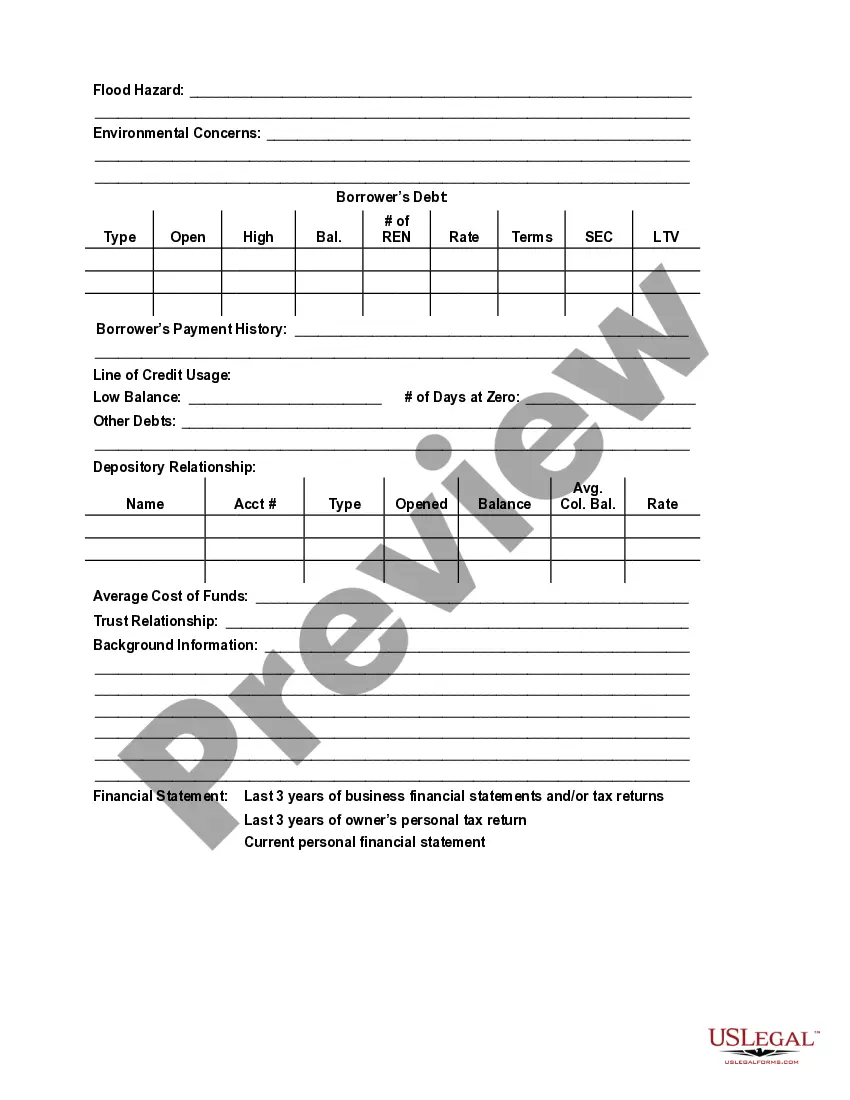

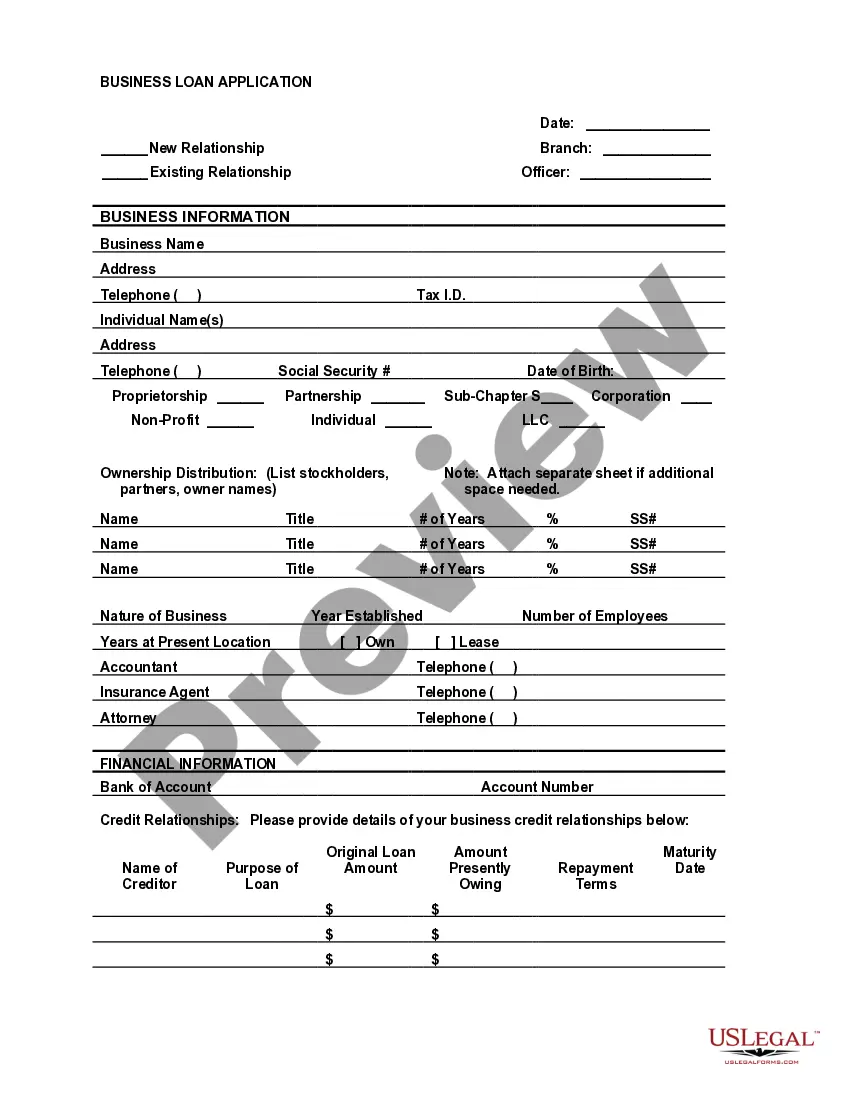

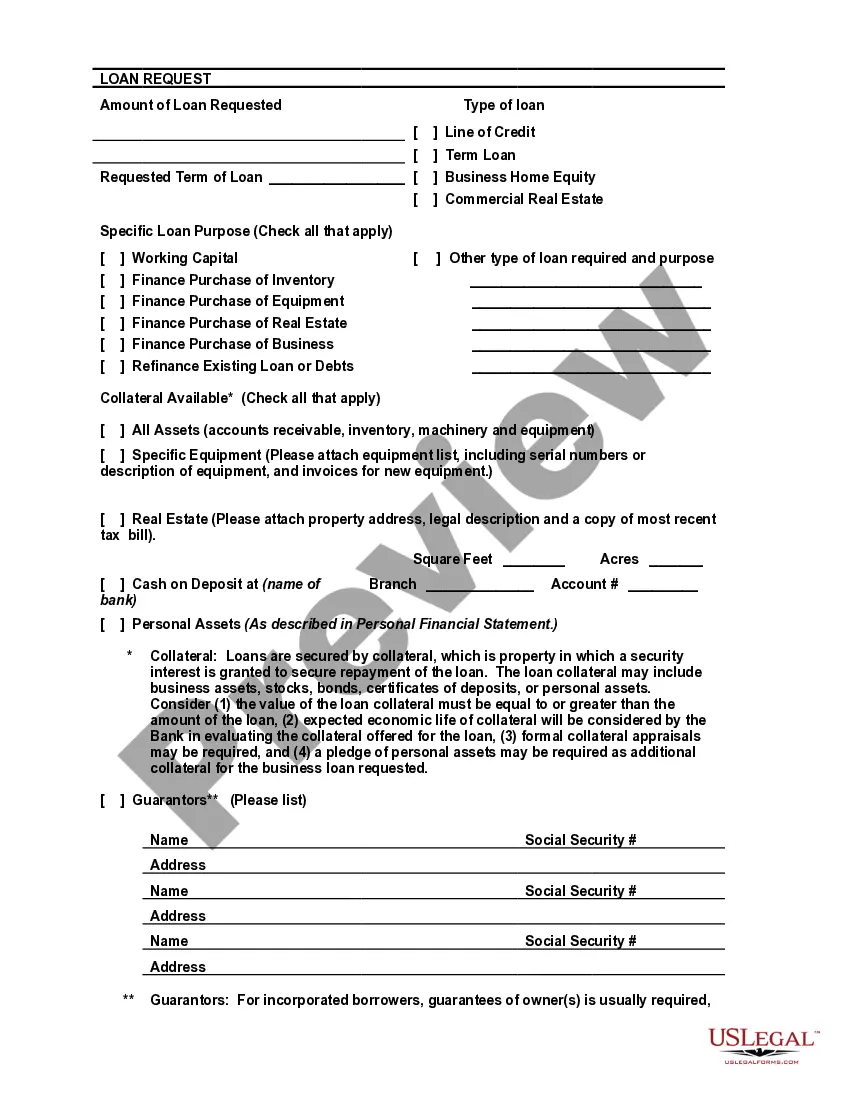

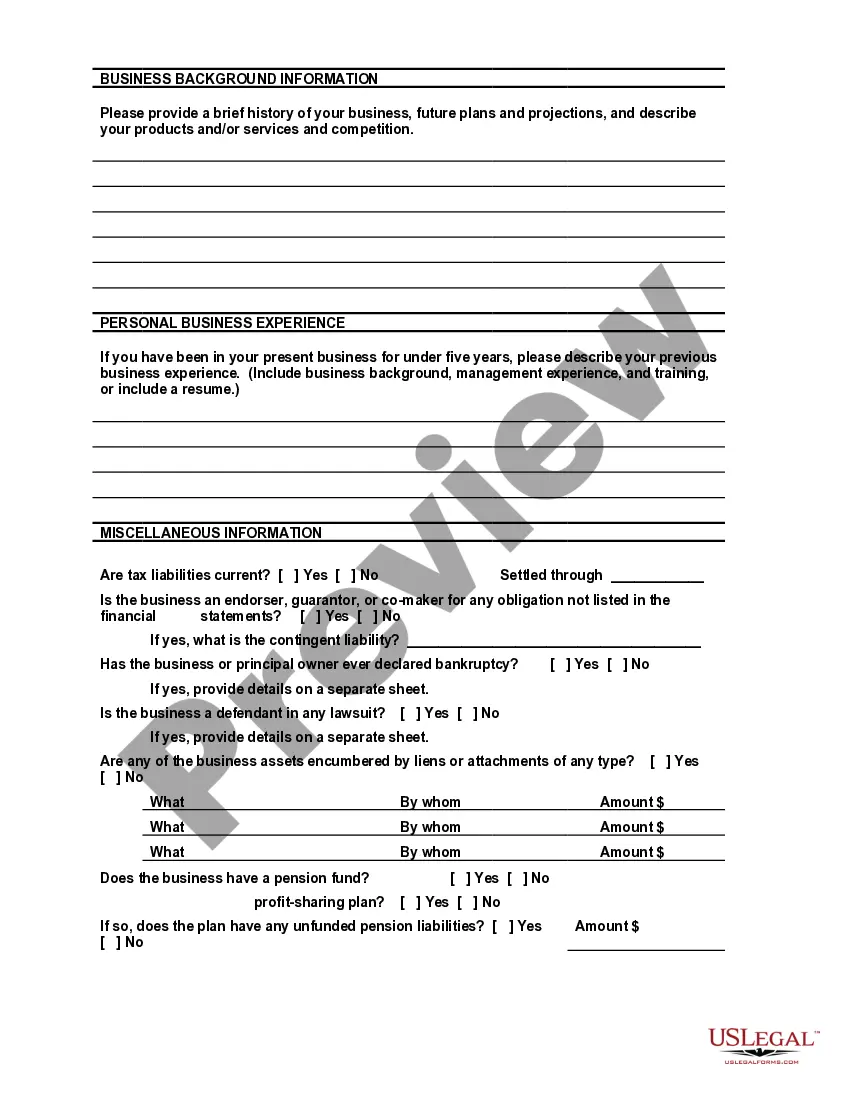

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

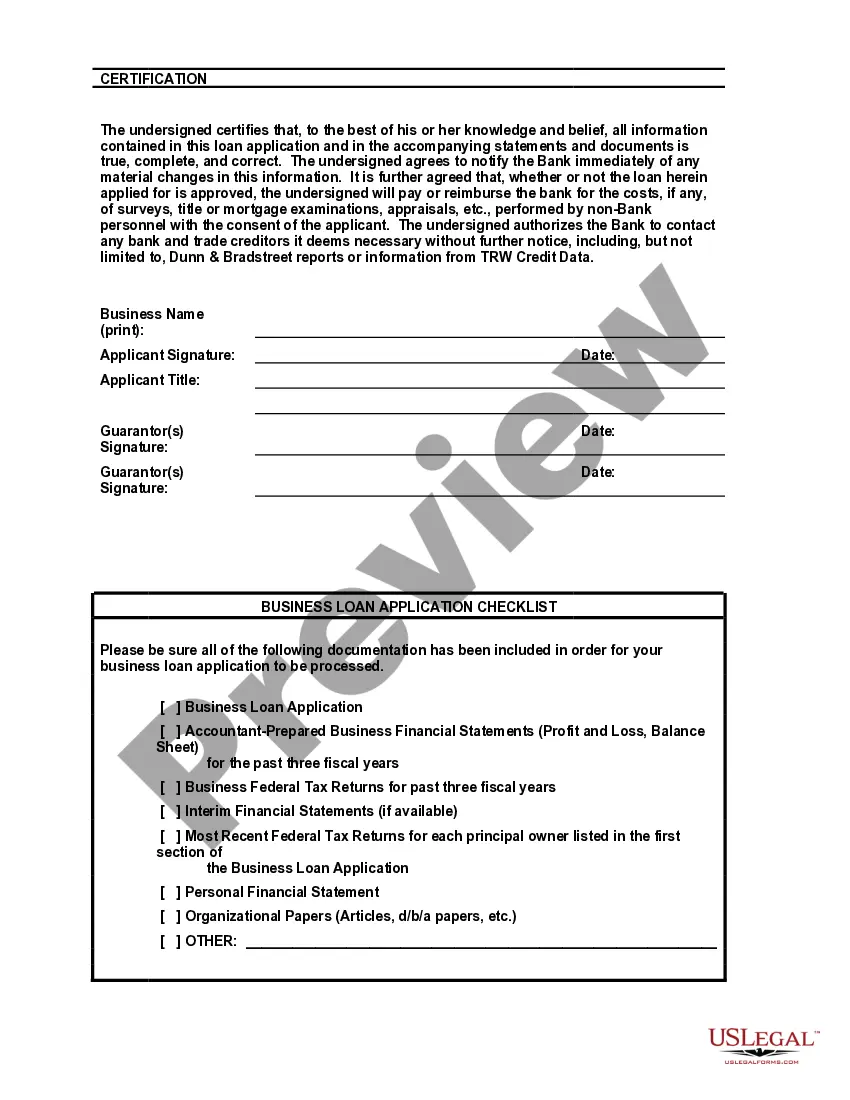

Allegheny Pennsylvania Bank Loan Application Form and Checklist — Business Loan The Allegheny Pennsylvania Bank Loan Application Form and Checklist for Business Loan serve as crucial documents for individuals and businesses seeking financial assistance from Allegheny Pennsylvania Bank. This comprehensive application form and checklist are designed to help streamline the loan application process and ensure that all necessary information and documentation are provided. The Allegheny Pennsylvania Bank Loan Application Form is specifically tailored to business loans, catering to the unique requirements involved in securing financing for enterprises. It encompasses a detailed set of fields covering diverse aspects of the loan application, including business information, financial statements, collateral details, and personal information of the applicant. By diligently completing this form, applicants present a comprehensive overview of their business, enabling the bank to assess their eligibility and determine the appropriate loan amount, interest rates, and repayment terms. Moreover, the checklist accompanying the application form streamlines the loan submission process, ensuring that all required supporting documents are included. This checklist typically includes but is not limited to the following items: 1. Business plan: A detailed overview of the business model, market analysis, financial projections, and strategies for growth. 2. Financial statements: Complete financial records, including income statements, balance sheets, and cash flow statements, typically covering the last three years. 3. Tax returns: Copies of personal and business tax returns for the previous three years. 4. Bank statements: Statements for business and personal bank accounts, showcasing cash flows and financial health. 5. Legal documents: Relevant legal documents such as articles of incorporation, partnership agreements, and leases. 6. Collateral documentation: Information about assets that may serve as collateral, such as property deeds, equipment titles, or purchase invoices. 7. Personal identification: Valid identification documents, such as driver's license, passport, or social security card. In addition to the general business loan application form and checklist, Allegheny Pennsylvania Bank may offer specific loan application forms for various purposes. These could include: 1. Small Business Administration (SBA) Loan Application: Designed for businesses seeking loans guaranteed by the Small Business Administration, helping applicants navigate the SBA requirements effectively. 2. Equipment Financing Loan Application: Tailored for businesses seeking financing options specifically for purchasing or leasing equipment required for their operations. 3. Commercial Real Estate Loan Application: Catering to businesses seeking loans for acquiring or refinancing commercial properties, such as office spaces, warehouses, or retail spaces. 4. Working Capital Loan Application: Targeting businesses requiring financial assistance to cover their day-to-day operational expenses, including payroll, inventory, and debt payments. By offering these specialized loan application forms, Allegheny Pennsylvania Bank ensures that businesses can conveniently apply for the specific types of loans they require. In conclusion, the Allegheny Pennsylvania Bank Loan Application Form and Checklist for Business Loan are essential tools for businesses seeking financial assistance. By providing accurate and detailed information, along with the requisite supporting documentation, applicants improve their chances of securing a loan from Allegheny Pennsylvania Bank. Additionally, the availability of specialized loan application forms enables businesses to apply for loans tailored to their specific needs, such as SBA loans, equipment financing, commercial real estate loans, or working capital loans.Allegheny Pennsylvania Bank Loan Application Form and Checklist — Business Loan The Allegheny Pennsylvania Bank Loan Application Form and Checklist for Business Loan serve as crucial documents for individuals and businesses seeking financial assistance from Allegheny Pennsylvania Bank. This comprehensive application form and checklist are designed to help streamline the loan application process and ensure that all necessary information and documentation are provided. The Allegheny Pennsylvania Bank Loan Application Form is specifically tailored to business loans, catering to the unique requirements involved in securing financing for enterprises. It encompasses a detailed set of fields covering diverse aspects of the loan application, including business information, financial statements, collateral details, and personal information of the applicant. By diligently completing this form, applicants present a comprehensive overview of their business, enabling the bank to assess their eligibility and determine the appropriate loan amount, interest rates, and repayment terms. Moreover, the checklist accompanying the application form streamlines the loan submission process, ensuring that all required supporting documents are included. This checklist typically includes but is not limited to the following items: 1. Business plan: A detailed overview of the business model, market analysis, financial projections, and strategies for growth. 2. Financial statements: Complete financial records, including income statements, balance sheets, and cash flow statements, typically covering the last three years. 3. Tax returns: Copies of personal and business tax returns for the previous three years. 4. Bank statements: Statements for business and personal bank accounts, showcasing cash flows and financial health. 5. Legal documents: Relevant legal documents such as articles of incorporation, partnership agreements, and leases. 6. Collateral documentation: Information about assets that may serve as collateral, such as property deeds, equipment titles, or purchase invoices. 7. Personal identification: Valid identification documents, such as driver's license, passport, or social security card. In addition to the general business loan application form and checklist, Allegheny Pennsylvania Bank may offer specific loan application forms for various purposes. These could include: 1. Small Business Administration (SBA) Loan Application: Designed for businesses seeking loans guaranteed by the Small Business Administration, helping applicants navigate the SBA requirements effectively. 2. Equipment Financing Loan Application: Tailored for businesses seeking financing options specifically for purchasing or leasing equipment required for their operations. 3. Commercial Real Estate Loan Application: Catering to businesses seeking loans for acquiring or refinancing commercial properties, such as office spaces, warehouses, or retail spaces. 4. Working Capital Loan Application: Targeting businesses requiring financial assistance to cover their day-to-day operational expenses, including payroll, inventory, and debt payments. By offering these specialized loan application forms, Allegheny Pennsylvania Bank ensures that businesses can conveniently apply for the specific types of loans they require. In conclusion, the Allegheny Pennsylvania Bank Loan Application Form and Checklist for Business Loan are essential tools for businesses seeking financial assistance. By providing accurate and detailed information, along with the requisite supporting documentation, applicants improve their chances of securing a loan from Allegheny Pennsylvania Bank. Additionally, the availability of specialized loan application forms enables businesses to apply for loans tailored to their specific needs, such as SBA loans, equipment financing, commercial real estate loans, or working capital loans.