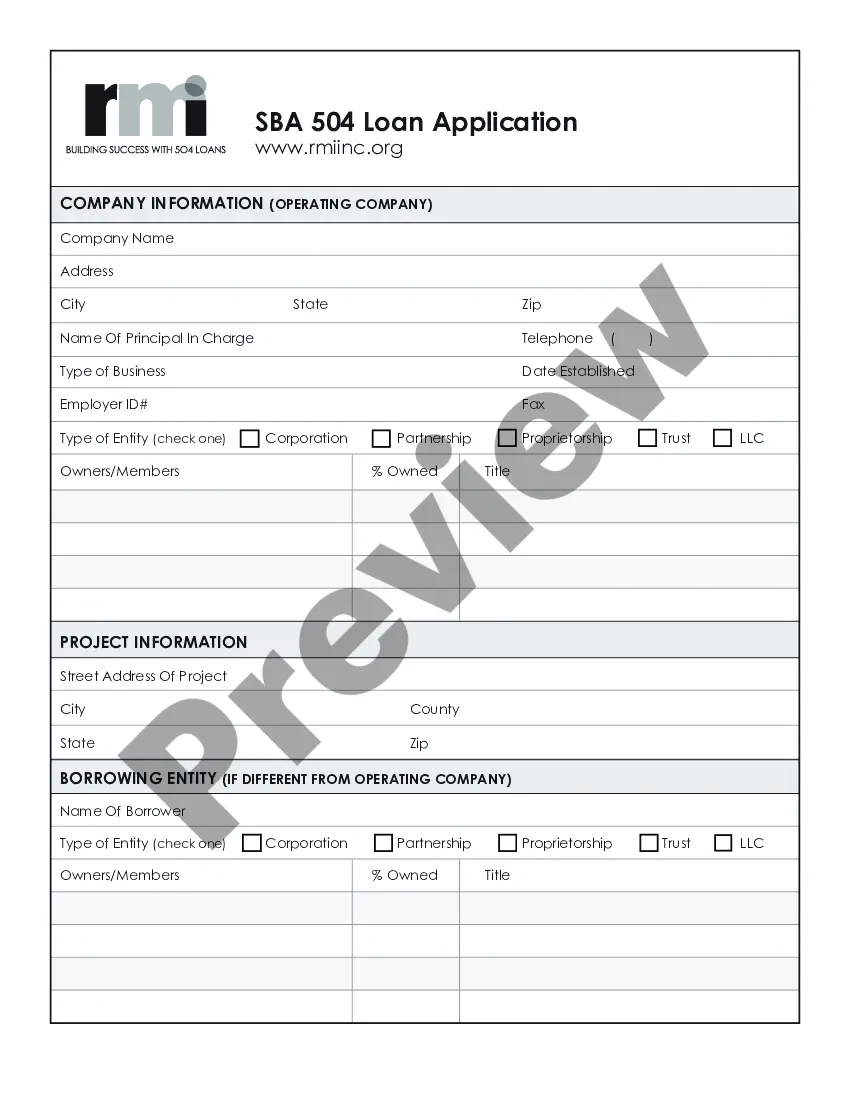

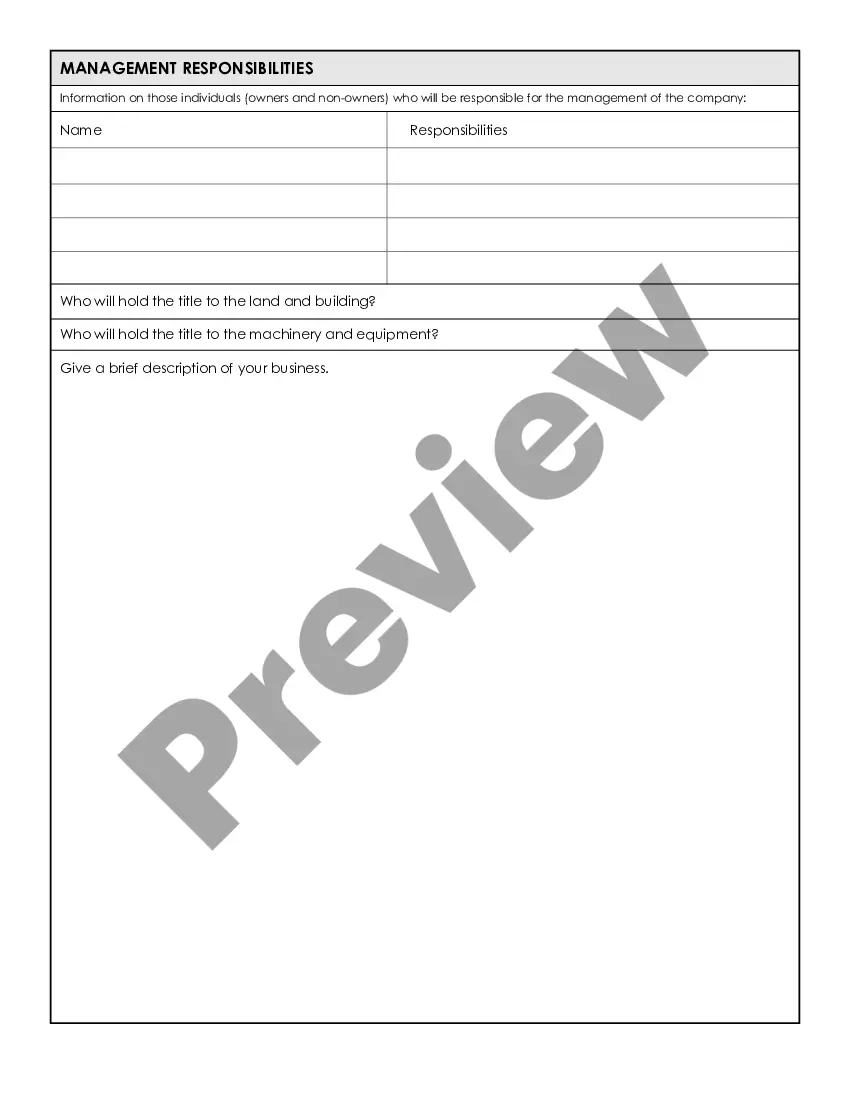

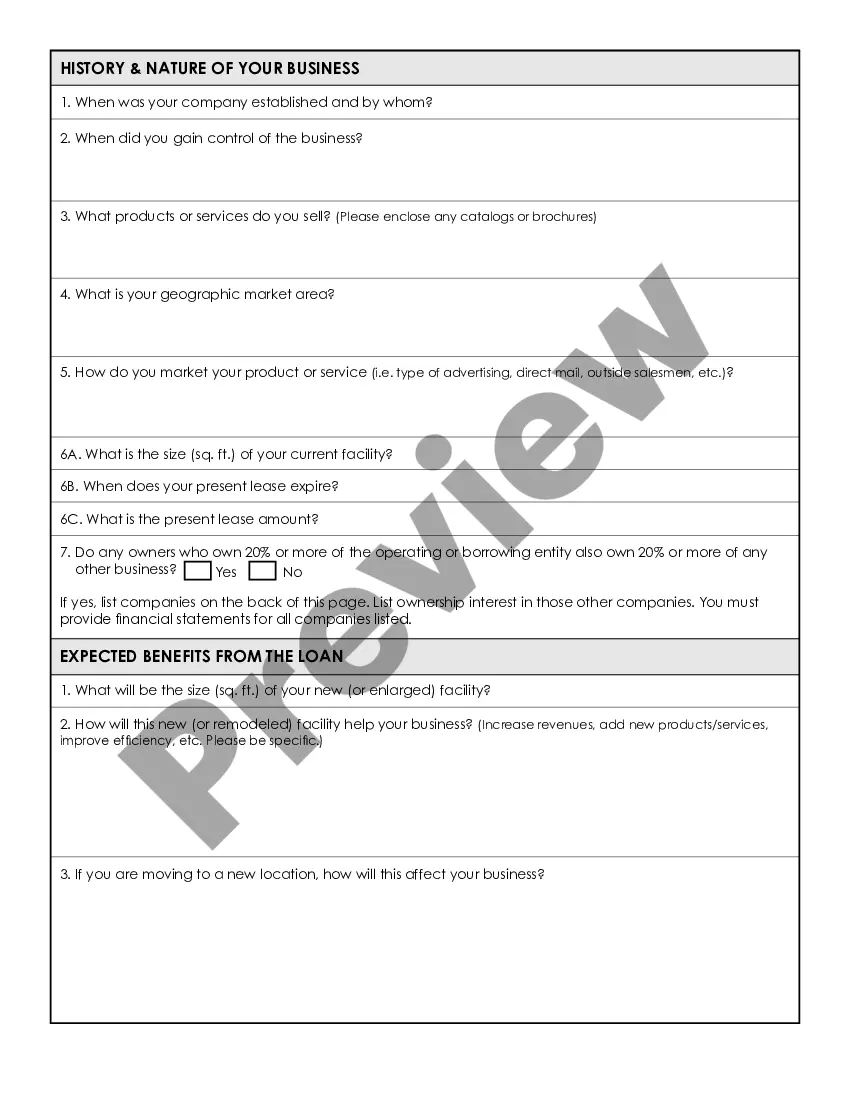

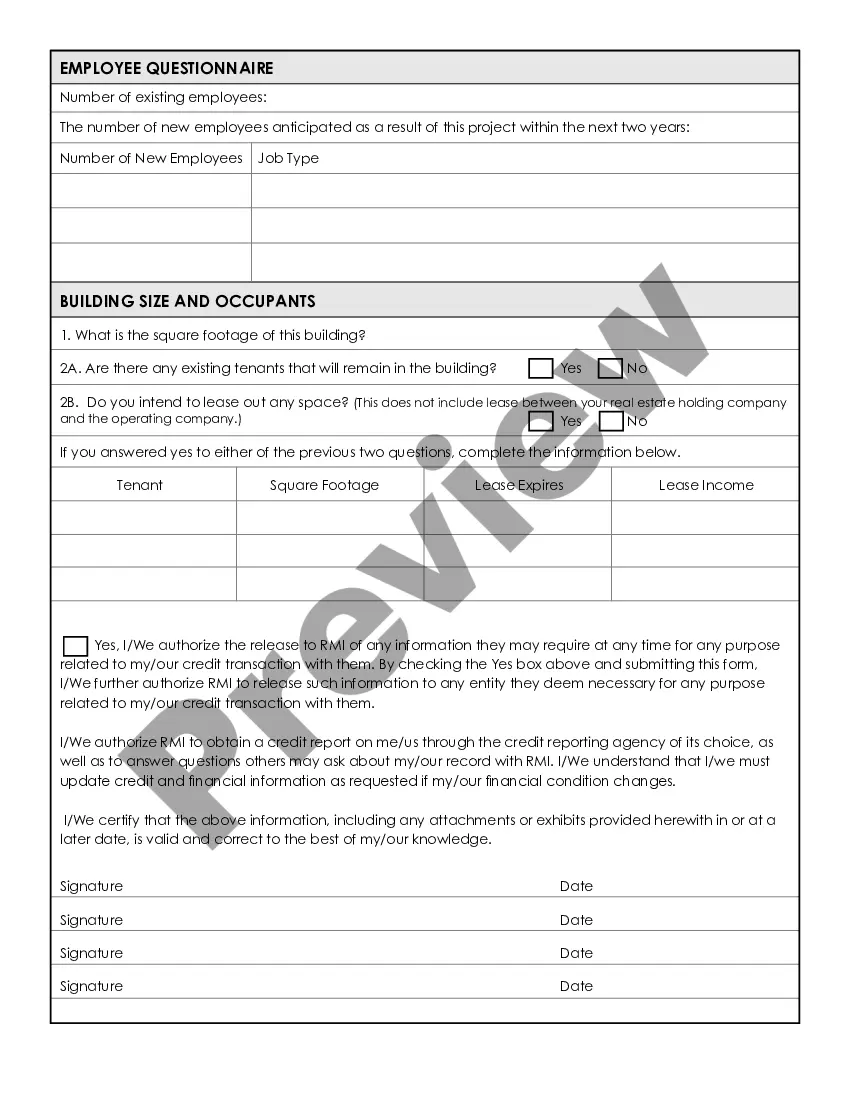

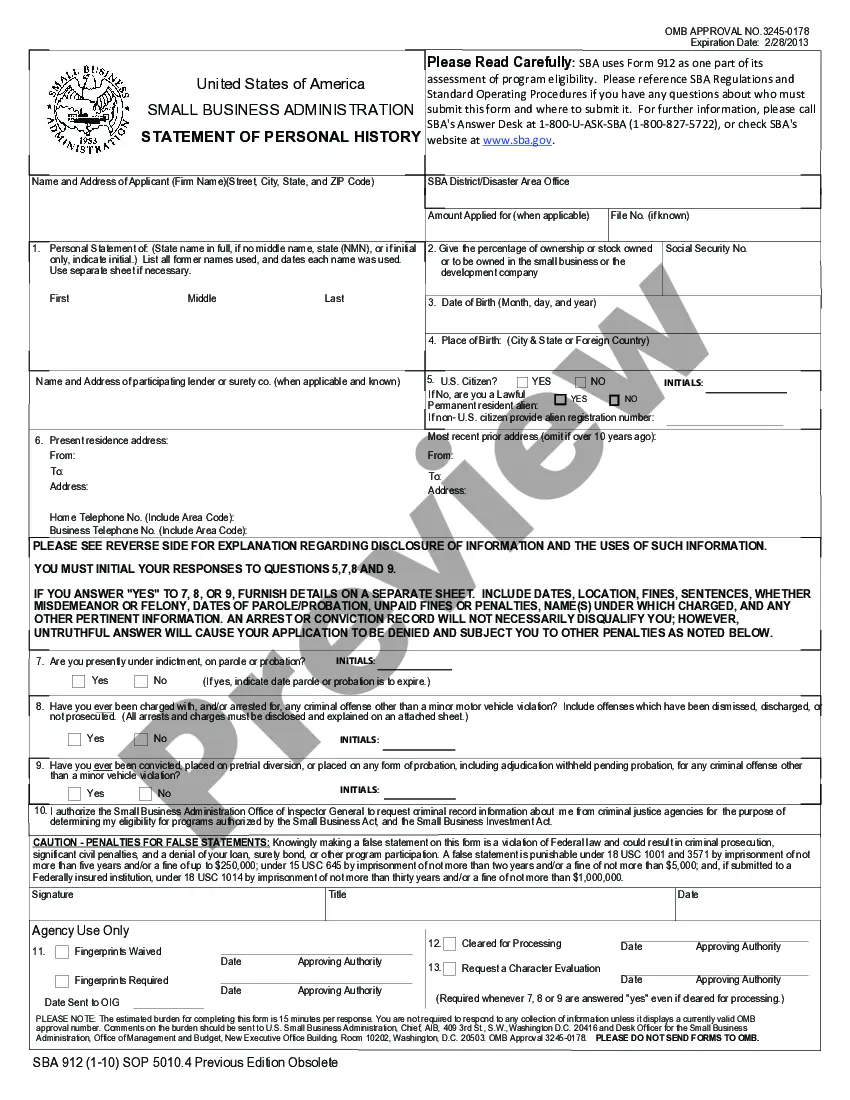

Wayne Michigan Small Business Administration Loan Application Form and Checklist are essential documents required by small business owners in Wayne, Michigan, who are seeking financial assistance through the Small Business Administration (SBA) loan program. These forms and checklists play a crucial role in ensuring a smooth loan application process and maximizing the chances of approval. The Wayne Michigan Small Business Administration Loan Application Form is a comprehensive document that captures vital details about the business, its owners, and the loan request. It requires information such as the business's legal name, address, industry, ownership structure, number of employees, annual revenue, and the purpose of the loan. Furthermore, the form also seeks details regarding the business owner's personal background, including their name, contact information, Social Security number, and financial history. The checklist associated with the loan application form helps applicants ensure they have compiled all the necessary documentation required for the SBA loan application. It acts as a reference guide for applicants, ensuring they have all the required paperwork in order, minimizing potential delays or missing information. Some essential documents typically included in the checklist are: 1. Business Plan: A detailed outline of the business's goals, marketing strategies, financial projections, and organizational structure. 2. Financial Statements: This includes the business's income statements, balance sheets, and cash flow statements, providing a snapshot of its financial health. 3. Personal and Business Tax Returns: The SBA loan application process usually necessitates the submission of personal and business tax returns for the previous three years. 4. Collateral Documentation: In cases where collateral is required for the loan, applicants must provide supporting documentation, such as property appraisals or equipment valuations. 5. Business Licenses and Permits: Copies of any applicable licenses or permits required to operate the business within Wayne, Michigan. 6. Personal Identification: Applicants need to provide a copy of their driver's license, passport, or other official identification documents. It is important to note that while this description provides a general understanding of what the Wayne Michigan Small Business Administration Loan Application Form and Checklist entail, these documents may vary slightly depending on the specific loan program or lender requirements. Some other types of SBA loan application forms that may be relevant to Wayne, Michigan, include the SBA 7(a) Loan Application and the SBA CDC/504 Loan Application, each tailored to the specific loan program. In conclusion, the Wayne Michigan Small Business Administration Loan Application Form and Checklist are vital tools in the loan application process, helping small business owners in Wayne, Michigan, to gather and organize their information effectively. By submitting a complete and accurate application, entrepreneurs can increase their chances of securing the financial support necessary to grow and thrive.

Wayne Michigan Small Business Administration Loan Application Form and Checklist

Description

How to fill out Wayne Michigan Small Business Administration Loan Application Form And Checklist?

Creating documents, like Wayne Small Business Administration Loan Application Form and Checklist, to take care of your legal matters is a challenging and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task expensive. However, you can get your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents crafted for various scenarios and life circumstances. We ensure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Wayne Small Business Administration Loan Application Form and Checklist template. Simply log in to your account, download the template, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before downloading Wayne Small Business Administration Loan Application Form and Checklist:

- Make sure that your template is specific to your state/county since the regulations for creating legal papers may differ from one state another.

- Discover more information about the form by previewing it or going through a quick description. If the Wayne Small Business Administration Loan Application Form and Checklist isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to start utilizing our service and get the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment details.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to locate and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!