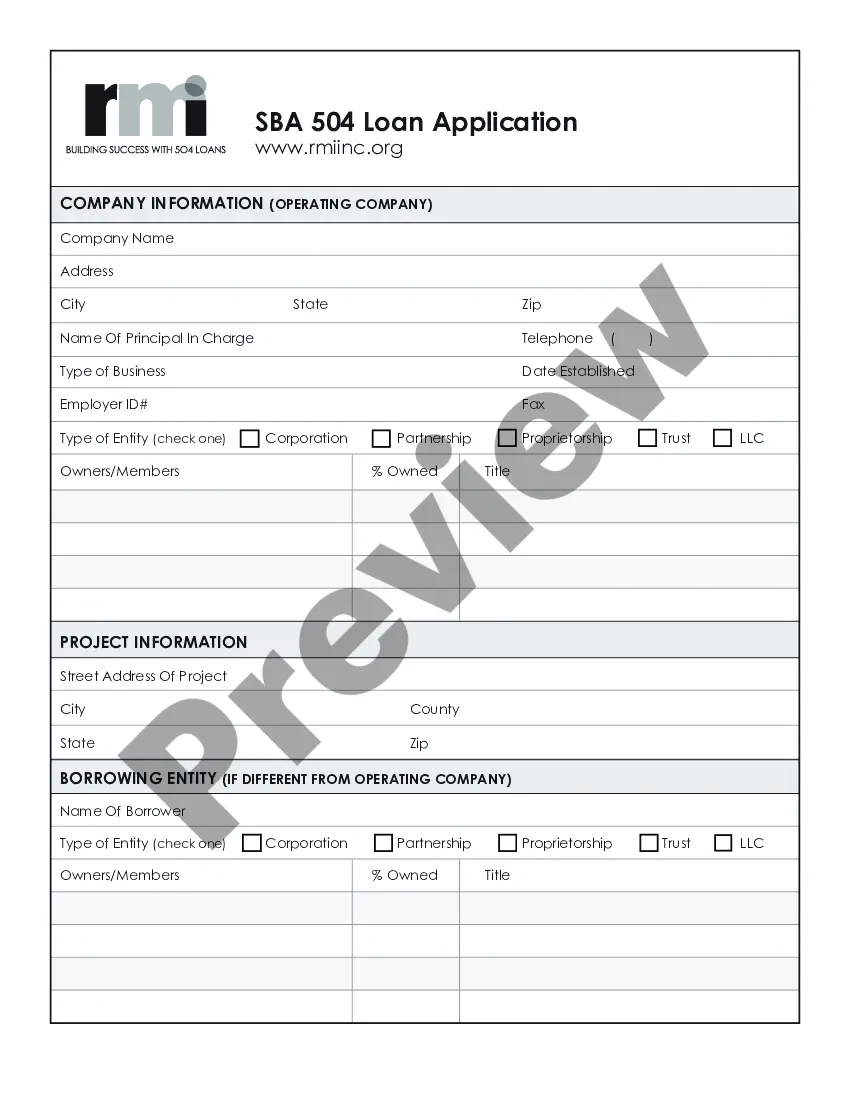

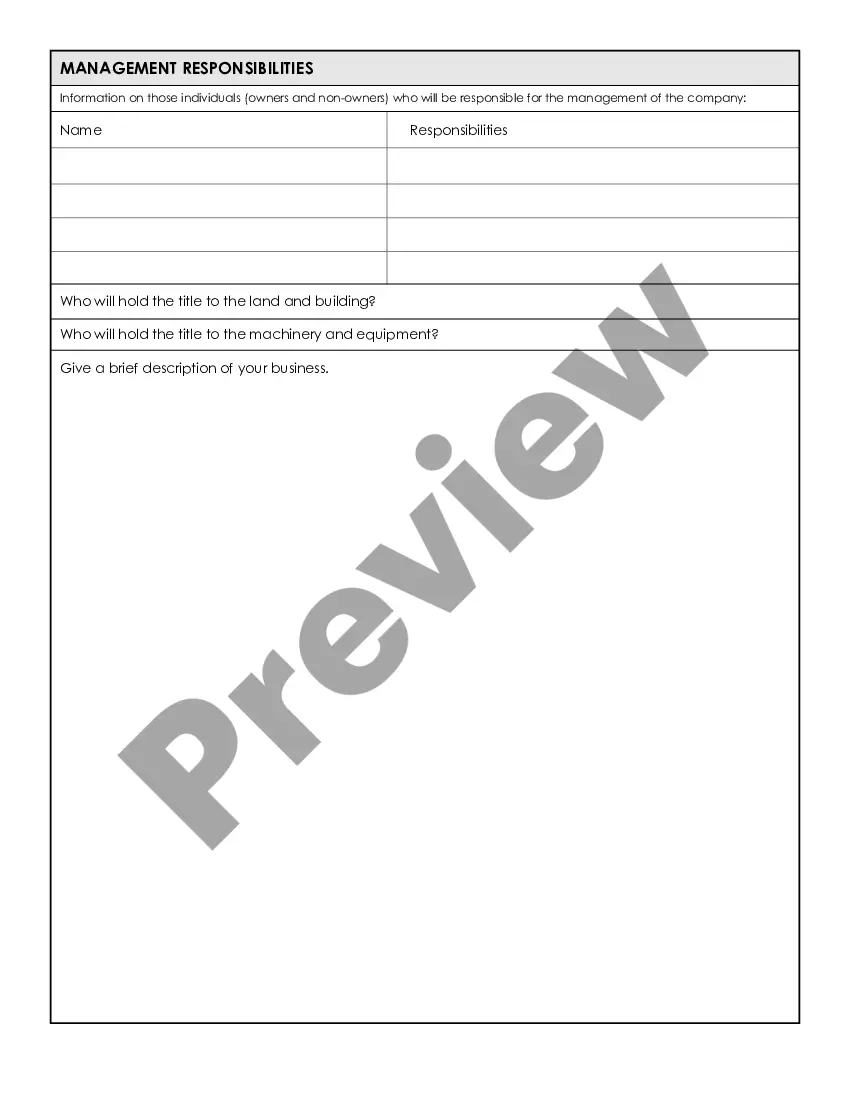

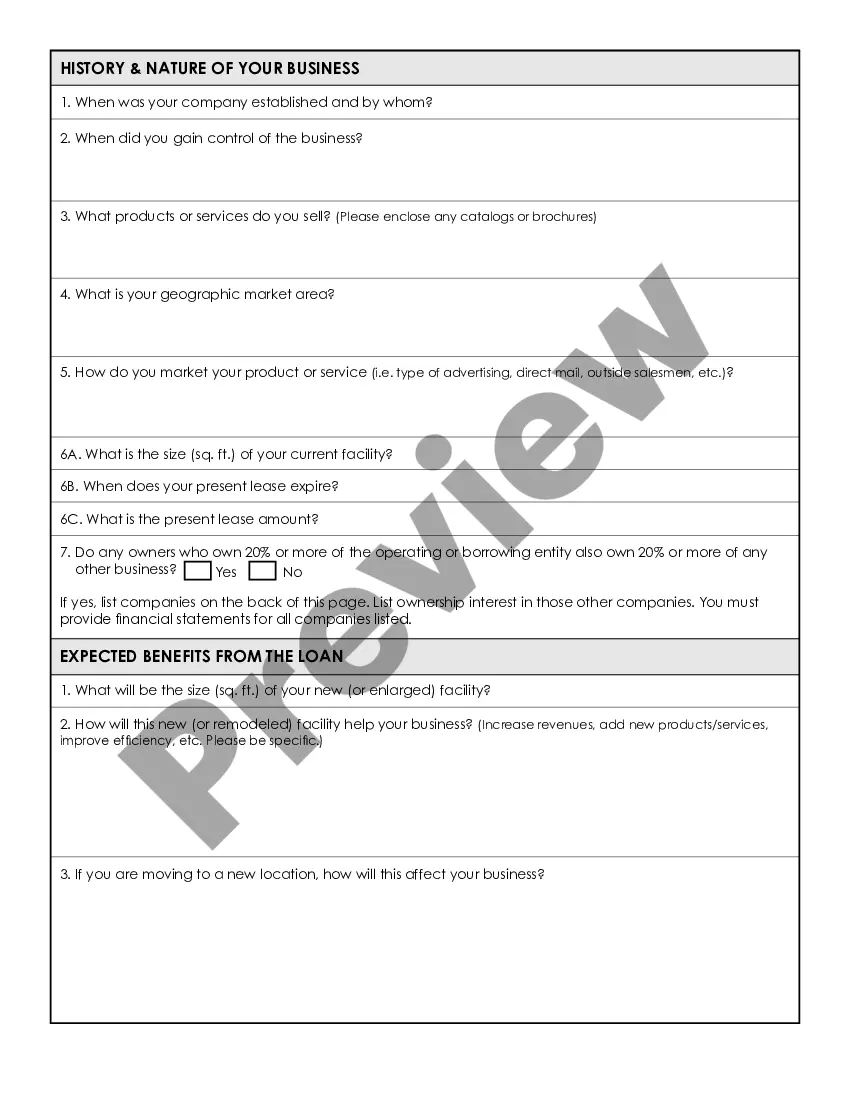

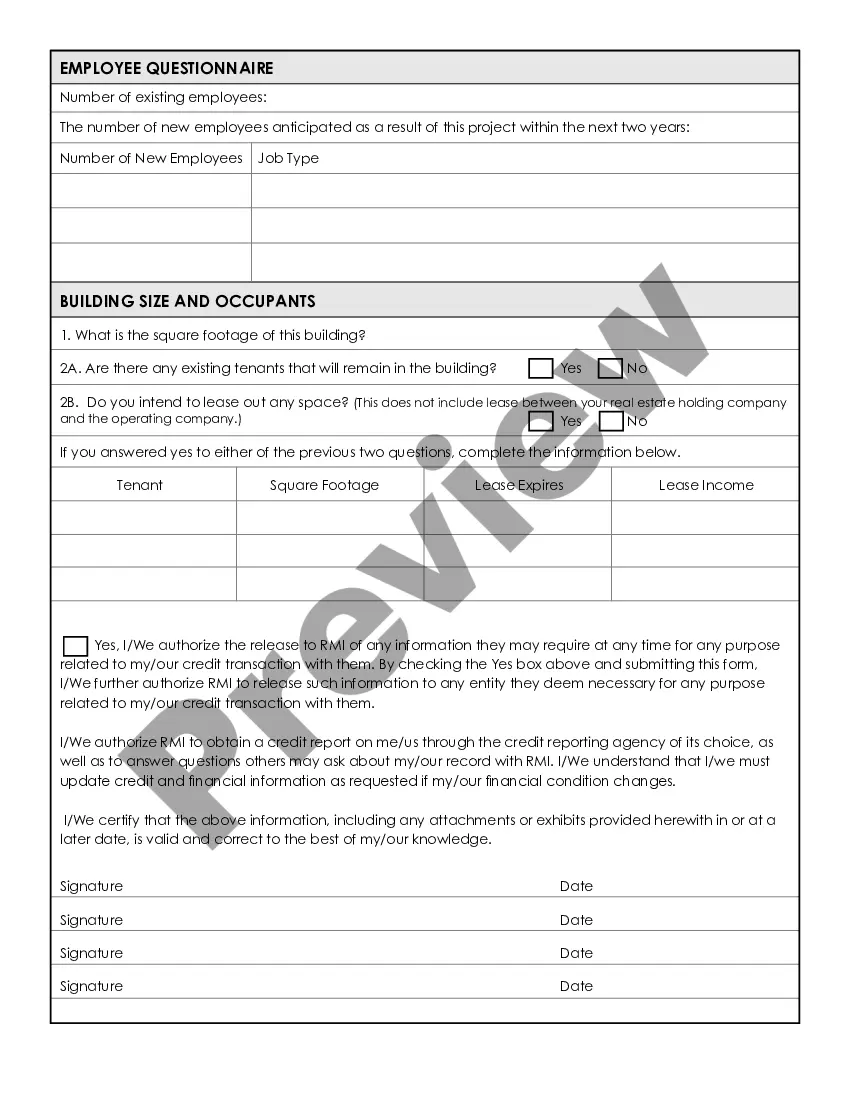

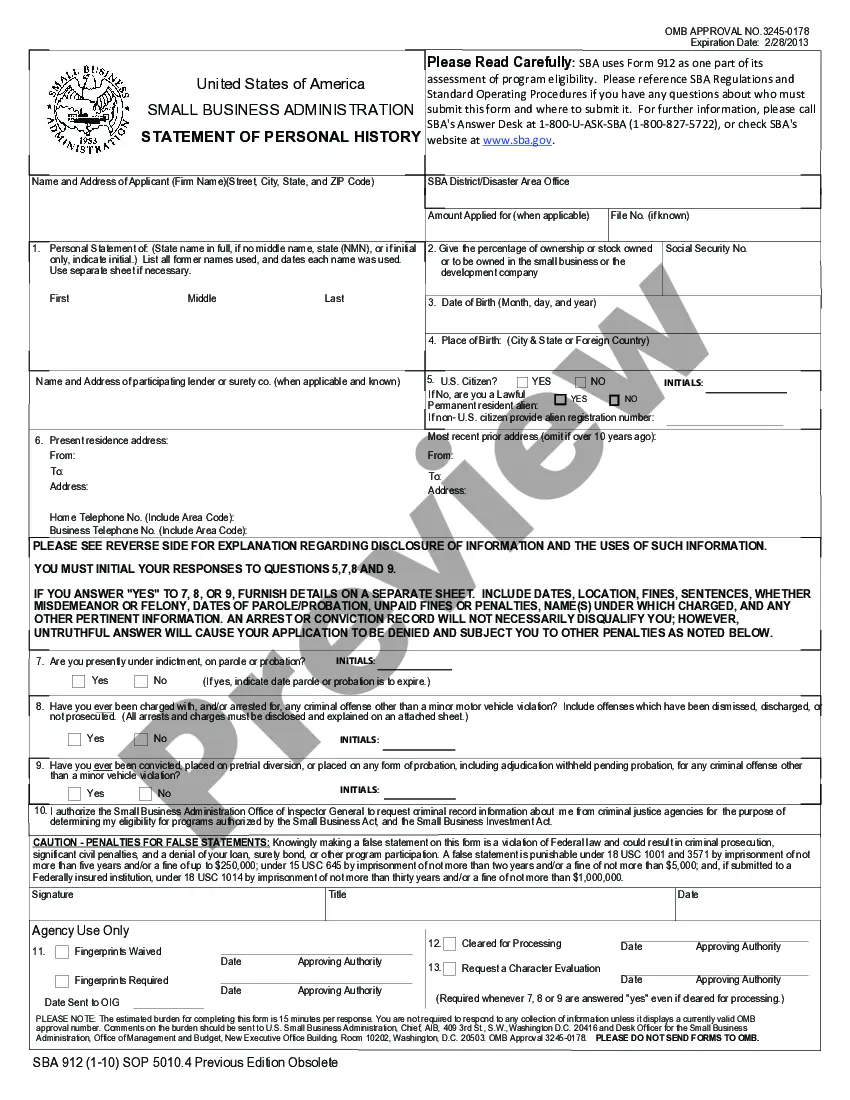

The Lima Arizona Small Business Administration (SBA) Loan Application Form and Checklist is an essential tool for local businesses seeking financial assistance. This document is specifically designed to guide small business owners through the application process for SBA loans, which aim to support entrepreneurship and economic growth in Lima, Arizona. The Lima Arizona SBA Loan Application Form serves as the primary document required by the Small Business Administration for loan consideration. It covers crucial information regarding the business, its owners, financial statements, borrowing history, collateral, and other relevant details. By completing this form meticulously, businesses can provide a comprehensive overview of their operations and demonstrate their eligibility for financial support. In addition to the main loan application form, there are several types of SBA loans available in Lima, Arizona, each tailored to meet different needs: 1. SBA 7(a) Loan Application: This is the most common loan program offered by the SBA, providing funds for various purposes, such as working capital, equipment purchases, debt refinancing, or business acquisitions. 2. SBA Microloan Application: Designed for small businesses with limited funding requirements, this program offers small loans of up to $50,000, which can be utilized for purchasing inventory, equipment, or covering operational expenses. 3. SBA CDC/504 Loan Application: This program supports businesses in acquiring fixed assets, including real estate or major equipment. The loan application for CDC/504 loans primarily focuses on the business's capital expenditure plans and financial projections. Regardless of the loan program, the key to obtaining SBA financing is to provide clear and accurate information. The Loan Application Form and Checklist help ensure that business owners gather all the necessary documentation, including business plans, financial statements, tax returns, personal financial statements, and other supporting materials. The Checklist serves as a valuable tool to ensure that all required documents are included with the application. It outlines the necessary paperwork, such as the completed loan application form, business plan, cash flow projections, credit history reports, collateral documentation, and any additional forms or statements required by the specific loan program. Subsequently, the completed Lima Arizona SBA Loan Application Form and Checklist, along with the supporting documents, should be submitted to the designated SBA office or an approved lender. Thoroughly reviewing and organizing all required materials increases the likelihood of a successful loan application, helping business owners secure the financial support needed to grow and thrive in Lima, Arizona.

Pima Arizona Small Business Administration Loan Application Form and Checklist

Description

How to fill out Pima Arizona Small Business Administration Loan Application Form And Checklist?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from the ground up, including Pima Small Business Administration Loan Application Form and Checklist, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in various categories ranging from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching process less challenging. You can also find detailed resources and guides on the website to make any tasks related to document execution simple.

Here's how to find and download Pima Small Business Administration Loan Application Form and Checklist.

- Go over the document's preview and outline (if available) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can affect the validity of some records.

- Check the related document templates or start the search over to locate the right document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment method, and buy Pima Small Business Administration Loan Application Form and Checklist.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Pima Small Business Administration Loan Application Form and Checklist, log in to your account, and download it. Needless to say, our website can’t take the place of a lawyer completely. If you have to cope with an extremely challenging situation, we recommend using the services of an attorney to review your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-compliant documents with ease!