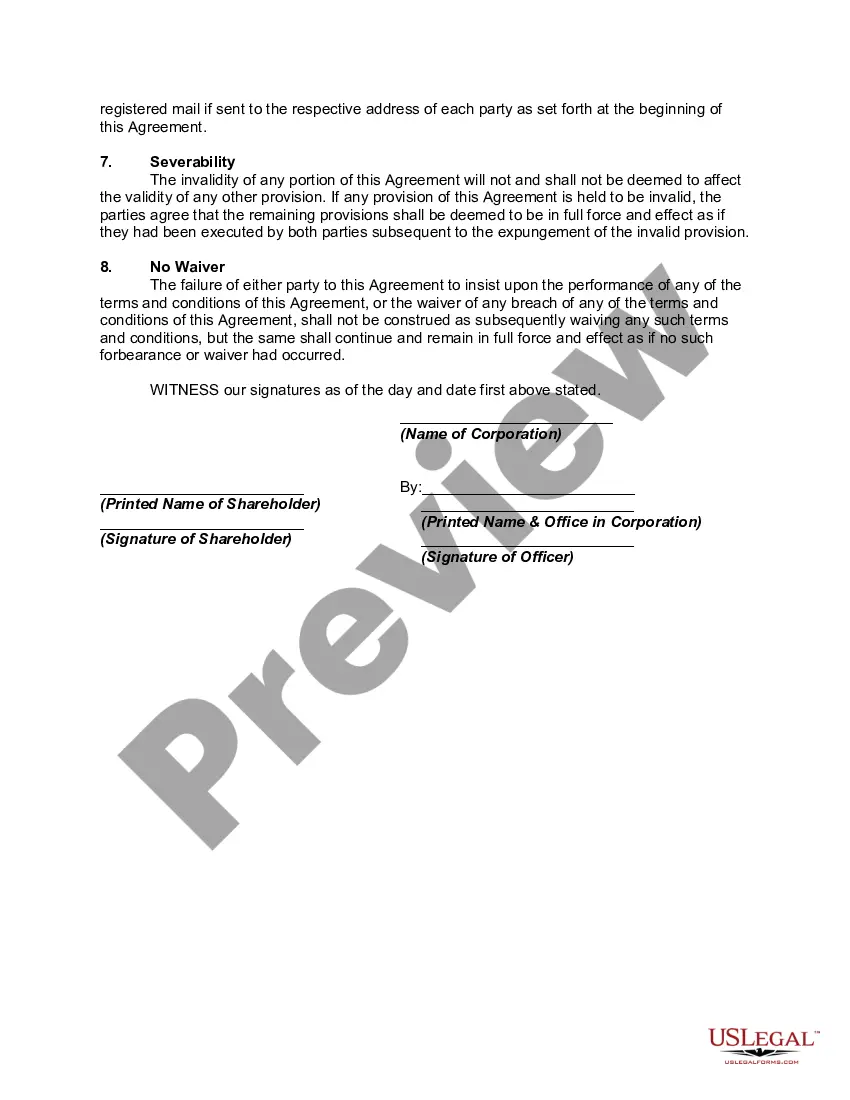

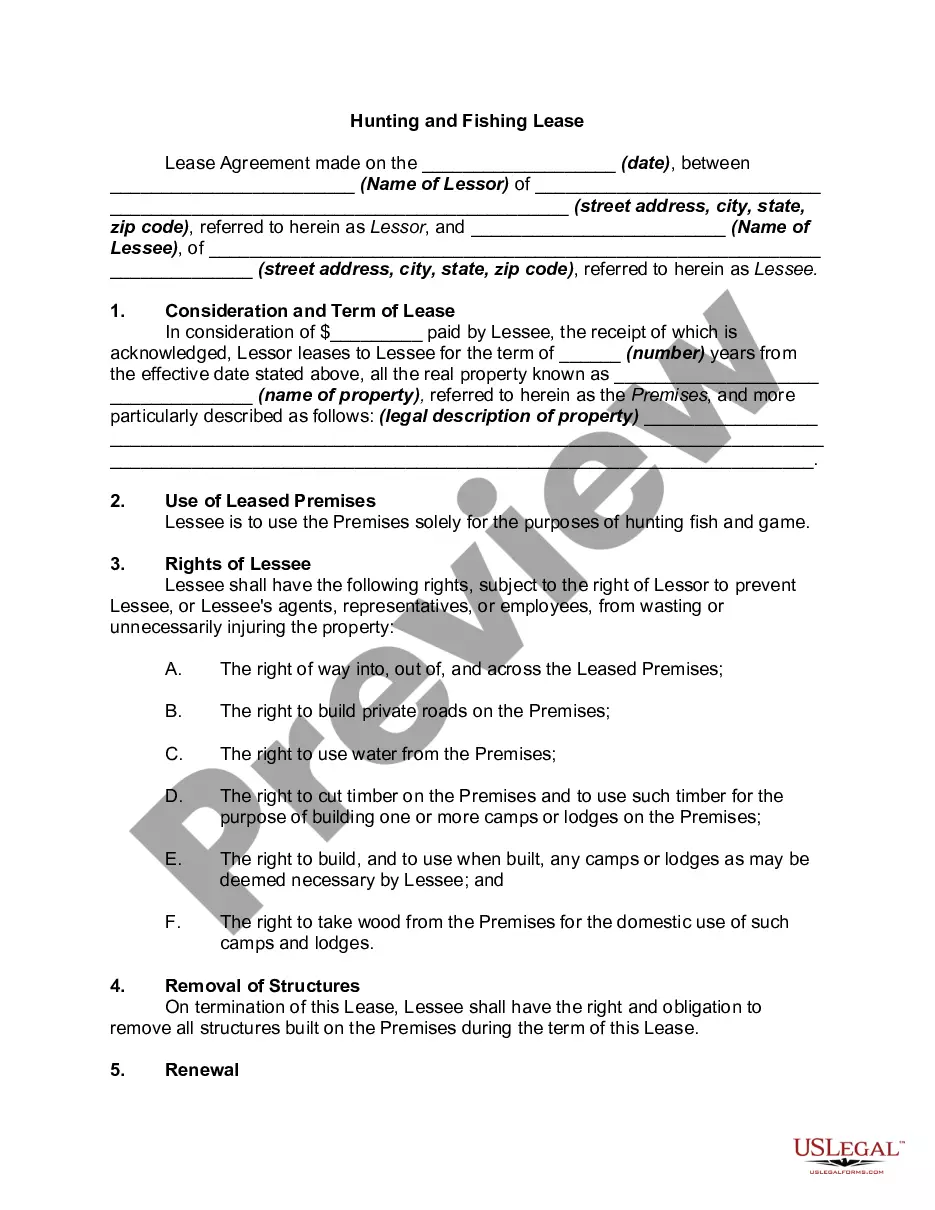

The Kings New York Loan Agreement between Stockholder and Corporation is a legally binding contract that outlines the terms and conditions of a loan transaction between a stockholder and a corporation. This agreement is designed to protect the interests of both parties involved and ensure transparency and accountability throughout the borrowing process. The agreement typically includes key details such as the loan amount, interest rate, repayment terms, and any collateral or guarantees provided by the stockholder. It also outlines the rights and responsibilities of both parties, and provisions for default, amendment, and termination of the loan agreement. There are different types of Kings New York Loan Agreements between Stockholder and Corporation, depending on the specific circumstances and needs of the parties involved. Some common types include: 1. Term Loan Agreement: This type of agreement establishes a specific term during which the loan must be repaid in full, along with any interest accrued. 2. Revolving Loan Agreement: Unlike a term loan, a revolving loan agreement provides the stockholder with ongoing access to a credit line. The stockholder can borrow, repay, and re-borrow funds up to a predetermined limit without the need for additional documentation. 3. Secured Loan Agreement: In this type of agreement, the stockholder provides collateral as security for the loan. This collateral could be in the form of real estate, assets, or other valuable property. 4. Unsecured Loan Agreement: Unlike a secured loan, an unsecured loan agreement does not require collateral. This type of loan typically carries a higher interest rate to compensate for the increased risk to the corporation. 5. Promissory Note: Although not strictly a loan agreement, a promissory note is often used in conjunction with a loan agreement. It is a written promise from the stockholder to repay the loan according to specific terms and conditions. In conclusion, the Kings New York Loan Agreement between Stockholder and Corporation is a comprehensive contract that governs the borrowing relationship between a stockholder and a corporation. It ensures that both parties are fully aware of their rights and obligations and provides a framework for conducting a loan transaction in a fair and transparent manner.

Kings New York Loan Agreement between Stockholder and Corporation

Description

How to fill out Kings New York Loan Agreement Between Stockholder And Corporation?

Drafting paperwork for the business or individual needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to generate Kings Loan Agreement between Stockholder and Corporation without expert help.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Kings Loan Agreement between Stockholder and Corporation by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Kings Loan Agreement between Stockholder and Corporation:

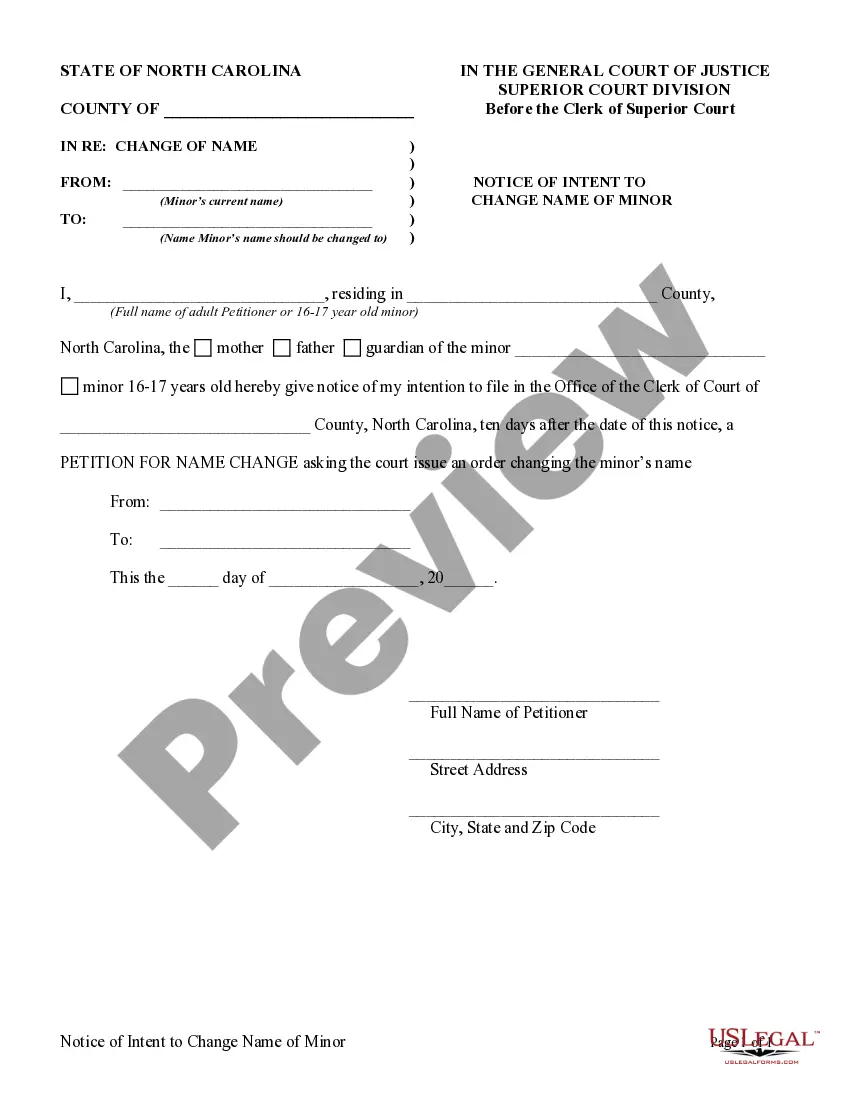

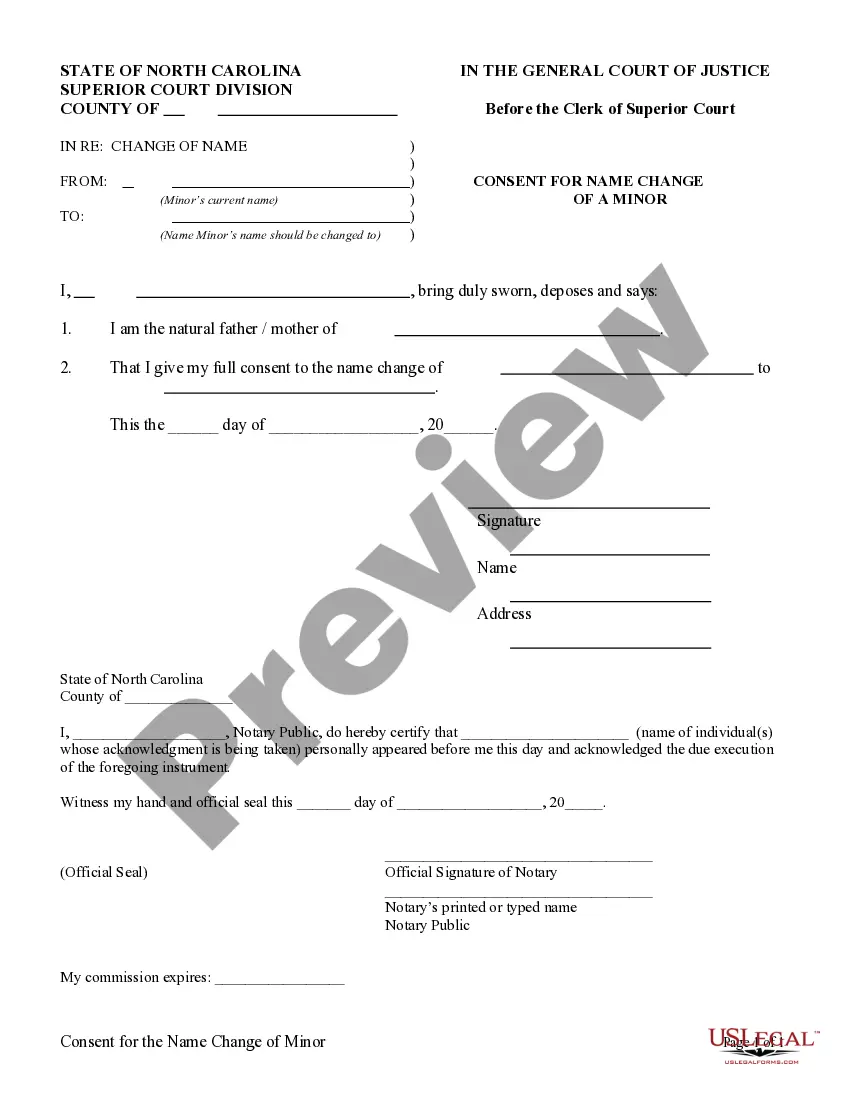

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that meets your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any situation with just a couple of clicks!