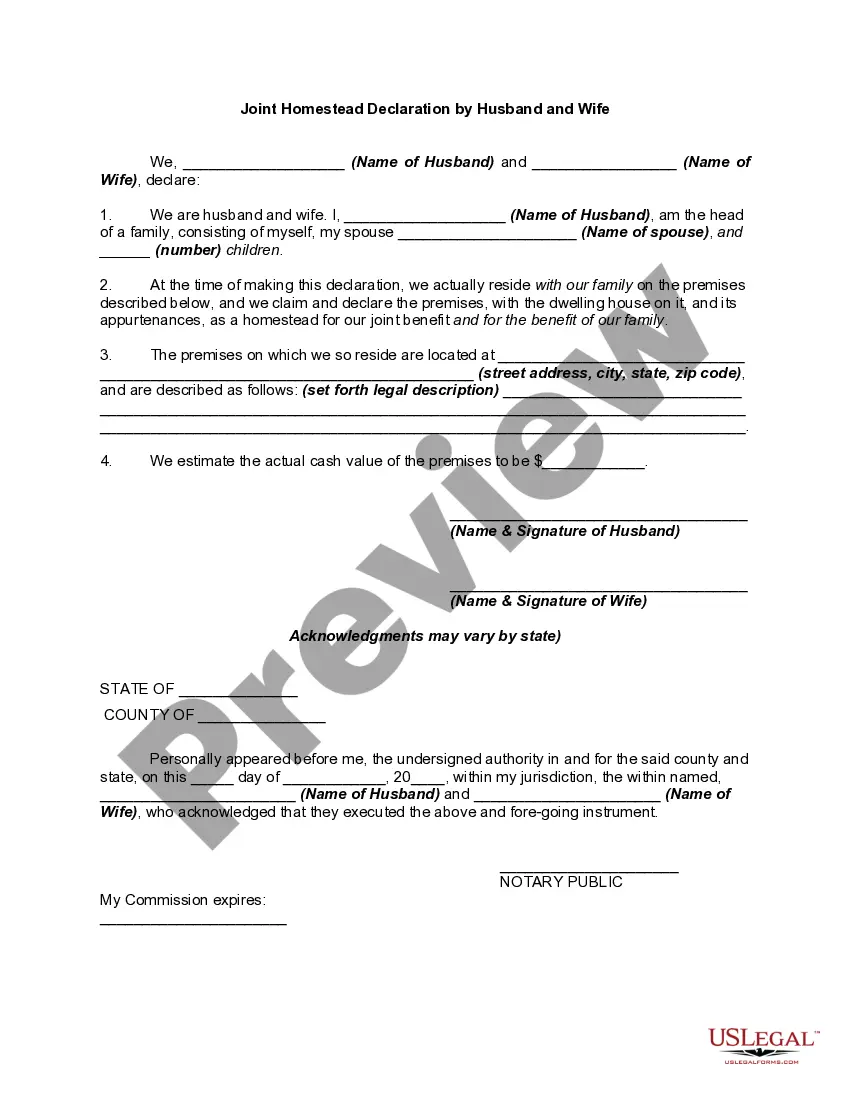

Homestead laws are primarily governed by state laws, which vary by state. They may deal with such matters as the ability of creditors to attach a person's home, the amount of real estate taxes owed on the home, or the ability of the homeowner to mortgage or devise the home under a will, among other issues.

For example, in one state, when you record a Declaration of Homestead, the equity in your home is protected up to a statutory amount. In another state, there is no statutory limit. This protection precludes seizure or forced sale of your residence by general creditor claims (unpaid medical bills, bankruptcy, charge card debts, business & personal loans, accidents, etc.). State laws often provide a homestead exemption for older citizens so that a certain dollar amount of the home's value is exempt from real estate taxes. Other laws may provide rules for a person's ability to mortgage or devise the homestead. Local laws should be consulted for requirements in your area.

The Miami-Dade Florida Joint Homestead Declaration is a legal document that provides protection and benefits to married couples who own a homestead property in Miami-Dade County, Florida. This declaration allows married couples to claim their property as a homestead and enjoy various rights and exemptions provided by the state. Keywords: Miami-Dade Florida, Joint Homestead Declaration, husband and wife, married couples, homestead property, protection, benefits, rights, exemptions, state. There are different types of Miami-Dade Florida Joint Homestead Declaration by Husband and Wife, specifically: 1. Basic Joint Homestead Declaration: This is the standard form that allows married couples to declare their homestead property and claim certain benefits and exemptions offered by Florida law. It provides protection against creditors, limited property tax increases, and restrictions on the sale of the property without the consent of both spouses. 2. Joint Homestead Declaration with Asset Protection Trust: This type of declaration adds a layer of asset protection by establishing a trust. The trust holds the homestead property, providing further safeguard against potential creditors and claims. This option is suitable for couples with significant assets and a desire for enhanced protection. 3. Joint Homestead Declaration for Estate Planning Purposes: This variant focuses on planning for the future. It includes provisions related to the distribution of the homestead property upon the death of either spouse, ensuring that the surviving spouse is adequately provided for and that the property passes smoothly to the intended heirs or beneficiaries. 4. Joint Homestead Declaration for Tax Planning: For couples looking to minimize their tax liabilities, this type of declaration incorporates specific provisions that optimize the tax advantages granted to homestead properties within the Miami-Dade County area. These provisions may vary depending on individual circumstances and the current tax laws in place. In all cases, it is essential for couples to consult with a qualified attorney specializing in real estate and estate planning to ensure the proper completion and filing of the Miami-Dade Florida Joint Homestead Declaration. This legal document carries significant weight and can have long-lasting implications on property ownership and protection for married couples residing in Miami-Dade County, Florida.The Miami-Dade Florida Joint Homestead Declaration is a legal document that provides protection and benefits to married couples who own a homestead property in Miami-Dade County, Florida. This declaration allows married couples to claim their property as a homestead and enjoy various rights and exemptions provided by the state. Keywords: Miami-Dade Florida, Joint Homestead Declaration, husband and wife, married couples, homestead property, protection, benefits, rights, exemptions, state. There are different types of Miami-Dade Florida Joint Homestead Declaration by Husband and Wife, specifically: 1. Basic Joint Homestead Declaration: This is the standard form that allows married couples to declare their homestead property and claim certain benefits and exemptions offered by Florida law. It provides protection against creditors, limited property tax increases, and restrictions on the sale of the property without the consent of both spouses. 2. Joint Homestead Declaration with Asset Protection Trust: This type of declaration adds a layer of asset protection by establishing a trust. The trust holds the homestead property, providing further safeguard against potential creditors and claims. This option is suitable for couples with significant assets and a desire for enhanced protection. 3. Joint Homestead Declaration for Estate Planning Purposes: This variant focuses on planning for the future. It includes provisions related to the distribution of the homestead property upon the death of either spouse, ensuring that the surviving spouse is adequately provided for and that the property passes smoothly to the intended heirs or beneficiaries. 4. Joint Homestead Declaration for Tax Planning: For couples looking to minimize their tax liabilities, this type of declaration incorporates specific provisions that optimize the tax advantages granted to homestead properties within the Miami-Dade County area. These provisions may vary depending on individual circumstances and the current tax laws in place. In all cases, it is essential for couples to consult with a qualified attorney specializing in real estate and estate planning to ensure the proper completion and filing of the Miami-Dade Florida Joint Homestead Declaration. This legal document carries significant weight and can have long-lasting implications on property ownership and protection for married couples residing in Miami-Dade County, Florida.