Harris Texas Guaranty of a Lease is a legal document that serves as a binding agreement between a tenant (the guarantor) and a landlord (the beneficiary), typically seen in commercial real estate transactions. This guarantee reinforces the tenant's commitment to fulfill the terms and conditions mentioned in a lease agreement, ensuring that the landlord will receive timely rent payments and adherence to other lease obligations. Key phrases: Harris Texas Guaranty of a Lease, commercial real estate transactions, lease agreement, tenant commitment, rent payments, lease obligations. This guaranty comes into play when the landlord desires additional security beyond the tenant's obligations under the lease. It provides the landlord with recourse to the guarantor's assets if the tenant fails to meet their lease requirements, such as defaulting on rent payments, violating lease terms, or abandoning the property. The Harris Texas Guaranty of a Lease minimizes the landlord's financial risks and safeguards their investment. Different types of Harris Texas Guaranty of a Lease may include: 1. Full Guaranty: In this type, the guarantor is responsible for fulfilling all lease obligations, including payment of rent, maintenance costs, and any legal fees that arise from violations. 2. Limited Guaranty: As the name suggests, this type restricts the guarantor's liability to specific lease obligations or a certain duration. For example, the guarantor may only be responsible for rent payments for the initial term of the lease or may exclude responsibilities related to property maintenance. 3. Subsidiary Guaranty: This type involves a subsidiary company guaranteeing the lease obligations of the tenant. It acts as an additional layer of protection for the landlord, ensuring that the parent company or the guarantor remains accountable. 4. Conditional Guaranty: This form of guaranty imposes specific conditions or triggers before the guarantor becomes liable. For instance, the guarantor may only be responsible in case of a default by the tenant or if the property's occupancy falls below a certain level. The Harris Texas Guaranty of a Lease is a vital tool that grants landlords peace of mind, particularly when dealing with tenants with limited financial strength or uncertain credit histories. It helps protect the landlord's investment and allows for recourse in case the tenant fails to fulfill their lease obligations. In conclusion, the Harris Texas Guaranty of a Lease is a legally binding agreement that strengthens the landlord's position by ensuring tenant compliance with lease obligations. Whether it's a full, limited, subsidiary, or conditional guaranty, each type offers different degrees of protection and liability to both parties involved in the lease agreement.

Harris Texas Guaranty of a Lease

Description

How to fill out Harris Texas Guaranty Of A Lease?

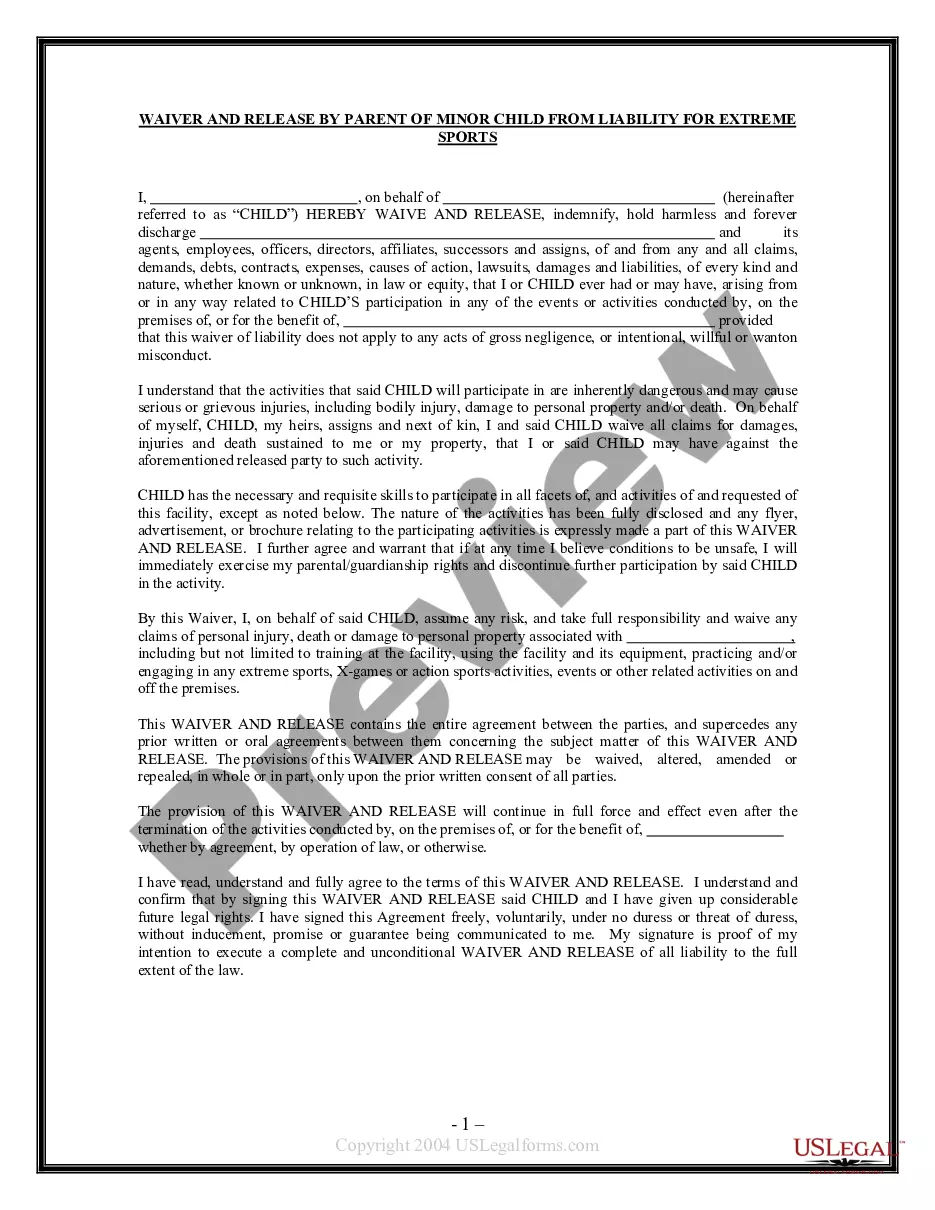

Preparing legal documentation can be burdensome. Besides, if you decide to ask an attorney to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Harris Guaranty of a Lease, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Consequently, if you need the latest version of the Harris Guaranty of a Lease, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Harris Guaranty of a Lease:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Harris Guaranty of a Lease and download it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

A lease guarantee is an official agreement signed by the landlord, tenant, and in addition, a third party who meets the monetary requirements of the landlord. A lease guarantor serves as a financial intermediary and is responsible for the tenant's defaults, which protects the tenant from eviction.

Guarantor unconditionally guarantees payment to Lender of all amounts owing under the Note. This Guarantee remains in effect until the Note is paid in full. Guarantor must pay all amounts due under the Note when Lender makes written demand upon Guarantor.

The most important difference between a cosigner and a guarantor is that a cosigner is immediately responsible for paying rent, just as the tenant is. A guarantor is only responsible for paying rent when the tenant fails to do so themselves.

You might need a 'guarantor' so you can rent a place to live. A guarantor is someone who agrees to pay your rent if you don't pay it, for example a parent or close relative. If you don't pay your landlord what you owe them, they can ask your guarantor to pay instead.

Consult with an attorney on what your options are. Show proof of consistent revenues and profits (P&L statements, balance sheets, etc) Ask for an amendment to the lease after 12-24 months. Ask for the guarantee to expire after 12-24 months as long as you have paid rent payments on time.

A personal guarantee can be enforced the same way as any debt. If the business owner does not pay, the creditor can bring a lawsuit to receive a judgment and levy the owner's personal assets to cover the debt. The exact terms of a personal guarantee specify a creditor's options under the guarantee.

However, there are steps you can take; Take Out Personal Guarantee Insurance.Renegotiating The Contract Upon Which the Personal Guarantee Is Attached.Go into an Individual Voluntary Arrangement (IVA)Go Bankrupt.

A personal guarantee puts the tenant's own assets such as real estate, savings, or other valuables on the line should their business not be in a position to pay rent or other lease obligations.

Show proof of consistent revenues and profits (P&L statements, balance sheets, etc) Ask for an amendment to the lease after 12-24 months. Ask for the guarantee to expire after 12-24 months as long as you have paid rent payments on time. Try to renegotiate the guarantee terms.

Unless you have negotiated a lease termination clause that hinges on the closing of your business, a property lease will continue to be legally valid even if you cease business operations.