In this agreement, one corporation (the Guarantor) is providing financial assistance to another Corporation (the Corporation) by guaranteeing certain indebtedness for the Company in exchange for a guaranty fee.

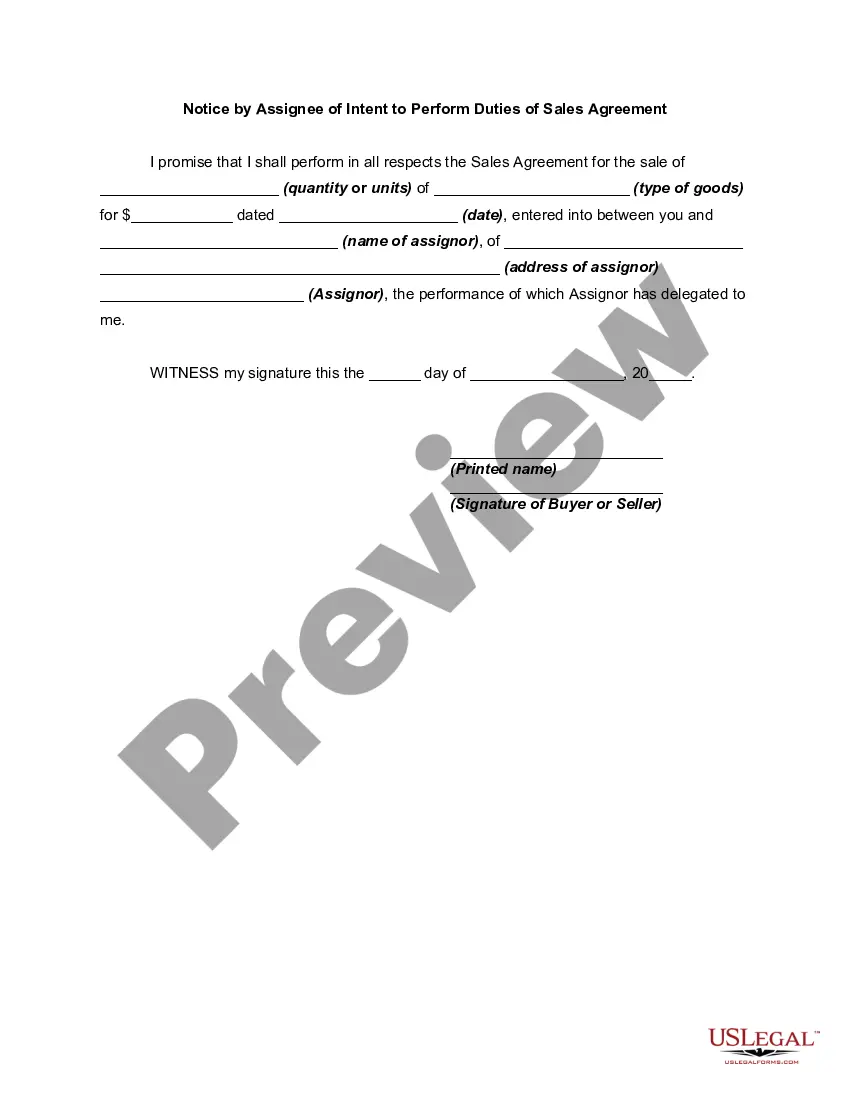

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Mecklenburg North Carolina Financial Support Agreement — Guaranty of Obligation is a legally binding document that outlines the terms and conditions for financial support provided by one party to another, guaranteeing their obligations in Mecklenburg County, North Carolina. This agreement ensures that the supported party fulfills their financial commitments as specified. The Mecklenburg North Carolina Financial Support Agreement — Guaranty of Obligation acts as a safeguard for lenders, creditors, or other entities providing financial assistance. By entering into this agreement, the guarantor assumes liability for the supported party's debts or obligations in case of default or non-payment. The following are some relevant keywords associated with Mecklenburg North Carolina Financial Support Agreement — Guaranty of Obligation: 1. Financial support: This refers to the provision of monetary assistance by one party to another, often in the form of loans, credit lines, or guarantees. 2. Mecklenburg County, North Carolina: This specifies the jurisdiction where the agreement is applicable, specifically in Mecklenburg County. 3. Obligations: These are the duties or responsibilities that the supported party must fulfill, such as making payments, meeting contractual terms, or delivering specified goods or services. 4. Guarantor: The individual or entity that guarantees the obligations of the supported party, assuming the responsibility for repayment if the supported party defaults. 5. Lender/Creditor: The entity providing financial support to the supported party, often a bank, financial institution, or individual. 6. Default: Refers to the failure of the supported party to meet their obligations, which triggers the guarantor's liability to fulfill those obligations. 7. Liability: The legal responsibility and obligation of the guarantor to repay the debt, fulfill obligations, or cover losses incurred by the supported party. Types of Mecklenburg North Carolina Financial Support Agreement — Guaranty of Obligation can vary depending on the context and purpose. Some common types include: 1. Loan Guaranty Agreement: In this type of agreement, the guarantor pledges to repay the loan if the borrower defaults. 2. Commercial Lease Guaranty Agreement: This agreement is commonly used in the context of commercial real estate leases and ensures the landlord that the guarantor will fulfill the tenant's lease obligations. 3. Contract Guaranty Agreement: This agreement assures the fulfillment of contractual obligations by the supported party. It may apply to various contracts, such as construction, services, or sales agreements. 4. Debt Guaranty Agreement: This agreement secures the repayment of a debt, guaranteeing the creditor that the guarantor will cover the outstanding amount if the debtor fails to pay. It's important that both parties thoroughly review and understand the Mecklenburg North Carolina Financial Support Agreement — Guaranty of Obligation before signing it to ensure all obligations and liabilities are clearly defined and agreed upon.Mecklenburg North Carolina Financial Support Agreement — Guaranty of Obligation is a legally binding document that outlines the terms and conditions for financial support provided by one party to another, guaranteeing their obligations in Mecklenburg County, North Carolina. This agreement ensures that the supported party fulfills their financial commitments as specified. The Mecklenburg North Carolina Financial Support Agreement — Guaranty of Obligation acts as a safeguard for lenders, creditors, or other entities providing financial assistance. By entering into this agreement, the guarantor assumes liability for the supported party's debts or obligations in case of default or non-payment. The following are some relevant keywords associated with Mecklenburg North Carolina Financial Support Agreement — Guaranty of Obligation: 1. Financial support: This refers to the provision of monetary assistance by one party to another, often in the form of loans, credit lines, or guarantees. 2. Mecklenburg County, North Carolina: This specifies the jurisdiction where the agreement is applicable, specifically in Mecklenburg County. 3. Obligations: These are the duties or responsibilities that the supported party must fulfill, such as making payments, meeting contractual terms, or delivering specified goods or services. 4. Guarantor: The individual or entity that guarantees the obligations of the supported party, assuming the responsibility for repayment if the supported party defaults. 5. Lender/Creditor: The entity providing financial support to the supported party, often a bank, financial institution, or individual. 6. Default: Refers to the failure of the supported party to meet their obligations, which triggers the guarantor's liability to fulfill those obligations. 7. Liability: The legal responsibility and obligation of the guarantor to repay the debt, fulfill obligations, or cover losses incurred by the supported party. Types of Mecklenburg North Carolina Financial Support Agreement — Guaranty of Obligation can vary depending on the context and purpose. Some common types include: 1. Loan Guaranty Agreement: In this type of agreement, the guarantor pledges to repay the loan if the borrower defaults. 2. Commercial Lease Guaranty Agreement: This agreement is commonly used in the context of commercial real estate leases and ensures the landlord that the guarantor will fulfill the tenant's lease obligations. 3. Contract Guaranty Agreement: This agreement assures the fulfillment of contractual obligations by the supported party. It may apply to various contracts, such as construction, services, or sales agreements. 4. Debt Guaranty Agreement: This agreement secures the repayment of a debt, guaranteeing the creditor that the guarantor will cover the outstanding amount if the debtor fails to pay. It's important that both parties thoroughly review and understand the Mecklenburg North Carolina Financial Support Agreement — Guaranty of Obligation before signing it to ensure all obligations and liabilities are clearly defined and agreed upon.