This form is a type of asset-financing arrangement in which a company uses its receivables (money owed by customers) as collateral in a financing agreement. The company receives an amount that is equal to a reduced value of the receivables pledged. The age of the receivables have a large effect on the amount a company will receive. The older the receivables, the less the company can expect.

This type of financing helps companies free up capital that is stuck in accounts receivables. Accounts receivable financing transfers the default risk associated with the accounts receivables to the financing company. This transfer of risk can help the company using the financing to shift focus from trying to collect receivables to current business activities.

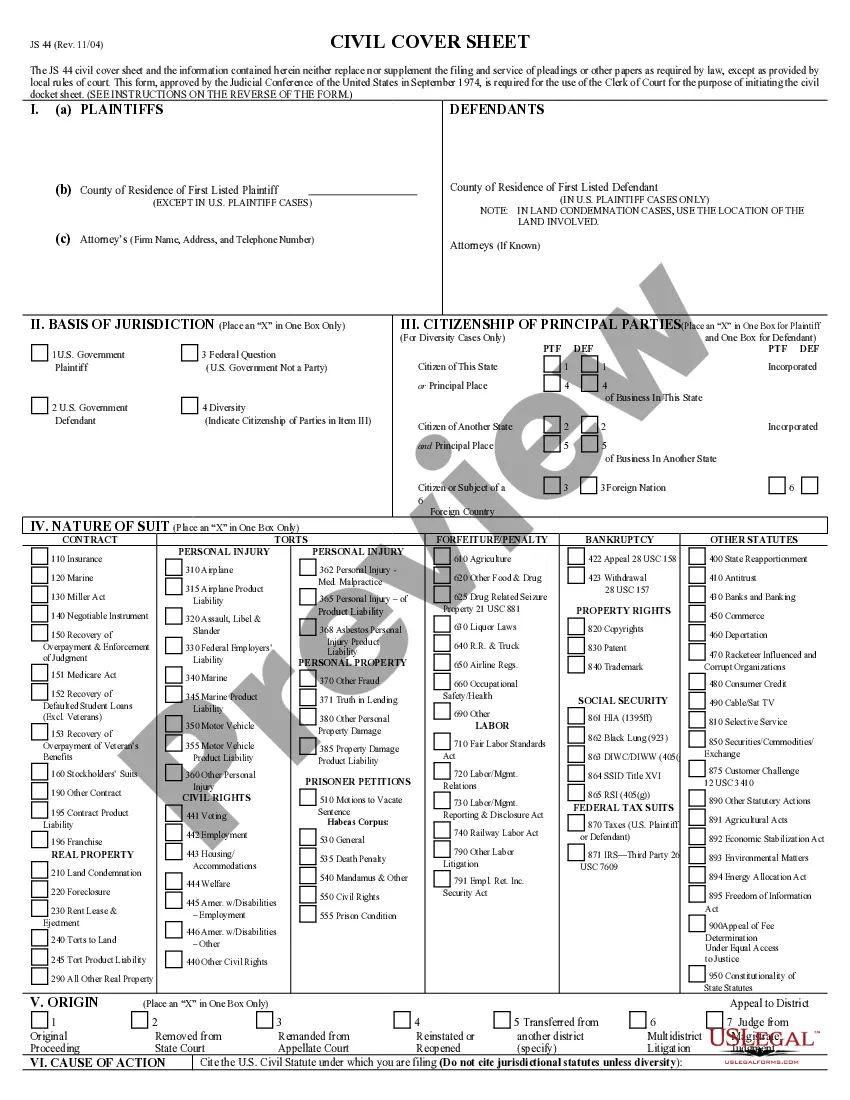

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Kings New York Financing Agreement between Dealer and Credit Corporation for Wholesale Financing with Security interest in Accounts and General Intangibles is a comprehensive legal document that outlines the terms and conditions of a financing arrangement between a dealer and a credit corporation. This agreement is specifically designed for wholesale financing transactions and aims to protect the interests of both parties involved. Several types of Kings New York Financing Agreements can be established, depending on the specific requirements and circumstances of the parties. These agreements could include: 1. Standard Kings New York Financing Agreement: This is the basic form of the agreement, which covers the typical terms and conditions of wholesale financing arrangements. It includes provisions regarding loan amounts, interest rates, repayment terms, and security interest in accounts and general intangibles. 2. Modified Kings New York Financing Agreement: In certain cases, parties may have specific requirements that are not covered by the standard agreement. A modified agreement can be drafted to incorporate custom terms that address these unique requirements. This type of agreement may include added clauses, provisions, or modifications to certain terms to suit the specific needs of the dealer and credit corporation. 3. Subordination Agreement: In some cases, there might be multiple creditors involved in a dealer's financing arrangement. A subordination agreement is established to determine the priority of each creditor's security interest in accounts and general intangibles. This type of agreement ensures that the rights and priorities of each creditor are clearly defined and respected. 4. Amendment Agreement: If there is a need to modify any terms or conditions of an existing Kings New York Financing Agreement, an amendment agreement can be established. This document specifies the changes to be made and acts as an addendum to the original agreement. Some relevant keywords for this type of financing agreement and its various types could include: financing arrangement, wholesale financing, security interest, accounts, general intangibles, loan terms, interest rates, repayment terms, subordination agreement, amendment agreement, custom terms, creditor priority, legal document.Kings New York Financing Agreement between Dealer and Credit Corporation for Wholesale Financing with Security interest in Accounts and General Intangibles is a comprehensive legal document that outlines the terms and conditions of a financing arrangement between a dealer and a credit corporation. This agreement is specifically designed for wholesale financing transactions and aims to protect the interests of both parties involved. Several types of Kings New York Financing Agreements can be established, depending on the specific requirements and circumstances of the parties. These agreements could include: 1. Standard Kings New York Financing Agreement: This is the basic form of the agreement, which covers the typical terms and conditions of wholesale financing arrangements. It includes provisions regarding loan amounts, interest rates, repayment terms, and security interest in accounts and general intangibles. 2. Modified Kings New York Financing Agreement: In certain cases, parties may have specific requirements that are not covered by the standard agreement. A modified agreement can be drafted to incorporate custom terms that address these unique requirements. This type of agreement may include added clauses, provisions, or modifications to certain terms to suit the specific needs of the dealer and credit corporation. 3. Subordination Agreement: In some cases, there might be multiple creditors involved in a dealer's financing arrangement. A subordination agreement is established to determine the priority of each creditor's security interest in accounts and general intangibles. This type of agreement ensures that the rights and priorities of each creditor are clearly defined and respected. 4. Amendment Agreement: If there is a need to modify any terms or conditions of an existing Kings New York Financing Agreement, an amendment agreement can be established. This document specifies the changes to be made and acts as an addendum to the original agreement. Some relevant keywords for this type of financing agreement and its various types could include: financing arrangement, wholesale financing, security interest, accounts, general intangibles, loan terms, interest rates, repayment terms, subordination agreement, amendment agreement, custom terms, creditor priority, legal document.