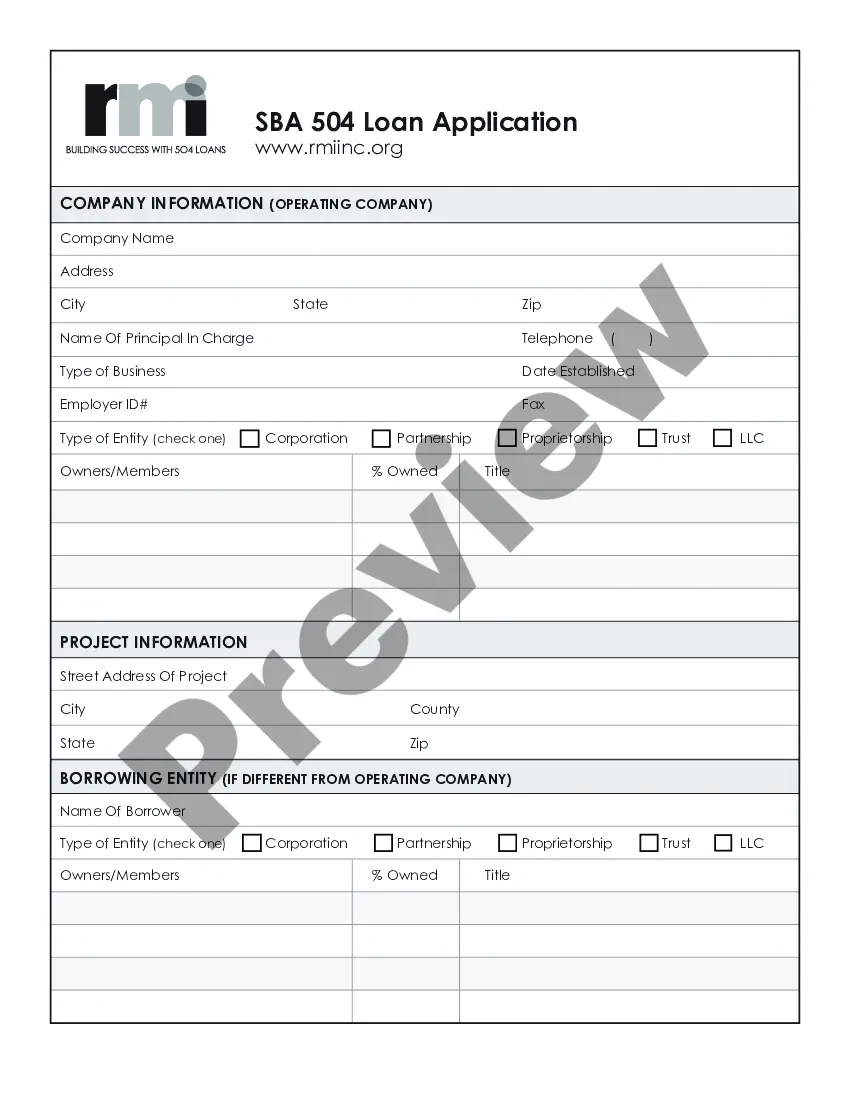

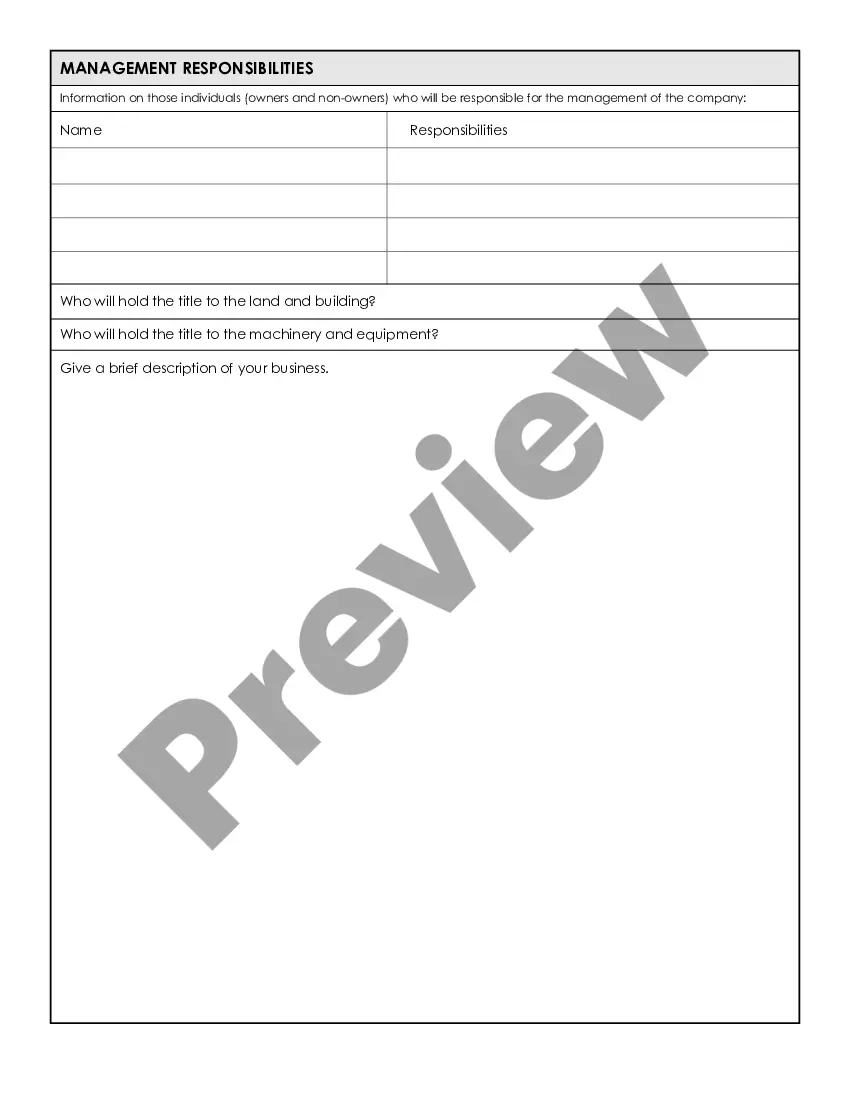

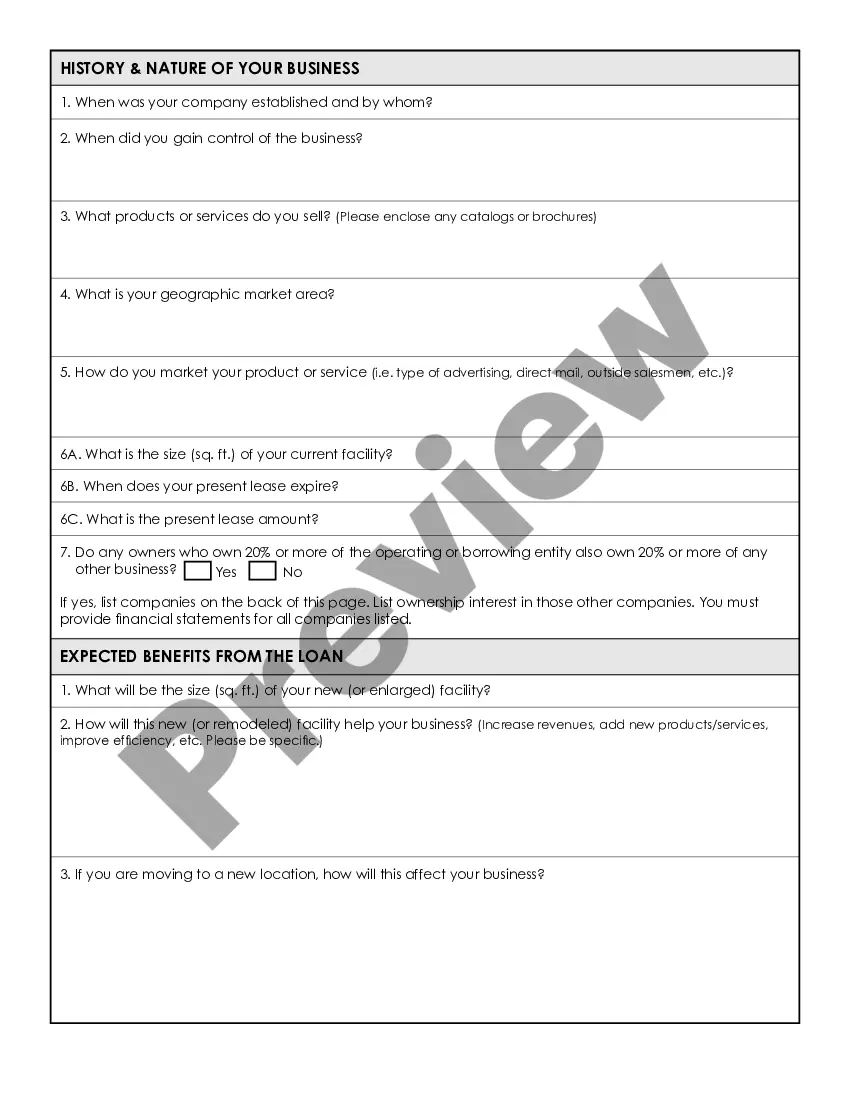

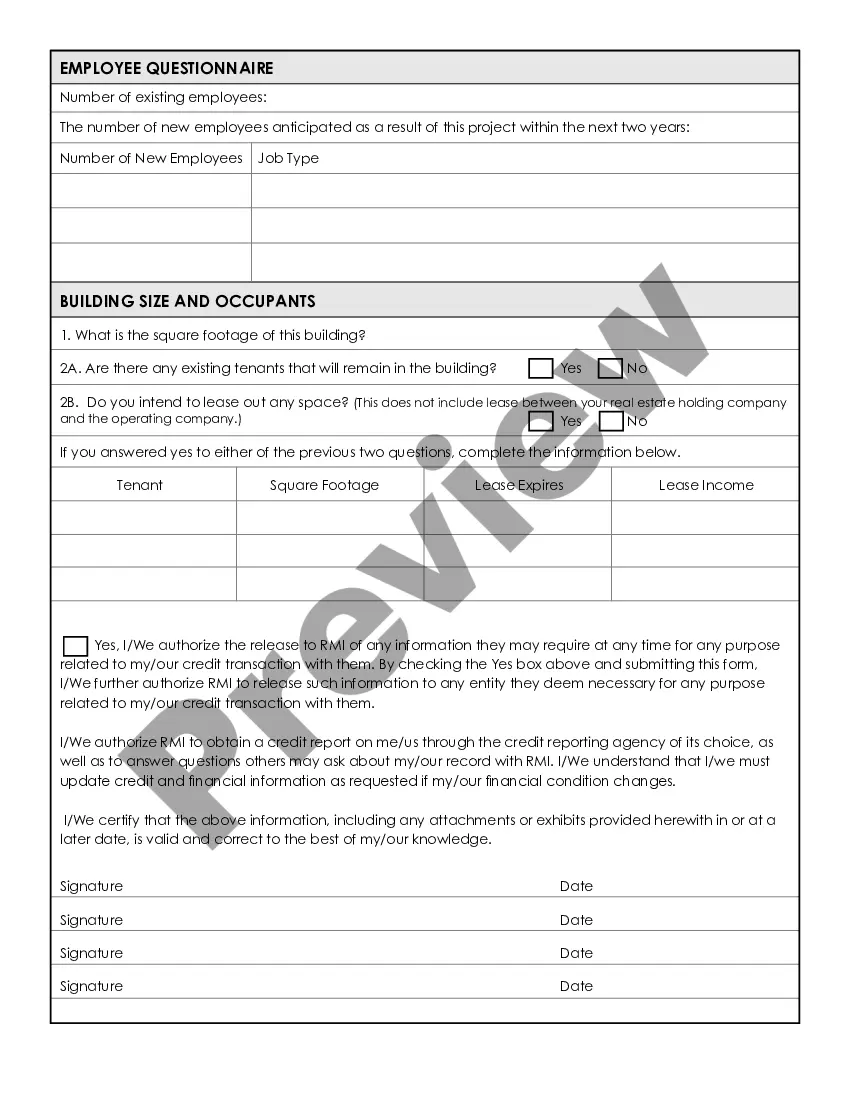

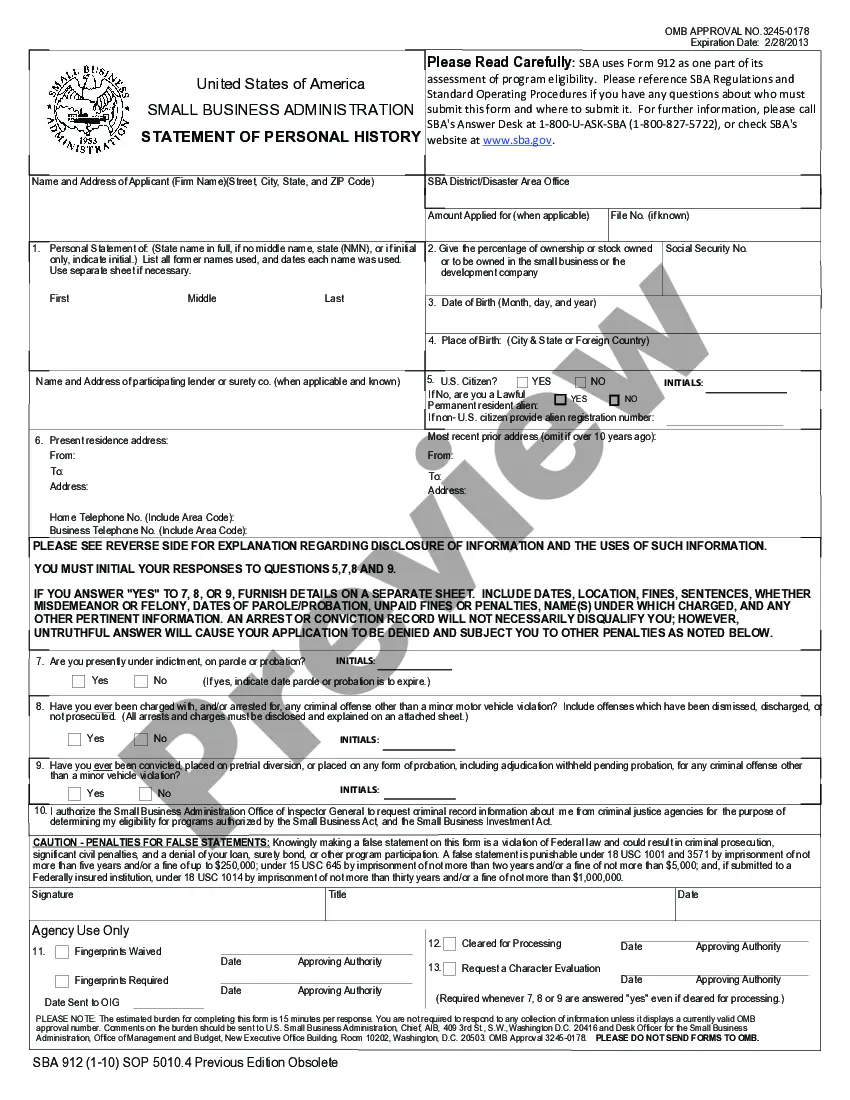

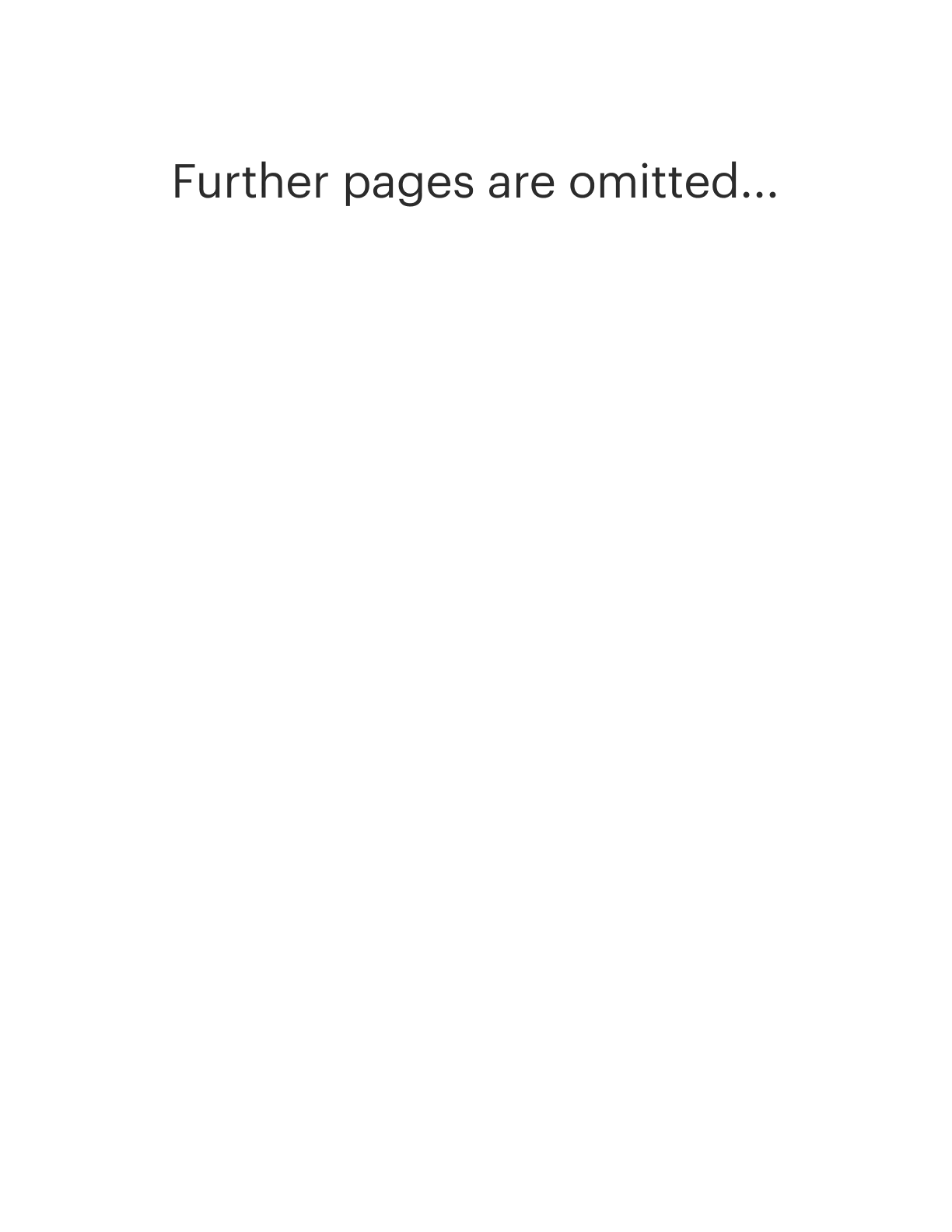

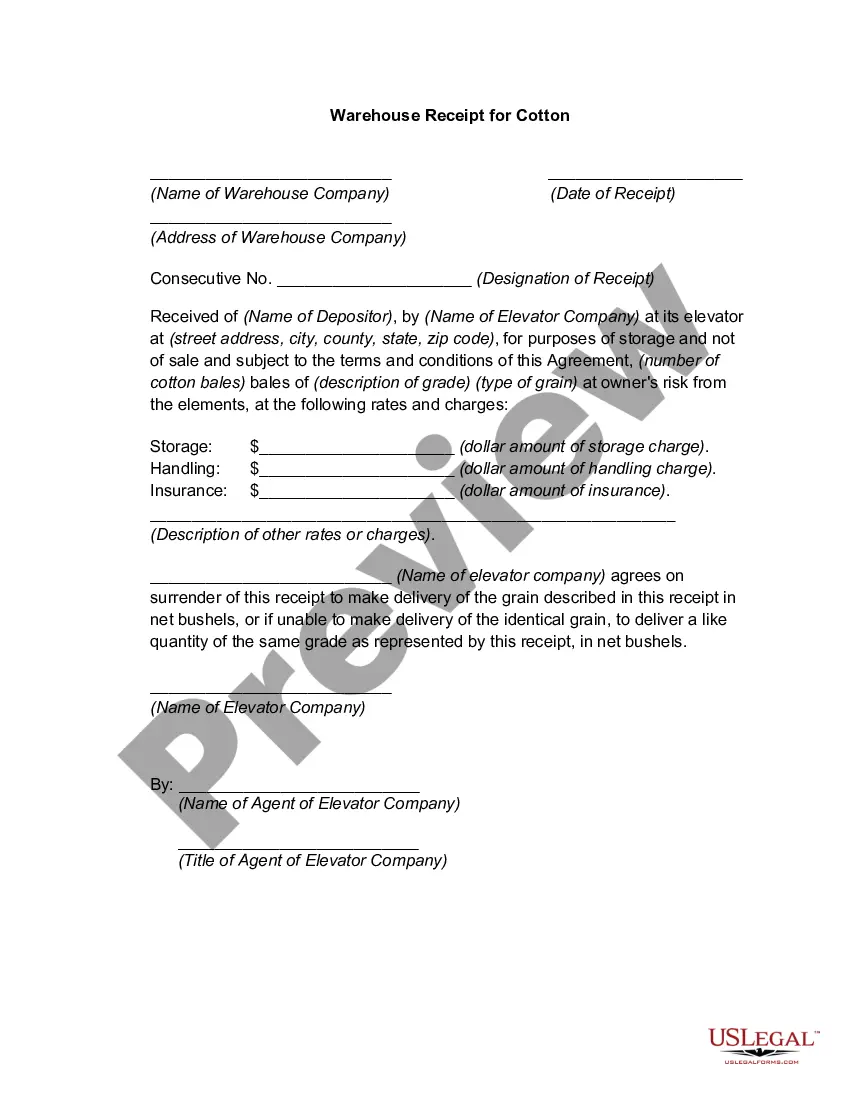

When applying for a Small Business Administration (SBA) loan in San Bernardino, California, it is crucial to familiarize yourself with the necessary application form and checklist. These documents serve as a guide to help small business owners navigate the loan application process effectively. Whether you're establishing a startup or expanding an existing business, obtaining an SBA loan can be a significant stepping stone towards success. To fulfill this goal, it is important to complete the proper forms and meet all the requirements specified by the SBA. The main SBA loan application form used in San Bernardino is known as the SBA Form 7(a) Loan Application. This comprehensive document requests detailed information about the business, its owners, financial records, and other relevant aspects. The SBA Form 7(a) requires specifics such as the business name, address, and legal structure, along with details about the ownership, management, and any affiliations. Additionally, the form asks for financial statements, tax returns, and existing debts, providing a comprehensive overview of the business's financial health. In addition to the SBA Form 7(a), there are several types of checklist forms that accompany the loan application process. These checklists ensure that all required documents are submitted correctly, minimizing delays and increasing the chances of approval. Here are some of the checklists often used in San Bernardino for different types of SBA loans: 1. SBA 7(a) Loan Application Document Checklist: This checklist outlines the necessary paperwork, including financial statements, business licenses, federal tax returns, resumes of owners and key executives, and personal financial statements. 2. SBA 504 Loan Application Document Checklist: Specifically designed for the SBA 504 loan program, this checklist requires similar information as the SBA 7(a) checklist, but also includes additional documents related to the proposed project, like construction plans, contractor estimates, and environmental impact reports. 3. SBA Disaster Loan Application Document Checklist: When seeking assistance for a disaster-related economic injury or physical damage, this checklist becomes essential. It may include items such as insurance information, ownership documentation, personal financial statements, and an explanation of adverse financial impacts caused by the disaster. 4. SBA Microloan Application Document Checklist: For small businesses in need of a microloan, this checklist helps gather essential documents such as business plans, cash flow projections, personal financial statements, and credit reports. By carefully reviewing and completing the necessary forms and checklists, San Bernardino small business owners can streamline the loan application process. It is crucial to submit all required documents accurately and provide detailed information to increase the chances of loan approval. The Small Business Administration provides these resources to ensure that businesses in San Bernardino, California, can access the financing they need to succeed and drive economic growth in the region.

San Bernardino California Small Business Administration Loan Application Form and Checklist

Description

How to fill out San Bernardino California Small Business Administration Loan Application Form And Checklist?

Creating forms, like San Bernardino Small Business Administration Loan Application Form and Checklist, to manage your legal matters is a difficult and time-consumming task. Many situations require an attorney’s participation, which also makes this task not really affordable. However, you can take your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms intended for various cases and life situations. We make sure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the San Bernardino Small Business Administration Loan Application Form and Checklist form. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is fairly straightforward! Here’s what you need to do before downloading San Bernardino Small Business Administration Loan Application Form and Checklist:

- Ensure that your document is compliant with your state/county since the rules for writing legal documents may differ from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the San Bernardino Small Business Administration Loan Application Form and Checklist isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to start using our service and download the document.

- Everything looks great on your side? Click the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment details.

- Your form is all set. You can try and download it.

It’s an easy task to locate and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!