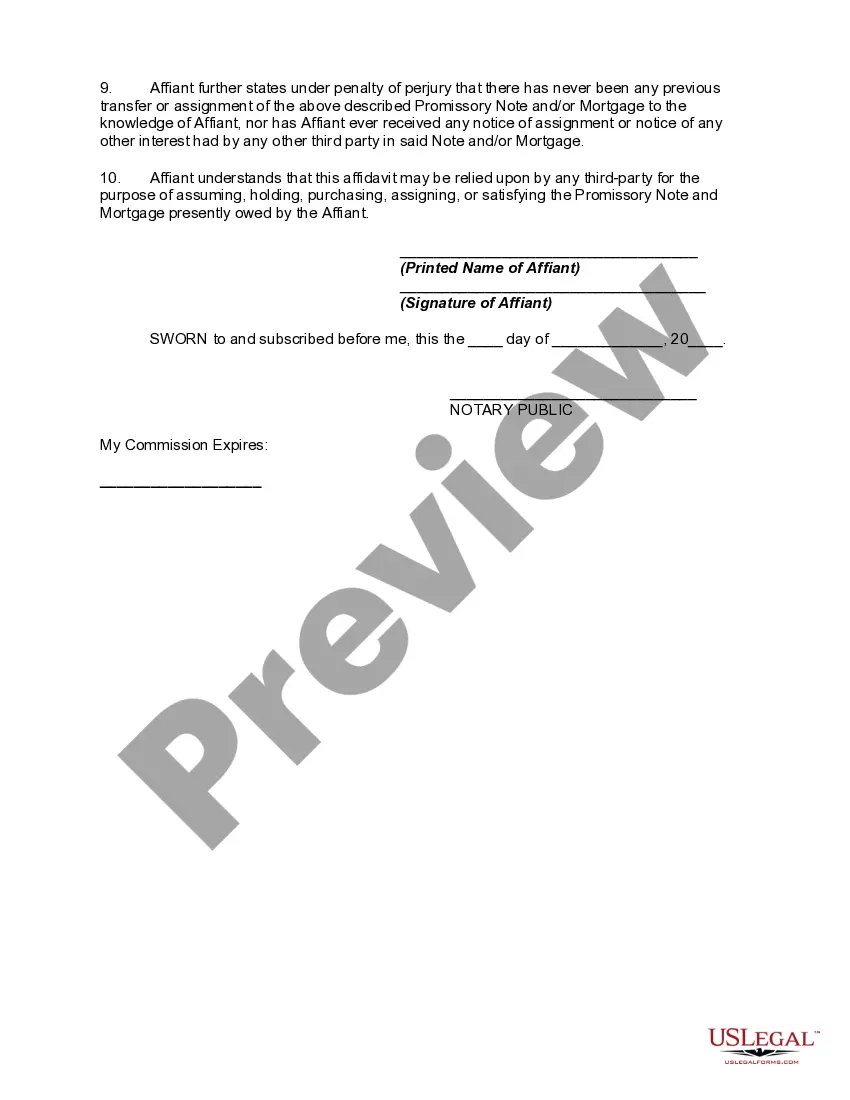

Houston, Texas Estoppel Affidavit of Mortgagor is a legal document used in real estate transactions when a property owner (mortgagor) provides a statement confirming certain facts related to their mortgage. This affidavit is often required by lenders, title companies, or potential buyers to ensure transparency and avoid any potential disputes or misunderstandings. The Houston, Texas Estoppel Affidavit of Mortgagor typically includes the following information: 1. Identification of the mortgagor: This includes the full name, address, and contact details of the individual or entity who holds the mortgage. 2. Property details: The affidavit should provide a detailed description of the property being mortgaged, including its legal description, physical address, and any other relevant identifying information. 3. Mortgage terms: This section outlines the essential terms of the mortgage, such as the loan amount, interest rate, repayment period, monthly installments, and any other specific conditions agreed upon by the mortgagor and the lender. 4. Outstanding obligations: The affidavit should state any outstanding debts, liens, or encumbrances on the property that may affect the mortgage, such as unpaid property taxes, existing mortgages, or other claims against the property. 5. Change in ownership: If there have been any changes in the property's ownership or if the mortgagor has assigned the mortgage to another party, such transactions should be noted in the affidavit. 6. Defaults and breaches: The mortgagor must disclose any defaults or breaches of the mortgage agreement, such as missed payments, late fees, or violations of any terms agreed upon with the lender. 7. Accuracy of information: The affidavit should include a statement declaring that all the information provided is accurate and complete to the best of the mortgagor's knowledge. 8. Signature and notarization: The mortgagor must sign the affidavit and have their signature notarized for validity. While there may not be different types of Houston, Texas Estoppel Affidavit of Mortgagor, variations or additional clauses may be required by lenders or specific circumstances. In such cases, these additional requirements should be clearly mentioned in the affidavit to ensure compliance with all applicable laws and regulations. Keywords: Houston, Texas, Estoppel Affidavit of Mortgagor, real estate transaction, property owner, mortgage, lenders, title companies, potential buyers, transparency, disputes, misunderstandings, identification, property details, mortgage terms, outstanding obligations, change in ownership, defaults, breaches, accuracy of information, signature, notarization.

Houston Texas Estoppel Affidavit of Mortgagor

Description

How to fill out Houston Texas Estoppel Affidavit Of Mortgagor?

Drafting paperwork for the business or personal demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to create Houston Estoppel Affidavit of Mortgagor without expert help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Houston Estoppel Affidavit of Mortgagor on your own, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Houston Estoppel Affidavit of Mortgagor:

- Look through the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any use case with just a couple of clicks!