A Suffolk New York Loan Agreement between Stockholder and Corporation is a legally binding document that outlines the terms and conditions related to a loan provided by a stockholder to a corporation based in Suffolk, New York. This agreement serves as a formal contract and ensures that both parties are protected by clearly defining their rights and obligations. The agreement begins with an introductory section that identifies the stockholder and the corporation, providing their legal names, addresses, and contact information. It also states the effective date of the agreement. Next, the agreement states the purpose of the loan, whether it is to finance the corporation's operations, fund specific projects, purchase assets, or meet other financial needs. The loan amount is specified, including the currency and any additional disbursement terms if applicable. The repayment terms are a crucial aspect of the agreement. It outlines the repayment schedule, including the frequency and method of payment. The interest rate charged on the loan is also documented, along with any additional fees or penalties that may be incurred for late payments or defaults. Collateral details are included if the loan agreement requires the corporation to provide security to the stockholder. This may involve specific assets, shares, or any other valuable items that can be used as collateral in case of default. In addition, the agreement outlines rights and responsibilities of both parties. It may include provisions related to prepayment options, loan modifications, and events of default. The document may also include confidentiality clauses, non-compete agreements, and dispute resolution mechanisms. Different types of Suffolk New York Loan Agreements between Stockholder and Corporation can vary depending on the specific circumstances. Some common variations may include: 1. Convertible Loan Agreement: This type of loan agreement allows the stockholder to convert their loan into equity at a later time, usually upon a specified event or predetermined conditions. 2. Term Loan Agreement: A loan agreement with a specific term, after which the loan must be fully repaid. The repayment schedule is generally fixed, including principal and interest payments. 3. Demand Loan Agreement: This type of agreement allows the stockholder to demand repayment of the loan at any time, usually with a notice period. It provides flexibility for the stockholder to call back the loan when needed. 4. Revolving Loan Agreement: This agreement sets up a line of credit that allows the corporation to borrow funds from the stockholder as needed, subject to an agreed-upon limit. The corporation can repay and reborrow within the predetermined terms. 5. Secured Loan Agreement: In this case, the loan is secured by specific collateral provided by the corporation. If there is a default, the stockholder has the right to seize and sell the collateral to recover their investment. To create an effective Suffolk New York Loan Agreement between Stockholder and Corporation, legal advice from a qualified attorney is highly recommended.

Suffolk New York Loan Agreement between Stockholder and Corporation

Description

How to fill out Suffolk New York Loan Agreement Between Stockholder And Corporation?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a lawyer to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Suffolk Loan Agreement between Stockholder and Corporation, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

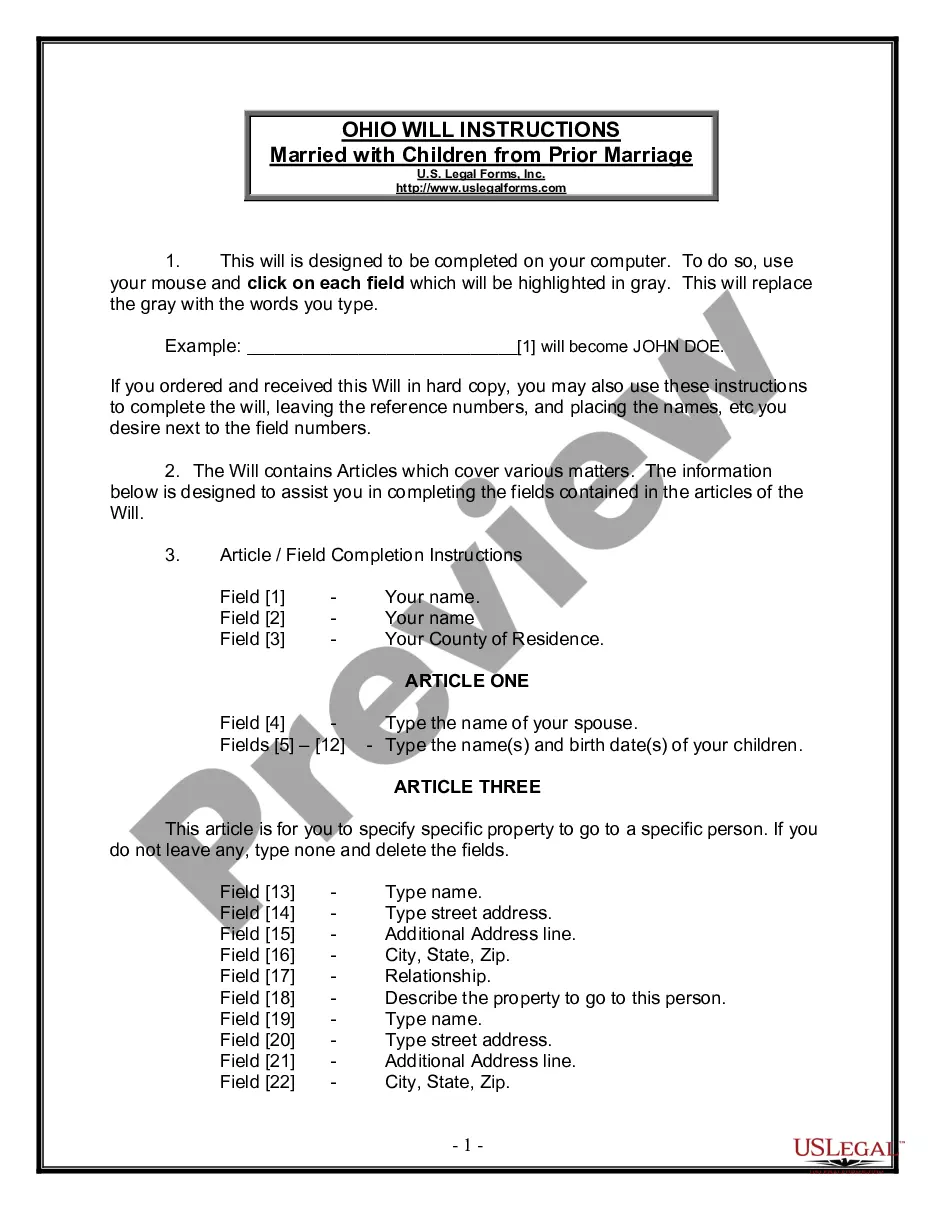

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Therefore, if you need the latest version of the Suffolk Loan Agreement between Stockholder and Corporation, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Suffolk Loan Agreement between Stockholder and Corporation:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Suffolk Loan Agreement between Stockholder and Corporation and download it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!