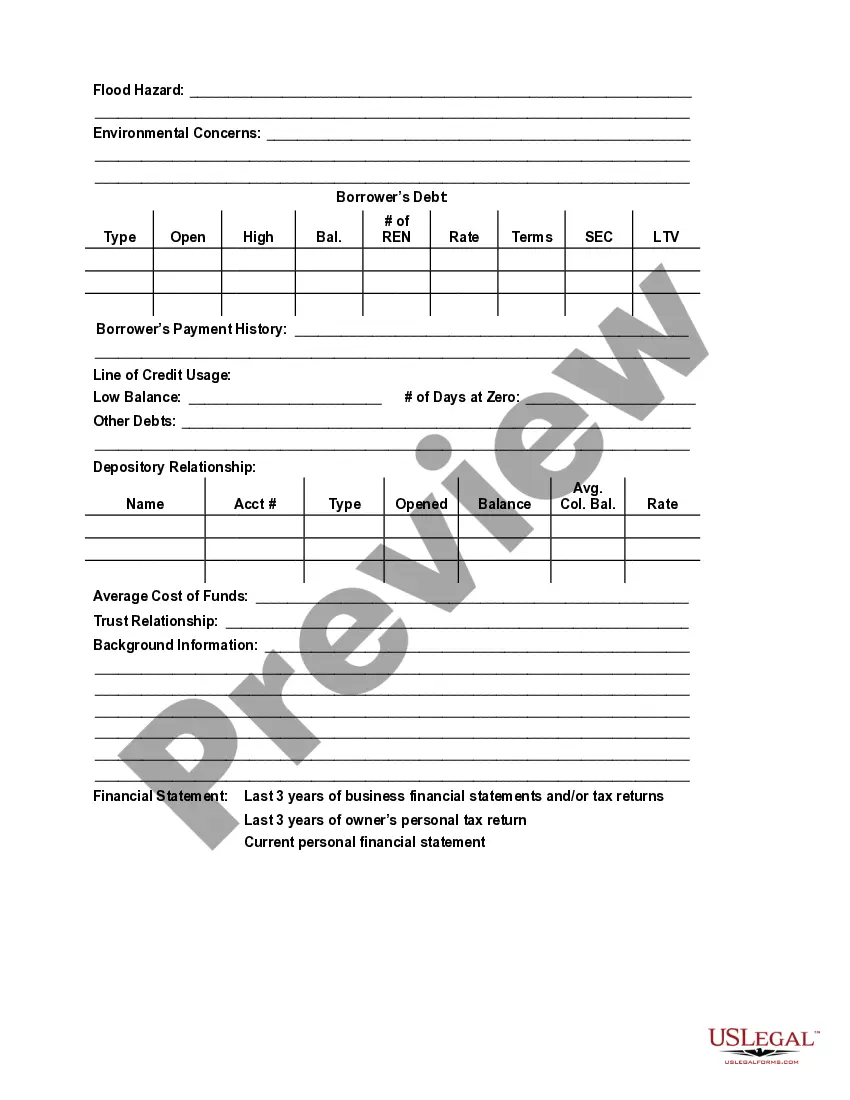

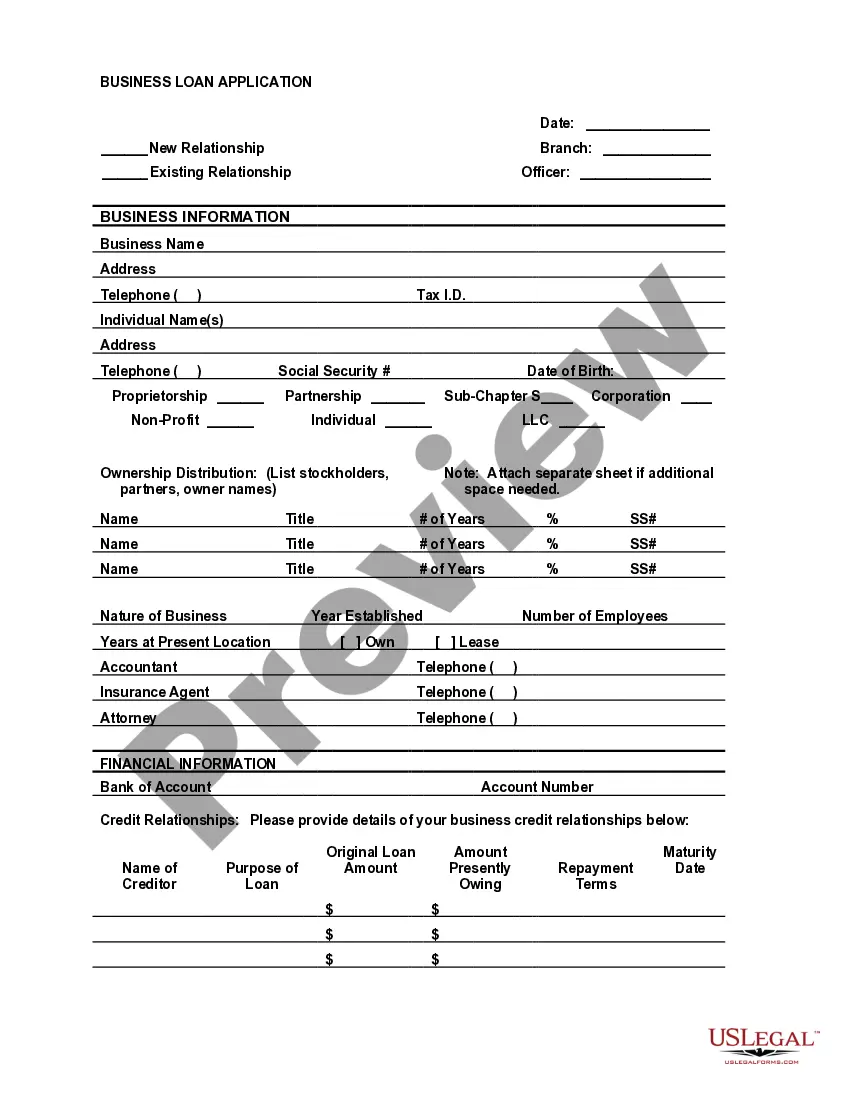

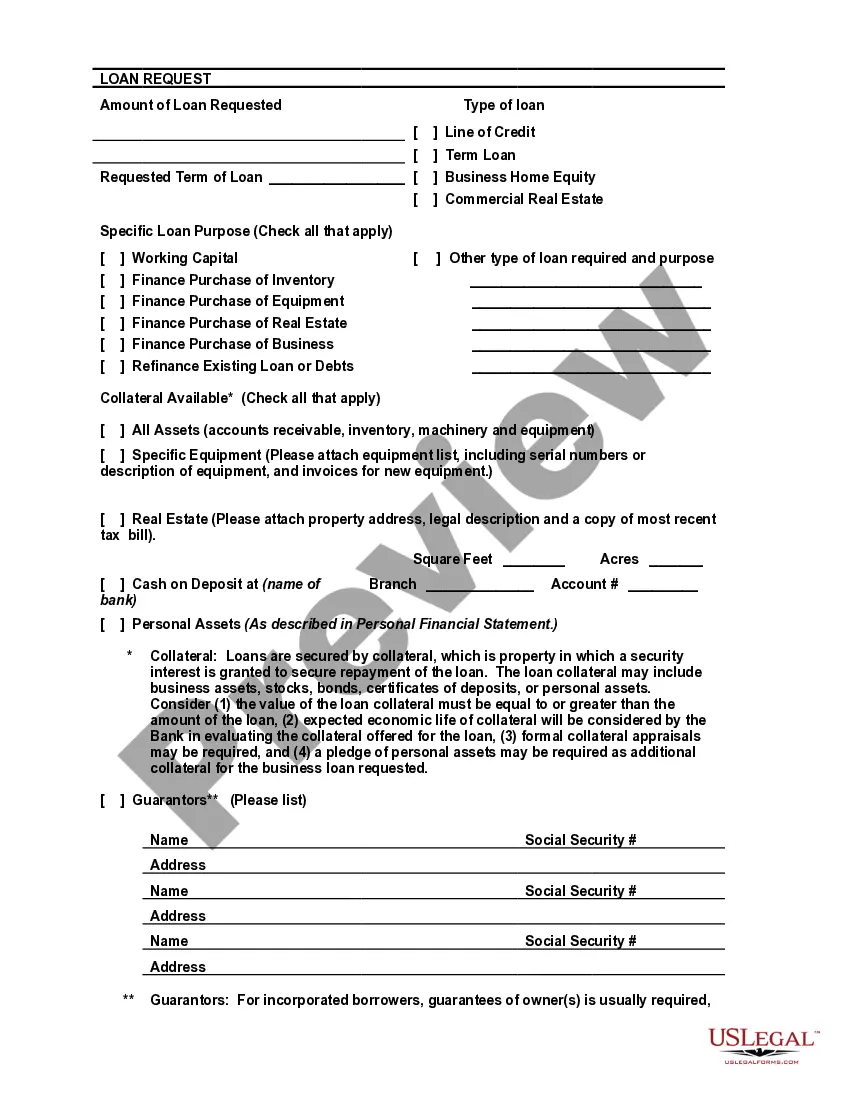

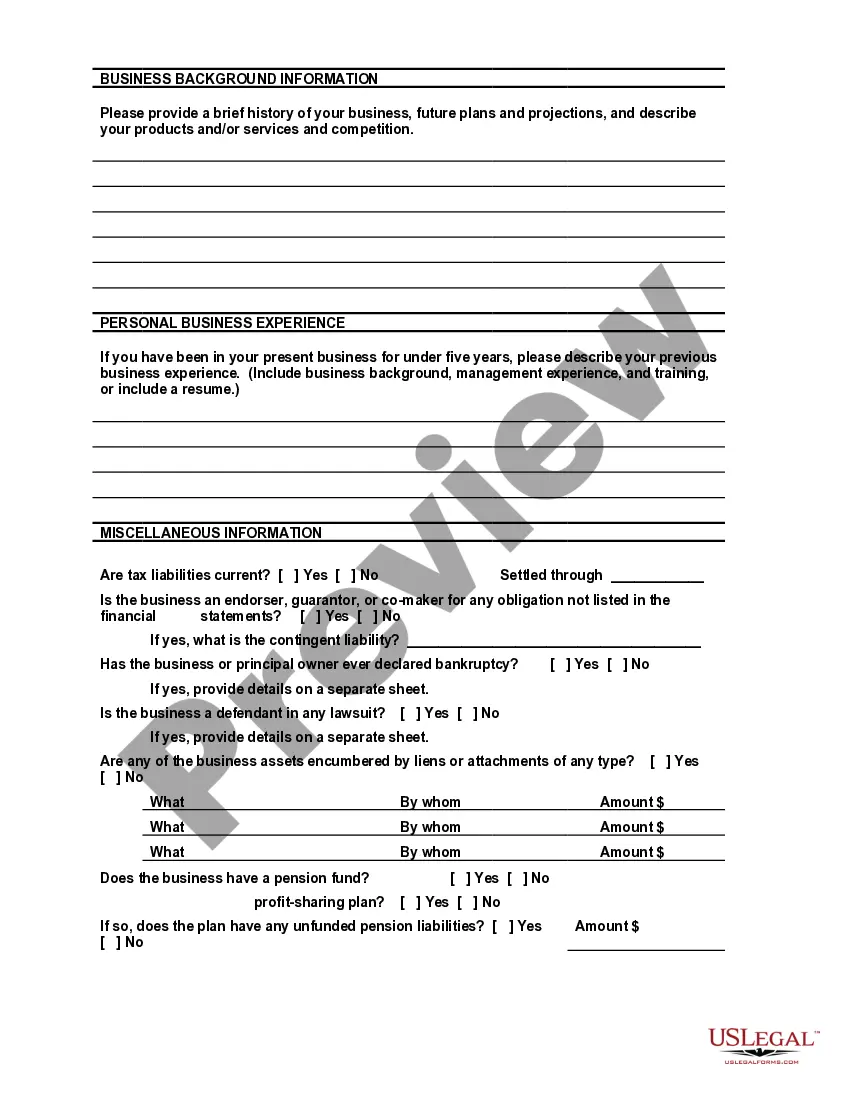

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

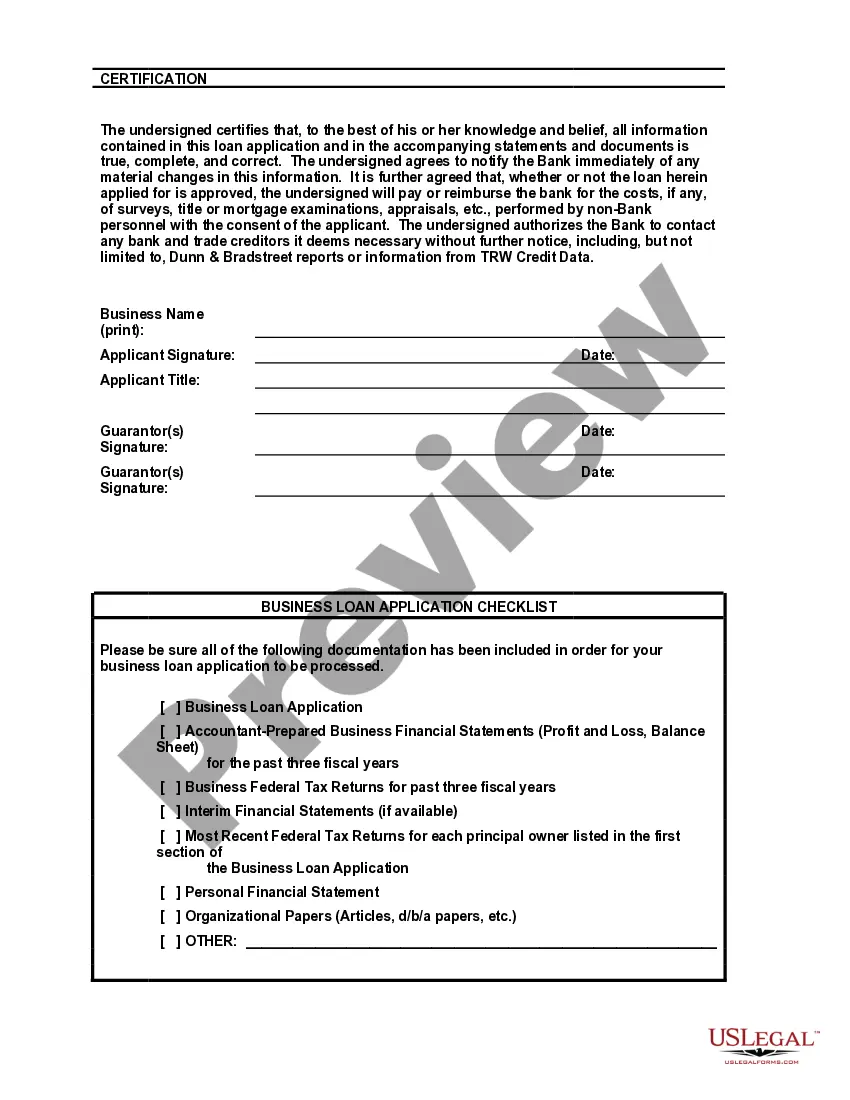

Bexar Texas Bank Loan Application Form and Checklist — Business Loan Are you a Texas-based business owner looking to secure a loan for your business growth or expansion plans? Bexar Texas Bank is here to support you. Our comprehensive Bexar Texas Bank Loan Application Form and Checklist for the Business Loan are designed to simplify the loan application process while ensuring all necessary information is provided. The Bexar Texas Bank Loan Application Form for a Business Loan consists of several sections that capture essential details about your business, its financial health, and the purpose of the loan. These sections include: 1. Applicant Information: Start by providing your business's legal name, address, contact details, and the tax identification number. Additionally, mention if you are a sole proprietor, partnership, or corporation. 2. Loan Amount and Purpose: Specify the loan amount you are seeking, along with a detailed description of how you plan to utilize the funds. Whether it is for expansion, equipment purchase, working capital, or any other specific purpose, state it clearly. 3. Financial Statements: Present your business's financial position accurately by attaching relevant financial statements like income statements, balance sheets, and cash flow statements for the past few years. These statements help lenders assess your business's ability to repay the loan. 4. Credit History: Provide information about your business's credit history, including outstanding loans, credit cards, and any previous bankruptcies or defaults. It is advised to include both personal and business credit histories. 5. Collateral: If you have any assets (such as real estate, equipment, or inventory) that can be used as collateral for the loan, specify their details in this section. Collateral offers additional security for lenders, which can positively impact loan approval and interest rates. 6. Business Plan: A strong business plan demonstrates your vision and strategy for success. Include details about your industry, target market, competition analysis, marketing plans, and revenue projections in this section. 7. Other Supporting Documentation: Attach additional documents that may support your loan application, such as licenses, permits, legal agreements, or contracts. Bexar Texas Bank understands that different types of businesses have varying financial needs. Therefore, we offer multiple loan products tailored to meet specific requirements. Some other types of business loans provided by Bexar Texas Bank include: 1. Start-up Business Loan Application Form and Checklist: Designed specifically for entrepreneurs looking to establish a new business, this form focuses on evaluating business ideas, financial projections, and personal credit history. 2. Small Business Administration (SBA) Loan Application Form and Checklist: For businesses seeking SBA-backed loans, this form aligns with the specific requirements set by the Small Business Administration. It assesses eligibility based on credit history, collateral, and business financials. 3. Equipment/Asset Financing Loan Application Form and Checklist: If you need funding specifically for purchasing or leasing equipment or other tangible assets, this form streamlines the loan application process by focusing on equipment specifications, cost, and value. By utilizing the Bexar Texas Bank Loan Application Form and Checklist for the Business Loan, you can ensure a comprehensive, organized, and accurate loan application that increases your chances of approval. Our dedicated loan officers are available to guide you through the application process, ensuring you understand your options and find the best loan for your business's unique needs. Apply with Bexar Texas Bank today and take a step towards driving your business to new heights.Bexar Texas Bank Loan Application Form and Checklist — Business Loan Are you a Texas-based business owner looking to secure a loan for your business growth or expansion plans? Bexar Texas Bank is here to support you. Our comprehensive Bexar Texas Bank Loan Application Form and Checklist for the Business Loan are designed to simplify the loan application process while ensuring all necessary information is provided. The Bexar Texas Bank Loan Application Form for a Business Loan consists of several sections that capture essential details about your business, its financial health, and the purpose of the loan. These sections include: 1. Applicant Information: Start by providing your business's legal name, address, contact details, and the tax identification number. Additionally, mention if you are a sole proprietor, partnership, or corporation. 2. Loan Amount and Purpose: Specify the loan amount you are seeking, along with a detailed description of how you plan to utilize the funds. Whether it is for expansion, equipment purchase, working capital, or any other specific purpose, state it clearly. 3. Financial Statements: Present your business's financial position accurately by attaching relevant financial statements like income statements, balance sheets, and cash flow statements for the past few years. These statements help lenders assess your business's ability to repay the loan. 4. Credit History: Provide information about your business's credit history, including outstanding loans, credit cards, and any previous bankruptcies or defaults. It is advised to include both personal and business credit histories. 5. Collateral: If you have any assets (such as real estate, equipment, or inventory) that can be used as collateral for the loan, specify their details in this section. Collateral offers additional security for lenders, which can positively impact loan approval and interest rates. 6. Business Plan: A strong business plan demonstrates your vision and strategy for success. Include details about your industry, target market, competition analysis, marketing plans, and revenue projections in this section. 7. Other Supporting Documentation: Attach additional documents that may support your loan application, such as licenses, permits, legal agreements, or contracts. Bexar Texas Bank understands that different types of businesses have varying financial needs. Therefore, we offer multiple loan products tailored to meet specific requirements. Some other types of business loans provided by Bexar Texas Bank include: 1. Start-up Business Loan Application Form and Checklist: Designed specifically for entrepreneurs looking to establish a new business, this form focuses on evaluating business ideas, financial projections, and personal credit history. 2. Small Business Administration (SBA) Loan Application Form and Checklist: For businesses seeking SBA-backed loans, this form aligns with the specific requirements set by the Small Business Administration. It assesses eligibility based on credit history, collateral, and business financials. 3. Equipment/Asset Financing Loan Application Form and Checklist: If you need funding specifically for purchasing or leasing equipment or other tangible assets, this form streamlines the loan application process by focusing on equipment specifications, cost, and value. By utilizing the Bexar Texas Bank Loan Application Form and Checklist for the Business Loan, you can ensure a comprehensive, organized, and accurate loan application that increases your chances of approval. Our dedicated loan officers are available to guide you through the application process, ensuring you understand your options and find the best loan for your business's unique needs. Apply with Bexar Texas Bank today and take a step towards driving your business to new heights.