Cook Illinois Installment Payment and Purchase Agreement is a legally binding contract between the Cook County, Illinois and a buyer, outlining the terms and conditions of purchasing a property in installments. This agreement enables buyers to spread out the payment of a property over a specified period, making it more affordable and accessible. The Cook Illinois Installment Payment and Purchase Agreement includes several key elements to protect both parties involved in the transaction. One type of Cook Illinois Installment Payment and Purchase Agreement is the Residential Installment Agreement, which is specifically designed for the purchase of residential properties. This agreement covers various aspects such as the purchase price, down payment, interest rate, payment schedule, late payment penalties, default terms, and rights of both the buyer and the seller. Another type is the Commercial Installment Agreement, specifically tailored for the purchase of commercial real estate properties. This agreement includes similar elements as the residential agreement, but with additional clauses related to zoning, property use, maintenance responsibilities, and any specific regulations applicable to commercial properties. Key terms and conditions covered in the Cook Illinois Installment Payment and Purchase Agreement include: 1. Purchase Price: The total agreed-upon amount for the property that the buyer will pay in installments. 2. Down Payment: The initial lump sum payment made by the buyer at the time of signing the agreement, usually a percentage of the purchase price. 3. Payment Schedule: The agreed-upon periodic payments by the buyer to the seller, specifying due dates, payment amounts, and the duration of the installment plan. 4. Interest Rate: The rate at which interest will accrue on the remaining balance, typically calculated annually or monthly. 5. Default and Termination: The conditions under which the agreement can be terminated, such as non-payment, violation of terms, or breach of contract, along with the consequences of defaulting. 6. Legal Rights and Responsibilities: The agreement delineates the legal rights and obligations of both the buyer and the seller, protecting their interests and limiting potential disputes. 7. Property Title: The agreement provides details on the transfer of property title, including the necessary documentation and procedures to complete the transfer legally. 8. Dispute Resolution: The methods agreed upon by both parties for resolving disputes or disagreements that may arise during the installment plan period. It is important to consult with legal professionals specializing in real estate law before entering into any Cook Illinois Installment Payment and Purchase Agreement, as the terms and conditions may vary based on individual circumstances and property type.

Cook Illinois Installment Payment and Purchase Agreement

Description

How to fill out Cook Illinois Installment Payment And Purchase Agreement?

How much time does it normally take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, locating a Cook Installment Payment and Purchase Agreement suiting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. Aside from the Cook Installment Payment and Purchase Agreement, here you can get any specific form to run your business or personal affairs, complying with your regional requirements. Experts verify all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can pick the file in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Cook Installment Payment and Purchase Agreement:

- Check the content of the page you’re on.

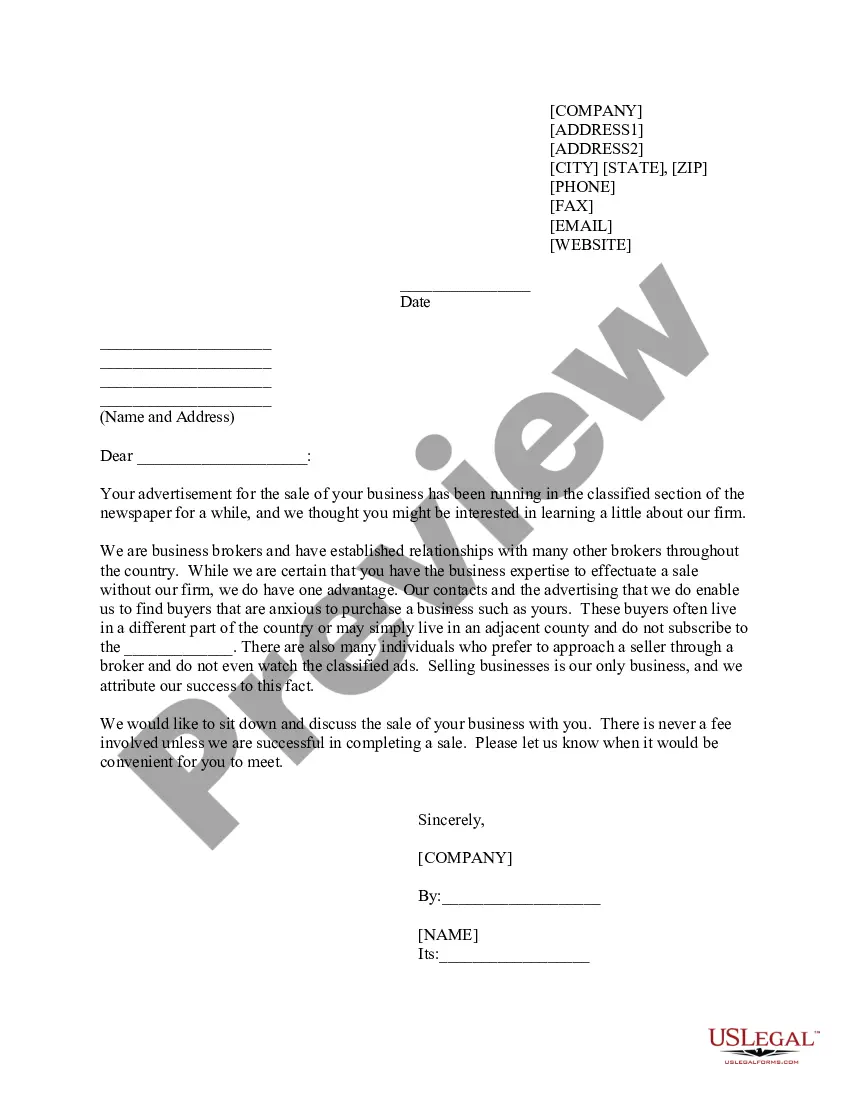

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Cook Installment Payment and Purchase Agreement.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!