Montgomery, Maryland is a vibrant county located in the heart of the state. It is known for its diverse communities, thriving business scene, and stunning natural beauty. One common financial instrument used by individuals and businesses in Montgomery, Maryland is the Installment Promissory Note with Bank Deposit as Collateral. The Montgomery Maryland Installment Promissory Note with Bank Deposit as Collateral is a legal document that outlines an agreement between two parties, namely the borrower and the lender. This type of promissory note is commonly used when the borrower is seeking a loan or credit extension and is willing to offer their bank deposit as collateral to secure the funds. The key feature of this promissory note is that it allows the lender to have a security interest in the borrower's bank deposit. In the event of default, the lender has the right to access the collateralized bank deposit to recover the loan amount. There are different types of Montgomery Maryland Installment Promissory Notes with Bank Deposit as Collateral, primarily categorized based on the duration of the loan repayment period. Some common types include: 1. Short-term Installment Promissory Note: This type of note typically has a repayment period ranging from three months to one year. It is often used for smaller loan amounts or temporary financial needs. 2. Medium-term Installment Promissory Note: This note usually has a repayment period of one to five years. It is commonly utilized for moderate loan amounts and allows borrowers additional time to repay the debt. 3. Long-term Installment Promissory Note: This note has a repayment period exceeding five years. It is typically used for significant loan amounts, such as mortgages or business loans, and provides borrowers with an extended timeframe to repay. It is essential to note that each type of Montgomery Maryland Installment Promissory Note with Bank Deposit as Collateral may have specific terms and conditions, including interest rates, late payment penalties, and default clauses. These terms should be carefully reviewed and understood by both the borrower and lender before entering into the agreement. Overall, the Montgomery Maryland Installment Promissory Note with Bank Deposit as Collateral offers a flexible and secure financing option for individuals and businesses in the county.

Montgomery Maryland Installment Promissory Note with Bank Deposit as Collateral

Description

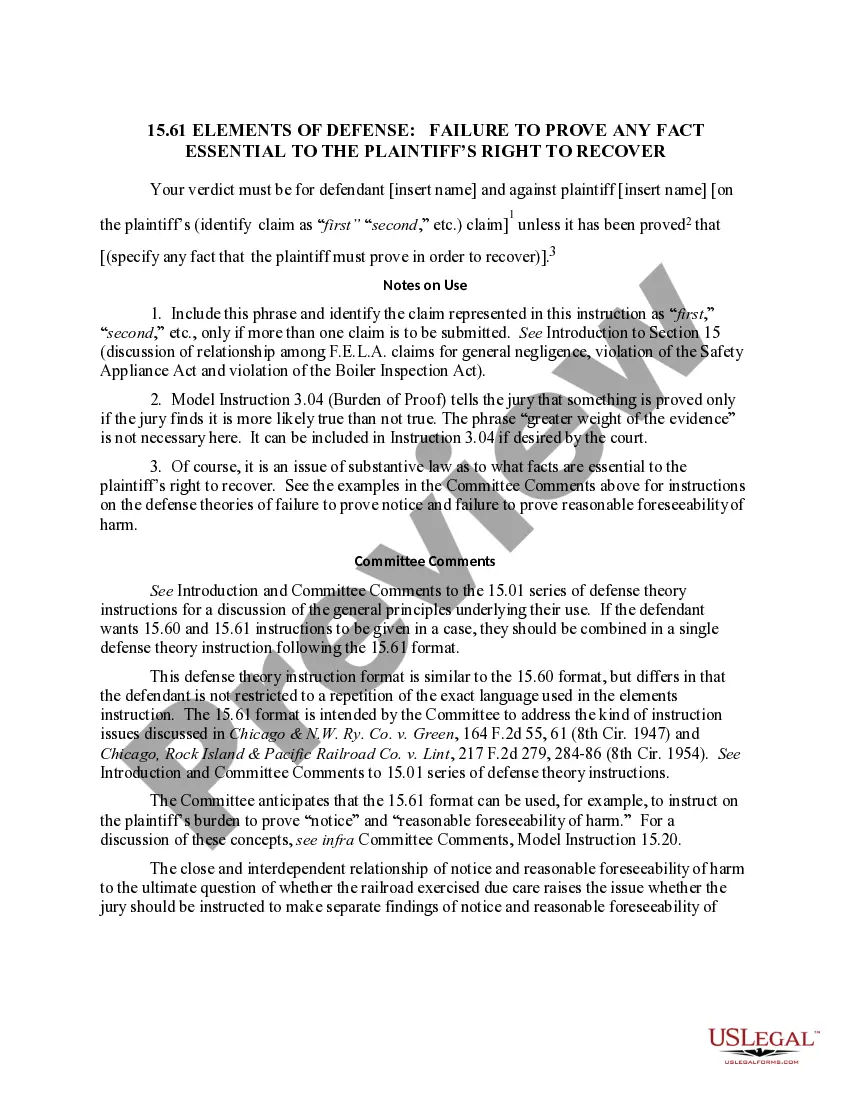

How to fill out Montgomery Maryland Installment Promissory Note With Bank Deposit As Collateral?

If you need to get a reliable legal document provider to get the Montgomery Installment Promissory Note with Bank Deposit as Collateral, consider US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can browse from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting resources, and dedicated support team make it simple to get and complete different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply type to search or browse Montgomery Installment Promissory Note with Bank Deposit as Collateral, either by a keyword or by the state/county the document is created for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Montgomery Installment Promissory Note with Bank Deposit as Collateral template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and select a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less costly and more affordable. Set up your first company, organize your advance care planning, create a real estate agreement, or complete the Montgomery Installment Promissory Note with Bank Deposit as Collateral - all from the comfort of your sofa.

Join US Legal Forms now!