Maricopa Arizona Loan Agreement between Stockholder and Corporation is a legally binding document that outlines the terms and conditions under which a stockholder agrees to provide a loan to a corporation located in Maricopa, Arizona. This agreement serves as a vital tool for ensuring transparency and clarity in financial transactions between the stockholder and the corporation. The loan agreement typically covers various essential aspects, such as the loan amount, interest rate, repayment terms, collateral, and any additional fees or charges associated with the loan. It specifies the responsibilities and obligations of both parties involved, ensuring that both the stockholder and the corporation fully understand and agree to the terms of the loan. Keywords: Maricopa Arizona, loan agreement, stockholder, corporation, terms and conditions, transparency, financial transactions, loan amount, interest rate, repayment terms, collateral, responsibilities, obligations. Different types of Maricopa Arizona Loan Agreement between Stockholder and Corporation may include: 1. Secured Loan Agreement: This type of agreement specifies the inclusion of collateral, such as real estate, inventory, or equipment, which serves as security for repayment in case the corporation defaults on the loan. 2. Unsecured Loan Agreement: Unlike a secured loan agreement, an unsecured loan does not require collateral. In this type of agreement, the stockholder relies solely on the corporation's ability to repay the loan. 3. Term Loan Agreement: A term loan agreement defines fixed repayment terms over a specified period. It outlines the loan amount, interest rate, and repayment schedule, providing a clear timeline for loan repayment. 4. Revolving Loan Agreement: This agreement allows the corporation to borrow, repay, and re-borrow funds within an agreed credit limit. It provides flexibility by enabling ongoing access to fund as needed. 5. Convertible Loan Agreement: In a convertible loan agreement, the stockholder has the option to convert the loan into equity shares of the corporation at a predetermined conversion rate. This can be beneficial to both parties as it offers potential for future financial gain. By understanding the various types of Maricopa Arizona Loan Agreement between Stockholder and Corporation, parties involved can select the agreement that best suits their financial needs and aligns with their long-term business goals.

Maricopa Arizona Loan Agreement between Stockholder and Corporation

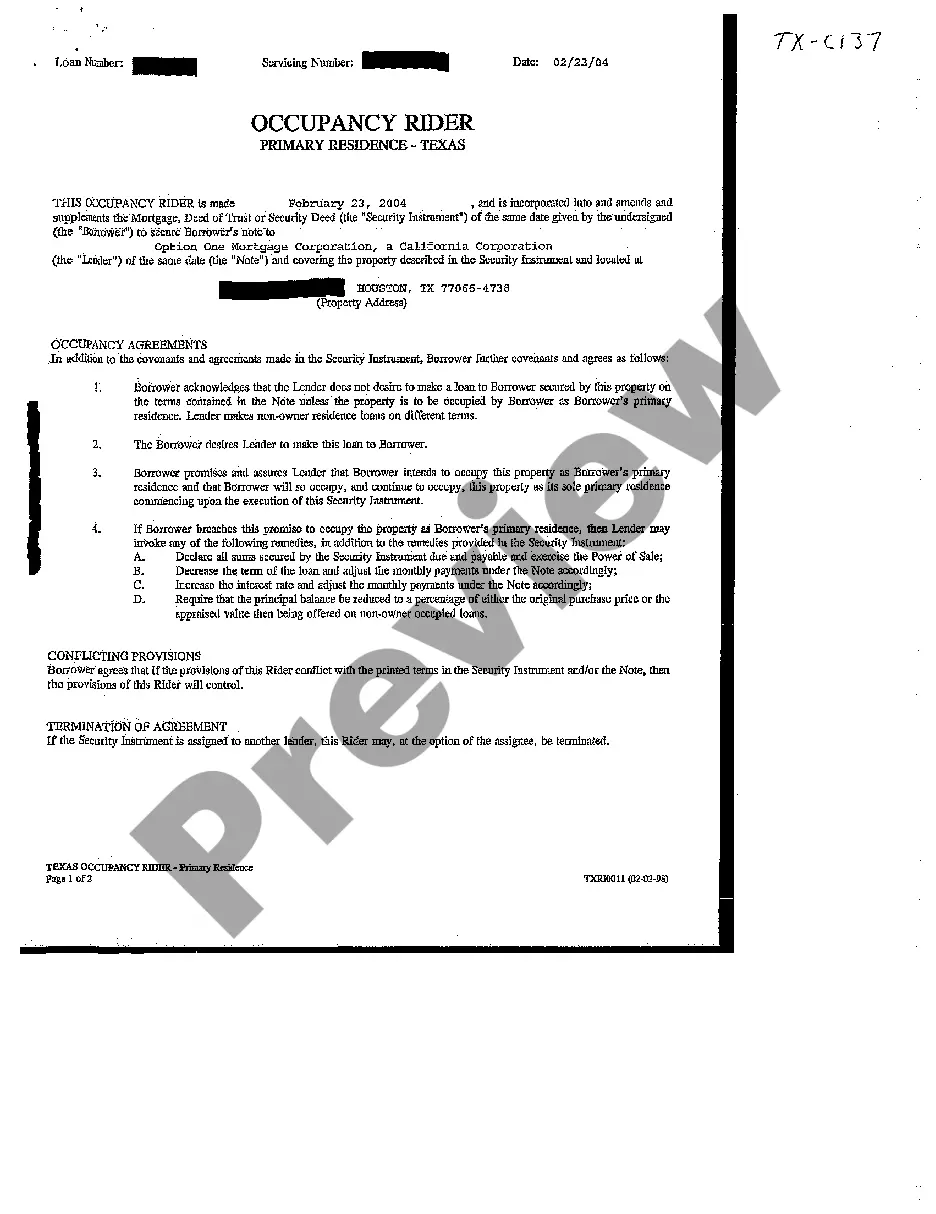

Description

How to fill out Maricopa Arizona Loan Agreement Between Stockholder And Corporation?

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life scenario, locating a Maricopa Loan Agreement between Stockholder and Corporation meeting all local requirements can be tiring, and ordering it from a professional lawyer is often pricey. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. In addition to the Maricopa Loan Agreement between Stockholder and Corporation, here you can get any specific document to run your business or individual affairs, complying with your regional requirements. Experts verify all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can retain the document in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Maricopa Loan Agreement between Stockholder and Corporation:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Maricopa Loan Agreement between Stockholder and Corporation.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Either type of contribution increases the shareholder's basis in the S-corp. A capital contribution (also called paid-in capital) increases the shareholder's stock basis; a loan increases the shareholder's debt basis.

You can receive a shareholder loan by borrowing money from your own company. The Income Tax Act of Canada has serious tax implications for shareholder loans that apply to anyone who borrows money from a corporation whether they're a shareholder or a person closely related to the company.

Shareholder loans are debt-type financing provided by financial sponsors to companies. They sit between the most junior debt and equity and often make up the largest part of the capital invested. They are sometimes called shareholder notes, preferred equity, or the institutional strip.

Shareholders often loan money to a corporation in order to keep the business operating, but be aware there are rules and regulations, which must be adhered to, so the loan is treated as a loan, and not reclassified as an equity contribution.

If you want to loan money to your business, you should have your attorney draw up paperwork to define the terms of the loan, including repayment and consequences for non-repayment of the loan. For tax purposes, a loan from you to your business must be an "arms-length" transaction.

A loan to a shareholder must be returned to the corporation by the end of the next fiscal year to ensure that the amount will not be taxed. For the loan not to be considered income, according to the CRA, interest must be charged by the corporation at a prescribed rate to any shareholder loan amount.

A Shareholder Loan Agreement, sometimes called a stockholder loan agreement, is an enforceable agreement between a shareholder and a corporation that details the terms of a loan (like the repayment schedule and interest rates) when a corporation borrows money from or owes money to a shareholder.

Lending corporate cash to shareholders can be an effective way to give the shareholders use of the funds without the double-tax consequences of dividends. However, an advance or loan to a shareholder must be a bona fide loan to avoid a constructive dividend.

If an owner draws cash from the company bank account which is not dividends or salary, they are considered a shareholder loan and debt owing to the company. The total draws will appear as an asset on the balance sheet called due from shareholder.