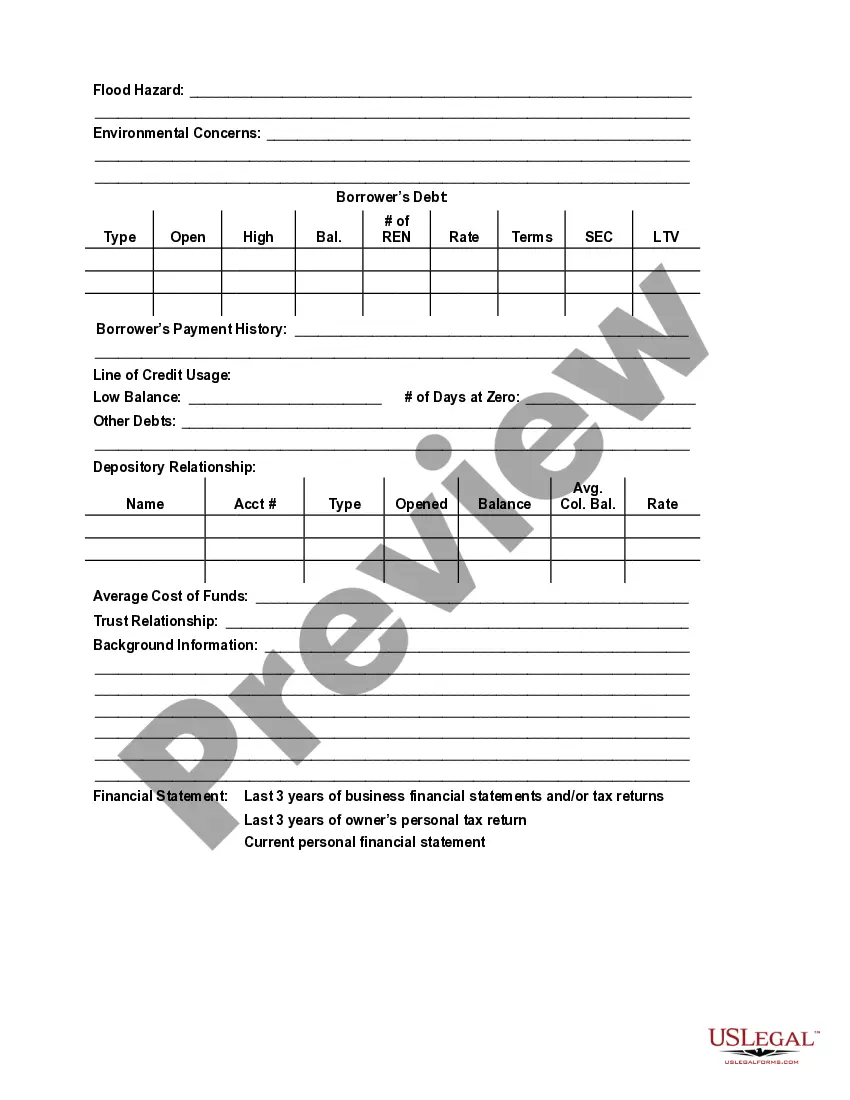

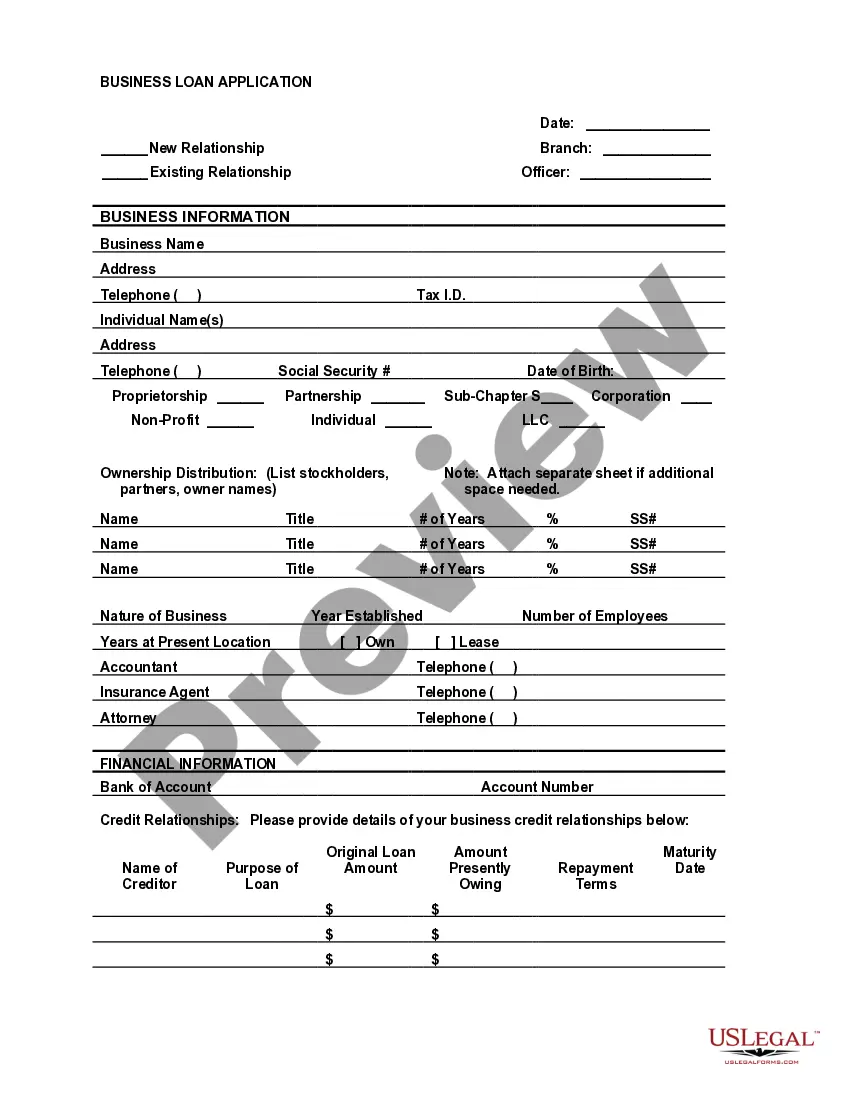

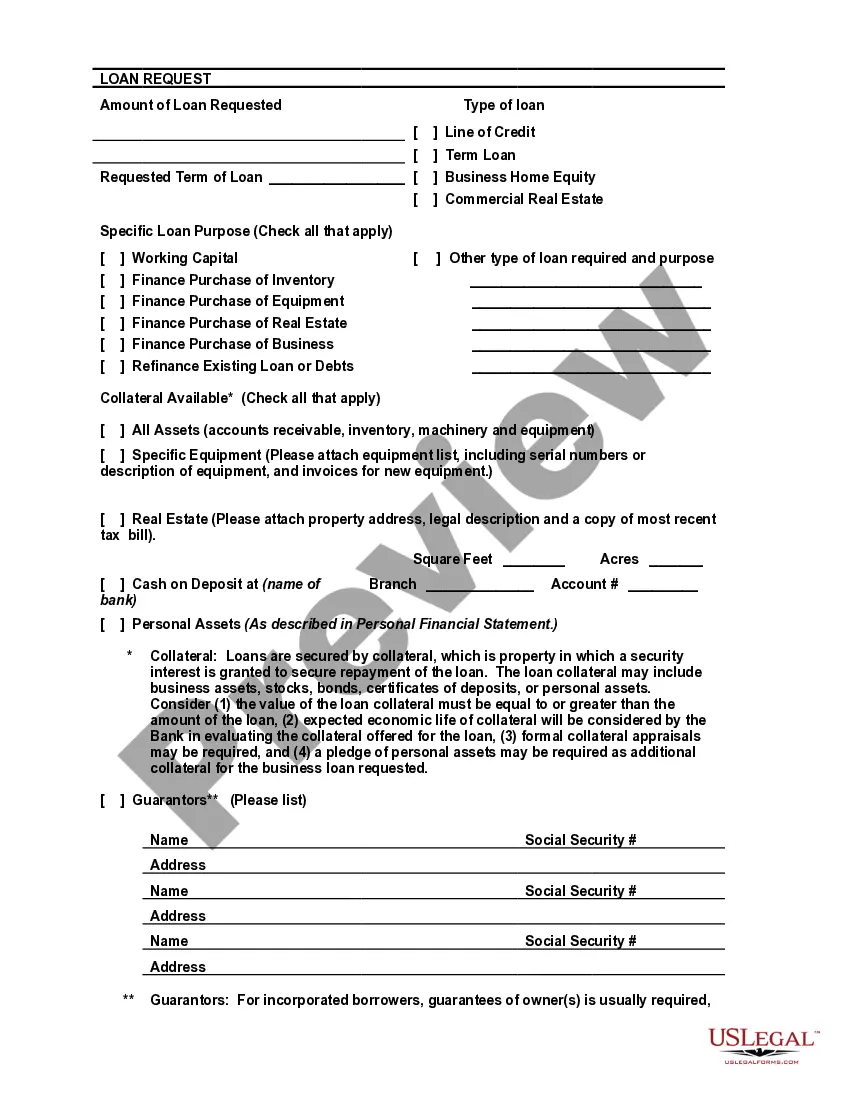

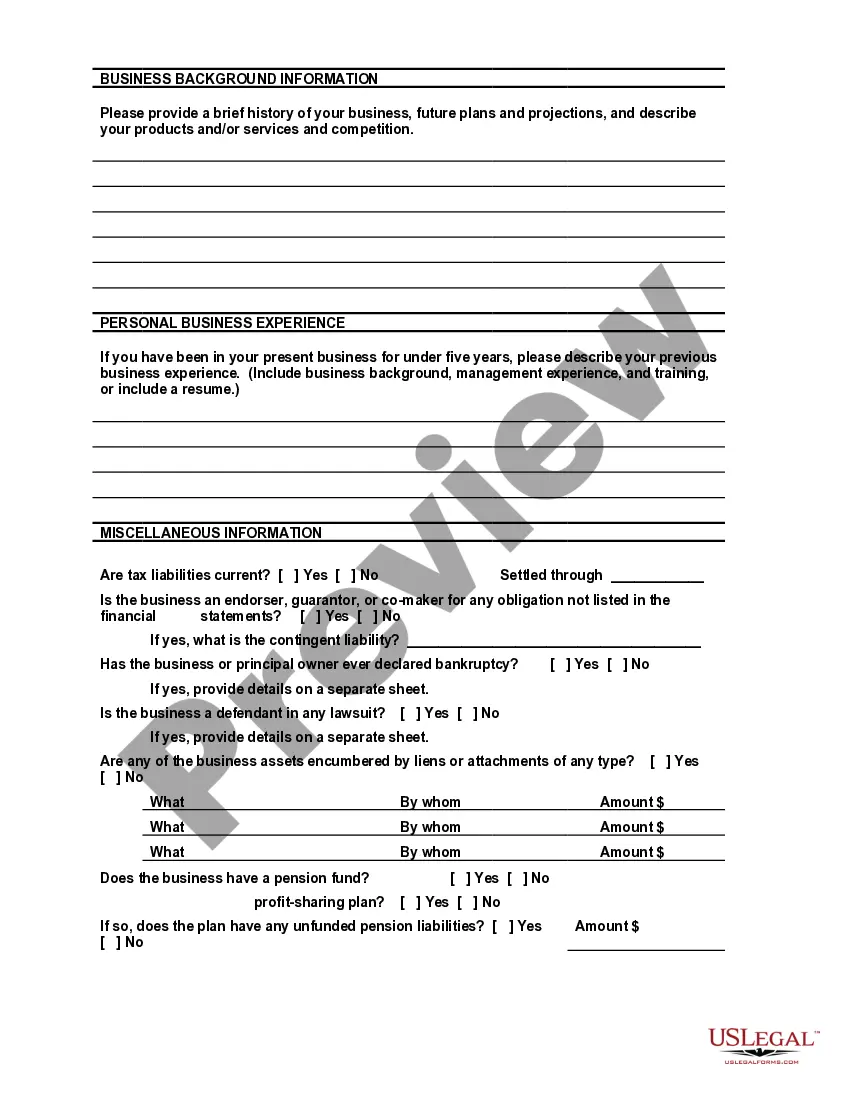

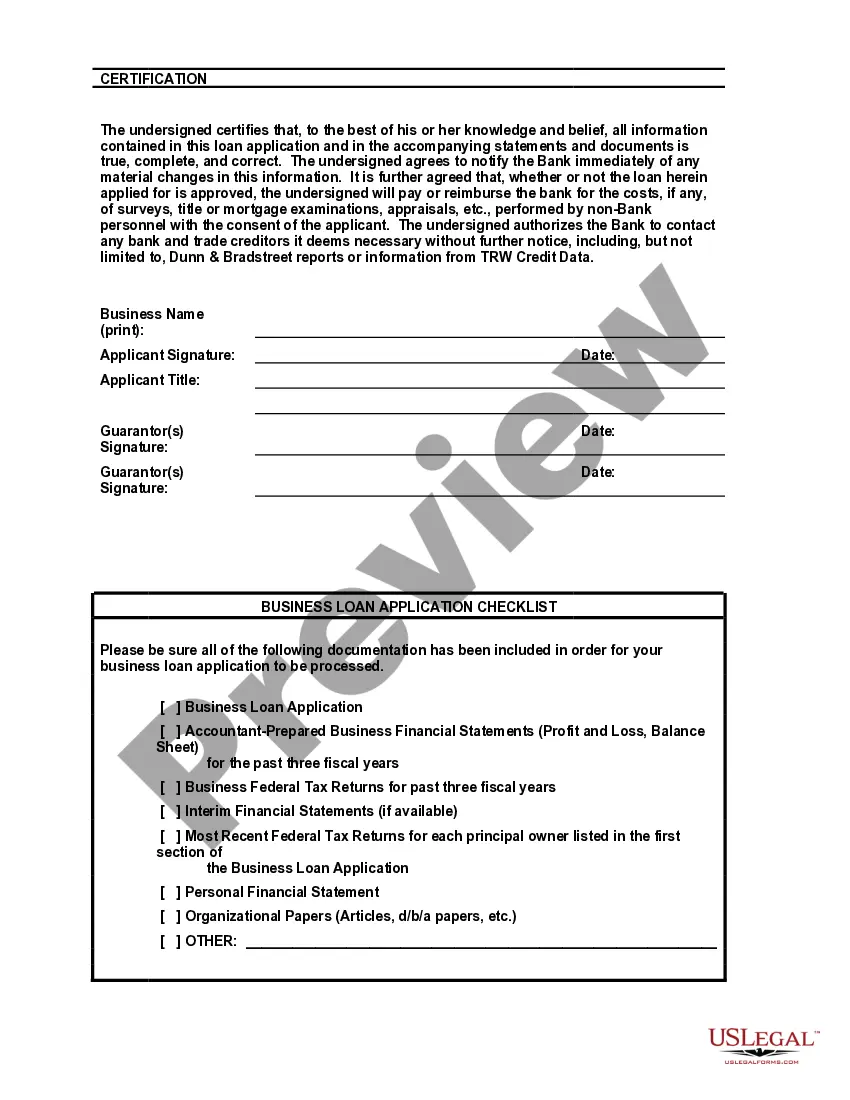

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

Title: Houston Texas Bank Loan Application Form and Checklist — Business Loan Introduction: Houston, Texas is a thriving business hub with numerous financial institutions offering various business loan options to support aspiring entrepreneurs and established companies. To streamline the loan application process, Houston-based banks provide specialized application forms and checklists specifically tailored for business loans. This article will provide a detailed description of Houston Texas Bank Loan Application Form and Checklist — Business Loan, highlighting different types of forms and checklists available. 1. Basic Business Loan Application Form: The Basic Business Loan Application Form offered by Houston Texas banks is a comprehensive document designed to gather crucial information about the applying business. It typically includes sections covering business details, ownership structure, financial statements, loan purpose, collateral details, and personal information of the applicants. The form ensures that every key aspect of the loan application process is efficiently captured. 2. Small Business Administration (SBA) Loan Application Form: Houston Texas banks also facilitate Small Business Administration (SBA) loan application forms. These forms are specifically tailored to meet the requirements outlined by the SBA and are designed to help small business owners access affordable financial assistance. The SBA loan application forms usually include additional sections related to SBA eligibility criteria, business certifications, financial projections, and past financial performance. 3. Commercial Real Estate Loan Application Form: For businesses seeking loans to purchase, refinance, or renovate commercial real estate properties in Houston, banks offer a specialized Commercial Real Estate Loan Application Form. This document typically includes sections pertaining to property details, appraisals, environmental assessments, business financial information, and intended use of the property. 4. Checklist for Business Loan Application: Alongside the loan application forms, Houston Texas banks provide applicants with comprehensive checklists. These checklists act as a guide, ensuring that all necessary documents and information are submitted correctly and thoroughly. The checklist typically includes items such as financial statements, tax returns, bank statements, business licenses, personal identification documents, business plans, and other required supporting documents. 5. Equipment Financing Loan Application Form: Some Houston Texas banks offer Equipment Financing Loan Application Forms, catering specifically to businesses seeking funding to purchase or lease essential equipment. These forms include sections related to equipment details, supplier quotes, intended use, and repayment plans. Such specialized forms streamline the application process for businesses requiring equipment financing. Conclusion: Houston, Texas banks provide a range of specialized loan application forms and checklists, catering to various business loan requirements. Whether seeking a basic business loan, a Small Business Administration loan, financing commercial real estate, securing equipment financing, or any other business funding needs, Houston-based banks offer the necessary tools to simplify the loan application process. By utilizing these specialized forms and checklists, applicants can ensure their loan applications are complete, accurate, and easily processed, allowing them to focus on growing their business.Title: Houston Texas Bank Loan Application Form and Checklist — Business Loan Introduction: Houston, Texas is a thriving business hub with numerous financial institutions offering various business loan options to support aspiring entrepreneurs and established companies. To streamline the loan application process, Houston-based banks provide specialized application forms and checklists specifically tailored for business loans. This article will provide a detailed description of Houston Texas Bank Loan Application Form and Checklist — Business Loan, highlighting different types of forms and checklists available. 1. Basic Business Loan Application Form: The Basic Business Loan Application Form offered by Houston Texas banks is a comprehensive document designed to gather crucial information about the applying business. It typically includes sections covering business details, ownership structure, financial statements, loan purpose, collateral details, and personal information of the applicants. The form ensures that every key aspect of the loan application process is efficiently captured. 2. Small Business Administration (SBA) Loan Application Form: Houston Texas banks also facilitate Small Business Administration (SBA) loan application forms. These forms are specifically tailored to meet the requirements outlined by the SBA and are designed to help small business owners access affordable financial assistance. The SBA loan application forms usually include additional sections related to SBA eligibility criteria, business certifications, financial projections, and past financial performance. 3. Commercial Real Estate Loan Application Form: For businesses seeking loans to purchase, refinance, or renovate commercial real estate properties in Houston, banks offer a specialized Commercial Real Estate Loan Application Form. This document typically includes sections pertaining to property details, appraisals, environmental assessments, business financial information, and intended use of the property. 4. Checklist for Business Loan Application: Alongside the loan application forms, Houston Texas banks provide applicants with comprehensive checklists. These checklists act as a guide, ensuring that all necessary documents and information are submitted correctly and thoroughly. The checklist typically includes items such as financial statements, tax returns, bank statements, business licenses, personal identification documents, business plans, and other required supporting documents. 5. Equipment Financing Loan Application Form: Some Houston Texas banks offer Equipment Financing Loan Application Forms, catering specifically to businesses seeking funding to purchase or lease essential equipment. These forms include sections related to equipment details, supplier quotes, intended use, and repayment plans. Such specialized forms streamline the application process for businesses requiring equipment financing. Conclusion: Houston, Texas banks provide a range of specialized loan application forms and checklists, catering to various business loan requirements. Whether seeking a basic business loan, a Small Business Administration loan, financing commercial real estate, securing equipment financing, or any other business funding needs, Houston-based banks offer the necessary tools to simplify the loan application process. By utilizing these specialized forms and checklists, applicants can ensure their loan applications are complete, accurate, and easily processed, allowing them to focus on growing their business.