Miami-Dade Florida Guaranty of a Lease is a legal agreement that provides protection to landlords in the event that tenants are unable to fulfill their lease obligations. This guarantee serves as a reassurance to landlords that they will receive the agreed-upon rent and other lease-related payments even if the tenant defaults on their obligations. It is an essential document for landlords, property managers, and real estate investors to mitigate the risks associated with tenant defaults. The Miami-Dade Florida Guaranty of a Lease encompasses various aspects and may come in different types, designed to cater to specific leasing scenarios. Some common types of Miami-Dade Florida Guaranty of a Lease include: 1. Full Guaranty: A full guaranty holds the guarantor fully liable for all aspects of the lease, including rent, damages, and other costs incurred due to tenant defaults. This type of guaranty offers landlords comprehensive protection against potential losses. 2. Limited Guaranty: A limited guaranty, on the other hand, limits the guarantor's liability to specific lease obligations or a certain period. Landlords can utilize this type of guaranty when dealing with tenants with questionable creditworthiness or uncertainty regarding long-term lease compliance. 3. Financial Guaranty: A financial guaranty is often used when tenants are unable to provide sufficient financial documentation or creditworthiness. In such cases, a third-party guarantor, such as a parent company or a financial institution, steps in to guarantee the lease to instill confidence in the landlord. 4. Continuing Guaranty: A continuing guaranty ensures that the guarantor's obligations extend beyond the initial lease term. This type of guaranty provides landlords with long-term protection, particularly in cases where lease renewals or extensions occur. 5. Conditional Guaranty: A conditional guaranty is a type of guaranty that becomes effective only under predetermined conditions. For instance, it may only be activated after the tenant fails to make rent payments for a specified number of months. This type of guaranty offers landlords an extra layer of protection while minimizing the guarantor's liability. Miami-Dade Florida Guaranty of a Lease serves as an invaluable tool in landlord-tenant relationships, providing landlords with a sense of security and financial protection. By choosing the appropriate type of guaranty based on the specific circumstances, landlords can safeguard their interests and minimize potential risks associated with tenant defaults or lease violations. It is recommended to consult with legal professionals well-versed in Miami-Dade Florida laws and regulations to ensure the drafting and execution of an effective guaranty of a lease.

Miami-Dade Florida Guaranty of a Lease

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-02996BG

Format:

Word;

Rich Text

Instant download

Description

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so.

Miami-Dade Florida Guaranty of a Lease is a legal agreement that provides protection to landlords in the event that tenants are unable to fulfill their lease obligations. This guarantee serves as a reassurance to landlords that they will receive the agreed-upon rent and other lease-related payments even if the tenant defaults on their obligations. It is an essential document for landlords, property managers, and real estate investors to mitigate the risks associated with tenant defaults. The Miami-Dade Florida Guaranty of a Lease encompasses various aspects and may come in different types, designed to cater to specific leasing scenarios. Some common types of Miami-Dade Florida Guaranty of a Lease include: 1. Full Guaranty: A full guaranty holds the guarantor fully liable for all aspects of the lease, including rent, damages, and other costs incurred due to tenant defaults. This type of guaranty offers landlords comprehensive protection against potential losses. 2. Limited Guaranty: A limited guaranty, on the other hand, limits the guarantor's liability to specific lease obligations or a certain period. Landlords can utilize this type of guaranty when dealing with tenants with questionable creditworthiness or uncertainty regarding long-term lease compliance. 3. Financial Guaranty: A financial guaranty is often used when tenants are unable to provide sufficient financial documentation or creditworthiness. In such cases, a third-party guarantor, such as a parent company or a financial institution, steps in to guarantee the lease to instill confidence in the landlord. 4. Continuing Guaranty: A continuing guaranty ensures that the guarantor's obligations extend beyond the initial lease term. This type of guaranty provides landlords with long-term protection, particularly in cases where lease renewals or extensions occur. 5. Conditional Guaranty: A conditional guaranty is a type of guaranty that becomes effective only under predetermined conditions. For instance, it may only be activated after the tenant fails to make rent payments for a specified number of months. This type of guaranty offers landlords an extra layer of protection while minimizing the guarantor's liability. Miami-Dade Florida Guaranty of a Lease serves as an invaluable tool in landlord-tenant relationships, providing landlords with a sense of security and financial protection. By choosing the appropriate type of guaranty based on the specific circumstances, landlords can safeguard their interests and minimize potential risks associated with tenant defaults or lease violations. It is recommended to consult with legal professionals well-versed in Miami-Dade Florida laws and regulations to ensure the drafting and execution of an effective guaranty of a lease.

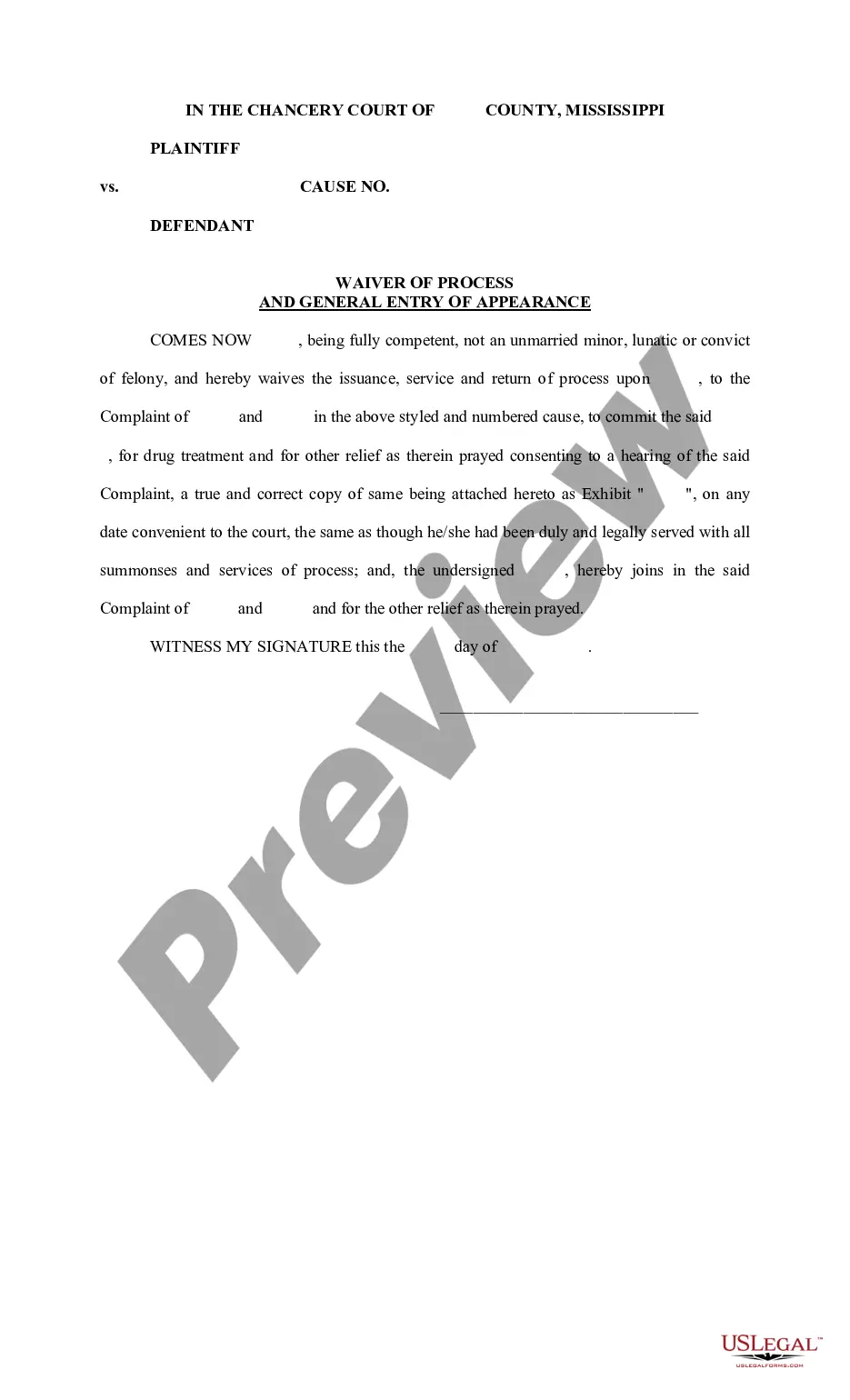

Free preview