Wayne Michigan Checklist — Action to Improve Collection of Accounts: A Comprehensive Guide for Effective Financial Management The Wayne Michigan Checklist — Action to Improve Collection of Accounts is a detailed guide aimed at assisting individuals, businesses, and organizations in enhancing their accounts collection processes. This checklist encompasses a wide range of practical actions and best practices that can be implemented to increase efficiency, ensure compliance, and ultimately improve financial stability. Key Actions to Enhance Collection of Accounts: 1. Customer Data Management: Ensure accurate and up-to-date customer information, such as contact details, payment terms, and credit limits. 2. Clear and Consistent Invoicing: Generate comprehensive and error-free invoices, clearly outlining the goods or services provided, quantities, prices, and terms of payment. 3. Timely Invoicing and Follow-ups: Establish a systematic approach to send invoices promptly and consistently, followed by regular reminders in case of non-payment. 4. Credit Policy Evaluation: Review and update credit policies to assess the creditworthiness of potential customers and establish appropriate payment terms. 5. Streamline Collection Procedures: Develop effective collection procedures, including escalation points, grace periods, and late fee policies. 6. Utilize Technology Solutions: Implement specialized accounting software or customer relationship management systems to automate billing, track payments, and streamline collection processes. 7. Offer Multiple Payment Options: Provide flexible payment options, such as online payments, credit card acceptance, and payment plans, to encourage prompt settlement of outstanding dues. 8. Communication and Relationships: Foster open communication channels to address customer queries, resolve disputes, and maintain positive relationships, ultimately facilitating timely payments. 9. Periodic Evaluation and Reporting: Continuously monitor and evaluate the effectiveness of collection efforts. Generate regular reports to analyze key metrics, identify trends, and initiate corrective measures if necessary. 10. Partner with Collection Agencies: Consider partnering with professional collection agencies or debt recovery services when internal efforts prove unsuccessful. Different Types of Wayne Michigan Checklist — Action to Improve Collection of Accounts: 1. Personal Finances Checklist: Tailored for individuals looking to enhance their personal financial management skills, optimize payment collections, and minimize debt. 2. Small Business Checklist: Designed to assist small business owners in streamlining their account collection procedures, improving cash flow, and ensuring financial stability. 3. Non-Profit Organization Checklist: Geared towards non-profit organizations, this checklist provides guidelines to efficiently manage accounts and improve collection efforts in a non-profit setting. 4. Large Corporation Checklist: Targeted at large corporations with a significant customer base and complex account collection processes, this checklist outlines advanced strategies to optimize collection performance, minimize bad debts, and improve financial reporting. By following the Wayne Michigan Checklist — Action to Improve Collection of Accounts, individuals, businesses, and organizations can proactively implement effective measures to streamline accounts collections, minimize outstanding dues, and achieve financial growth and stability.

Wayne Michigan Checklist - Action to Improve Collection of Accounts

Description

How to fill out Wayne Michigan Checklist - Action To Improve Collection Of Accounts?

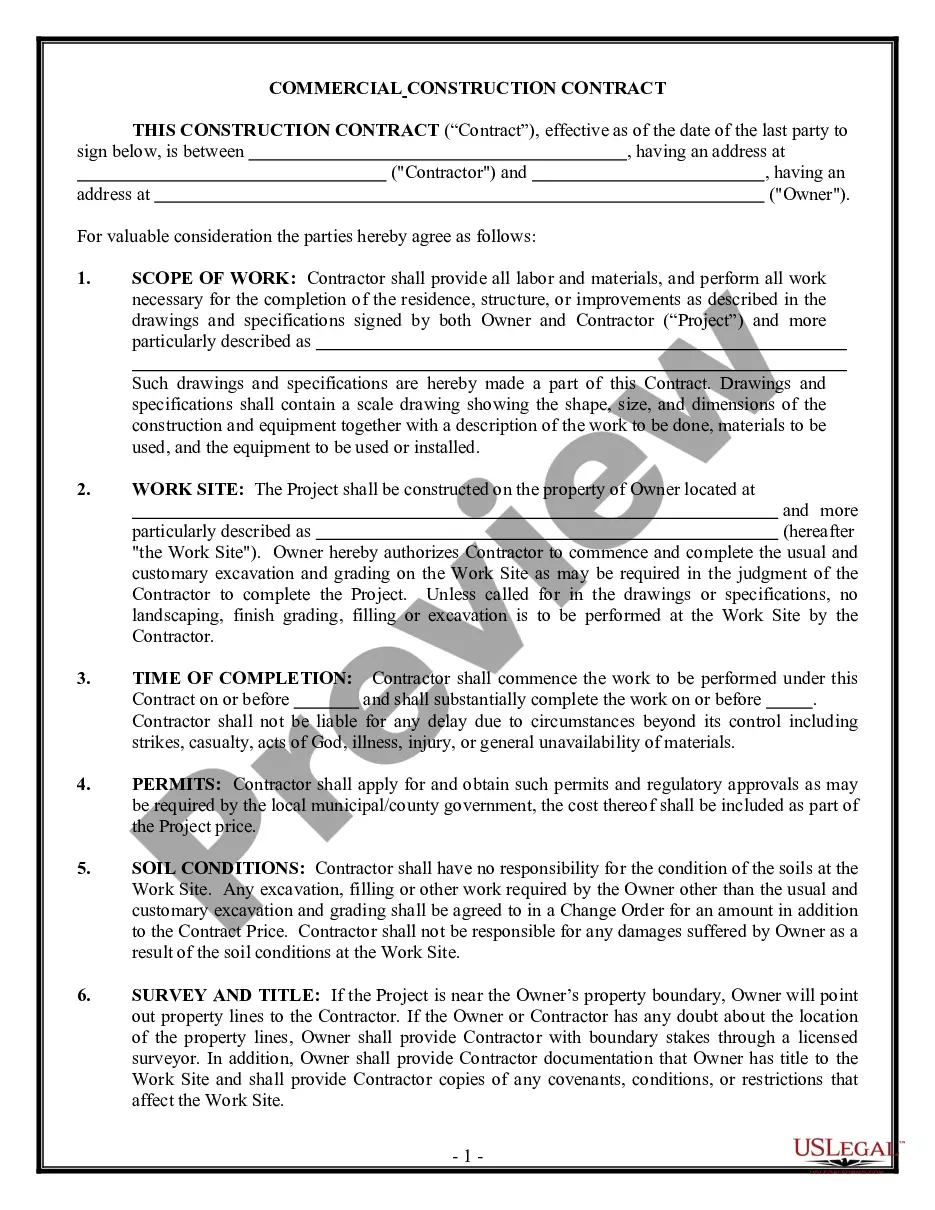

How much time does it usually take you to create a legal document? Given that every state has its laws and regulations for every life sphere, locating a Wayne Checklist - Action to Improve Collection of Accounts meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often pricey. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. Apart from the Wayne Checklist - Action to Improve Collection of Accounts, here you can get any specific document to run your business or individual deeds, complying with your regional requirements. Specialists check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can retain the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Wayne Checklist - Action to Improve Collection of Accounts:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Wayne Checklist - Action to Improve Collection of Accounts.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!