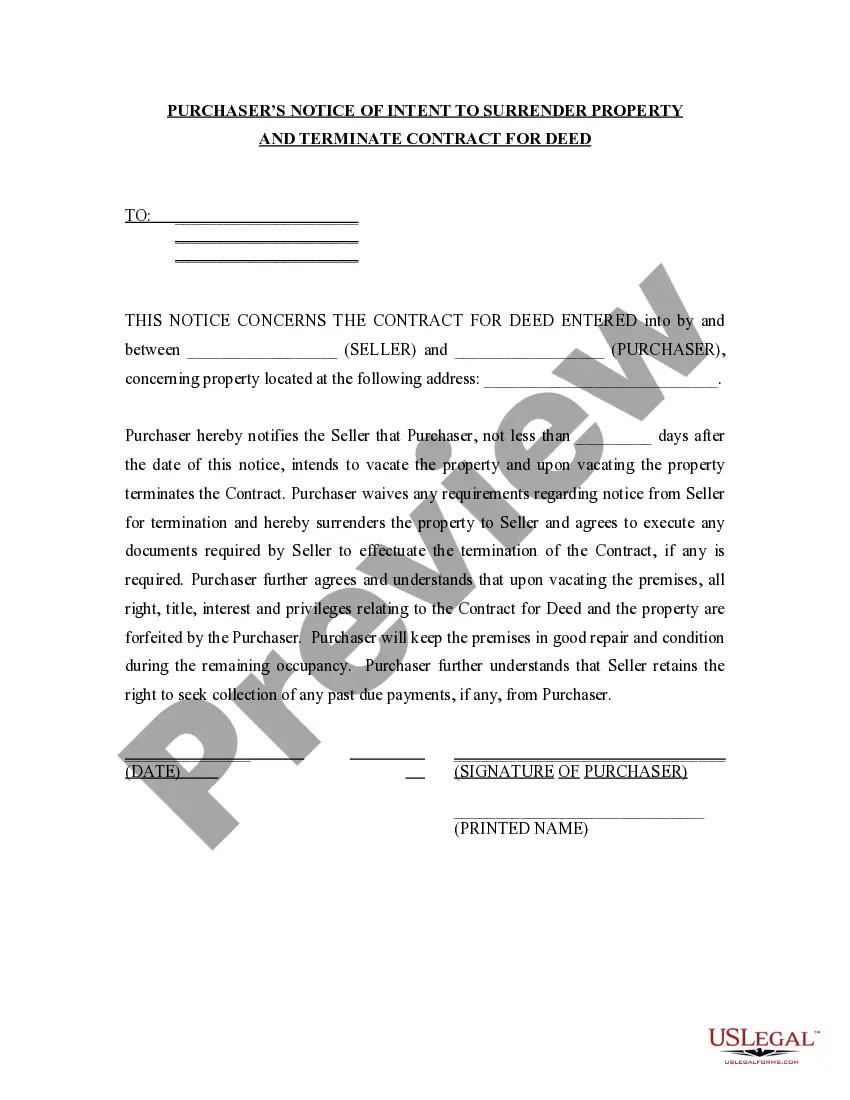

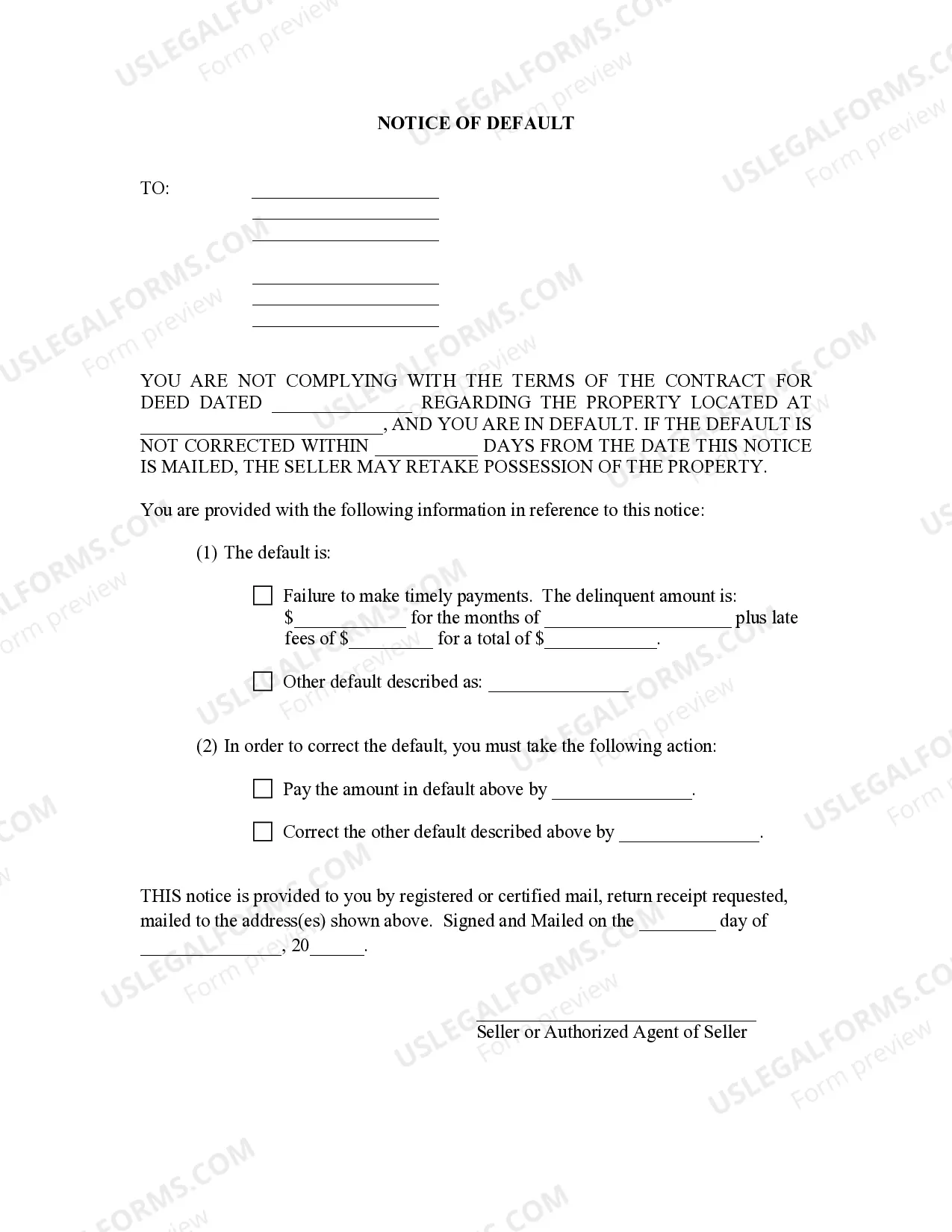

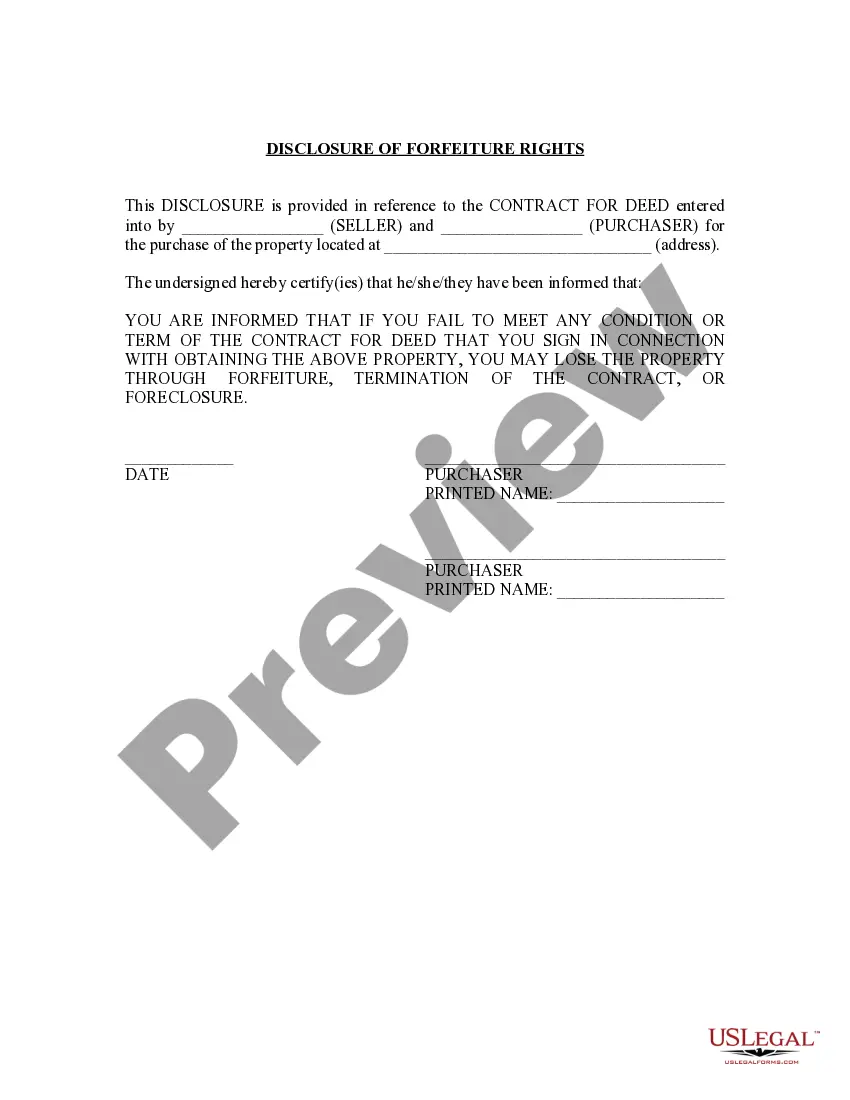

Dallas Texas Installment Payment and Purchase Agreement is a legal contract that outlines the terms and conditions for a purchase agreement in Dallas, Texas, where the buyer agrees to make installment payments to the seller over a specified period of time. This agreement enables individuals or businesses to acquire goods or property without paying the full amount upfront, providing a feasible option for budget-conscious buyers. In a typical Dallas Texas Installment Payment and Purchase Agreement, the buyer and seller mutually agree upon the purchase price, installment payment amounts, duration of the agreement, interest rates (if applicable), and any penalties or late fees. Both parties must thoroughly read and understand the agreement before signing to ensure clarity and protection of their rights. There are several types of Dallas Texas Installment Payment and Purchase Agreements, each catering to specific circumstances and assets: 1. Real Estate Installment Payment and Purchase Agreement: This type of agreement is commonly used when purchasing residential or commercial properties in Dallas. It outlines the terms for payment installments, including the down payment, monthly installments, interest rates, and the transfer of the property title upon the completion of payments. 2. Vehicle Installment Payment and Purchase Agreement: Used for buying automobiles, motorcycles, or other vehicles in Dallas, this agreement stipulates the purchase price, down payment, installment amounts, interest rates, and the collateral or security interest held by the seller until full payment is made. 3. Personal Property Installment Payment and Purchase Agreement: This agreement covers the purchase of personal property such as furniture, electronics, appliances, or other valuable items. It specifies the purchase price, installment amounts, interest rates, and any additional warranties or conditions associated with the purchased item. It is crucial for both buyers and sellers in Dallas, Texas, to have a clear and comprehensive Installment Payment and Purchase Agreement to protect their interests and prevent any potential disputes. Seeking legal advice or assistance when drafting or signing such agreements is highly recommended ensuring compliance with local laws and regulations.

Dallas Texas Installment Payment and Purchase Agreement

Description

How to fill out Dallas Texas Installment Payment And Purchase Agreement?

Whether you plan to start your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occurrence. All files are grouped by state and area of use, so picking a copy like Dallas Installment Payment and Purchase Agreement is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to obtain the Dallas Installment Payment and Purchase Agreement. Adhere to the guide below:

- Make certain the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Dallas Installment Payment and Purchase Agreement in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

Your sale and purchase agreement should include the following: Your name(s) and the names of the seller(s). The address of the property. The type of title (for example, freehold or leasehold). The price. Any deposit you must pay. Any chattels being sold with the property (for example, whiteware or curtains).

A buyer's agent prepares a purchase agreement as their client's formal offer on a property, then sends the offer to the seller's listing agent. The listing agent presents the document to the seller. If the seller isn't happy with the offer, they can decline or counteroffer, usually within 24 hours.

As discussed above, a purchase agreement should contain buyer and seller information, a legal description of the property, closing dates, earnest money deposit amounts, contingencies and other important information for the sale.

Often, when a buyer defaults on a contract, a seller will sue for breach of the installment sale contact, seek retention of the payments that were made as liquidated damages and possession of the property.

Most commonly, the buyer's real estate agent will write up and prepare the purchase agreement. Note that agents (not being practicing attorneys themselves) cannot create their own contracts.

A buyer's agent prepares a purchase agreement as their client's formal offer on a property, then sends the offer to the seller's listing agent. The listing agent presents the document to the seller. If the seller isn't happy with the offer, they can decline or counteroffer, usually within 24 hours.

The Elements of a Legally Enforceable Contract in Texas There Must Be an Offer. There Must Be Acceptance. There Must Be Mutual Consideration. The Parties Must Be Capable of Forming a Contract. The Purpose of the Contract Must Be Legal. The Contract Should Be in Writing.

He or she will then inform the current owner's bank (the bondholder) of the conclusion of the agreement. It's also noted at the Deeds Office that an instalment sale is in progress. This offers offers protection to the purchaser, stopping the vendor from selling the property on to a third party.

Which of the following is TRUE about an installment land contract? The buyer is given immediate possession and use of the property.

Either the seller or the buyer can prepare a purchase agreement. Like any contract, it can be a standard document that one party uses in the normal course of business or it can be the end result of back-and-forth negotiations.

Interesting Questions

More info

Contact us to find out more about our financing and installation services for your home or business. When you purchase an E3 Home, we also offer financing on a 30- or 60-day payment plan to cover your purchase cost and closing costs. It's the best way to get the financing you need to complete your home purchase. Can I pay it all at once or make installment payments? At the end of the EIP term, you'll have more time to take care of home maintenance and improvements such as remodeling, electrical work, and more. We work with you to set up a monthly payment schedule as quickly as you need it. Your purchase will become less expensive every month, and you get to keep those monthly payments to pay for new features and repairs. Will I need to complete additional paperwork to complete this loan? There are plenty of steps that must be completed as a result of your purchase of an E3 Home, including the EIP, Seller Financing Addendum and the Certificate of Title.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.