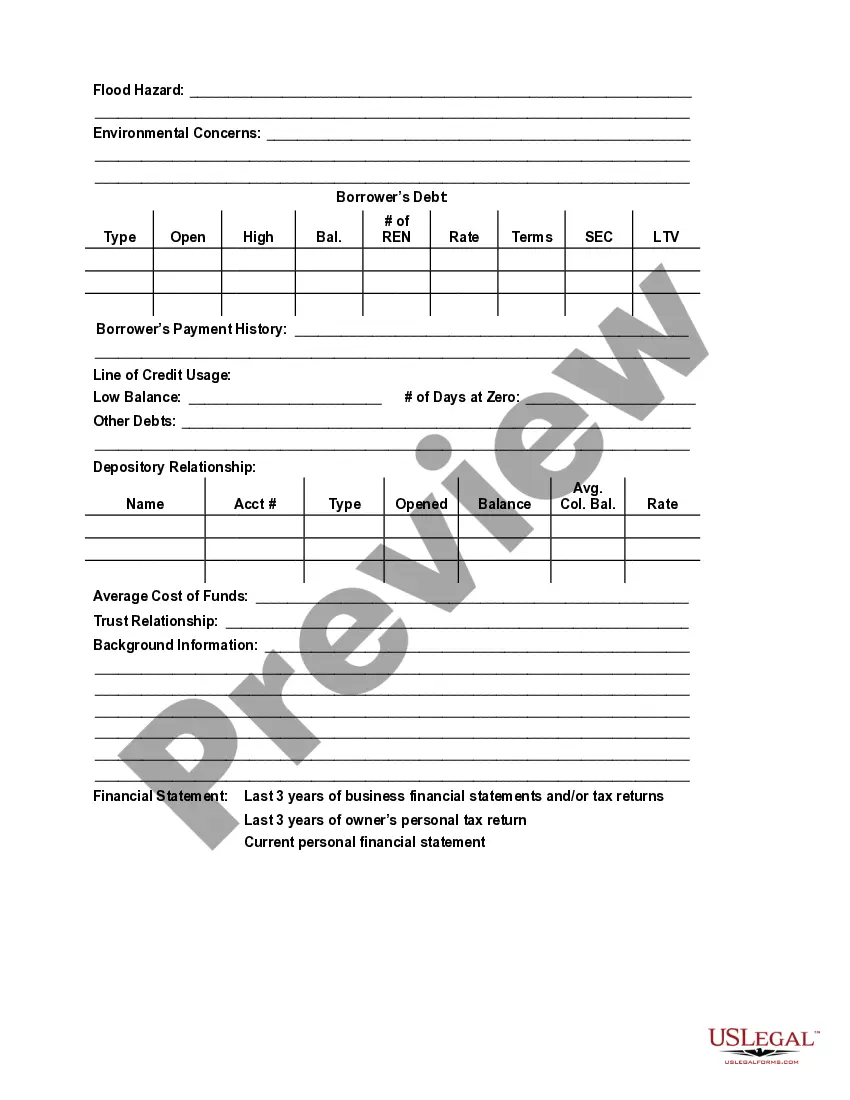

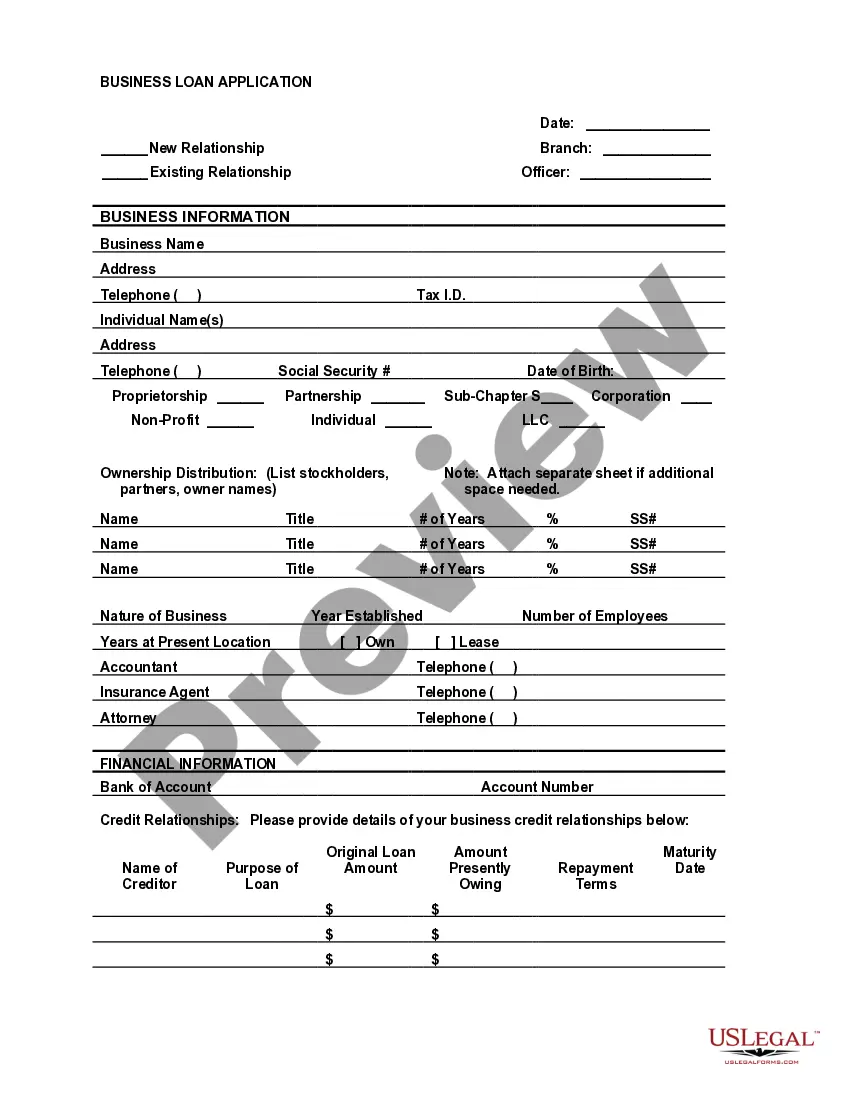

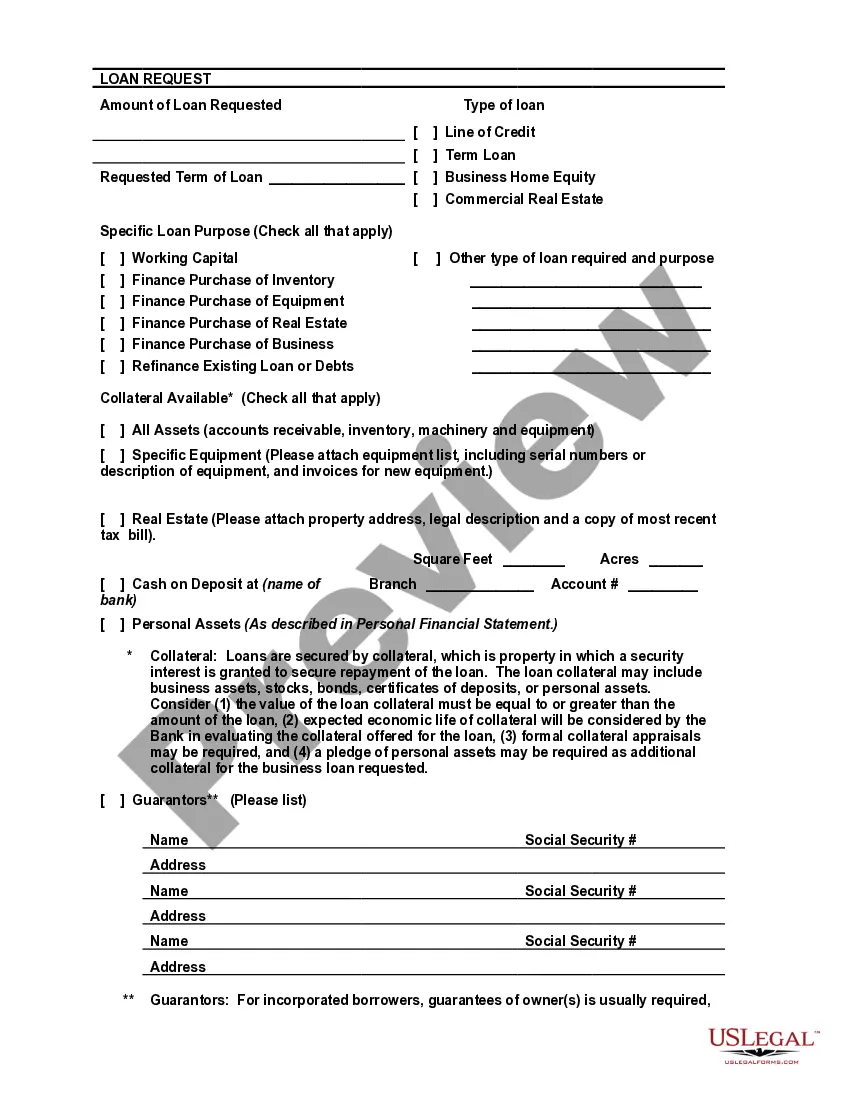

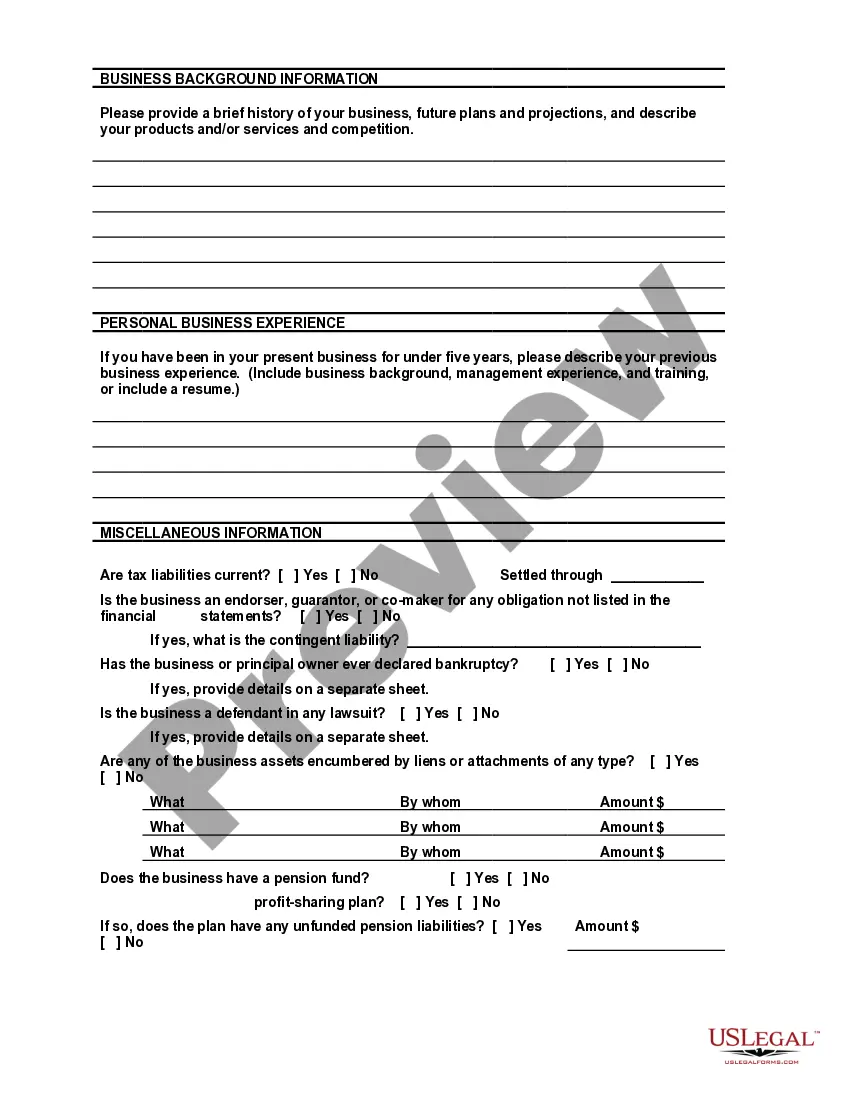

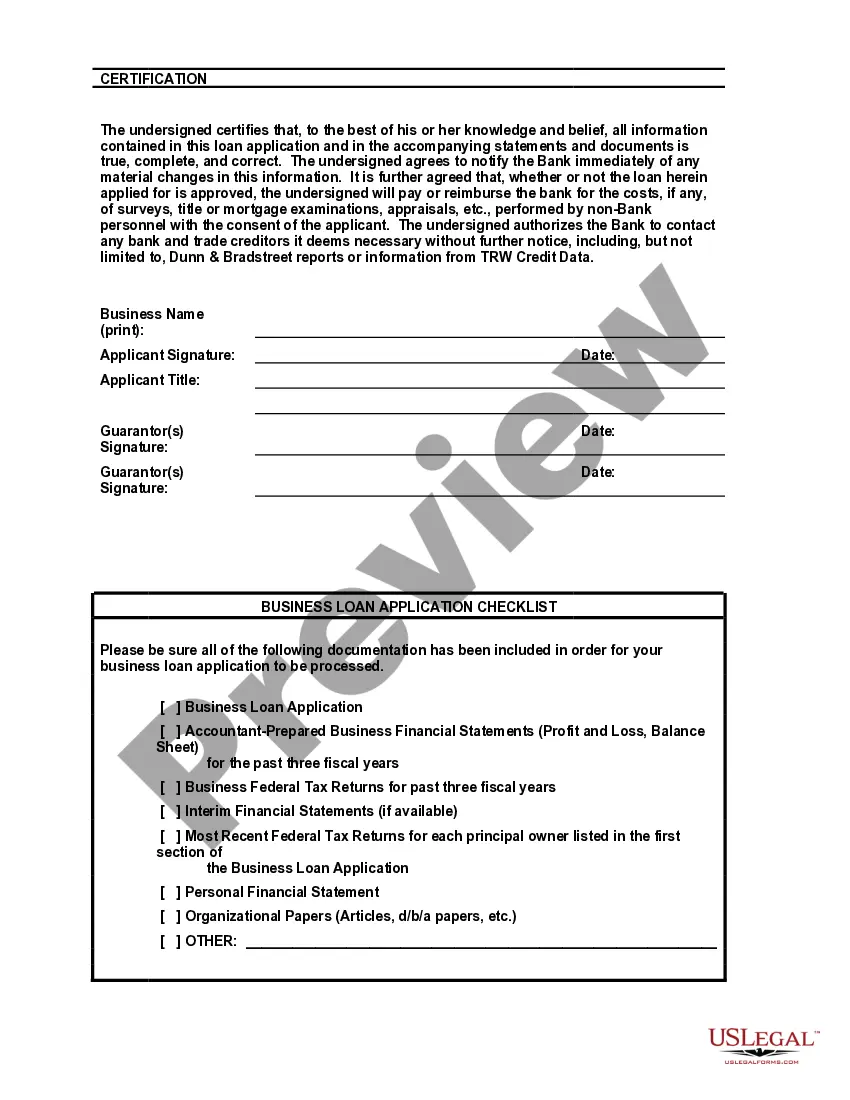

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

Montgomery Maryland Bank Loan Application Form and Checklist — Business Loan Introduction: Montgomery Maryland Bank provides a simplified and convenient process for businesses in Maryland seeking financial support through business loans. This detailed description highlights the various types of Montgomery Maryland Bank Loan Application Forms and Checklists for Business Loans, assisting entrepreneurs in understanding and preparing the necessary documents required for their loan applications. Types of Montgomery Maryland Bank Loan Application Forms and Checklists — Business Loan: 1. Start-up Business Loan Application Form and Checklist: For individuals embarking on a new business venture in Montgomery Maryland, the Start-up Business Loan Application Form and Checklist assists in presenting a comprehensive profile of the business concept and financial status. The form requests details such as the business plan, market analysis, projected financial statements, personal financial information, and collateral valuation. 2. Small Business Administration (SBA) Loan Application Form and Checklist: Montgomery Maryland Bank offers loan programs backed by the Small Business Administration. The SBA Loan Application Form and Checklist streamline the documentation process, ensuring compliance with SBA guidelines. The checklist typically includes requirements like personal background information, profit and loss statements, cash flow projections, business ownership details, tax returns, and collateral documentation. 3. Expansion or Growth Loan Application Form and Checklist: Businesses in Montgomery Maryland seeking to expand their operations or fund growth initiatives can utilize the Expansion or Growth Loan Application Form and Checklist. This form focuses on the financial performance of the existing business, the intended expansion plans, current assets and liabilities, credit history, and repayment capacity. It may also require submission of financial statements, balance sheets, income statements, and cash flow forecasts. 4. Equipment Financing Loan Application Form and Checklist: For businesses in need of capital to finance equipment purchases, Montgomery Maryland Bank offers Equipment Financing Loan Application Form and Checklist. This form emphasizes the specific equipment being financed, its estimated market value, maintenance and insurance requirements, and anticipated return on investment. Supporting documents may include invoices, quotes, equipment specifications, and warranty information. 5. Working Capital Loan Application Form and Checklist: The Working Capital Loan Application Form and Checklist helps businesses manage their daily operational expenses and improve cash flow. This form typically requires information about current assets, accounts receivable, accounts payable, inventory valuation, debt obligations, and cash reserves. Additional supporting documents might include financial statements, bank statements, and collateral details. Conclusion: Montgomery Maryland Bank Loan Application Forms and Checklists for Business Loans empower local businesses to conveniently apply for financing by providing a structured framework for necessary documentation. Entrepreneurs can choose the appropriate loan type and use the relevant form and checklist to ensure their loan applications are complete and comply with Montgomery Maryland Bank's requirements. Applying for a business loan has never been easier with Montgomery Maryland Bank's user-friendly application process.Montgomery Maryland Bank Loan Application Form and Checklist — Business Loan Introduction: Montgomery Maryland Bank provides a simplified and convenient process for businesses in Maryland seeking financial support through business loans. This detailed description highlights the various types of Montgomery Maryland Bank Loan Application Forms and Checklists for Business Loans, assisting entrepreneurs in understanding and preparing the necessary documents required for their loan applications. Types of Montgomery Maryland Bank Loan Application Forms and Checklists — Business Loan: 1. Start-up Business Loan Application Form and Checklist: For individuals embarking on a new business venture in Montgomery Maryland, the Start-up Business Loan Application Form and Checklist assists in presenting a comprehensive profile of the business concept and financial status. The form requests details such as the business plan, market analysis, projected financial statements, personal financial information, and collateral valuation. 2. Small Business Administration (SBA) Loan Application Form and Checklist: Montgomery Maryland Bank offers loan programs backed by the Small Business Administration. The SBA Loan Application Form and Checklist streamline the documentation process, ensuring compliance with SBA guidelines. The checklist typically includes requirements like personal background information, profit and loss statements, cash flow projections, business ownership details, tax returns, and collateral documentation. 3. Expansion or Growth Loan Application Form and Checklist: Businesses in Montgomery Maryland seeking to expand their operations or fund growth initiatives can utilize the Expansion or Growth Loan Application Form and Checklist. This form focuses on the financial performance of the existing business, the intended expansion plans, current assets and liabilities, credit history, and repayment capacity. It may also require submission of financial statements, balance sheets, income statements, and cash flow forecasts. 4. Equipment Financing Loan Application Form and Checklist: For businesses in need of capital to finance equipment purchases, Montgomery Maryland Bank offers Equipment Financing Loan Application Form and Checklist. This form emphasizes the specific equipment being financed, its estimated market value, maintenance and insurance requirements, and anticipated return on investment. Supporting documents may include invoices, quotes, equipment specifications, and warranty information. 5. Working Capital Loan Application Form and Checklist: The Working Capital Loan Application Form and Checklist helps businesses manage their daily operational expenses and improve cash flow. This form typically requires information about current assets, accounts receivable, accounts payable, inventory valuation, debt obligations, and cash reserves. Additional supporting documents might include financial statements, bank statements, and collateral details. Conclusion: Montgomery Maryland Bank Loan Application Forms and Checklists for Business Loans empower local businesses to conveniently apply for financing by providing a structured framework for necessary documentation. Entrepreneurs can choose the appropriate loan type and use the relevant form and checklist to ensure their loan applications are complete and comply with Montgomery Maryland Bank's requirements. Applying for a business loan has never been easier with Montgomery Maryland Bank's user-friendly application process.