This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

Queens New York Bank Loan Application Form and Checklist - Business Loan

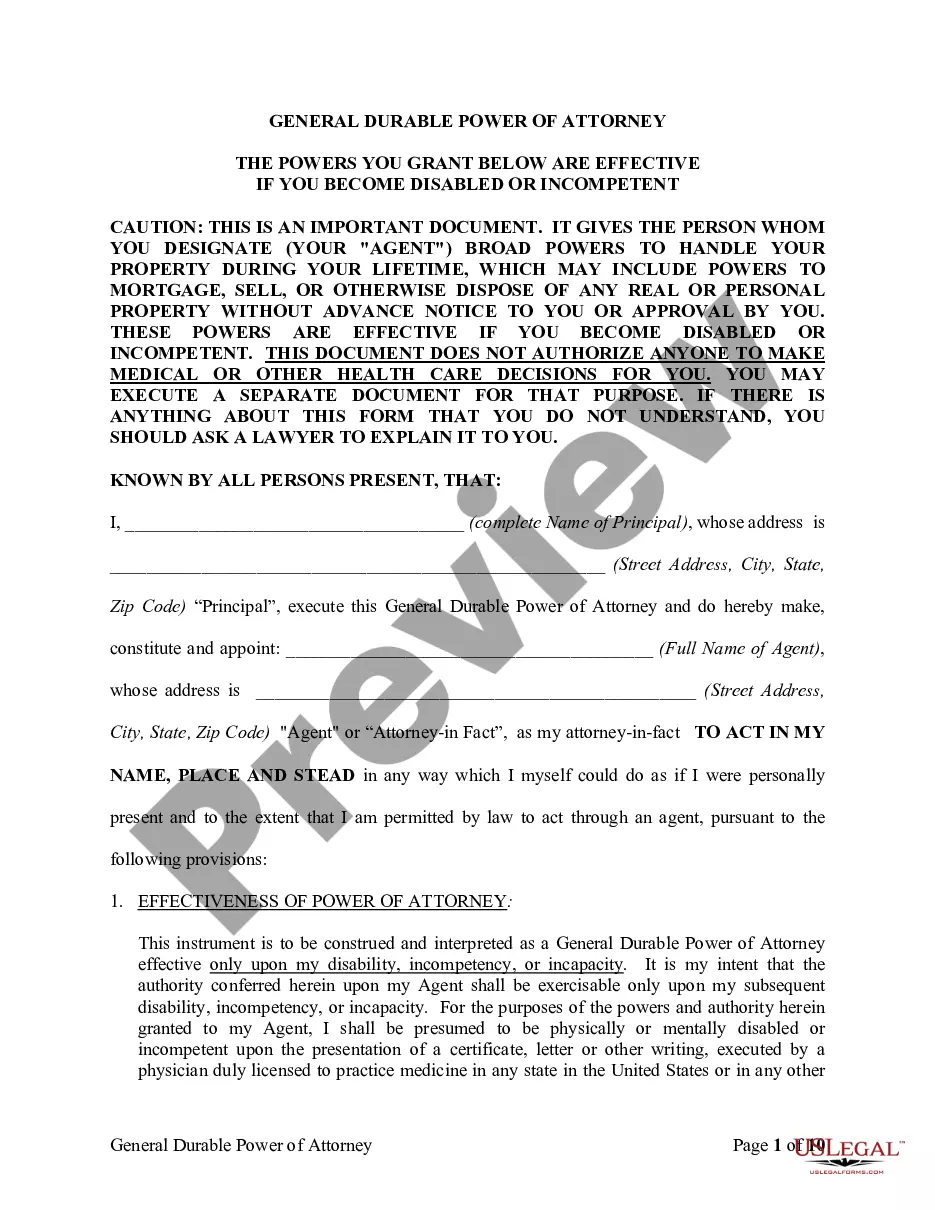

Description

How to fill out Queens New York Bank Loan Application Form And Checklist - Business Loan?

How much time does it typically take you to create a legal document? Since every state has its laws and regulations for every life sphere, locating a Queens Bank Loan Application Form and Checklist - Business Loan meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Aside from the Queens Bank Loan Application Form and Checklist - Business Loan, here you can get any specific form to run your business or individual affairs, complying with your regional requirements. Experts verify all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Queens Bank Loan Application Form and Checklist - Business Loan:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Queens Bank Loan Application Form and Checklist - Business Loan.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

How Much Do Most Business Loans Offer? Loan TypeLoan RangeBank loans$5,000-$5 millionShort-term loans$5,000-$500,000Business lines of credit$10,000-$1 millionMicroloan$500-$10,0003 more rows ?

Credit scores, annual revenue, business plan and collateral are the four cornerstones of most business loan applications. But note that there are many other supporting documents you'll need to qualify for a business loan. They can include: your driver's license.

Choose a bank or lender you have a relationship with. Prepare a detailed business plan.Show your relevant industry experience.Get your personal finances and credit in order.Be prepared to offer collateral, personal guarantee or a down payment.Detail what the loan will pay for.Register your business.

How to Get a Business Loan in 7 Steps Decide what type of loan you need to fund your business.Determine if you qualify for a business loan.Determine what payments you can afford.Decide whether and how you want to collateralize the loan.Compare small-business lenders.Gather your documents. Apply for a business loan.

Banks are best for small-business loans if your company has been around more than a year and doesn't need cash fast. Approvals can take months and are far from a sure thing even with good credit.

Best Banks for Small Business Loans Chase. Live Oak Bank. Wells Fargo. Capital One. Bank of America.

A secured loan will require some form of collateral (property or other assets) but no money from you. An unsecured loan does not require any collateral, so there's no money down (deposit) to get a business loan.

Determine how much funding you'll need. Fund your business yourself with self-funding. Get venture capital from investors. Use crowdfunding to fund your business. Get a small business loan. Use Lender Match to find lenders who offer SBA-guaranteed loans. SBA investment programs.

There is no set deposit amount for business loans, as each business is unique. Most lenders need 10 30% of the loan value as a deposit. This money can come from savings, working capital, alternative finance instruments or as an external investment.

If you're looking for a startup business loan with no money down, consider an SBA microloan. These loans are for amounts up to $50,000. Of note, while the SBA does not require a down payment for these types of loans, SBA-approved lenders providing the microloan funding might.