Maricopa Arizona Checklist for Business Loans Secured by Real Estate: A Comprehensive Guide If you are an entrepreneur or business owner in Maricopa, Arizona, and require financial assistance, securing a business loan backed by real estate can be a viable option. To navigate the loan application process smoothly and effectively, it is crucial to have a checklist prepared. This checklist will ensure you have all the necessary documentation and meet the requirements set by lenders. In this article, we will walk you through a detailed description of the Maricopa Arizona Checklist for Business Loans Secured by Real Estate. 1. Research Different Lenders: Start by researching different lenders in Maricopa, Arizona, who offer business loans secured by real estate. Compare interest rates, loan terms, and requirements to find the best fit for your business needs. 2. Gather Required Documents: Before applying for a business loan, compile all the necessary documents as per the lender's requirements. These may include: — Proof of identification: Provide copies of your driver's license, passport, or other government-issued IDs. — Business plan: Create a comprehensive business plan detailing your company's goals, financial projections, and marketing strategies. — Financial statements: Prepare balance sheets, income statements, and cash flow statements for your business. — Tax returns: Gather personal and business tax returns for at least the past two years. — Current financial obligations: Document any outstanding loans or debts your business currently holds. — Legal documentation: Provide copies of licenses, permits, contracts, or leases related to your business operations. — Property information: If you already own the real estate you plan to use as collateral, gather property deeds, titles, and appraisal reports. 3. Verify Credit Score and History: Request a credit report from all major credit bureaus and review it for inaccuracies. Ensure your credit history is in good standing, as this will greatly impact your loan approval and interest rates. 4. Assess Collateral Value: Determine the value of the real estate you plan to use as collateral by obtaining a professional appraisal. Lenders will typically require the property's value to exceed the loan amount significantly. 5. Prepare a Comprehensive Loan Proposal: Craft a well-structured loan proposal that highlights your business's strengths, growth potential, and how the funds will be utilized. Include financial projections, market analysis, and detailed plans for repayment. 6. Seek Professional Guidance: Consult with business loan experts or financial advisors who specialize in securing business loans secured by real estate. They can provide valuable insights, ensure you meet all requirements, and improve your chances of approval. Types of Maricopa Arizona Checklist for Business Loans Secured by Real Estate: 1. Small Business Administration (SBA) Loans: These loans provide financing for small businesses and are partially guaranteed by the SBA. The requirements and checklist for SBA loans differ from conventional loans, so it's essential to research and understand their specific guidelines. 2. Conventional Bank Loans: Traditional banks and financial institutions also offer business loans secured by real estate. Their checklist may include stringent documentation and eligibility criteria, making it crucial to be well-prepared. Remember, lenders may have specific additional requirements, so it's advisable to check with individual institutions before finalizing your checklist. By following a comprehensive checklist, you can increase your chances of obtaining a business loan in Maricopa, Arizona, enabling you to grow and expand your business with the financial support you need.

Maricopa Arizona Checklist for Business Loans Secured by Real Estate

Description

How to fill out Maricopa Arizona Checklist For Business Loans Secured By Real Estate?

Drafting documents for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft Maricopa Checklist for Business Loans Secured by Real Estate without expert help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Maricopa Checklist for Business Loans Secured by Real Estate on your own, using the US Legal Forms online library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Maricopa Checklist for Business Loans Secured by Real Estate:

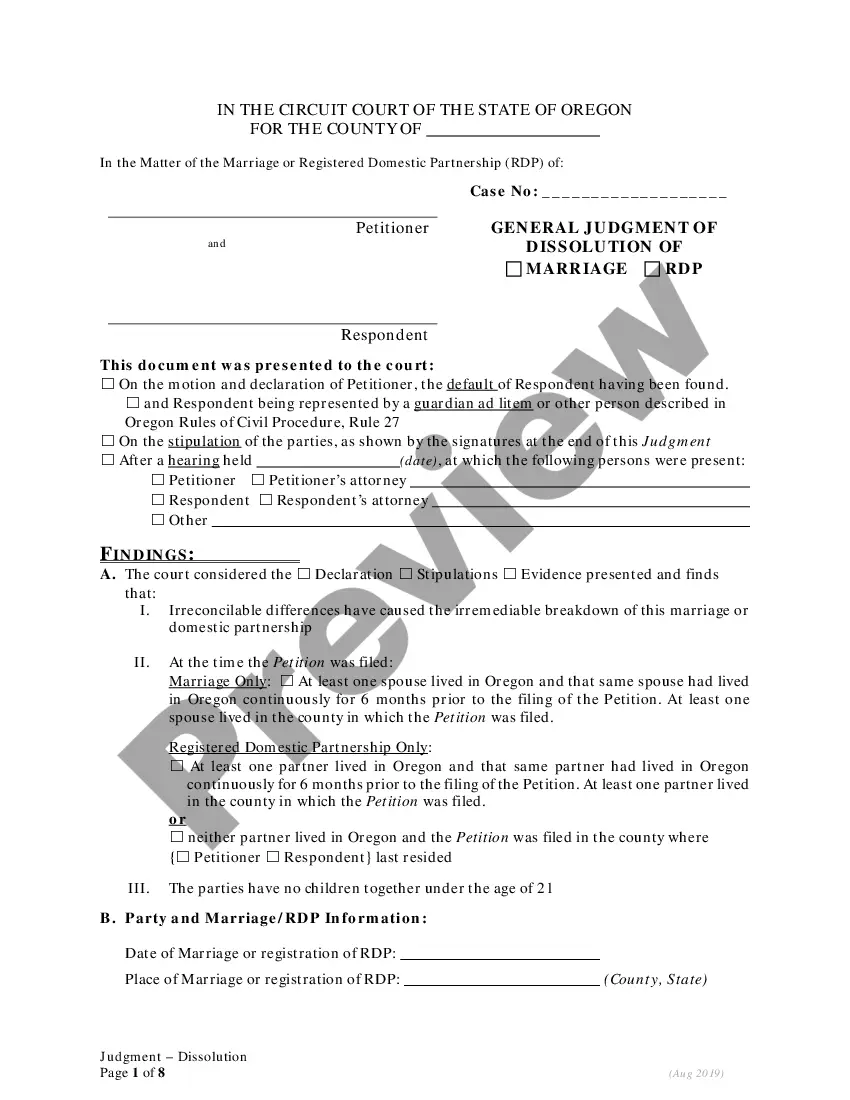

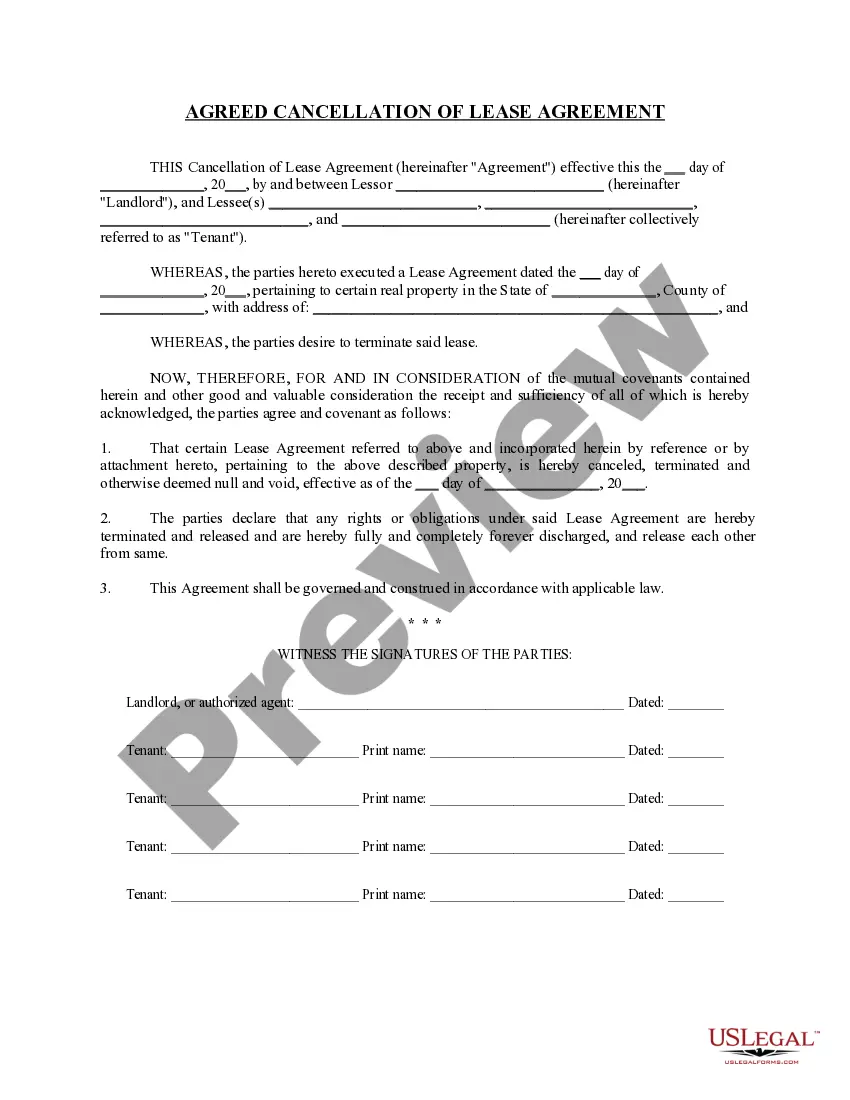

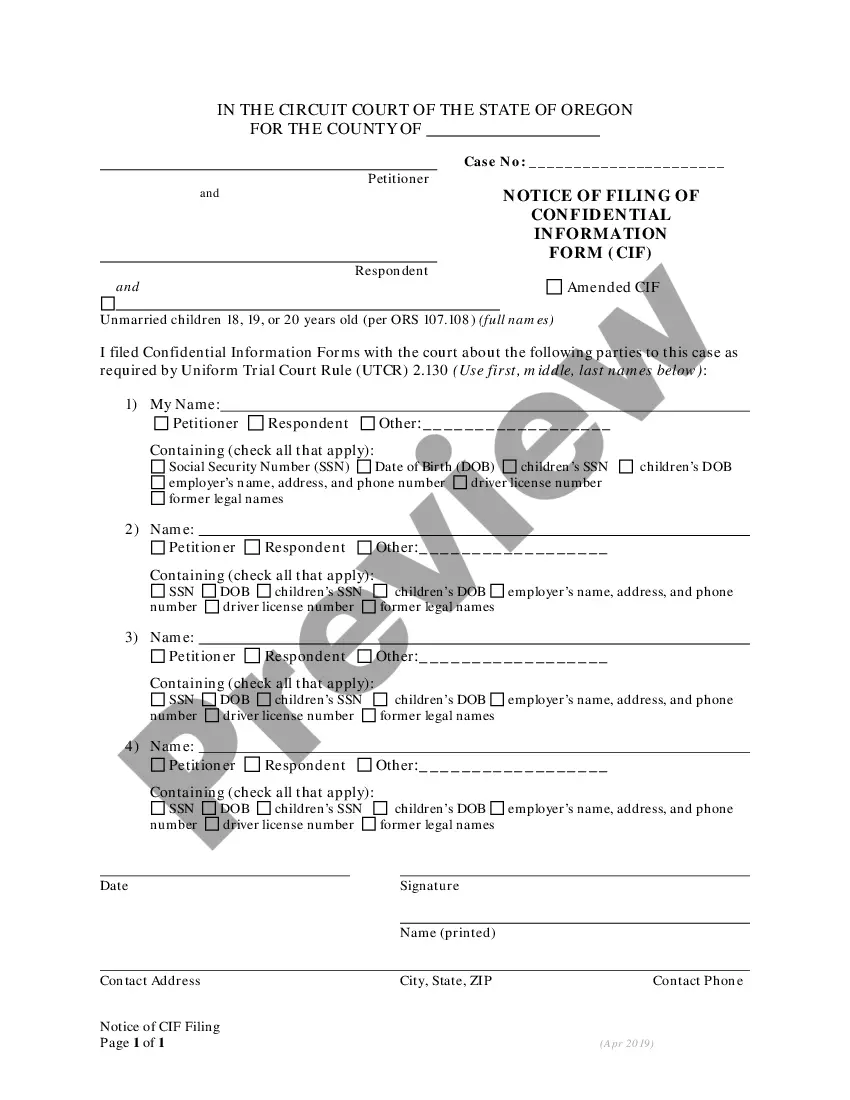

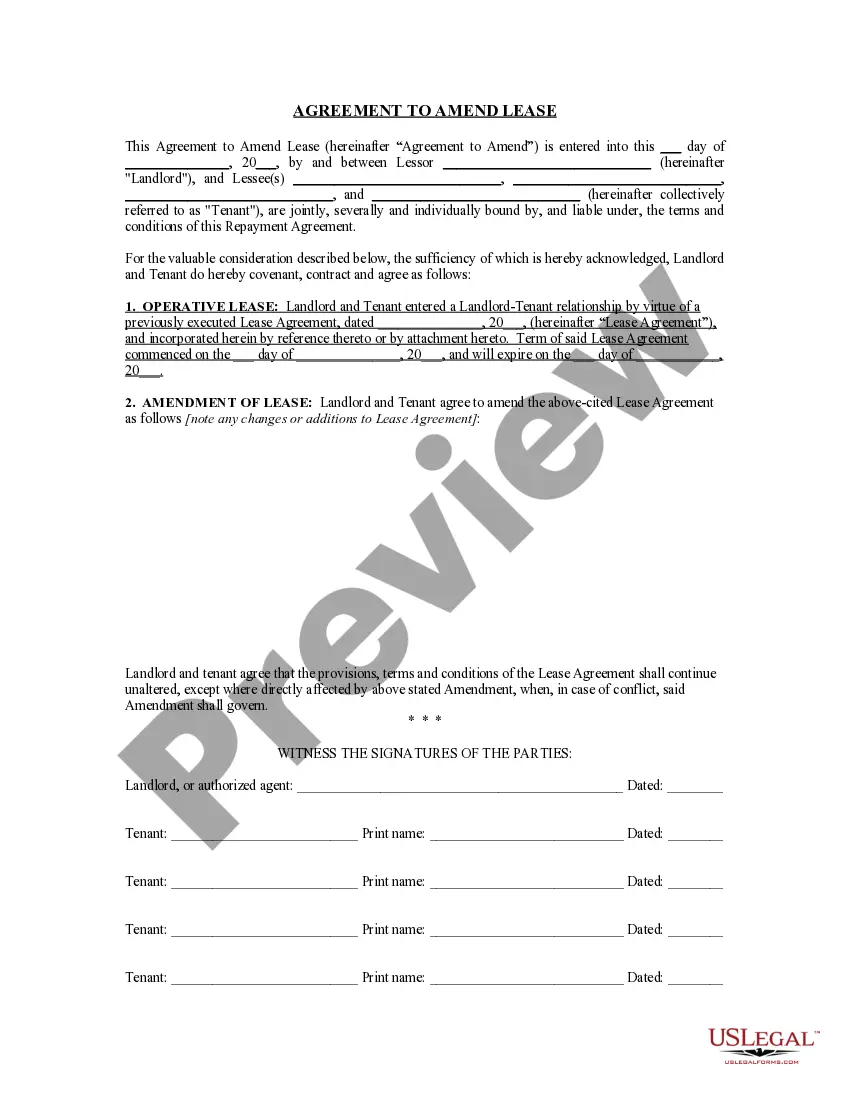

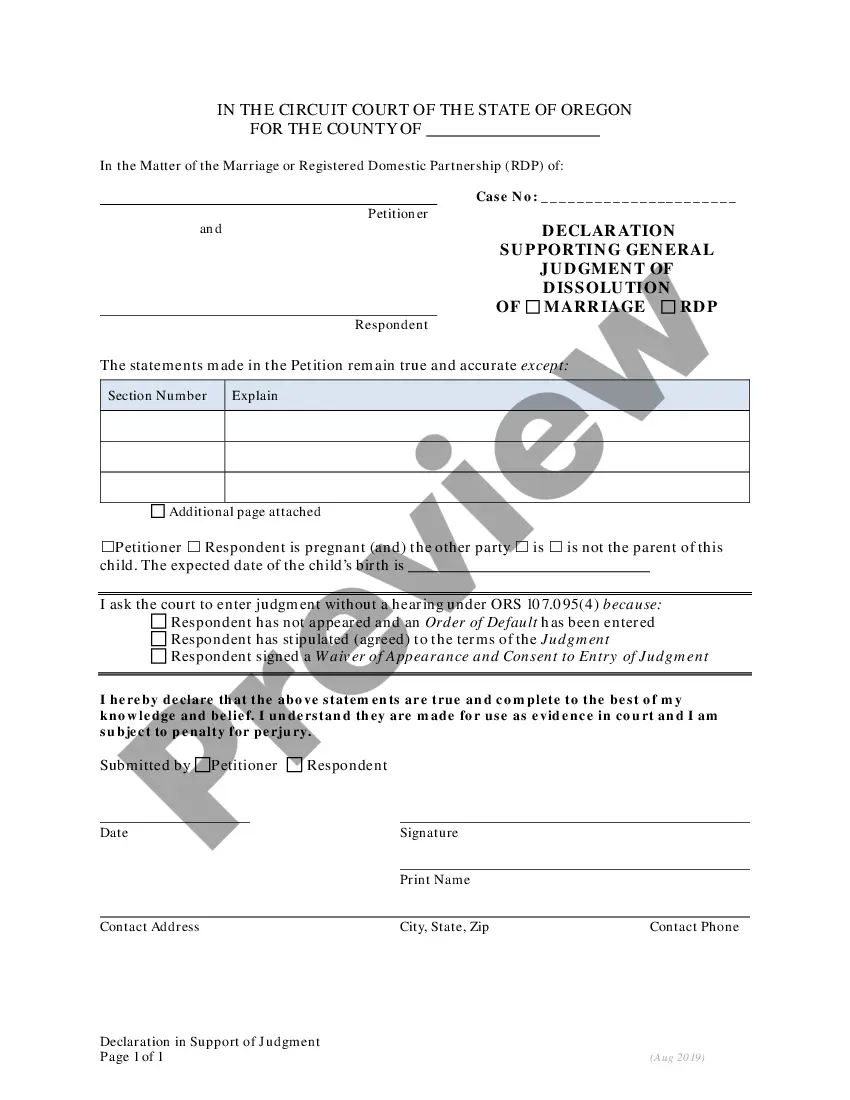

- Examine the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any scenario with just a couple of clicks!