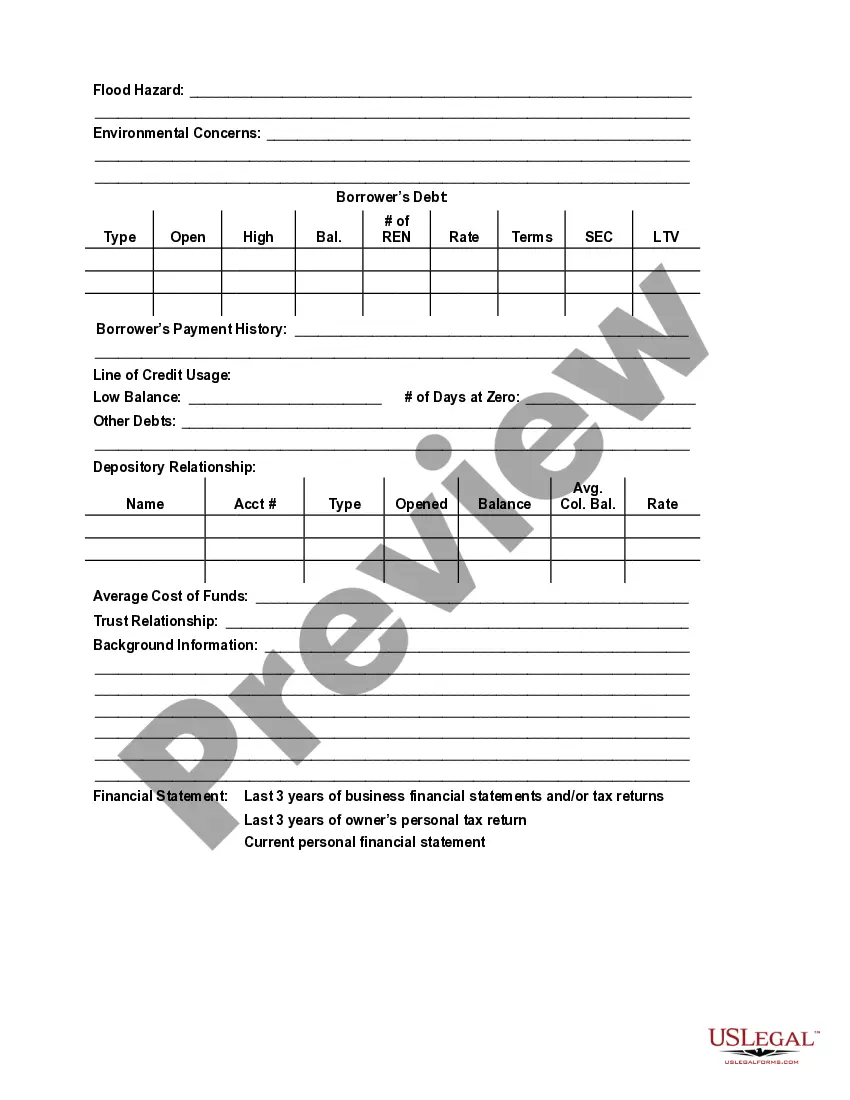

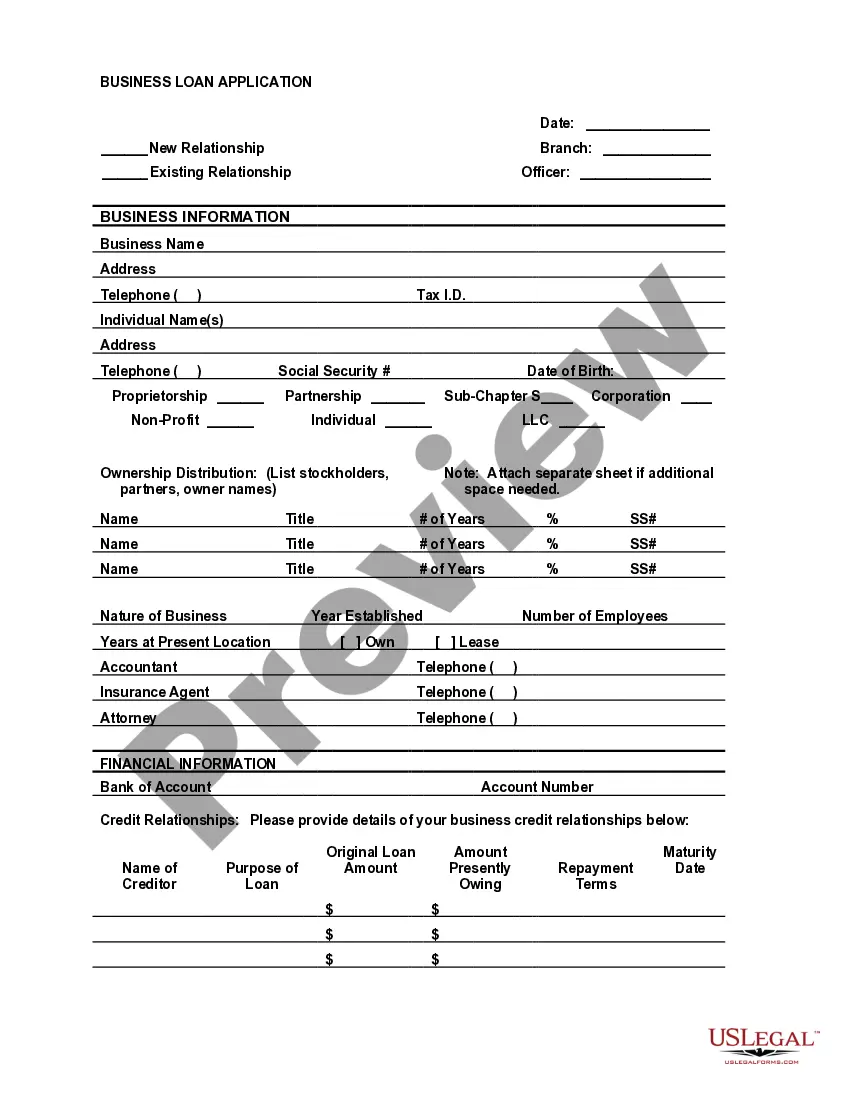

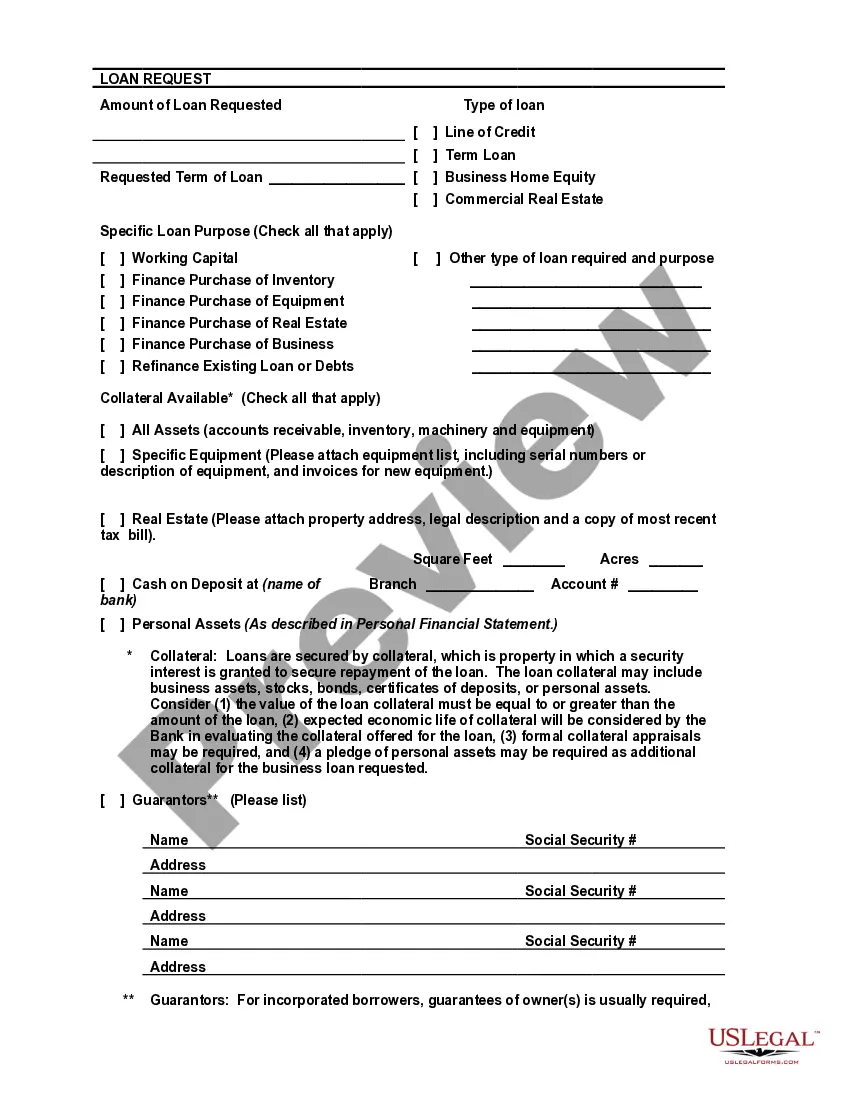

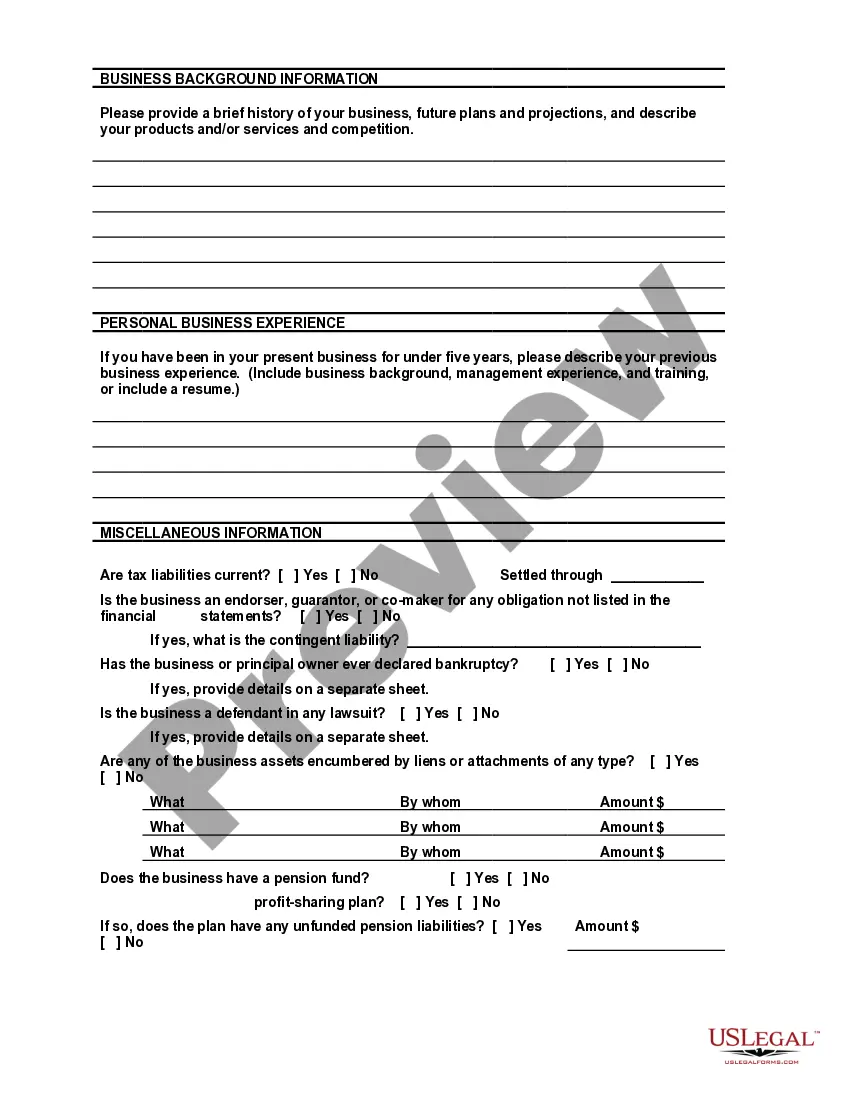

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

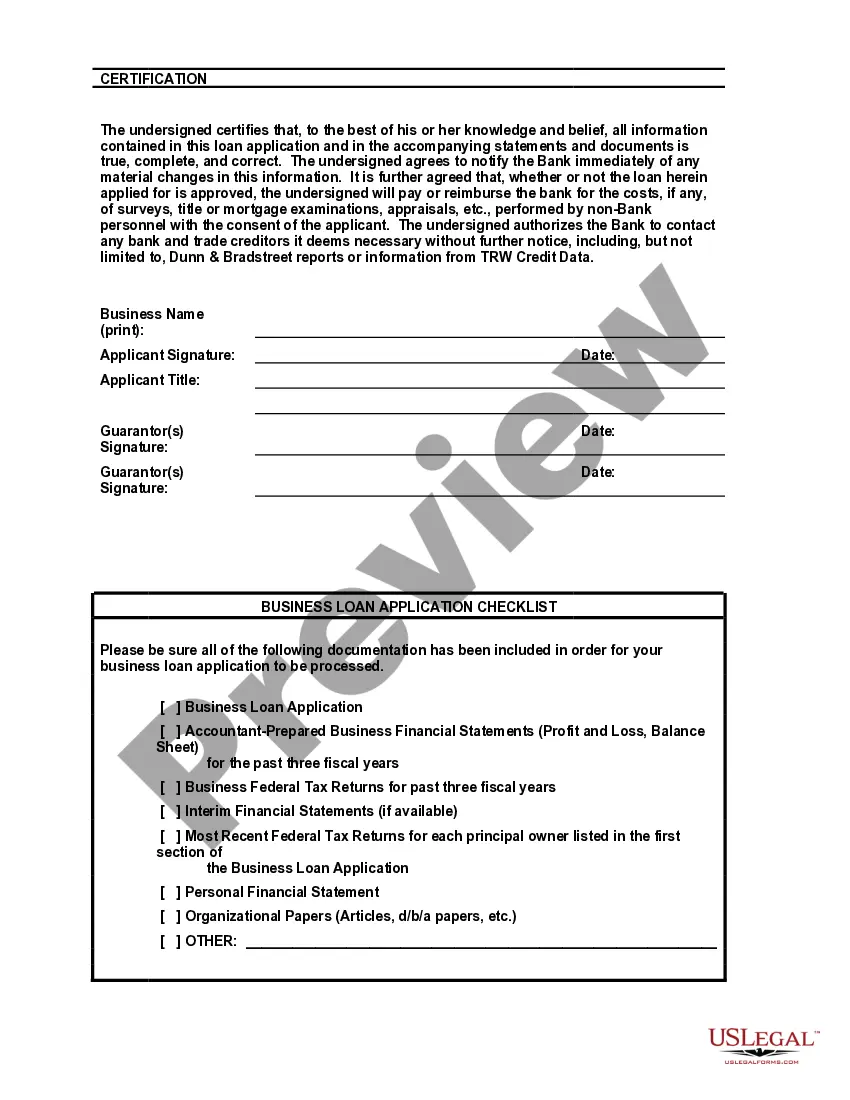

Fulton Georgia Bank Loan Application Form and Checklist — Business Loan A Fulton Georgia Bank Loan Application Form and Checklist for a Business Loan provides individuals and business owners with a step-by-step guide and document to apply for a loan from Fulton Georgia Bank. This comprehensive form gathers essential information about the borrower and their business, ensuring a smooth loan processing and evaluation process. The Fulton Georgia Bank Loan Application Form typically includes fields for personal information such as the borrower's name, contact details, social security number, date of birth, and residential address. Specific details about the business, such as its legal structure, registration number, founding date, and industry type, are also required. The form may ask for additional details regarding the business's revenue, profitability, and financial statements. To facilitate the loan application process, Fulton Georgia Bank often provides a comprehensive checklist alongside the application form. This checklist outlines the essential documents and information required to complete the application. By following the checklist, applicants can ensure that they provide all the necessary paperwork, which may include: 1. Business plan: A detailed description of the business's nature, objectives, strategies, and financial projections. 2. Financial statements: Balance sheets, income statements, cash flow statements, and tax returns for the previous fiscal year(s). 3. Bank statements: Recent bank statements to provide an overview of the business's cash flow and financial stability. 4. Collateral documentation: If the loan requires collateral, documents proving ownership and value of the assets being pledged (e.g., property deeds, vehicle titles, etc.) will be necessary. 5. Personal identification documents: Copies of government-issued identification documents such as driver's license or passport. 6. Legal documents: Articles of incorporation, partnership agreements, or other legal agreements relevant to the business structure. 7. Personal and business credit reports: A record of the borrower's credit history, including debts, loans, and payment records. Different types of Fulton Georgia Bank Loan Application Forms and Checklists may exist, tailored to specific business loan products. Some common types may include: 1. Small Business Loan Application: For entrepreneurs and small business owners seeking startup capital, working capital, or funds for expansion. 2. Commercial Real Estate Loan Application: Designed specifically for individuals or businesses looking to finance the purchase or development of commercial properties. 3. Equipment Financing Loan Application: Targets businesses that require financing for purchasing or leasing equipment necessary for their operations. 4. Lines of Credit Loan Application: Pertains to businesses looking for a revolving line of credit to manage cash flow fluctuations or cover day-to-day operating expenses. By using the relevant Fulton Georgia Bank Loan Application Form and Checklist — Business Loan, borrowers can navigate the loan application process efficiently and provide all the necessary information to help Fulton Georgia Bank evaluate loan eligibility and make an informed lending decision.Fulton Georgia Bank Loan Application Form and Checklist — Business Loan A Fulton Georgia Bank Loan Application Form and Checklist for a Business Loan provides individuals and business owners with a step-by-step guide and document to apply for a loan from Fulton Georgia Bank. This comprehensive form gathers essential information about the borrower and their business, ensuring a smooth loan processing and evaluation process. The Fulton Georgia Bank Loan Application Form typically includes fields for personal information such as the borrower's name, contact details, social security number, date of birth, and residential address. Specific details about the business, such as its legal structure, registration number, founding date, and industry type, are also required. The form may ask for additional details regarding the business's revenue, profitability, and financial statements. To facilitate the loan application process, Fulton Georgia Bank often provides a comprehensive checklist alongside the application form. This checklist outlines the essential documents and information required to complete the application. By following the checklist, applicants can ensure that they provide all the necessary paperwork, which may include: 1. Business plan: A detailed description of the business's nature, objectives, strategies, and financial projections. 2. Financial statements: Balance sheets, income statements, cash flow statements, and tax returns for the previous fiscal year(s). 3. Bank statements: Recent bank statements to provide an overview of the business's cash flow and financial stability. 4. Collateral documentation: If the loan requires collateral, documents proving ownership and value of the assets being pledged (e.g., property deeds, vehicle titles, etc.) will be necessary. 5. Personal identification documents: Copies of government-issued identification documents such as driver's license or passport. 6. Legal documents: Articles of incorporation, partnership agreements, or other legal agreements relevant to the business structure. 7. Personal and business credit reports: A record of the borrower's credit history, including debts, loans, and payment records. Different types of Fulton Georgia Bank Loan Application Forms and Checklists may exist, tailored to specific business loan products. Some common types may include: 1. Small Business Loan Application: For entrepreneurs and small business owners seeking startup capital, working capital, or funds for expansion. 2. Commercial Real Estate Loan Application: Designed specifically for individuals or businesses looking to finance the purchase or development of commercial properties. 3. Equipment Financing Loan Application: Targets businesses that require financing for purchasing or leasing equipment necessary for their operations. 4. Lines of Credit Loan Application: Pertains to businesses looking for a revolving line of credit to manage cash flow fluctuations or cover day-to-day operating expenses. By using the relevant Fulton Georgia Bank Loan Application Form and Checklist — Business Loan, borrowers can navigate the loan application process efficiently and provide all the necessary information to help Fulton Georgia Bank evaluate loan eligibility and make an informed lending decision.