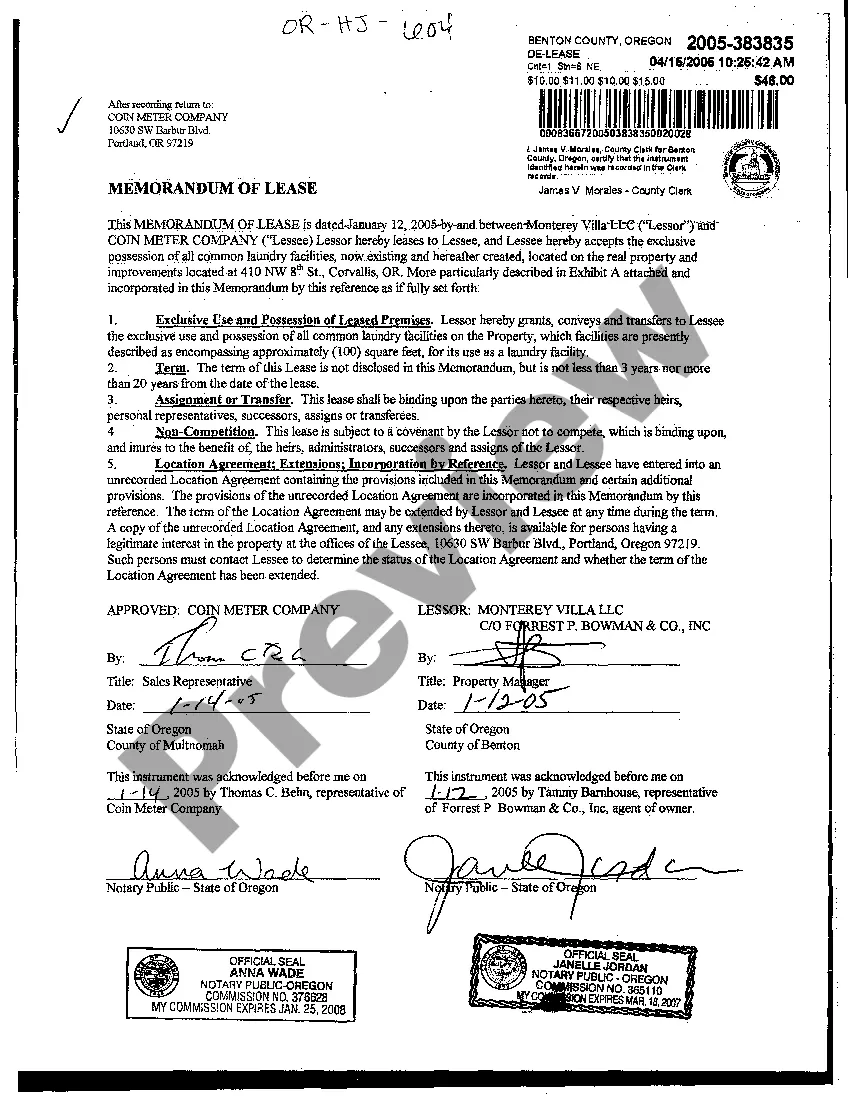

Fairfax Virginia Checklist for Business Loans Secured by Real Estate: A Comprehensive Guide Introduction: Fairfax, Virginia, located in the heart of Northern Virginia, is a thriving city with a robust business environment. If you are a business owner in Fairfax, seeking financial support through business loans secured by real estate, it is essential to be aware of the specific requirements and checklist to ensure a smooth loan application process. In this article, we will discuss the key factors and steps involved in securing business loans in Fairfax, Virginia, with real estate as collateral. 1. Preparing the Necessary Documents: Gathering all the required documentation is a crucial step before applying for a business loan secured by real estate in Fairfax, Virginia. Some essential documents you should have included: — Business plan: A thorough plan that outlines your business model, prospective revenue, and profitability projections. — Financial statements: This includes balance sheets, income statements, cash flow statements, and tax returns for the past few years. — Property information: Documents related to the real estate property, such as property valuation, titles, mortgage statements, and proof of ownership. — Business records: Important records such as licenses, permits, contracts, and leases (if applicable). — Personal financial statements: This gives lenders insights into your personal financial standing. 2. Assessing Credit History: Lenders will carefully scrutinize your credit history, both personal and business-related. This assessment includes reviewing credit scores, payment history, any outstanding debts, bankruptcies (if applicable), and other financial obligations. It is crucial to ensure that your credit history is in good standing before applying for a business loan. 3. Determining Loan Eligibility and Terms: Before approaching any lender, it is important to evaluate your business's eligibility for a loan and determine the loan type that aligns with your specific needs: — SBA loans: These loans are backed by the Small Business Administration, offering favorable terms and interest rates. — Traditional bank loans: Loans provided by local banks or financial institutions. — Private lenders: Non-traditional lenders who may offer more flexibility but potentially higher interest rates. 4. Researching Lenders: In Fairfax, Virginia, several banks, credit unions, and private lenders offer business loans secured by real estate. Conduct thorough research to identify lenders who specialize in real estate-backed loans and have experience working with businesses in Fairfax. Compare interest rates, repayment terms, and reputation to make an informed decision. 5. Creating a Strong Loan Application: Crafting a detailed and comprehensive loan application is essential to secure business financing: — Provide an executive summary: Highlight the purpose of the loan, the amount required, and a compelling case for your business's potential growth and profitability. — Include financial projections: Demonstrate your ability to repay the loan by presenting realistic revenue and expense forecasts. — It is recommended to seek professional assistance from accountants or business advisors who can guide you through the loan application process, ensuring that all necessary information is properly included. Conclusion: Securing a business loan secured by real estate in Fairfax, Virginia, requires careful planning and meticulous attention to detail. By following the checklist mentioned above, businesses can enhance their chances of securing the necessary financing for growth and prosperity. Remember to prepare the relevant documentation, assess your credit history, research lenders, and create a strong loan application to maximize your chances of success. Possible Related Types of Fairfax Virginia Checklist for Business Loans Secured by Real Estate: 1. Commercial Real Estate Loans: Specifically tailored for businesses that focus on acquiring or refinancing commercial properties, including offices, retail spaces, or industrial premises. 2. Construction Loans: Designed for businesses looking to fund new construction projects or major renovations of existing properties. 3. Multifamily Real Estate Loans: Aimed at businesses involved in multifamily residential property investments, such as apartment buildings or housing complexes. 4. Fix and Flip Loans: For businesses engaged in purchasing, renovating, and reselling properties for profit. These loans are short-term and focus on the property's potential value after renovations. 5. Investment Property Loans: For businesses seeking financing to purchase or refinance non-owner-occupied properties for investment purposes, such as rental properties or commercial real estate spaces. Remember, it is crucial to consult with a professional financial advisor or lender to determine the most suitable type of loan based on your specific business requirements and financial goals.

Fairfax Virginia Checklist for Business Loans Secured by Real Estate

Description

How to fill out Fairfax Virginia Checklist For Business Loans Secured By Real Estate?

Creating paperwork, like Fairfax Checklist for Business Loans Secured by Real Estate, to manage your legal affairs is a difficult and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents intended for different cases and life situations. We ensure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Fairfax Checklist for Business Loans Secured by Real Estate form. Simply log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly straightforward! Here’s what you need to do before getting Fairfax Checklist for Business Loans Secured by Real Estate:

- Ensure that your document is compliant with your state/county since the regulations for creating legal papers may vary from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the Fairfax Checklist for Business Loans Secured by Real Estate isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to begin using our service and download the document.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is ready to go. You can go ahead and download it.

It’s easy to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!