The Fulton, Georgia Small Business Administration (SBA) Loan Application Form and Checklist is a comprehensive set of documents designed to gather all the necessary information and ensure a smooth loan application process for small businesses in Fulton, Georgia. This package includes various forms and a detailed checklist to help applicants organize and assemble all the required documentation. The Fulton, Georgia SBA Loan Application Form serves as the primary document for applicants to provide essential information about their business, including details on their industry, years in operation, ownership structure, and business plan. It encompasses sections dedicated to personal background information, financial statements, outstanding debts, collateral, and other relevant details. This form is vital for the SBA to assess the eligibility and credibility of the applicant. The Fulton, Georgia SBA Loan Application Checklist is a crucial tool that assists small business owners in gathering and organizing the necessary documentation for their loan application. It includes a list of all the required documents, such as financial statements (balance sheet, income statement, cash flow statement), personal and business tax returns, business licenses and permits, insurance documentation, legal contracts, lease agreements, and current outstanding debts. This checklist ensures that applicants have all the necessary paperwork ready before submitting their loan application, reducing the chances of delays or rejections due to missing documents. Different types of Fulton, Georgia SBA Loan Application Forms and Checklists may exist depending on the specific loan program or purpose of the loan. One such example is the Fulton, Georgia SBA 7(a) Loan Application Form and Checklist, which is specifically tailored for businesses seeking funding through the SBA 7(a) loan program. This program is the SBA's primary loan program, providing financial assistance to small businesses for various purposes, including working capital, equipment purchase, and business expansion. Another possible variation might be the Fulton, Georgia SBA Disaster Loan Application Form and Checklist, which is designed for businesses affected by natural disasters, such as hurricanes, floods, or wildfires. This specific form and checklist cater to the requirements of the SBA Disaster Loan program, providing businesses in Fulton, Georgia with low-interest, long-term loans to help them recover and rebuild in the aftermath of a disaster. In conclusion, the Fulton, Georgia Small Business Administration Loan Application Form and Checklist are essential resources for small businesses looking to secure loans and financial assistance. These documents gather all the necessary information and documentation required by the SBA, ensuring a smooth application process and increasing the chances of approval. Different variations of these forms and checklists may exist depending on the loan program or purpose, such as the SBA 7(a) Loan Application Form and Checklist or the SBA Disaster Loan Application Form and Checklist. Small business owners in Fulton, Georgia should carefully review and complete the appropriate forms and checklists to enhance their chances of obtaining funding through the SBA loan programs.

Fulton Georgia Small Business Administration Loan Application Form and Checklist

Description

How to fill out Fulton Georgia Small Business Administration Loan Application Form And Checklist?

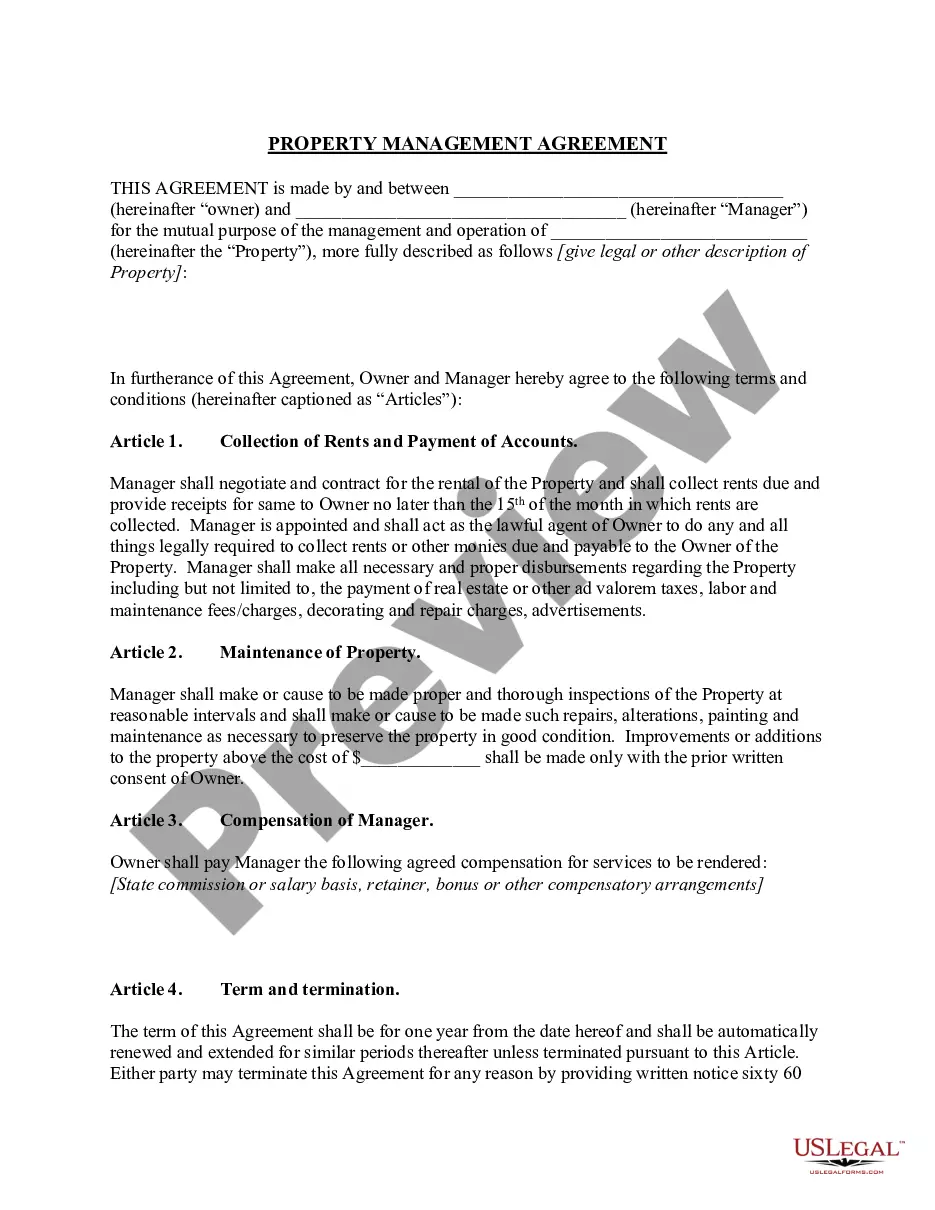

Preparing legal documentation can be difficult. In addition, if you decide to ask a legal professional to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Fulton Small Business Administration Loan Application Form and Checklist, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Consequently, if you need the recent version of the Fulton Small Business Administration Loan Application Form and Checklist, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Fulton Small Business Administration Loan Application Form and Checklist:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Fulton Small Business Administration Loan Application Form and Checklist and save it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

How to Fill Out Your EIDL Application Loan Application Walkthrough YouTube Start of suggested clip End of suggested clip Percent it must be 20% or above if they're going to be included on here an email. They can beMorePercent it must be 20% or above if they're going to be included on here an email. They can be contacted at there's social security number their birth date. Place of birth. Whether.

The form 5, IRS 4506T form, Personal Financial Statements, Schedule of Liabilities and Tax Returns. The form 5C, IRS 4506T form, Personal Financial Statement, Schedule of Liabilities and Tax Returns. Items with a must be completed. Include good email address and cell phone number.

You have a low overall personal or business credit score, or a poor credit history. You do not have sufficient collateral or assets to secure your loan. You do not have enough free capital or cash flow to meet loan repayments. You have too much already outstanding debt.

SBA microloans, which are some of the easiest SBA loans to get approved for, range in size between $500 and $50,000.

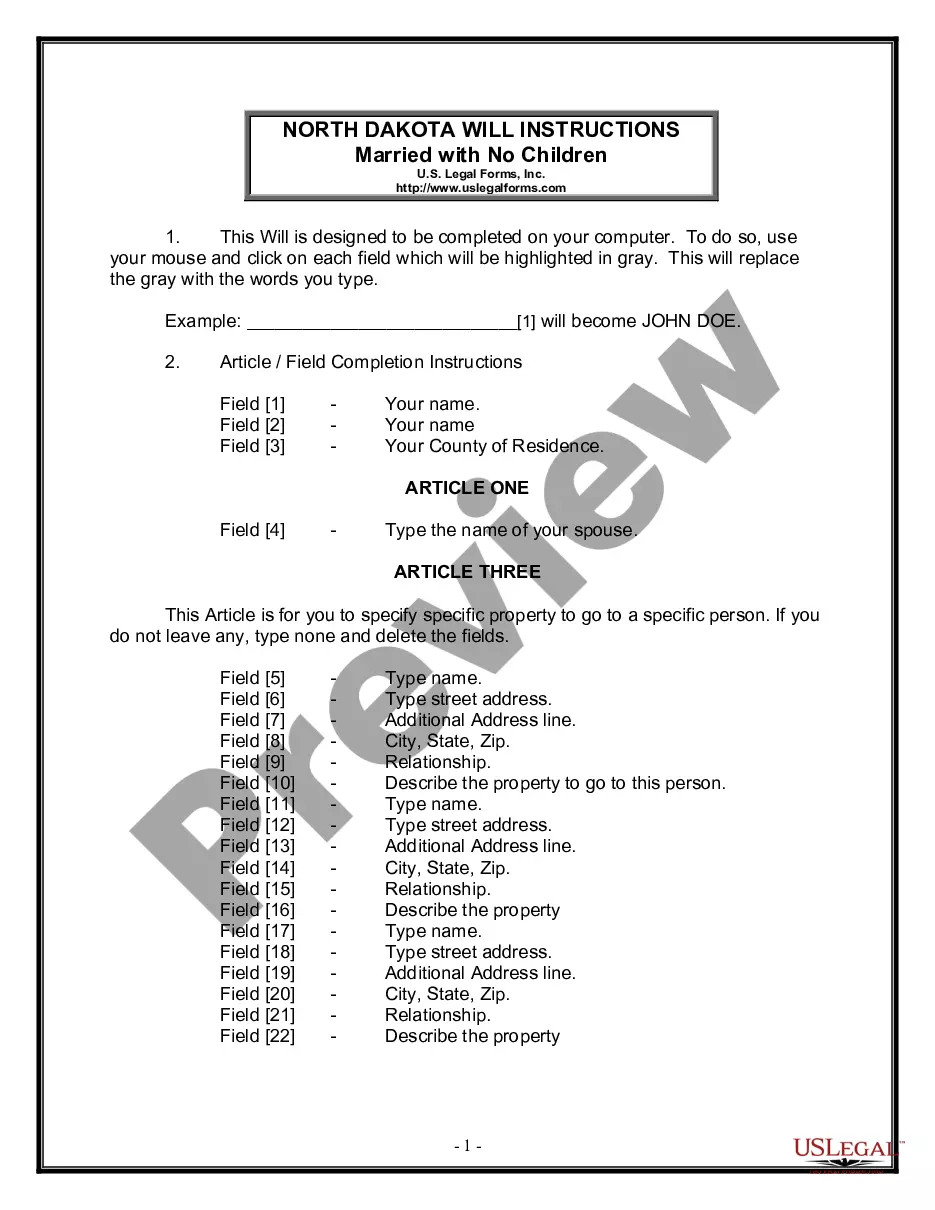

The SBA Checklist Borrower Information Form. To start, you'll need to complete SBA Form 1919.Personal Background and Financial Statement.Business Financial Statements.Business Certificate/License.Loan Application History.Income Tax Returns.Resumes.Business Overview and History.

The SBA Checklist Borrower Information Form. To start, you'll need to complete SBA Form 1919.Personal Background and Financial Statement.Business Financial Statements.Business Certificate/License.Loan Application History.Income Tax Returns.Resumes.Business Overview and History.

Must-Watch: All Your EIDL Questions, Answered - YouTube YouTube Start of suggested clip End of suggested clip So the first thing i would say is you should look and see what the denial. Reason was chances are itMoreSo the first thing i would say is you should look and see what the denial. Reason was chances are it may be unverifiable. Information because that's kind of the catch-all.

Under this model, the lender submits a complete application package and requests an SBA guarantee. The SBA reviews the package and will usually confirm the lender's decision about whether to approve the loan. This process generally takes between seven and 10 business days.

The SBA Checklist Borrower Information Form. To start, you'll need to complete SBA Form 1919.Personal Background and Financial Statement.Business Financial Statements.Business Certificate/License.Loan Application History.Income Tax Returns.Resumes.Business Overview and History.

How to fill out the SBA Disaster Loan Application - YouTube YouTube Start of suggested clip End of suggested clip So let's go ahead and pull it up on the screen and walk through it together it's sba.gov. So rightMoreSo let's go ahead and pull it up on the screen and walk through it together it's sba.gov. So right on the home page of sba.gov.

More info

Text 228744 for Atlanta or Atlanta GA. Call (for Atlanta). Contact a licensed health care professional in the Atlanta area for assistance in finding vaccine locations near you. Vaccination Information for the following states for the 2 school year for grades K — 12.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.