Homestead laws are primarily governed by state laws, which vary by state. They may deal with such matters as the ability of creditors to attach a person's home, the amount of real estate taxes owed on the home, or the ability of the homeowner to mortgage or devise the home under a will, among other issues.

For example, in one state, when you record a Declaration of Homestead, the equity in your home is protected up to a statutory amount. In another state, there is no statutory limit. This protection precludes seizure or forced sale of your residence by general creditor claims (unpaid medical bills, bankruptcy, charge card debts, business & personal loans, accidents, etc.). State laws often provide a homestead exemption for older citizens so that a certain dollar amount of the home's value is exempt from real estate taxes. Other laws may provide rules for a person's ability to mortgage or devise the homestead. Local laws should be consulted for requirements in your area.

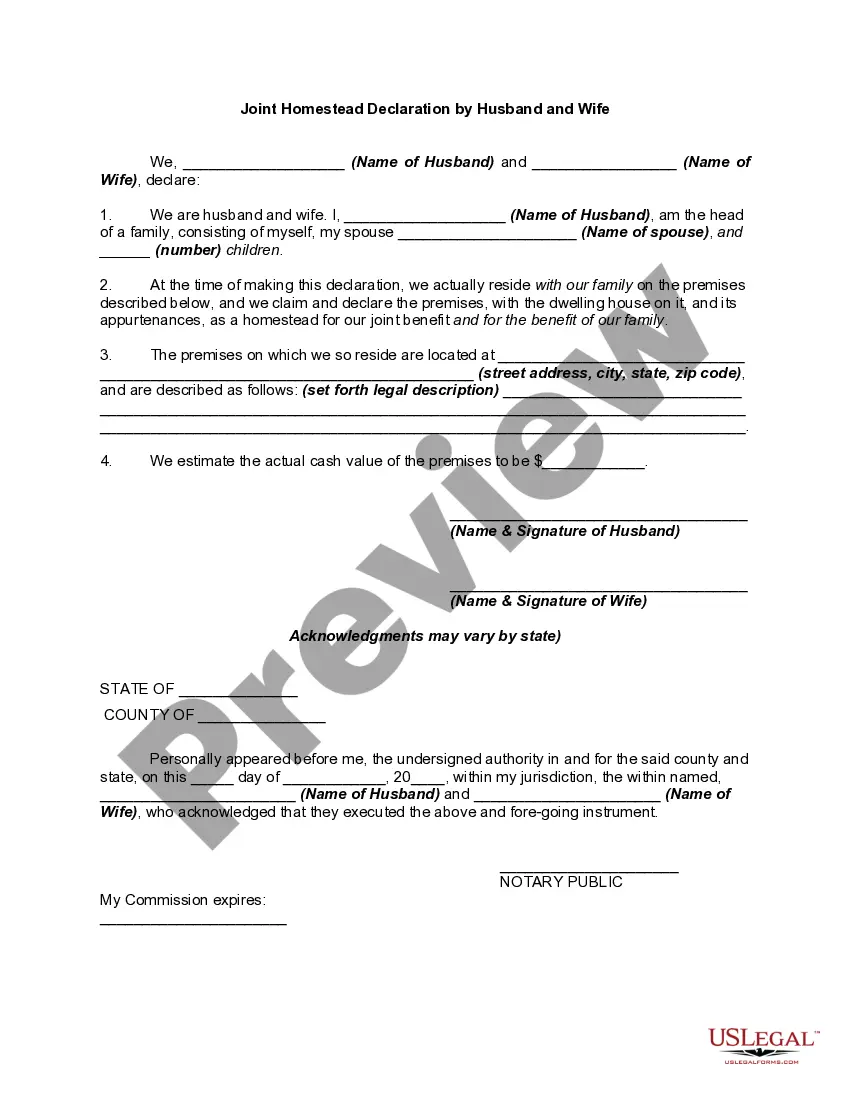

The Nassau New York Joint Homestead Declaration by Husband and Wife is a legal document that allows married couples residing in Nassau County, New York, to declare their primary residence as a homestead. This declaration provides additional asset protection to the couple, ensuring that their home is safeguarded against certain creditors and legal claims. By filing a Joint Homestead Declaration, husbands and wives can jointly affirm that their Nassau County residence is their primary and principal place of residence, protecting it from potential future judgments and claims. This legal safeguard ensures that the couple's home is shielded from creditors seeking repayment for debts, lawsuits, or other financial liabilities. The Joint Homestead Declaration offers an opportunity for the married couple to take advantage of New York's homestead exemption laws. It provides significant benefits, such as protection against the forced sale of a primary residence to satisfy debts or judgments up to a specific threshold, which can vary based on the individual circumstances. The Nassau County Clerk's Office is responsible for processing and recording these declarations. It is important for married couples to consult with an attorney familiar with the Nassau New York Joint Homestead Declaration process to ensure the proper submission of all necessary documents and compliance with relevant legal requirements. There may be different types of Nassau New York Joint Homestead Declarations available, tailored to specific circumstances or legal arrangements. Some variations could include: 1. Nassau New York Joint Homestead Declaration by Husband and Wife with Minor Children: This variation may allow couples with children to further strengthen asset protection for their primary residence, considering the added responsibilities and financial concerns associated with raising a family. 2. Nassau New York Joint Homestead Declaration by Husband and Wife with Shared Business: Couples engaged in a joint business venture may opt for this variation to protect their primary residence from potential liabilities or legal claims related to their business activities. 3. Nassau New York Joint Homestead Declaration by Husband and Wife with Separate Property: In cases where one or both spouses own separate property outside their primary residence, this type of declaration can help safeguard their homestead while preserving the separate property's legal status. It is essential to consult with legal experts or attorneys specializing in real estate law and asset protection to determine the most suitable type of Nassau New York Joint Homestead Declaration based on individual circumstances and unique requirements. An attorney can provide guidance and ensure compliance with Nassau County regulations, helping couples secure the maximum protection available for their primary residence.The Nassau New York Joint Homestead Declaration by Husband and Wife is a legal document that allows married couples residing in Nassau County, New York, to declare their primary residence as a homestead. This declaration provides additional asset protection to the couple, ensuring that their home is safeguarded against certain creditors and legal claims. By filing a Joint Homestead Declaration, husbands and wives can jointly affirm that their Nassau County residence is their primary and principal place of residence, protecting it from potential future judgments and claims. This legal safeguard ensures that the couple's home is shielded from creditors seeking repayment for debts, lawsuits, or other financial liabilities. The Joint Homestead Declaration offers an opportunity for the married couple to take advantage of New York's homestead exemption laws. It provides significant benefits, such as protection against the forced sale of a primary residence to satisfy debts or judgments up to a specific threshold, which can vary based on the individual circumstances. The Nassau County Clerk's Office is responsible for processing and recording these declarations. It is important for married couples to consult with an attorney familiar with the Nassau New York Joint Homestead Declaration process to ensure the proper submission of all necessary documents and compliance with relevant legal requirements. There may be different types of Nassau New York Joint Homestead Declarations available, tailored to specific circumstances or legal arrangements. Some variations could include: 1. Nassau New York Joint Homestead Declaration by Husband and Wife with Minor Children: This variation may allow couples with children to further strengthen asset protection for their primary residence, considering the added responsibilities and financial concerns associated with raising a family. 2. Nassau New York Joint Homestead Declaration by Husband and Wife with Shared Business: Couples engaged in a joint business venture may opt for this variation to protect their primary residence from potential liabilities or legal claims related to their business activities. 3. Nassau New York Joint Homestead Declaration by Husband and Wife with Separate Property: In cases where one or both spouses own separate property outside their primary residence, this type of declaration can help safeguard their homestead while preserving the separate property's legal status. It is essential to consult with legal experts or attorneys specializing in real estate law and asset protection to determine the most suitable type of Nassau New York Joint Homestead Declaration based on individual circumstances and unique requirements. An attorney can provide guidance and ensure compliance with Nassau County regulations, helping couples secure the maximum protection available for their primary residence.