Maricopa, Arizona Small Business Administration (SBA) Loan Application Form and Checklist serve as essential tools for entrepreneurs and small business owners in Maricopa, Arizona, seeking financial support for their ventures. By providing detailed information and documentation, these forms enable businesses to apply for SBA loans efficiently and seamlessly. Below, you will find a description of the commonly used Maricopa Arizona Small Business Administration Loan Application Form and Checklist variants: 1. Standard Loan Application (SBA Form 5): *Keywords: Maricopa Arizona, small business loan application form, SBA Form 5, standard loan application.* The SBA Form 5, often referred to as the "Standard Loan Application," is a widely utilized document by small businesses in Maricopa, Arizona, wanting to seek financial assistance from the SBA. This comprehensive form collects essential information about the applicant, business entity, management team, financial statements, collateral, and any previous government loans. Completing this form is crucial as it provides the necessary details for loan evaluators to assess the business's eligibility for SBA loans. 2. Disaster Loan Application (SBA Form 5C): *Keywords: Maricopa Arizona, SBA disaster loan application, SBA Form 5C, small business disaster loan.* The SBA Form 5C, or the "Disaster Loan Application" variant, is specifically designed for businesses seeking financial aid due to an officially declared disaster in Maricopa, Arizona. Entrepreneurs who have experienced damages or losses resulting from a natural disaster, such as floods, earthquakes, or fires, can utilize this form to apply for low-interest loans offered by the SBA. The document requires detailed information on the nature of the disaster, losses incurred, insurance coverage, and compensatory resources. 3. Microloan Application (SBA Form 7(a)): *Keywords: Maricopa Arizona, SBA microloan application, SBA Form 7(a), small business microloan.* Designed specifically for small businesses and startups in Maricopa, Arizona, the SBA Form 7(a) or "Microloan Application" serves as a comprehensive tool for accessing microloans. Microloans aim to provide smaller loan amounts (up to $50,000) to support the growth, working capital, and equipment needs of small enterprises. This form requests information about business plans, financial statements, credit history, collateral, and other crucial details to assess the applicant's eligibility for microloans. 4. Exporting Loan Application (SBA Form 601): *Keywords: Maricopa Arizona, SBA exporting loan application, SBA Form 601, small business exporting loan.* For Maricopa-based small businesses focusing on international expansion and exporting, the SBA offers an Exporting Loan Application in the form of SBA Form 601. This application form requires businesses to outline their goals, export plans, market analysis, strategies, and other critical details related to expanding their products or services globally. The SBA assesses this information to determine eligibility for exporting loans and guarantees aimed at supporting businesses venturing into international trade. To apply for any of these Maricopa Arizona Small Business Administration Loan Application Form and Checklist variants, interested entrepreneurs should thoroughly complete the corresponding form, supplying accurate and relevant information, and ensure that they have all the accompanying required documentation. Meeting the necessary requirements and gathering the correct documentation can significantly increase the chances of securing the desired financial assistance from the SBA.

Maricopa Arizona Small Business Administration Loan Application Form and Checklist

Description

How to fill out Maricopa Arizona Small Business Administration Loan Application Form And Checklist?

Whether you plan to start your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Maricopa Small Business Administration Loan Application Form and Checklist is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to obtain the Maricopa Small Business Administration Loan Application Form and Checklist. Follow the instructions below:

- Make sure the sample fulfills your individual needs and state law requirements.

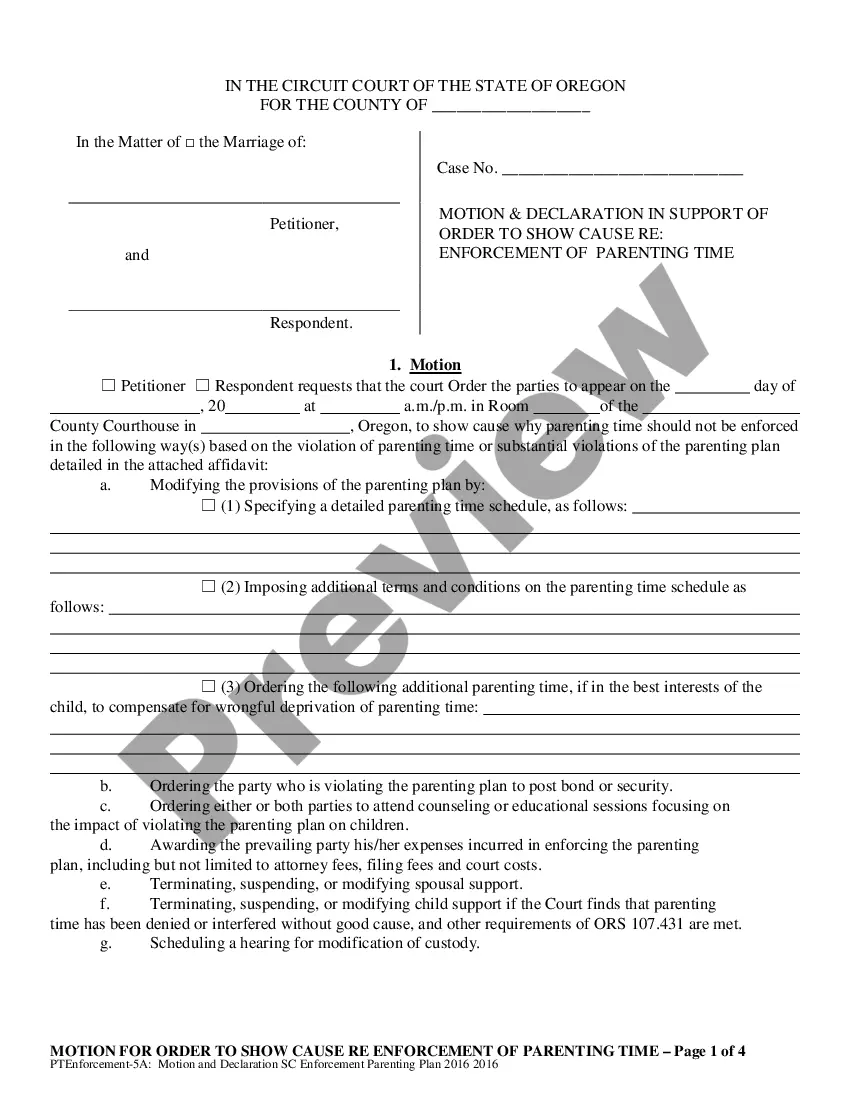

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample when you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Small Business Administration Loan Application Form and Checklist in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!