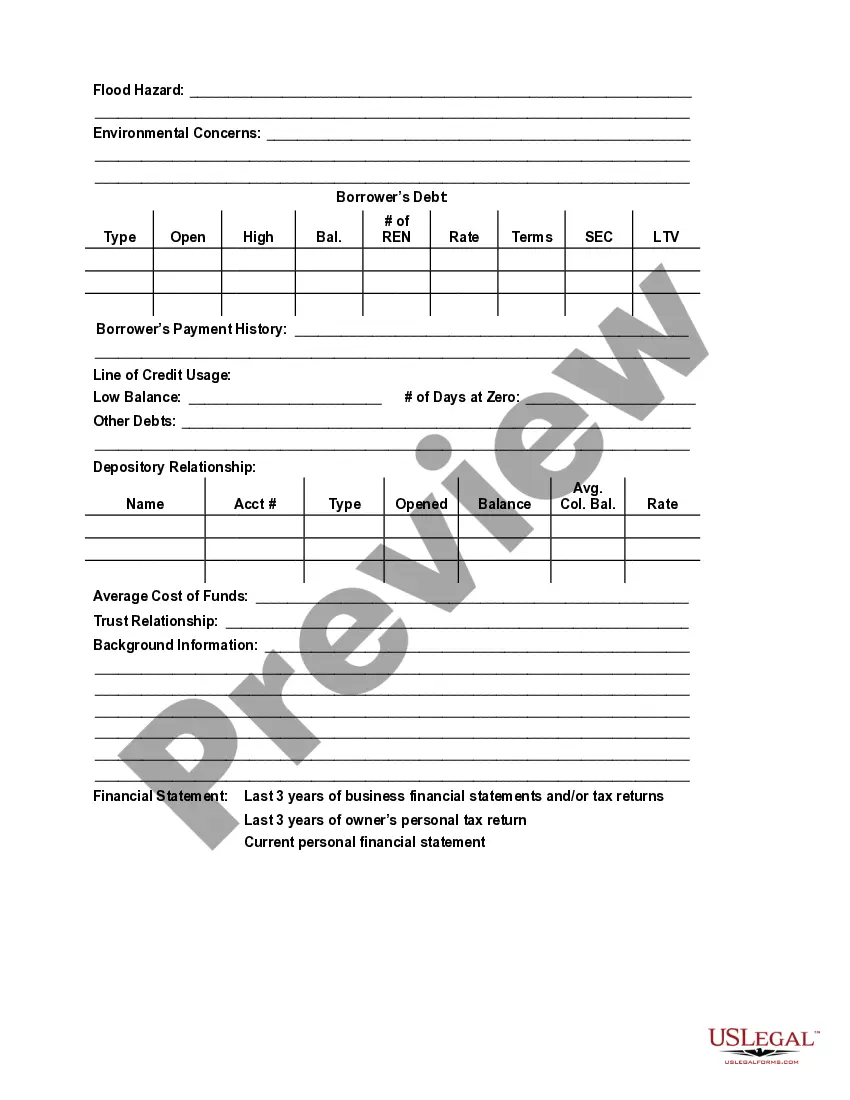

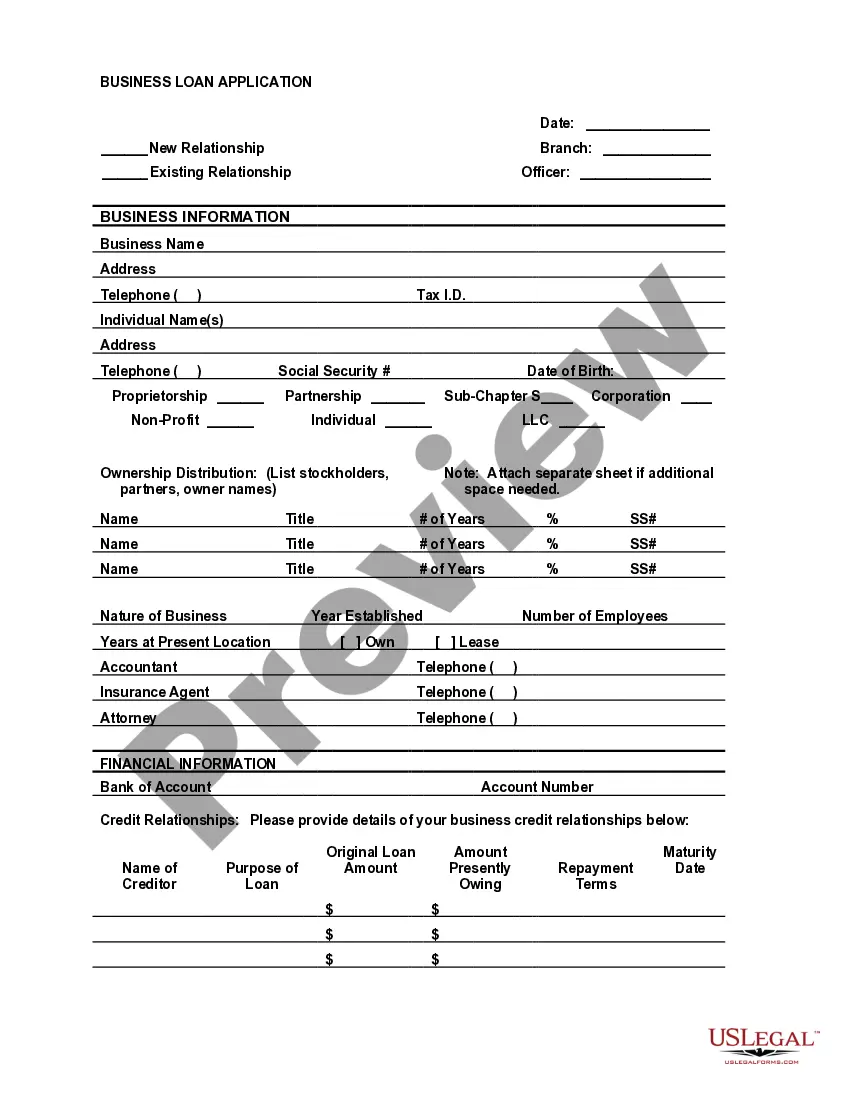

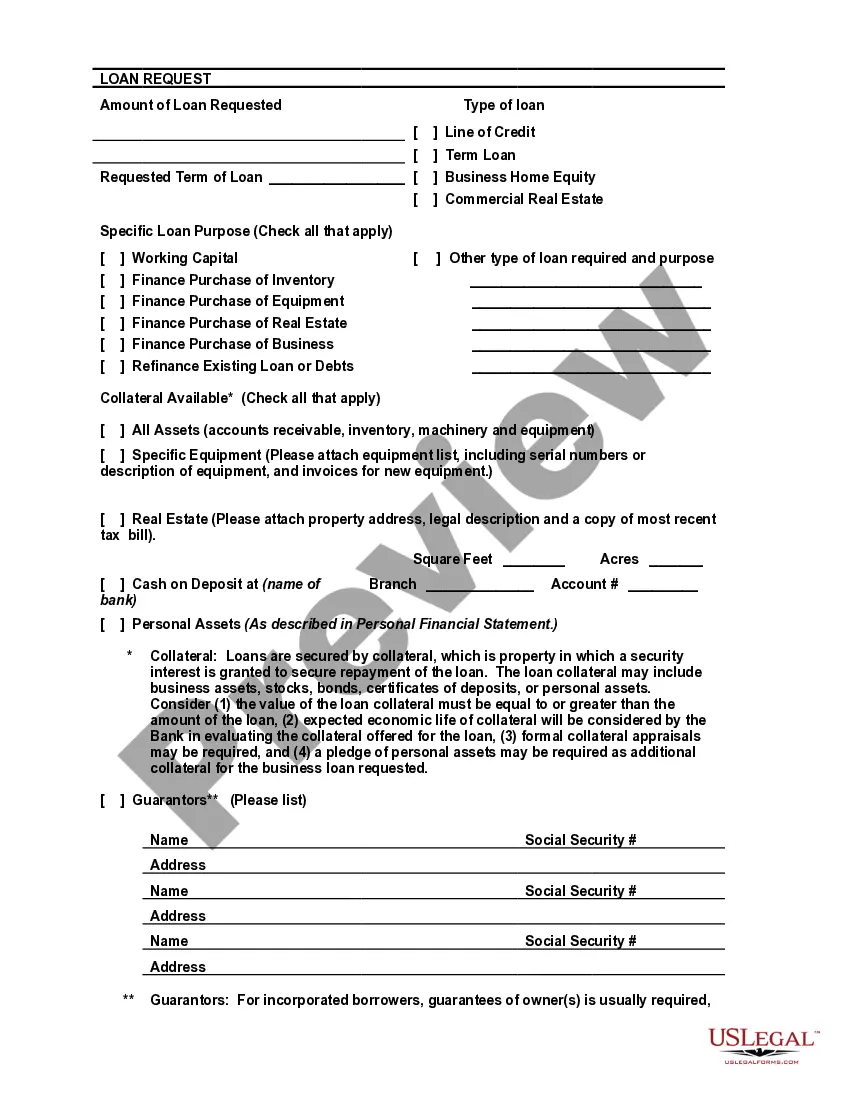

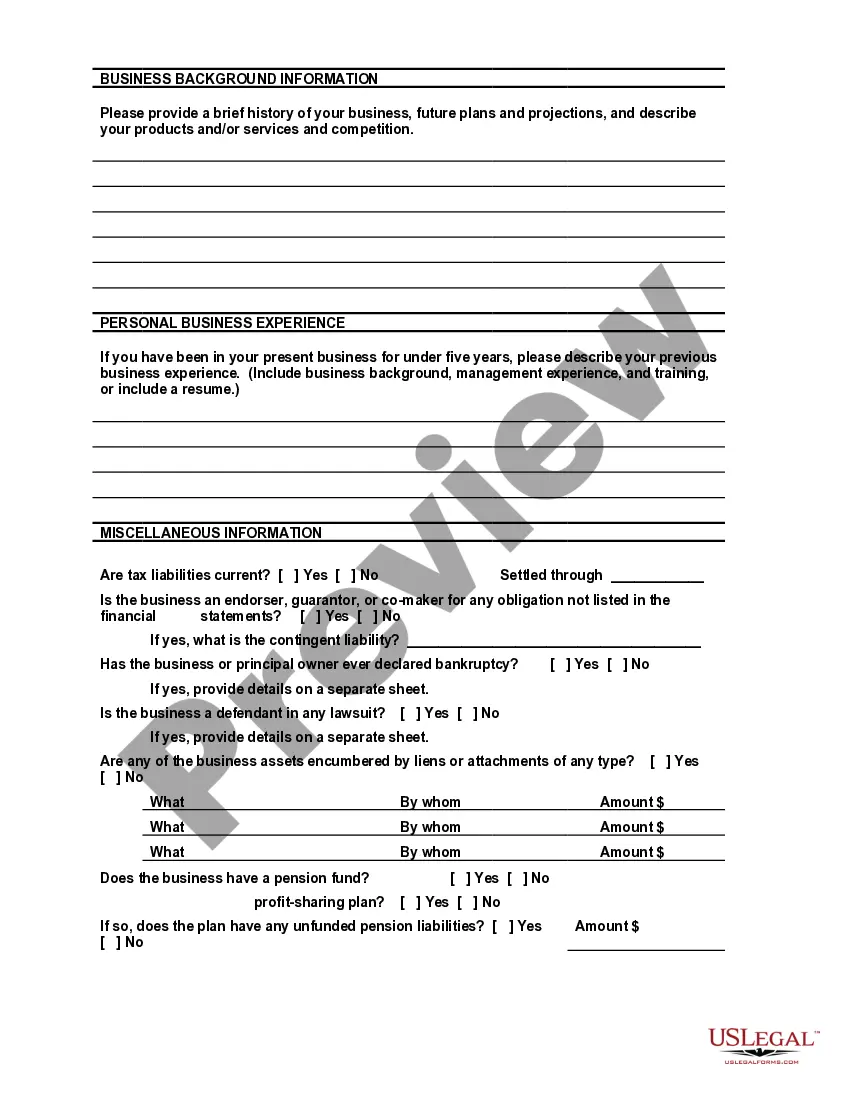

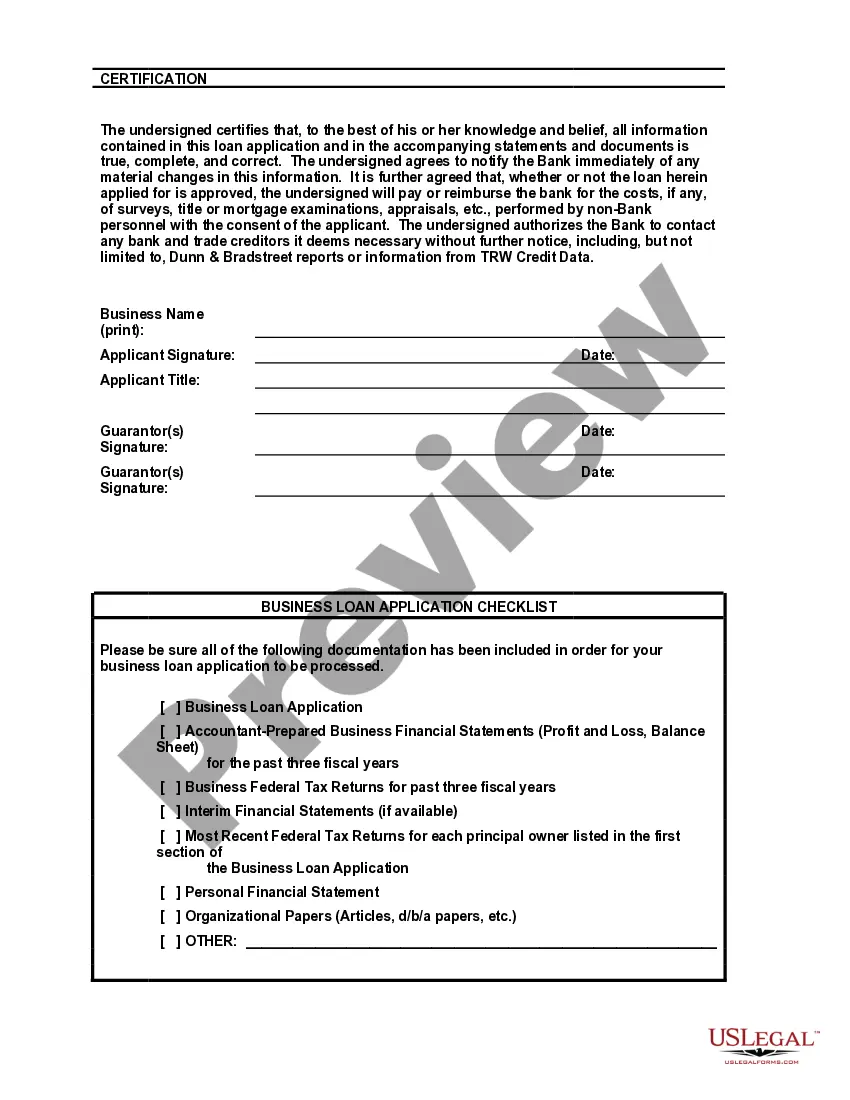

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

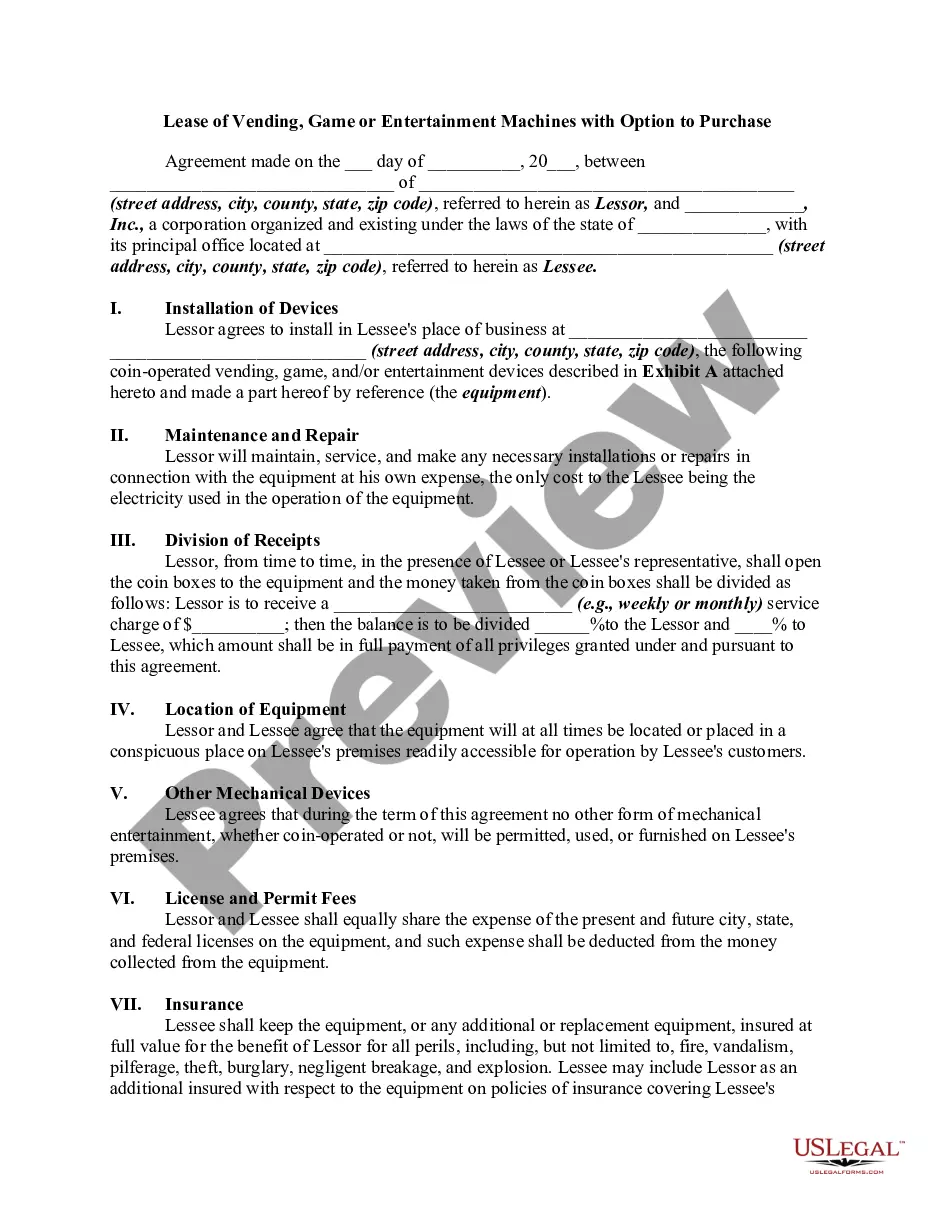

Travis Texas Bank Loan Application Form and Checklist — Business Loan: Travis Texas Bank is a reputable financial institution dedicated to serving the diverse financing needs of businesses in Travis County, Texas. To streamline the loan application process, Travis Texas Bank offers a comprehensive Loan Application Form and Checklist specifically tailored for business loans. These necessary documents aid businesses in presenting their funding requirements accurately and efficiently, ensuring a smooth application process. Below, we outline the different types of Travis Texas Bank Loan Application Forms and Checklists available for various business loan types: 1. Small Business Administration (SBA) Loan Application Form and Checklist: If you are seeking an SBA loan, Travis Texas Bank provides an SBA Loan Application Form and Checklist. SBA loans are government-backed loans designed to support small businesses. This form covers essential details such as personal information, business history, financial statements, collateral information, and credit history. Completing this comprehensive checklist will facilitate the SBA loan application process and increase the likelihood of approval. 2. Commercial Real Estate Loan Application Form and Checklist: For businesses looking to finance commercial real estate projects, Travis Texas Bank offers a specific Commercial Real Estate Loan Application Form and Checklist. This form captures vital information about the property, including purchase price, location, appraisal, and property details. By carefully compiling all the necessary documentation using the accompanying checklist, businesses can expedite their loan application and secure financing for their commercial real estate ventures. 3. Equipment and Machinery Loan Application Form and Checklist: Travis Texas Bank understands that businesses often require loans for purchasing or upgrading equipment and machinery. To cater to such needs, they provide an Equipment and Machinery Loan Application Form and Checklist. This form focuses on equipment specifications, purchase options, warranties, and maintenance requirements. By completing this checklist thoroughly, businesses can present a clear and accurate case for their equipment loan, enhancing their chances of approval. 4. Working Capital Loan Application Form and Checklist: When businesses require additional working capital to support day-to-day operations, Travis Texas Bank offers a dedicated Working Capital Loan Application Form and Checklist. This form highlights the company's financial position, cash flow projections, accounts payable, and accounts receivable. By diligently completing this checklist, businesses can effectively articulate their working capital requirements and demonstrate their ability to repay the loan, ensuring a higher likelihood of approval. Regardless of the loan type you seek, the Travis Texas Bank Loan Application Form and Checklist is a crucial resource for businesses navigating the loan application process. By providing all the required information accurately and promptly, businesses can confidently apply for loans through Travis Texas Bank, knowing that their application is complete and well-prepared. Partnering with Travis Texas Bank ensures that businesses receive the financial assistance they need to thrive and grow within Travis County, Texas.Travis Texas Bank Loan Application Form and Checklist — Business Loan: Travis Texas Bank is a reputable financial institution dedicated to serving the diverse financing needs of businesses in Travis County, Texas. To streamline the loan application process, Travis Texas Bank offers a comprehensive Loan Application Form and Checklist specifically tailored for business loans. These necessary documents aid businesses in presenting their funding requirements accurately and efficiently, ensuring a smooth application process. Below, we outline the different types of Travis Texas Bank Loan Application Forms and Checklists available for various business loan types: 1. Small Business Administration (SBA) Loan Application Form and Checklist: If you are seeking an SBA loan, Travis Texas Bank provides an SBA Loan Application Form and Checklist. SBA loans are government-backed loans designed to support small businesses. This form covers essential details such as personal information, business history, financial statements, collateral information, and credit history. Completing this comprehensive checklist will facilitate the SBA loan application process and increase the likelihood of approval. 2. Commercial Real Estate Loan Application Form and Checklist: For businesses looking to finance commercial real estate projects, Travis Texas Bank offers a specific Commercial Real Estate Loan Application Form and Checklist. This form captures vital information about the property, including purchase price, location, appraisal, and property details. By carefully compiling all the necessary documentation using the accompanying checklist, businesses can expedite their loan application and secure financing for their commercial real estate ventures. 3. Equipment and Machinery Loan Application Form and Checklist: Travis Texas Bank understands that businesses often require loans for purchasing or upgrading equipment and machinery. To cater to such needs, they provide an Equipment and Machinery Loan Application Form and Checklist. This form focuses on equipment specifications, purchase options, warranties, and maintenance requirements. By completing this checklist thoroughly, businesses can present a clear and accurate case for their equipment loan, enhancing their chances of approval. 4. Working Capital Loan Application Form and Checklist: When businesses require additional working capital to support day-to-day operations, Travis Texas Bank offers a dedicated Working Capital Loan Application Form and Checklist. This form highlights the company's financial position, cash flow projections, accounts payable, and accounts receivable. By diligently completing this checklist, businesses can effectively articulate their working capital requirements and demonstrate their ability to repay the loan, ensuring a higher likelihood of approval. Regardless of the loan type you seek, the Travis Texas Bank Loan Application Form and Checklist is a crucial resource for businesses navigating the loan application process. By providing all the required information accurately and promptly, businesses can confidently apply for loans through Travis Texas Bank, knowing that their application is complete and well-prepared. Partnering with Travis Texas Bank ensures that businesses receive the financial assistance they need to thrive and grow within Travis County, Texas.