A Nassau New York Estoppel Affidavit of Mortgagor is a legal document that is commonly used in real estate transactions. This affidavit serves as a statement from the mortgagor, affirming certain facts and providing important information about the mortgage. It is primarily used to protect the interests of the mortgagee (lender) in case of any future disputes or claims. Keywords: Nassau New York, Estoppel Affidavit, Mortgagor, real estate transactions, legal document, statement, affirming, facts, information, mortgage, protect, interests, disputes, claims. There are different types of Nassau New York Estoppel Affidavit of Mortgagor, including: 1. General Estoppel Affidavit of Mortgagor: This is the standard type of affidavit used in most real estate transactions. It includes the basic information about the mortgagor, the property, and the mortgage terms. It also affirms that there are no undisclosed claims, liens, or encumbrances on the property. 2. Limited Estoppel Affidavit of Mortgagor: This type of affidavit is used when there are specific issues or concerns related to the property. It may be required if there are outstanding disputes, pending litigation, or special conditions that need to be addressed. 3. Estoppel Affidavit of Mortgagor in a Refinancing: This type of affidavit is utilized when a property owner is refinancing an existing mortgage. It provides updated information on the outstanding balance, interest rate, and other relevant details. 4. Estoppel Affidavit of Mortgagor in a Sale: This affidavit is used when the property is being sold, and the new buyer needs assurance that there are no undisclosed claims or encumbrances on the property. It validates the accuracy of the representations made by the seller regarding the mortgage. 5. Estoppel Affidavit of Mortgagor in a Foreclosure: In foreclosure proceedings, this affidavit is used by the mortgagor to provide an official statement regarding the current mortgage status, the amount owed, and any defenses or challenges to the foreclosure action. In conclusion, a Nassau New York Estoppel Affidavit of Mortgagor is an important legal document used in real estate transactions. It ensures clarity and protection for all parties involved by affirming facts, protecting the interests of the mortgagee, and addressing any potential disputes or claims related to the property and mortgage.

Nassau New York Estoppel Affidavit of Mortgagor

Description

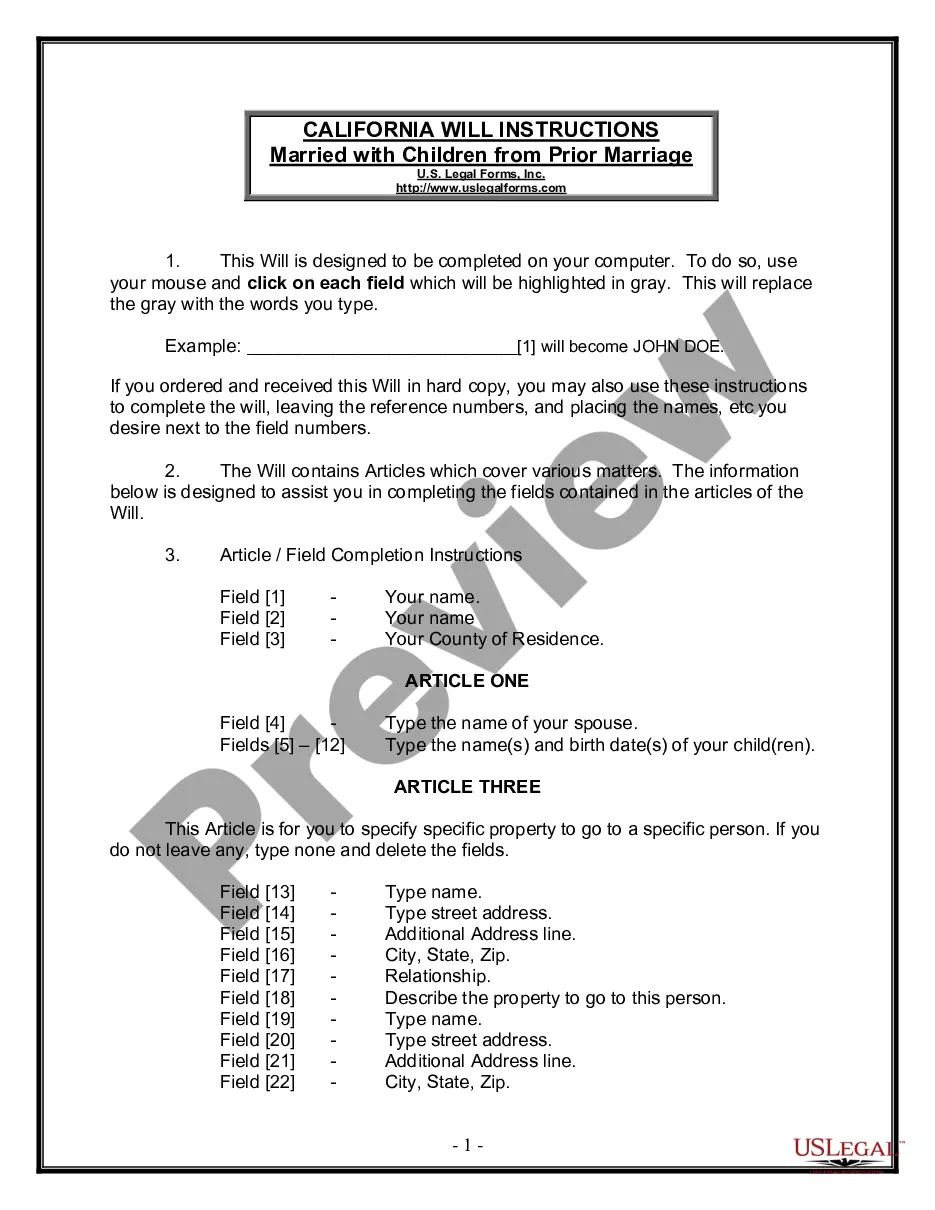

How to fill out Nassau New York Estoppel Affidavit Of Mortgagor?

If you need to get a trustworthy legal document supplier to find the Nassau Estoppel Affidavit of Mortgagor, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can browse from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support make it easy to find and execute various paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply type to search or browse Nassau Estoppel Affidavit of Mortgagor, either by a keyword or by the state/county the document is intended for. After locating needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Nassau Estoppel Affidavit of Mortgagor template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Register an account and select a subscription option. The template will be instantly available for download as soon as the payment is processed. Now you can execute the form.

Handling your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less costly and more affordable. Set up your first company, organize your advance care planning, create a real estate agreement, or execute the Nassau Estoppel Affidavit of Mortgagor - all from the comfort of your sofa.

Sign up for US Legal Forms now!