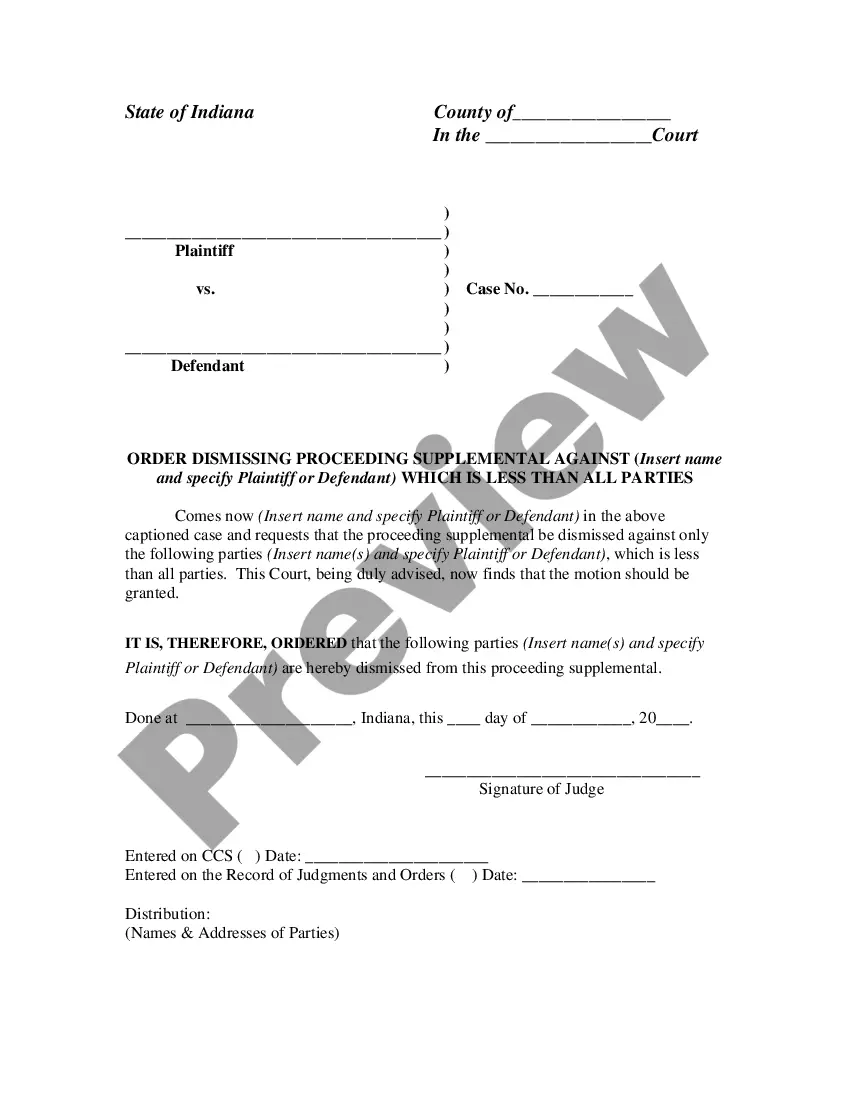

Riverside California Equipment Financing Agreement is a legally binding document that outlines the terms and conditions of financing equipment in Riverside, California. This agreement allows businesses and individuals in Riverside to acquire necessary equipment without paying the full amount upfront, opting instead for installment payments over an agreed-upon period. Equipment financing is a popular option for businesses in Riverside, as it helps them access the latest technologies and equipment without depleting their working capital. This agreement offers flexibility and allows businesses to upgrade or replace equipment as needed, ultimately enhancing productivity and competitiveness. There are several types of Riverside California Equipment Financing Agreements, each catering to specific needs and circumstances. Some common variations include: 1. Capital Lease Agreement: This type of agreement allows the lessee to finance equipment while retaining ownership rights. The lessee assumes risks associated with ownership, such as maintenance and obsolescence, and typically includes a purchase option at the end of the lease term. 2. Operating Lease Agreement: In contrast to a capital lease, an operating lease agreement implies temporary equipment use without any ownership transfer. This agreement suits businesses that need equipment for a shorter term or frequently upgrade, as it provides flexibility and removes the burden of equipment ownership. 3. Conditional Sales Agreement: This agreement is often used when a business wants to take ownership of the equipment at the end of the financing period. The borrower is considered the owner throughout the financing term, subject to fulfilling the conditions outlined in the agreement. 4. Installment Sales Agreement: Similar to a conditional sales agreement, an installment sales agreement involves periodic payments to purchase the equipment. The borrower gains ownership once the full amount is paid, making it an attractive option for businesses looking for eventual ownership. When entering a Riverside California Equipment Financing Agreement, it is crucial to consider factors such as interest rates, repayment terms, options for early payment, default consequences, maintenance responsibilities, and insurance requirements. Both lenders and borrowers should negotiate and clearly define these terms to ensure a mutually beneficial agreement. In conclusion, Riverside California Equipment Financing Agreement enables businesses and individuals to acquire essential equipment by spreading payments over time. With various types of agreements available, each tailored to specific requirements, businesses in Riverside can effectively manage their cash flow while accessing the necessary tools for growth and success.

Riverside California Equipment Financing Agreement

Description

How to fill out Riverside California Equipment Financing Agreement?

Are you looking to quickly create a legally-binding Riverside Equipment Financing Agreement or maybe any other document to manage your own or corporate matters? You can go with two options: contact a legal advisor to draft a legal document for you or draft it completely on your own. Luckily, there's another solution - US Legal Forms. It will help you receive neatly written legal paperwork without paying unreasonable fees for legal services.

US Legal Forms offers a huge collection of over 85,000 state-specific document templates, including Riverside Equipment Financing Agreement and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the necessary document without extra troubles.

- First and foremost, double-check if the Riverside Equipment Financing Agreement is adapted to your state's or county's regulations.

- If the form has a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the plan that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Riverside Equipment Financing Agreement template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to find and download legal forms if you use our services. In addition, the documents we offer are reviewed by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!