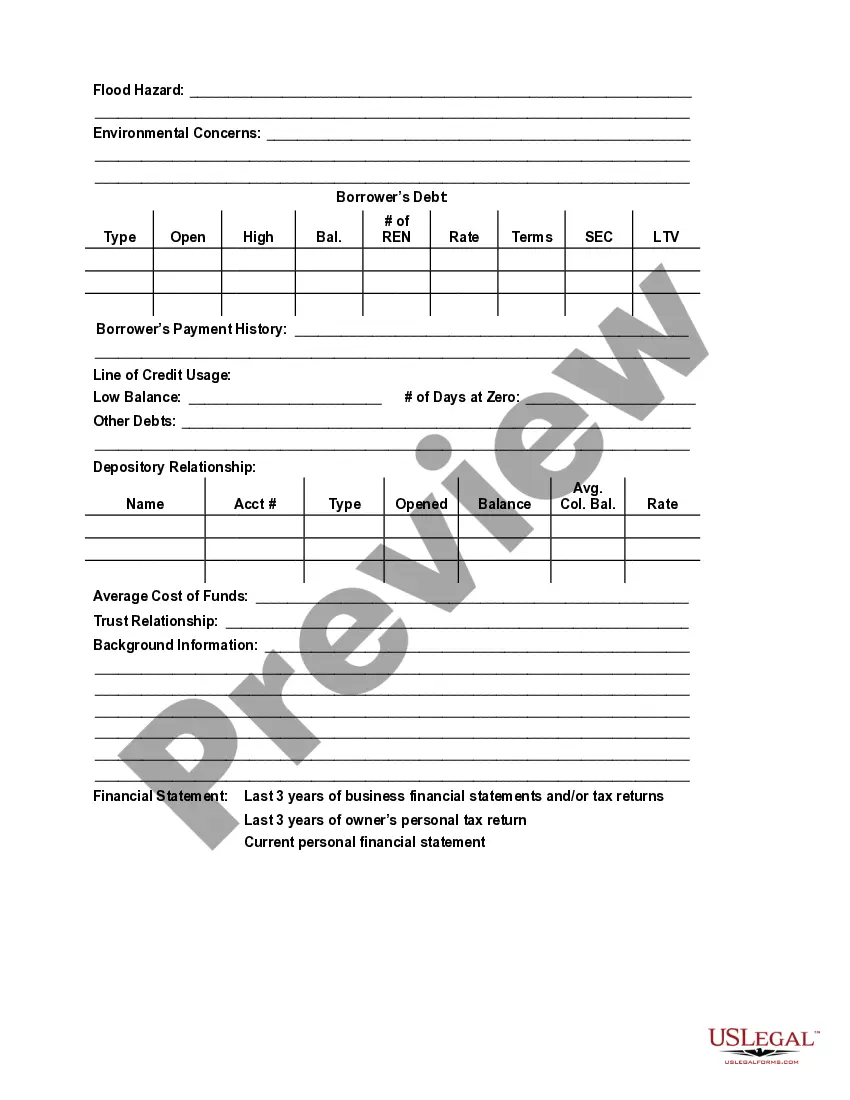

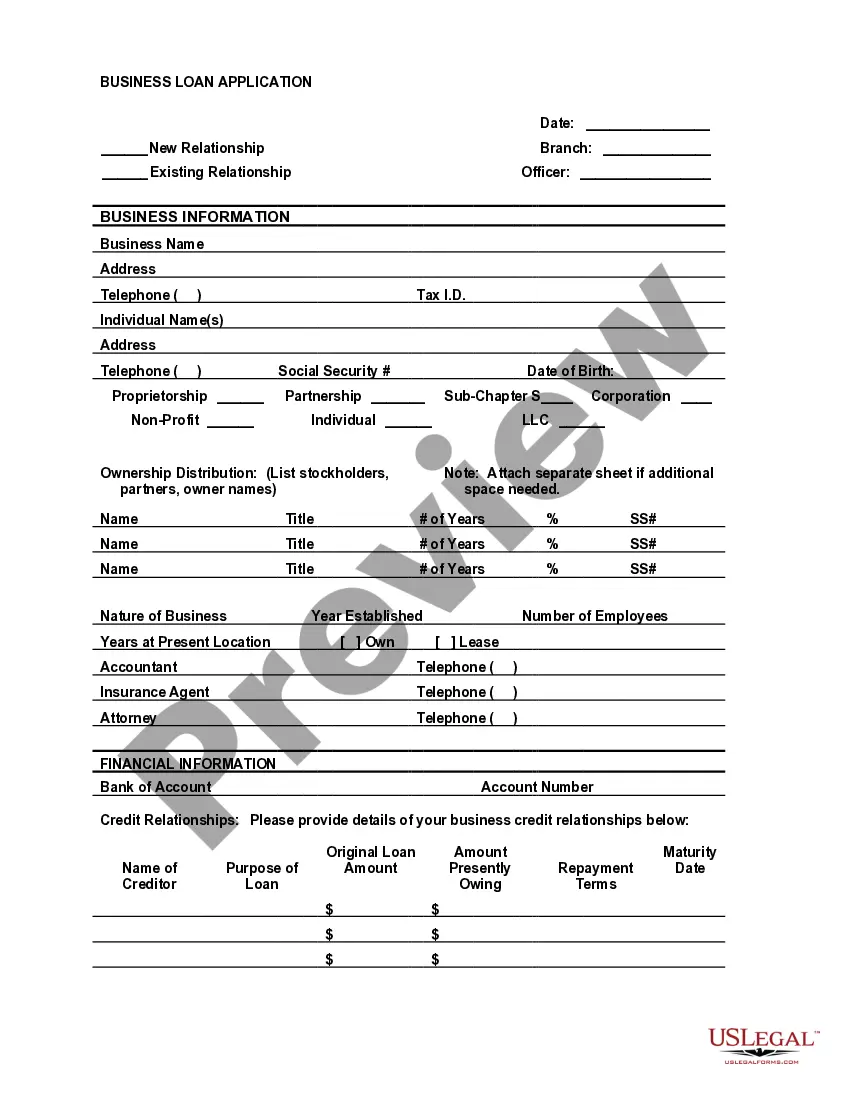

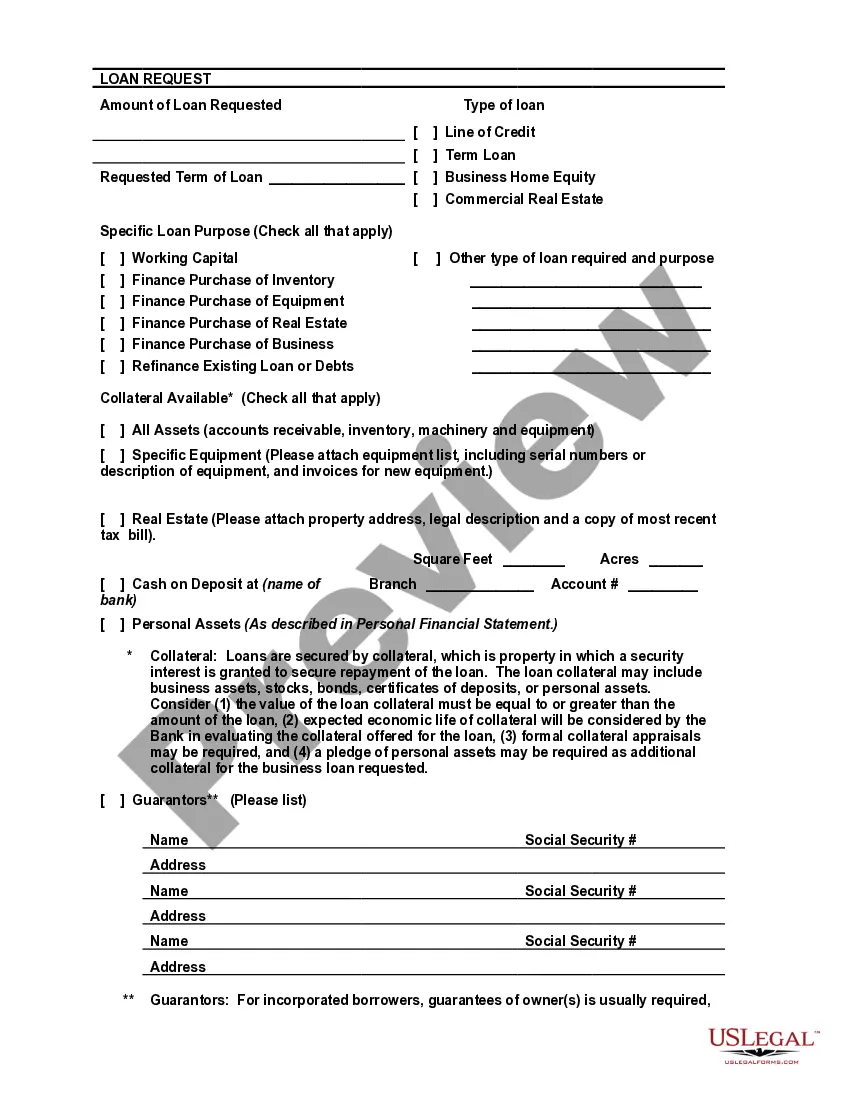

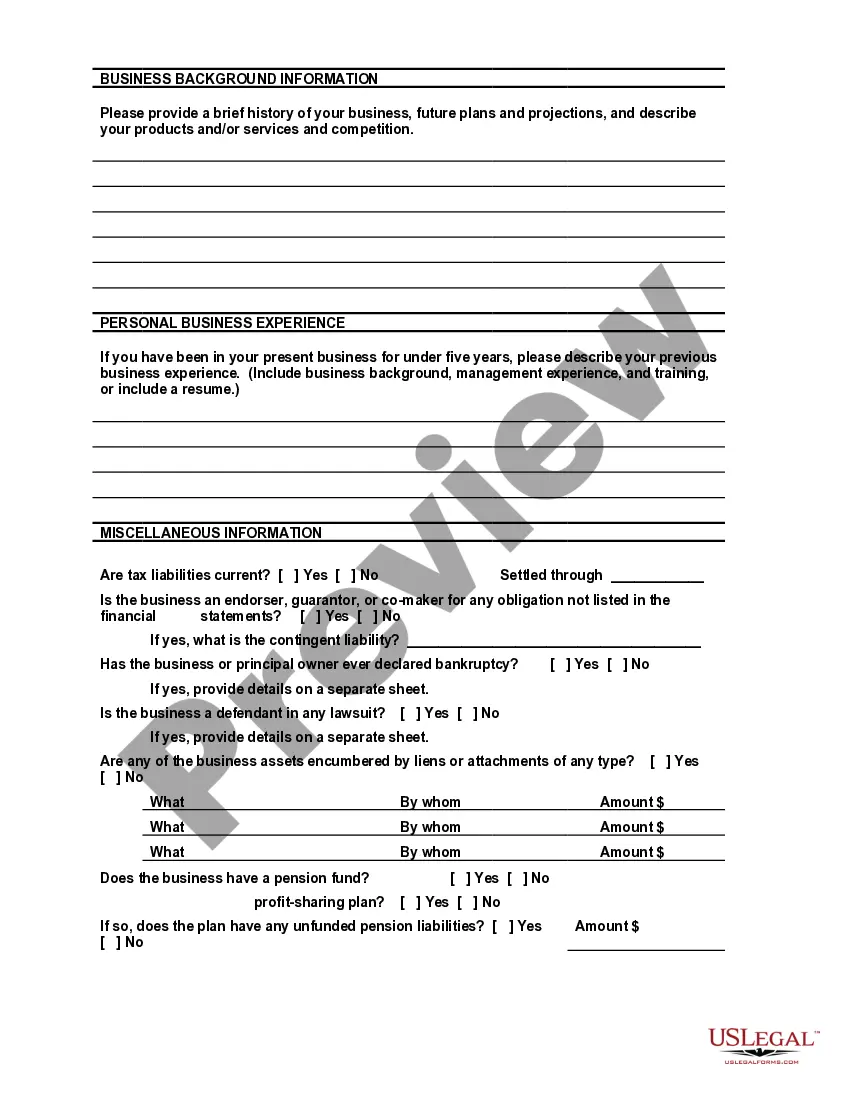

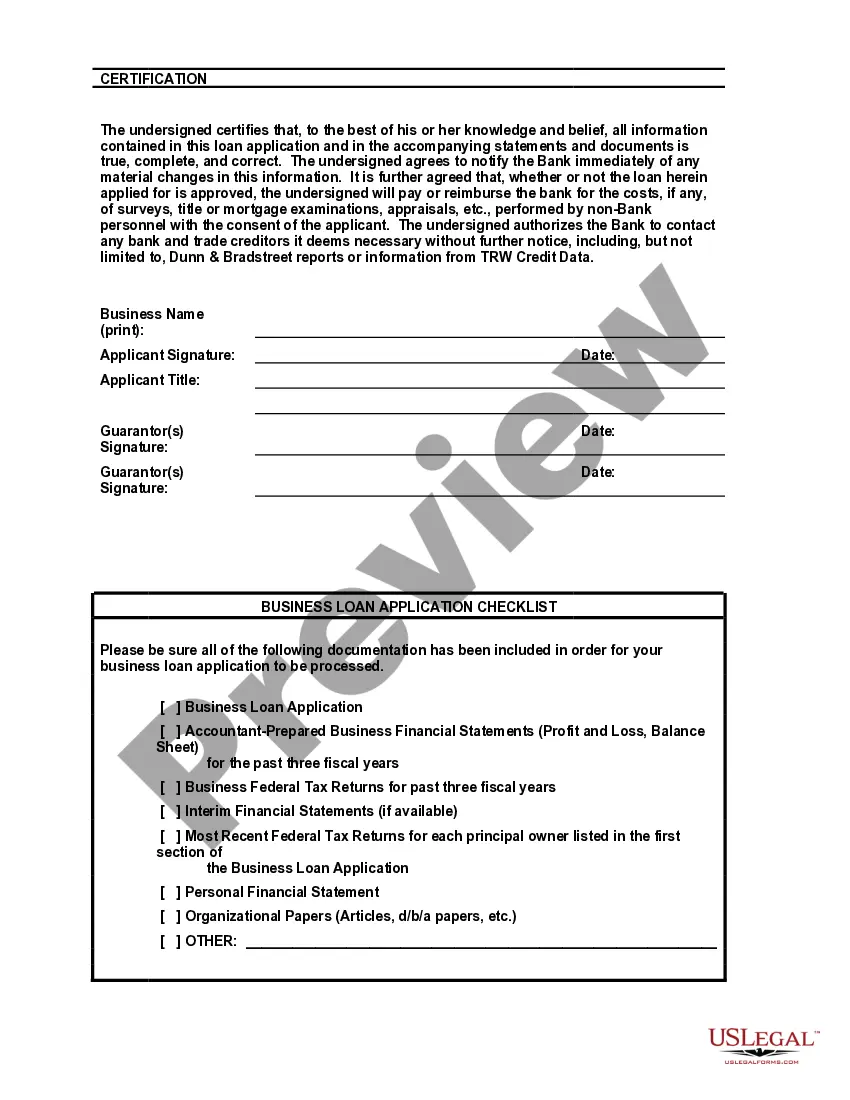

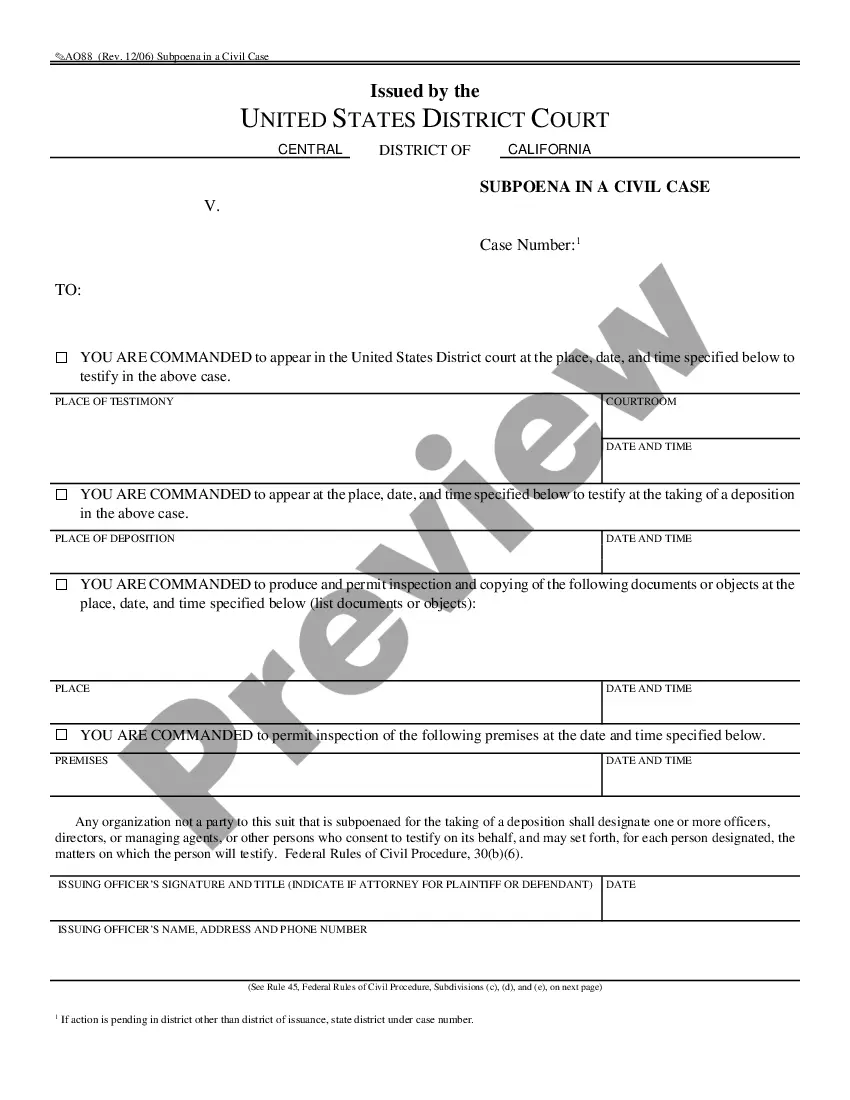

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

Title: Collin Texas Bank Loan Application Form and Checklist — Business Loan: Everything You Need to Know Introduction: Collin Texas Bank offers a comprehensive range of business loan options to support entrepreneurs and businesses in achieving their financial goals. To apply for a business loan from Collin Texas Bank, you will need to complete their loan application form and checklist. This article will provide a detailed description of the Collin Texas Bank Loan Application Form and Checklist for Business Loans, along with information on different types of business loans available. 1. Collin Texas Bank Loan Application Form: The Collin Texas Bank Loan Application Form is a crucial document that helps the bank understand your business, its financial health, and the purpose of your loan request. It includes various sections that require you to provide essential details and supporting documents. Keywords: Collin Texas Bank Loan, application form, business loan, financial health, loan request, supporting documents. 2. Collin Texas Bank Business Loan Checklist: The Business Loan Checklist is designed to ensure that borrowers have included all the necessary documents and information required for the loan application process. Following this checklist streamlines the process and enhances your chances of successfully obtaining a business loan. Keywords: Collin Texas Bank, business loan checklist, loan application process, documents, information, loan approval. Types of Collin Texas Bank Business Loans: a. Equipment Financing Loan: Collin Texas Bank offers Equipment Financing Loans to help businesses purchase or lease essential equipment. This loan type allows you to preserve your working capital while obtaining the necessary machinery, tools, or vehicles required for your business operations. Keywords: Collin Texas Bank, equipment financing loan, lease equipment, working capital, business operations. b. Commercial Real Estate Loan: Collin Texas Bank's Commercial Real Estate Loans are tailored for businesses looking to purchase or refinance commercial properties. Whether you aim to expand your office space, buy a retail space, or invest in other commercial properties, this loan option can meet your needs. Keywords: Collin Texas Bank, commercial real estate loan, purchase property, refinance, expand office space, retail space, commercial properties. c. Small Business Administration (SBA) Loan: Collin Texas Bank is an approved lender for Small Business Administration (SBA) Loans. These loans are government-backed and offer favorable terms and conditions for small businesses. SBA loans can be used for various purposes, from business acquisitions to working capital and equipment financing. Keywords: Collin Texas Bank, SBA loan, small business administration, government-backed, business acquisitions, working capital. Conclusion: Collin Texas Bank Loan Application Form and Checklist are essential tools for securing a business loan. By providing complete and accurate information while adhering to the checklist, you can enhance your chances of obtaining funding for various purposes such as equipment purchase, commercial real estate, or utilizing the benefits of SBA loans. Contact Collin Texas Bank today to start your business loan application journey.Title: Collin Texas Bank Loan Application Form and Checklist — Business Loan: Everything You Need to Know Introduction: Collin Texas Bank offers a comprehensive range of business loan options to support entrepreneurs and businesses in achieving their financial goals. To apply for a business loan from Collin Texas Bank, you will need to complete their loan application form and checklist. This article will provide a detailed description of the Collin Texas Bank Loan Application Form and Checklist for Business Loans, along with information on different types of business loans available. 1. Collin Texas Bank Loan Application Form: The Collin Texas Bank Loan Application Form is a crucial document that helps the bank understand your business, its financial health, and the purpose of your loan request. It includes various sections that require you to provide essential details and supporting documents. Keywords: Collin Texas Bank Loan, application form, business loan, financial health, loan request, supporting documents. 2. Collin Texas Bank Business Loan Checklist: The Business Loan Checklist is designed to ensure that borrowers have included all the necessary documents and information required for the loan application process. Following this checklist streamlines the process and enhances your chances of successfully obtaining a business loan. Keywords: Collin Texas Bank, business loan checklist, loan application process, documents, information, loan approval. Types of Collin Texas Bank Business Loans: a. Equipment Financing Loan: Collin Texas Bank offers Equipment Financing Loans to help businesses purchase or lease essential equipment. This loan type allows you to preserve your working capital while obtaining the necessary machinery, tools, or vehicles required for your business operations. Keywords: Collin Texas Bank, equipment financing loan, lease equipment, working capital, business operations. b. Commercial Real Estate Loan: Collin Texas Bank's Commercial Real Estate Loans are tailored for businesses looking to purchase or refinance commercial properties. Whether you aim to expand your office space, buy a retail space, or invest in other commercial properties, this loan option can meet your needs. Keywords: Collin Texas Bank, commercial real estate loan, purchase property, refinance, expand office space, retail space, commercial properties. c. Small Business Administration (SBA) Loan: Collin Texas Bank is an approved lender for Small Business Administration (SBA) Loans. These loans are government-backed and offer favorable terms and conditions for small businesses. SBA loans can be used for various purposes, from business acquisitions to working capital and equipment financing. Keywords: Collin Texas Bank, SBA loan, small business administration, government-backed, business acquisitions, working capital. Conclusion: Collin Texas Bank Loan Application Form and Checklist are essential tools for securing a business loan. By providing complete and accurate information while adhering to the checklist, you can enhance your chances of obtaining funding for various purposes such as equipment purchase, commercial real estate, or utilizing the benefits of SBA loans. Contact Collin Texas Bank today to start your business loan application journey.