A Fulton Georgia Installment Promissory Note with Bank Deposit as Collateral is a legally binding agreement between a borrower and a lender in Fulton, Georgia. This type of promissory note is commonly used when individuals or businesses borrow money from a financial institution, with a bank deposit serving as collateral. In this agreement, the borrower promises to repay the loan amount, along with interest, through regular installment payments over a specified period. The bank deposit, which is held as collateral, provides security for the lender in case the borrower defaults on the loan. The Fulton Georgia Installment Promissory Note with Bank Deposit as Collateral serves as a written record of the terms and conditions of the loan, ensuring clarity and protection for both parties involved. It typically includes details such as: 1. Loan Amount: The specific amount of money borrowed by the borrower from the lender. 2. Interest Rate: The percentage at which interest will accrue on the loan amount. 3. Repayment Schedule: A detailed plan outlining the number and frequency of installment payments. 4. Maturity Date: The final date by which the loan, including interest, must be fully repaid. 5. Default Consequences: The potential actions that the lender can take if the borrower fails to make timely payments, including seizing the bank deposit collateral. 6. Other Fees and Charges: Any additional costs associated with the loan, such as late payment fees or prepayment penalties. 7. Governing Law: The legal jurisdiction that will govern the promissory note. It is important to note that there might be different variations or types of Fulton Georgia Installment Promissory Note with Bank Deposit as Collateral, each tailored to specific borrowing scenarios. For example, there may be variations in repayment terms, interest rates, or the lenders' requirements. Some possible types could include: 1. Fixed-Rate Installment Promissory Note: This note has a set interest rate from the beginning, allowing borrowers to plan their payment schedules accordingly. 2. Variable-Rate Installment Promissory Note: In this case, the interest rate fluctuates based on an agreed-upon index, potentially resulting in varying installment payments over time. 3. Balloon Installment Promissory Note: This note incorporates smaller installment payments throughout the loan term, with a larger "balloon" payment due at the end. 4. Secured Installment Promissory Note: Apart from the bank deposit collateral, this agreement may involve additional assets or property serving as security for the lender. Overall, a Fulton Georgia Installment Promissory Note with Bank Deposit as Collateral provides a clear framework for loan transactions, protecting both borrowers and lenders by documenting their obligations and rights while ensuring the loan's security through lateralization.

Fulton Georgia Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Fulton Georgia Installment Promissory Note With Bank Deposit As Collateral?

Preparing legal documentation can be difficult. In addition, if you decide to ask an attorney to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Fulton Installment Promissory Note with Bank Deposit as Collateral, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Therefore, if you need the recent version of the Fulton Installment Promissory Note with Bank Deposit as Collateral, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Fulton Installment Promissory Note with Bank Deposit as Collateral:

- Glance through the page and verify there is a sample for your area.

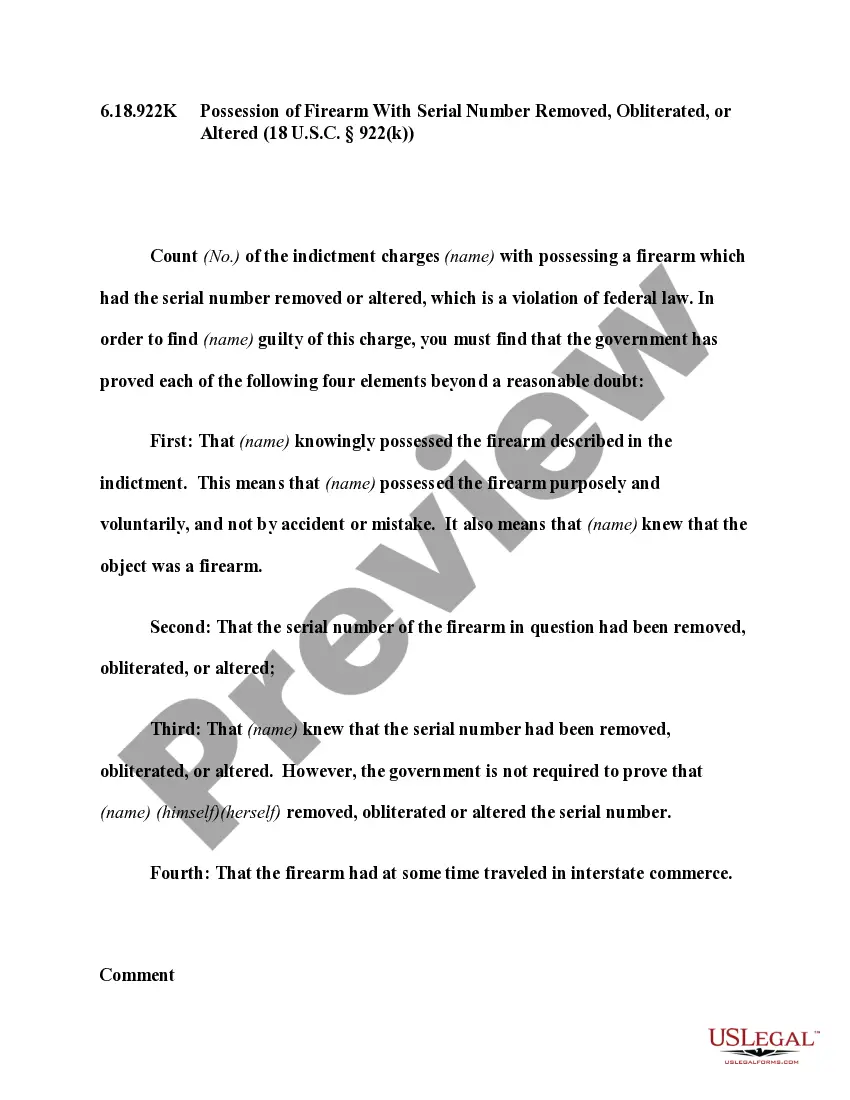

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Fulton Installment Promissory Note with Bank Deposit as Collateral and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!