Bexar Texas Membership Certificate of Nonprofit or Non Stock Corporation

Description

How to fill out Bexar Texas Membership Certificate Of Nonprofit Or Non Stock Corporation?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to create some of them from the ground up, including Bexar Membership Certificate of Nonprofit or Non Stock Corporation, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different types varying from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find detailed materials and guides on the website to make any tasks associated with paperwork execution simple.

Here's how you can locate and download Bexar Membership Certificate of Nonprofit or Non Stock Corporation.

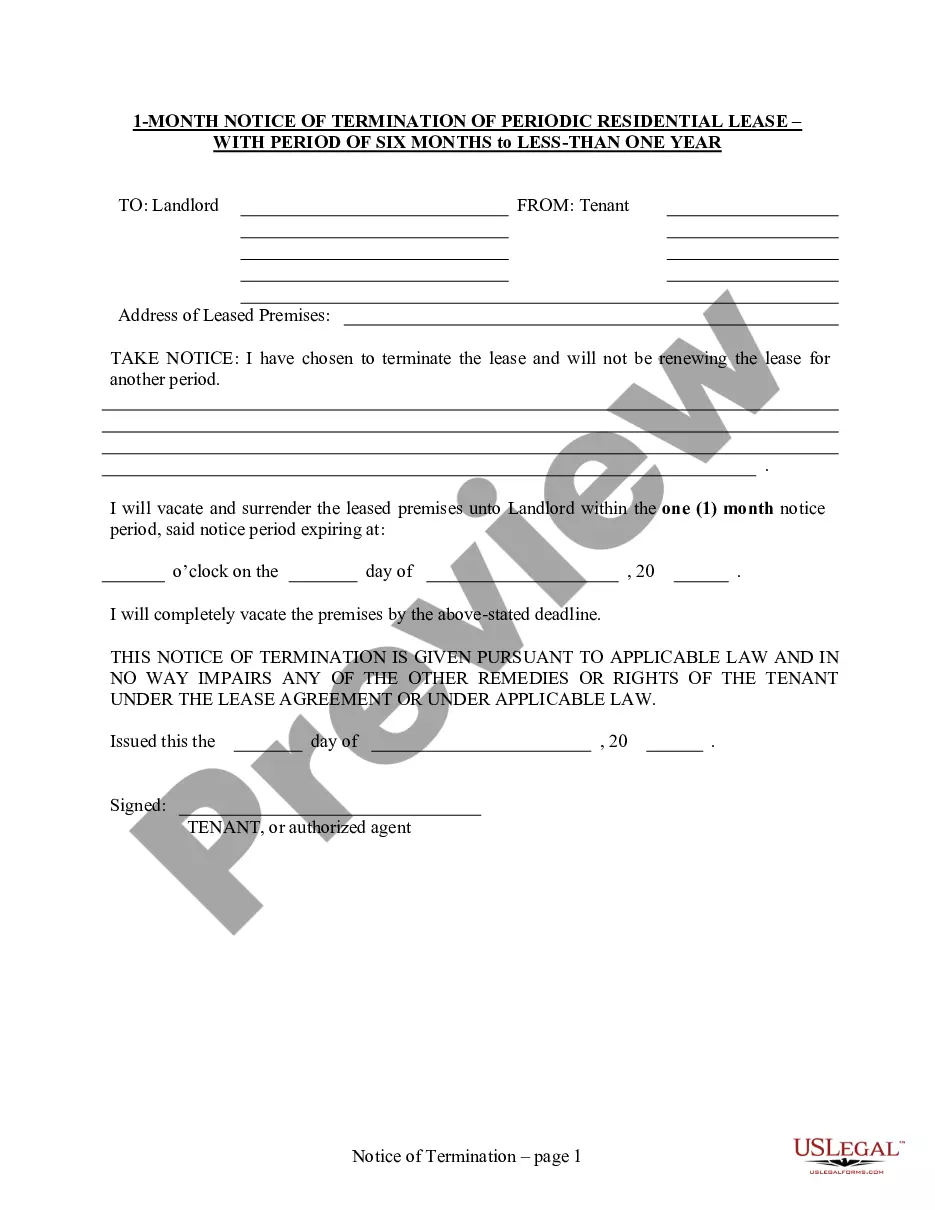

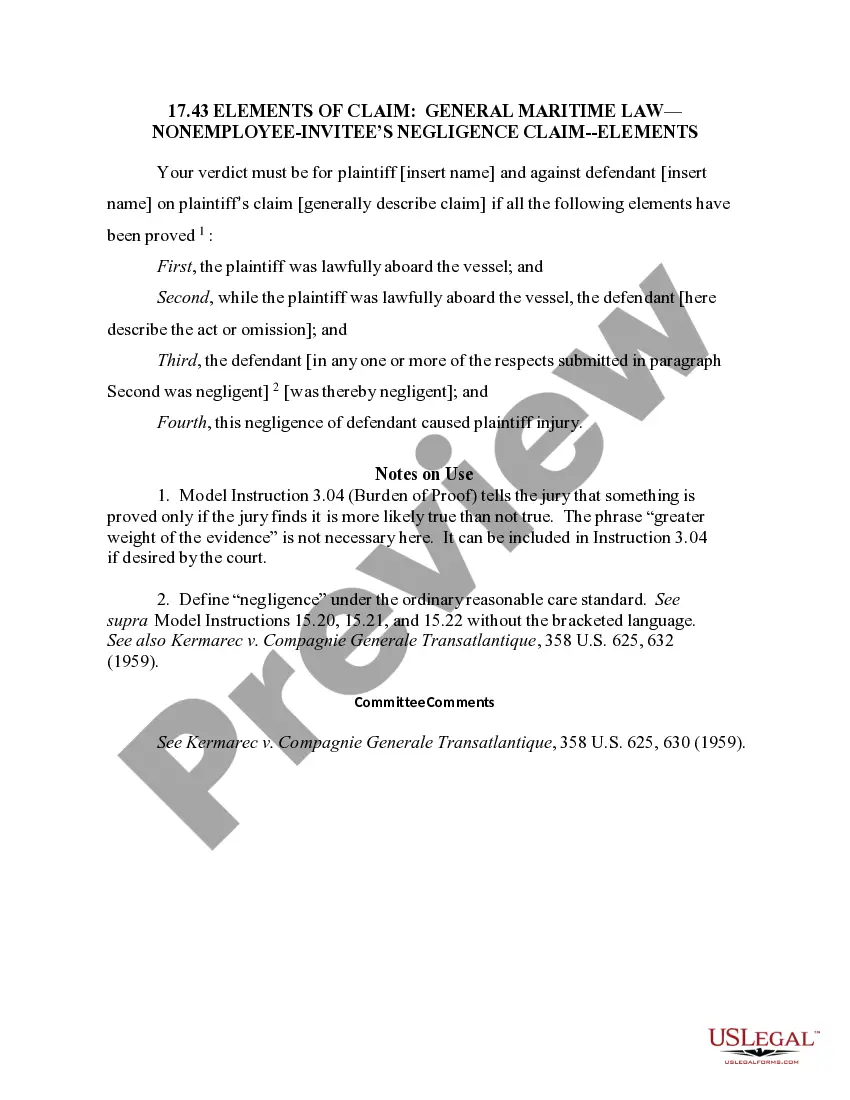

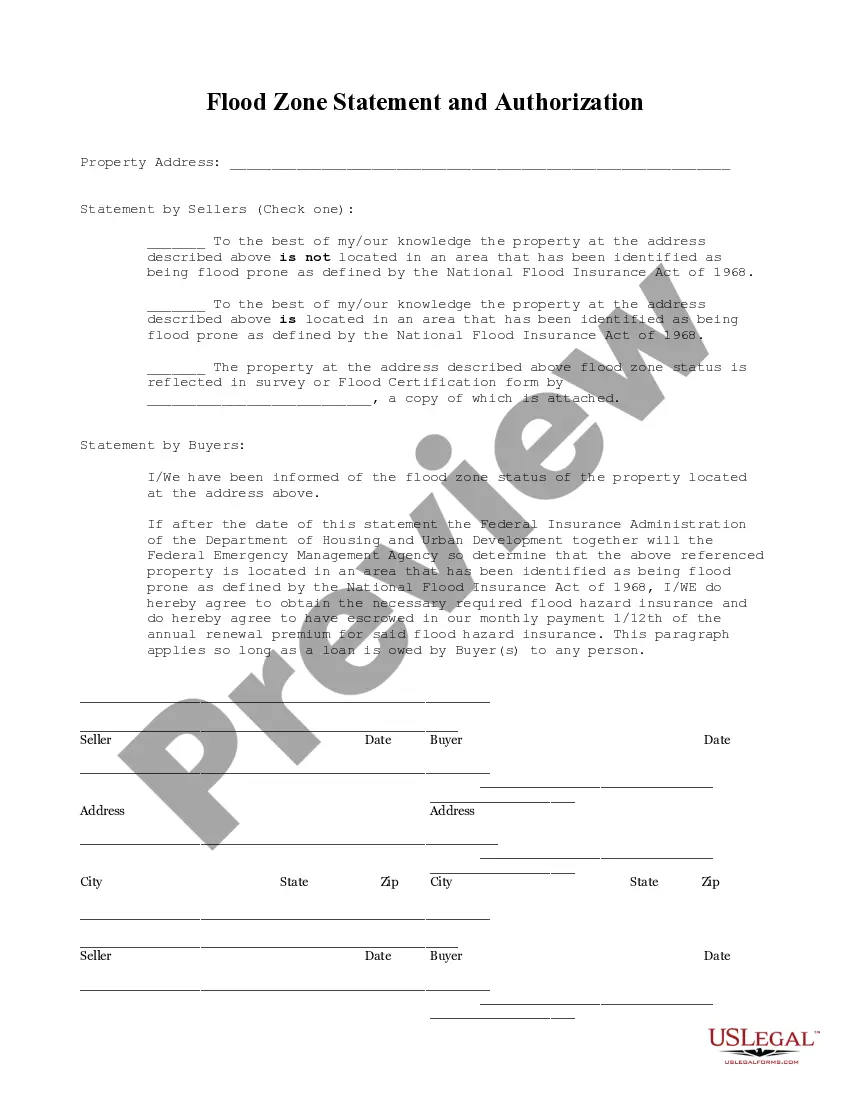

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the legality of some documents.

- Check the similar forms or start the search over to find the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Bexar Membership Certificate of Nonprofit or Non Stock Corporation.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Bexar Membership Certificate of Nonprofit or Non Stock Corporation, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer entirely. If you have to cope with an extremely challenging situation, we advise using the services of an attorney to examine your form before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Join them today and purchase your state-specific documents with ease!

Form popularity

FAQ

Types of Nonprofits TypeDescription501(c)(4)Civic Leagues, Social Welfare Organizations, and Local Associations of Employees501(c)(5)Labor, Agricultural, and Horticultural Organizations501(c)(6)Business Leagues, Chambers of Commerce, Real Estate Boards, etc.501(c)(7)Social and Recreational Clubs23 more rows ?

There Are Three Main Types of Charitable Organizations Most organizations are eligible to become one of the three main categories, including public charities, private foundations and private operating foundations.

As per IRS, 501(c)3 is a nonprofit organization for religious, charitable, scientific, and educational purposes. Donations to 501(c)3 are tax-deductible. Whereas on the other hand, 501(c)4 is a social welfare group, and donations to 501(c)4 are not tax-deductible.

A nonprofit corporation is an organization formed to serve the public good, such as for charitable, religious, educational, or other public service reasons, rather than purely for the creation of profit itself, as businesses aim to do.

Can I form a nonprofit LLC in Texas? The Texas Business Organizations Code (BOC) does not recognize the term nonprofit LLC as describing a specific type of entity, but the BOC does allow for the formation of an LLC with a nonprofit purpose.

There Are Three Main Types of Charitable Organizations The IRS designates eight categories of organizations that may be allowed to operate as 501(c)(3) entities. Most organizations are eligible to become one of the three main categories, including public charities, private foundations and private operating foundations.

The corporation is the most common, and usually best, form for a nonprofit organization. Some of the benefits follow. There is a small price to pay for these benefits: the organization must register with a state and must make periodic filings and disclosures. There are also filing fees, but these are usually small.

501(c)(3) charities are the most popular type of nonprofit. There are more than 1.5 million registered charitable organizations in the United States. 501(c)(3) organizations are funded primarily through charitable donations and government grants.

Types of not-for-profit organizations Charitable organizations.Social advocacy groups.Foundations.Civil leagues, social welfare organizations and local employee associations.Trade and professional associations.Social and recreational clubs.Fraternal societies.Employee beneficiary associations.

IRS 557 provides details on the different categories of nonprofit organizations. Public charities, foundations, social advocacy groups, and trade organizations are common types of nonprofit organization.